Abercrombie Is Cool Again, Pass It on

Key Takeaways

Abercrombie & Fitch’s net favorability reached a record high of 22.2 among millennials, the brands’ core audience of the 2000s era, in the first quarter of 2024.

Abercrombie shoppers today tend to be socially connected, trend-conscious Gen Zers and millennials with an affinity for mall brands.

The brand’s resurgence comes amid a trend of mall retailers (like J.Crew and Victoria’s Secret) finding their footing again by reestablishing their fashion credibility.

The rumblings about the return of Abercrombie & Fitch started a few years ago, as a whispered answer when an on-trend millennial was asked where she got her jeans. “Abercrombie! I know, can you believe it?” S&P Global Ratings made it official in April: Abercrombie is back. The beleaguered mall brand’s credit rating raised from BB- to BB, citing positive sales and margin momentum. With the share price soaring, let’s dig into what consumers think about the retailer.

Abercrombie shed its 2000’s reputation to make a 2020s comeback

Millennials remember. Abercrombie & Fitch in the early 2000s was a standout at suburban American malls. The stores were known for occasionally racist graphic t-shirts, dark lighting, heavy cologne wafting through the air, and occasionally shirtless male models stationed at the door beckoning shoppers inside. These were hallmarks of an era that many, including Abercrombie & Fitch’s current leadership, would like to leave to collect dust along with the high school yearbooks.

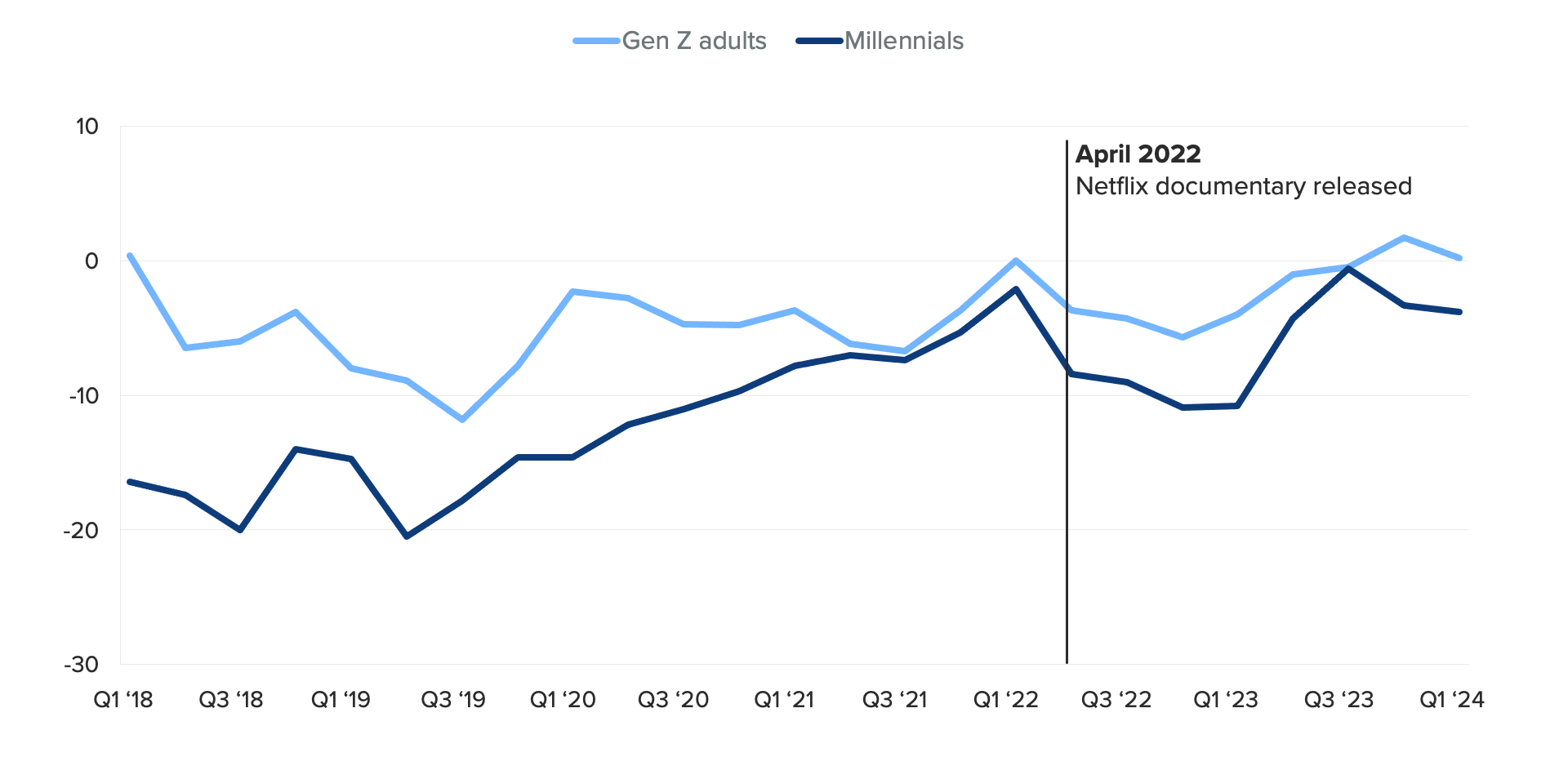

Stores feel different now. They’re brighter and friendlier, and far less headache-inducing. The models are a thing of the past. There’s even a bridal collection. Efforts to remake the brand’s image have been underway since Fran Horowitz was named as CEO in 2017, and Morning Consult data shows the efforts have been working. The brand’s net favorability (the share of respondents who say they have a favorable view of the brand minus the share that say they have an unfavorable view) has been on a steady upward trajectory since we began tracking in 2018, climbing over 20 points among millennials.

Abercrombie’s brand favorability is on the rise

There was a notable dip in favorability in early 2022. That spring Netflix released the documentary White Hot: The Rise & Fall of Abercrombie & Fitch, covering the brand’s many controversies when it was helmed by former CEO Mike Jeffries, now under FBI inquiry for sex crimes. Shoppers noticed: the brand’s favorability dropped 6.9 points among Gen Zers that quarter. Two years later, all seems forgiven as favorability has gained the ground lost in 2022 among Gen Z and millennials.

Abercrombie has strong momentum with millennials

Abercrombie’s net purchasing consideration (the share of respondents who say they would consider purchasing a product from the brand minus the share who say they would not), eked above zero among Gen Zers in late 2023, but the growth trend among millennials is more impressive.

Abercrombie’s net purchase consideration reaches positive numbers

Abercrombie successfully dug out of a low point (-20.5 in Q2 2019) with their core millennial audience, reaching -0.6 in Q3 of 2023. The documentary release was a setback in purchasing consideration, but the brand has recovered, capitalizing on an expert blend of 2020s relevance with 2000s nostalgia. When millennials’ parents dropped them off at the mall, they made a beeline for Abercrombie. They wore the brand to high school homecoming bonfires and college move in day, and now the brand is dressing them for workwear and even wedding events.

Trend-conscious mall shoppers are flocking to Abercrombie

Abercrombie shoppers trend younger, with higher rates of shoppers among Gen Zers (+8 percentage points) and millennials (+14 pp) versus the general population. Customers are also slightly more likely to be men than women (+5pp).

Further evidence that the brand is cool again comes from the psychographic profile of its shoppers: Abercrombie customers are much more likely than the general population to say that they are always looking out for the latest trends (+25 pp) and that they like to live a lifestyle that impresses others (+18 pp). And it’s not just Abercrombie & Fitch. While their baseline preference for Amazon is consistent with the general population, this cohort is more likely to shop across mall brands.

Abercrombie customers shop across mall brands

Victoria’s Secret has a similar history in a once popular brand brought down by both scandals and shifting trend tides that is also finding its footing again with a similar audience. H&M and Zara helped to dethrone Abercrombie from its former heyday and still hold strong relevance for Abercrombie shoppers today. J.Crew and American Eagle have also seen upticks in popularity recently, and both overlap with Abercrombie’s all-American style ethos, attracting a similar consumer. These mall brands were part of the core millennial teenage consumer experience and are poised to carry the generation into their 40s and beyond.

Morning Consult Intelligence customers can access the platform here. If you are interested in learning more about our audience profile data, reach out to your Morning Consult contact or email [email protected].