Always On: Are Your Customers Abroad Boycotting U.S. Companies?

Welcome to Always On. Each week, we’ll dig into a brand or audience trend you need to know about, tapping into Morning Consult Intelligence, our always-on insights platform powered by 15,000 daily surveys across 40+ countries. That means thousands of brands, audience deep dives, and enough fresh data to make your spreadsheets jealous. Sign-up here to get this email sent to you directly every week.

We’ve started tracking a new behavior in almost a dozen countries: Consumers who are boycotting U.S. goods and services because of tariffs. We’ve been asking tens of thousand consumers this question every week globally since April and my colleagues on the global politics team have taken a look at this data to learn who these consumers are and which countries’ boycotts are the most prominent.

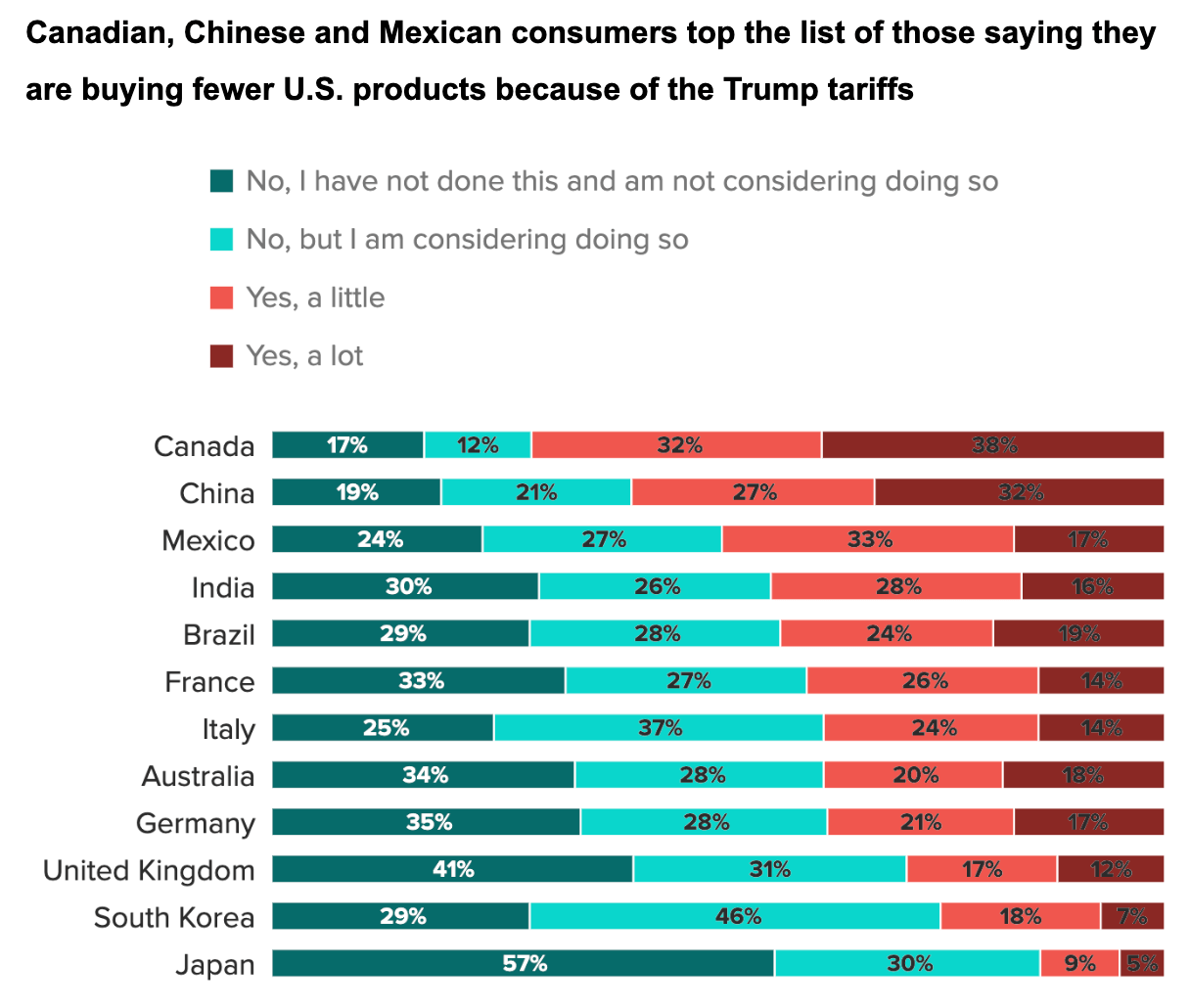

Canadian, Mexican, and Chinese consumers are the most likely among 11 major economies to say they are spending less with U.S. companies in response to the Trump tariffs, while consumers in Japan and South Korea are among the least likely to report doing so. Explore the full memo here, which also dives into declining favorability towards the United States and which demographics are the most predictive for boycotting.

In this week’s edition of Always On, let’s explore how clients with global data can use this new question to track consumer sentiment.

Going Deeper: Are Your Customers Boycotting U.S. Brands?

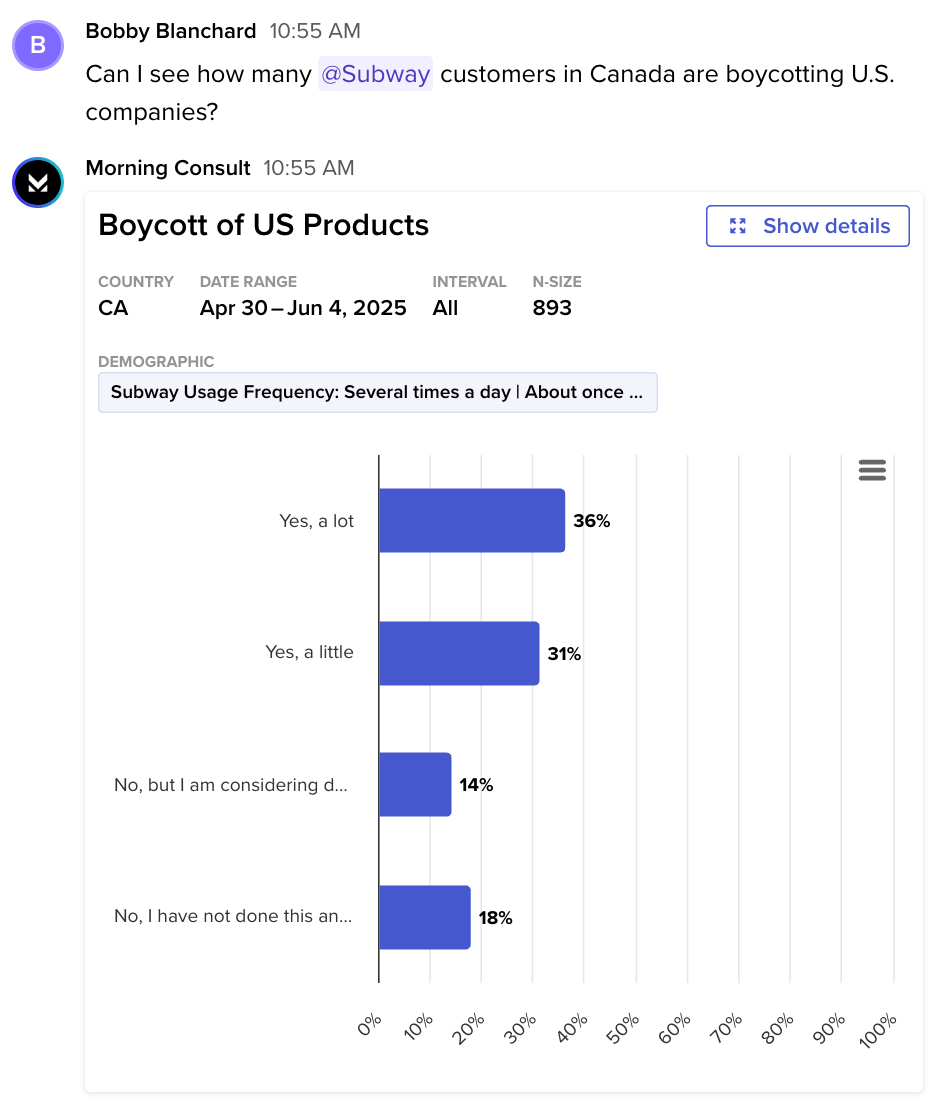

Here's a quick use-case on asking MorningConsult.AI if your brand's users are boycotting U.S. products. The exact query I used: Can I see how many @Subway customers in Canada are boycotting U.S. goods?

Two-thirds of Subway’s user base in Canada says they’re boycotting U.S. products, with more than a third saying they’re doing it a lot. This is a slightly lower rate of boycotting relative to the overall rate at which Canadians are avoiding U.S. products, meaning Subway customers are slightly less likely than the average Canadian to say they are boycotting U.S. brands.

You can try asking a similar query for their brand at MorningConsult.AI.

Extra Credit: How Do U.S. Consumers Feel About the Tariffs?

We’ve talked a lot in this and last week’s edition of Always On about how consumers abroad feel about the new tariffs the United States is implementing. But what about U.S. consumers’ approval and disapproval? Overall, support for tariffs among U.S. adults has declined since the start of the Trump administration, while awareness of both tariffs in general and of specific U.S. tariff proposals has grown.

This is true across generations, income and political affiliation. Explore more in our new tariffs tracker, which is a monthly update that provides a comprehensive look at U.S. consumers’ topline support, inflation expectations, spending behavior, corporate messaging and political sentiment around the Trump tariffs.

Bobby Blanchard is the senior director of audience development at Morning Consult. @bobbycblanchard