American Allies Want U.S. Leadership on Taiwan if China Invades

See our companion analysis of U.S. views on retaliation against China if it invades Taiwan here.

Key Takeaways

Public attitudes among American allies in Europe and Asia favor U.S.-led retaliation over their own countries taking action if China invades Taiwan.

The finding suggests that major U.S. partners and allies whose populations are inclined to dither — most notably Germany, Japan, South Korea and the United Kingdom — could hesitate to join U.S.-led retaliation efforts.

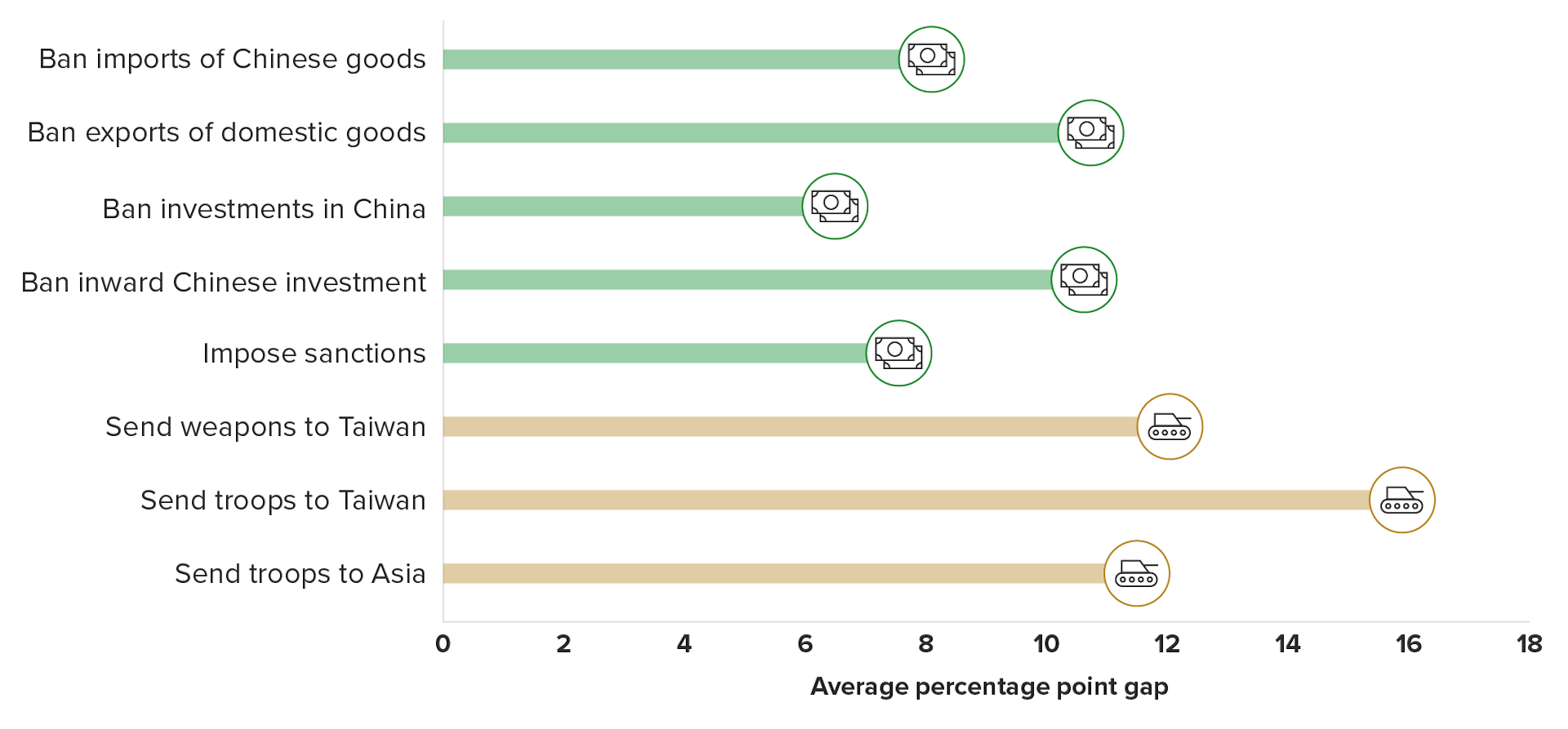

The average premium on American leadership is larger for military options than for economic ones. Among the latter, public opinion is most amenable to a coordinated response that entails banning China-bound investment and Chinese imports, as well as sanctioning Chinese government officials and companies.

Trends within the countries surveyed largely mirror these patterns.

Given these findings, companies and financial market actors with holdings in China should plan for restrictions on trade and capital flows if Taiwan is invaded.

A comprehensive, multilateral effort covering a wider range of economic and military actions would provide certainty in the rules of the game for global trade and capital flows. But a piecemeal approach is the more likely outcome.

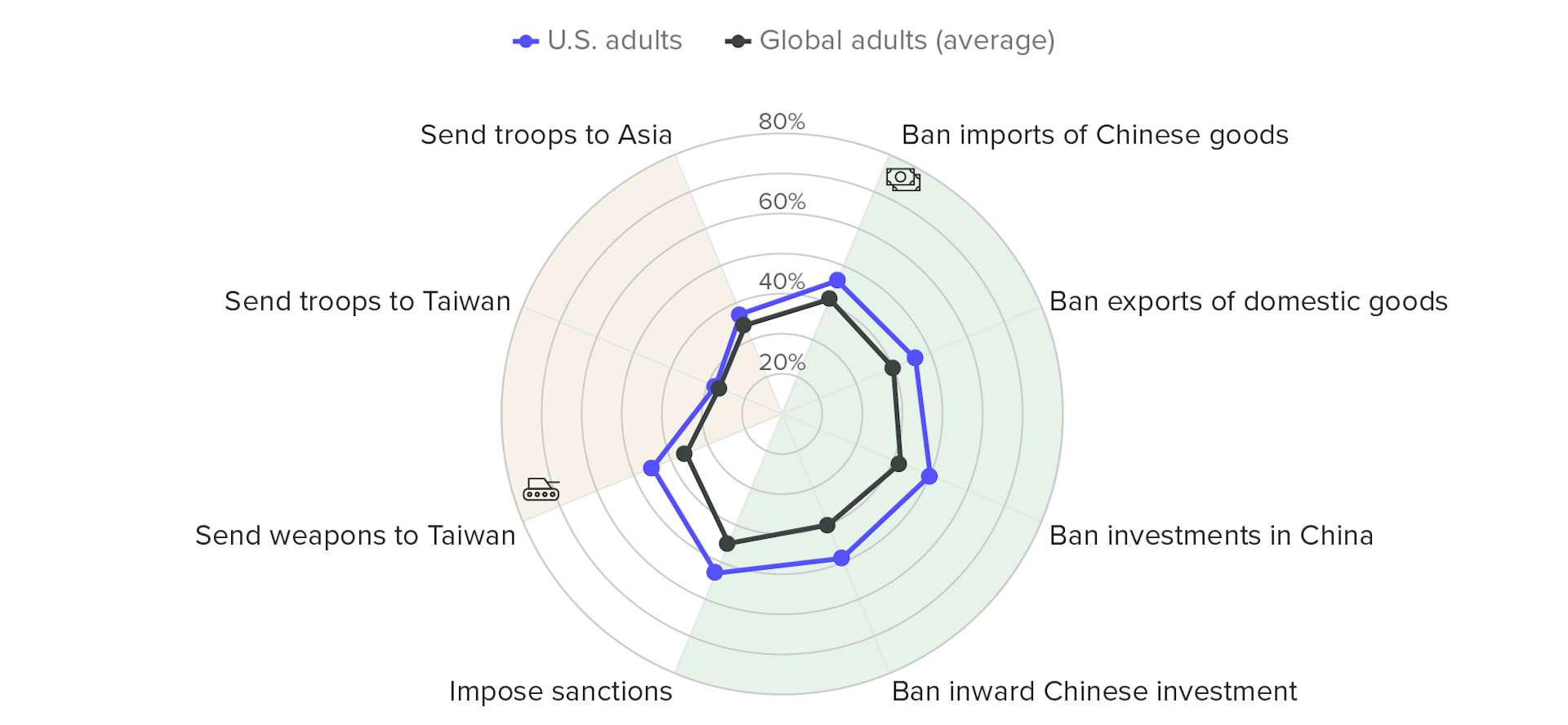

Public demand for U.S. leadership on Taiwan is high

Across major U.S. partners and allies in Asia and Europe, the shares of adults who support retaliating against China if it invades Taiwan are within 10 percentage points of the equivalent shares of U.S. adults. On average, support is weakest for military responses, including sending troops or weapons to Taiwan, or deploying troops in Asia. Economic retaliation, including various types of import and investment bans as well as sanctions, sees higher levels of public support.

Adults in Europe and Asia Want U.S.-Led Retaliation Against China if It Invades Taiwan

Despite these similarities, Asian and European countries nevertheless would prefer that the United States lead the charge if China invades. In particular, when asked whether they would prefer their own government take action relative to the United States doing so, larger shares of adults consistently indicated the latter, regardless of the type of retaliation on the table. This finding suggests there is a meaningful risk that some countries’ governments might dither before committing to coordinated multilateral retaliation alongside the United States.

Public Support for U.S. and Domestic Retaliation Against China if It Invades Taiwan

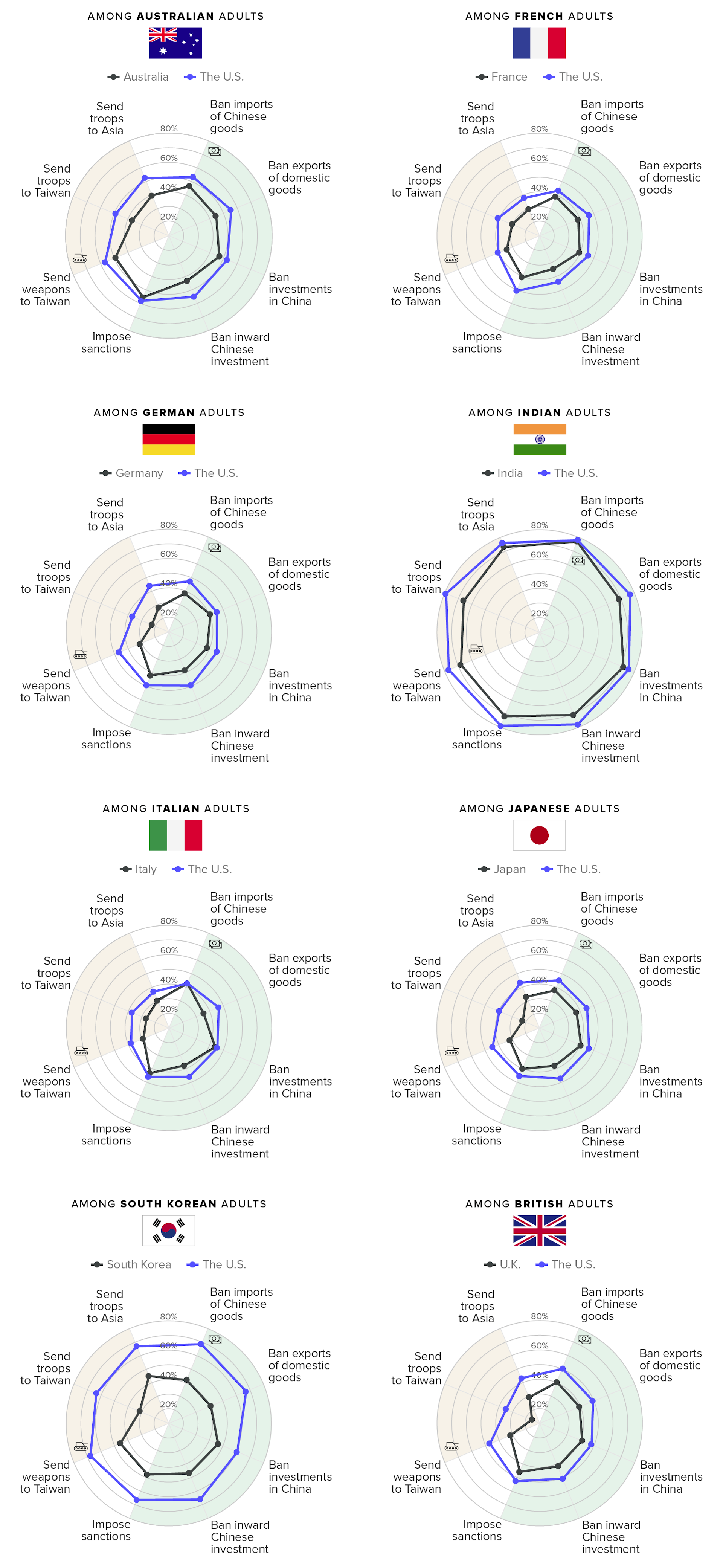

Major U.S. military and economic allies are at risk of passing the buck

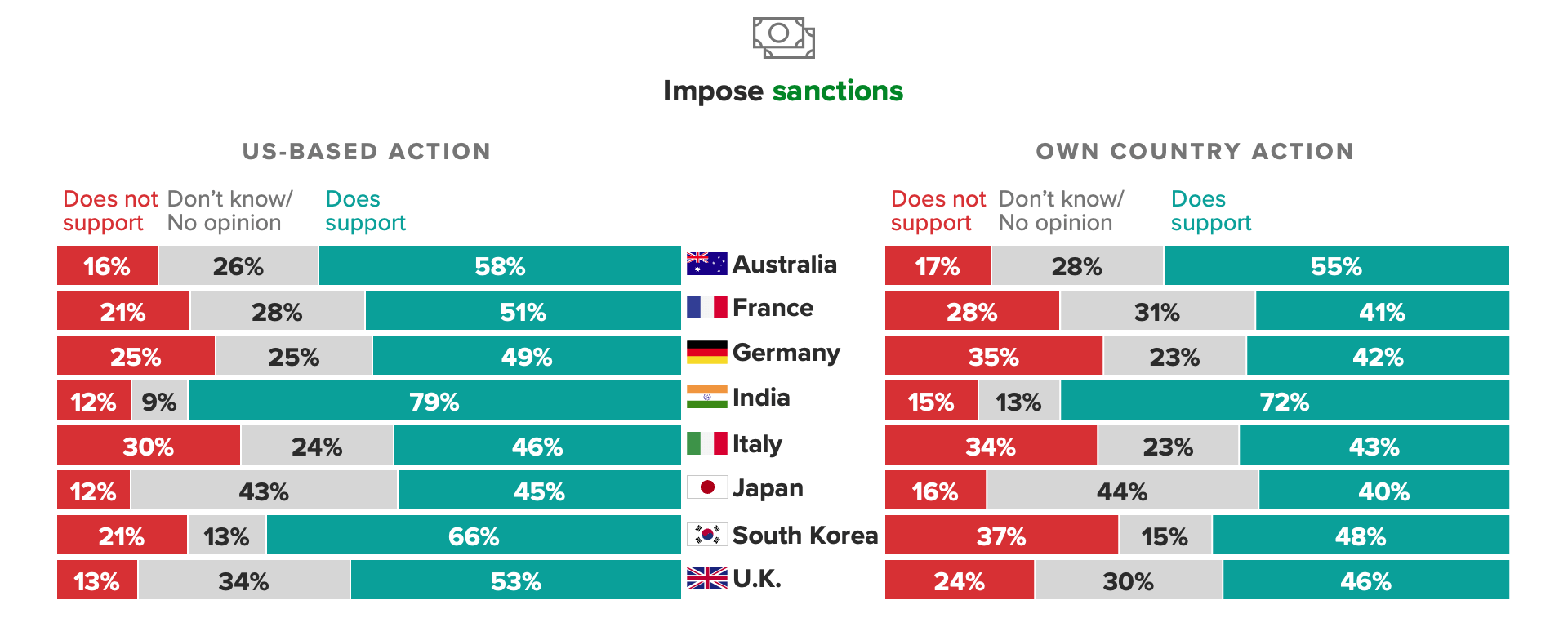

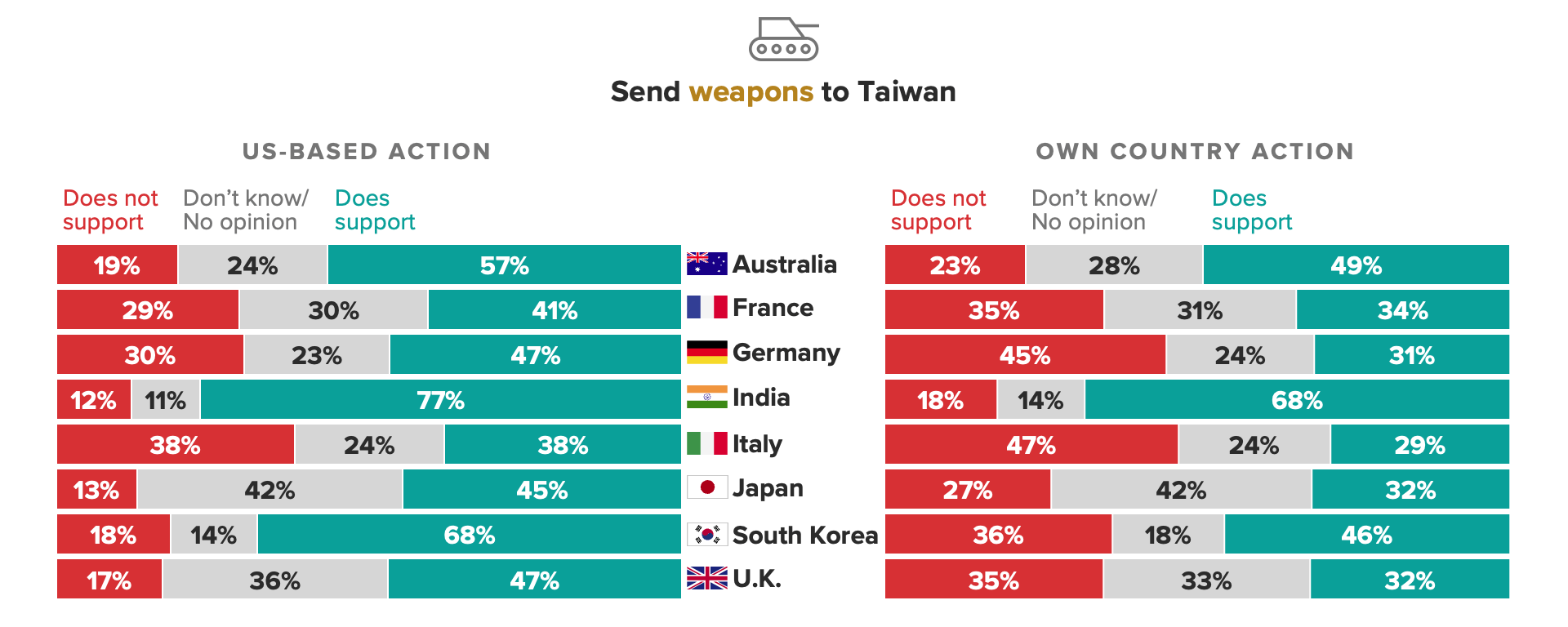

The United Kingdom and South Korea — both major U.S. allies and trading partners — show the greatest risk of wavering. Across all policy options, the gaps between the shares of adults who would prefer that the United States move against China relative to their own government doing so are larger in the United Kingdom and South Korea than in all other countries surveyed. When it comes to gaps in support for military retaliation specifically, Germany and Japan are close behind.

India is an outlier by a wide margin. It shows relatively robust public support for all types of retaliation, with small gaps between the shares of adults willing to support Indian-led retaliation relative to U.S.-led efforts. The former finding is likely attributable to India’s ongoing border dispute with China: If Indians feel they're already positioning troops to defend their frontier from Chinese encroachment, they might be more willing to commit troops to Taiwan as well. High levels of public support for retaliation regardless of the initiator, meanwhile, are more likely attributable to pervasive acquiescence bias that we commonly observe in results from surveys fielded in India, such that respondents are very likely to indicate support or agreement regardless of the content.

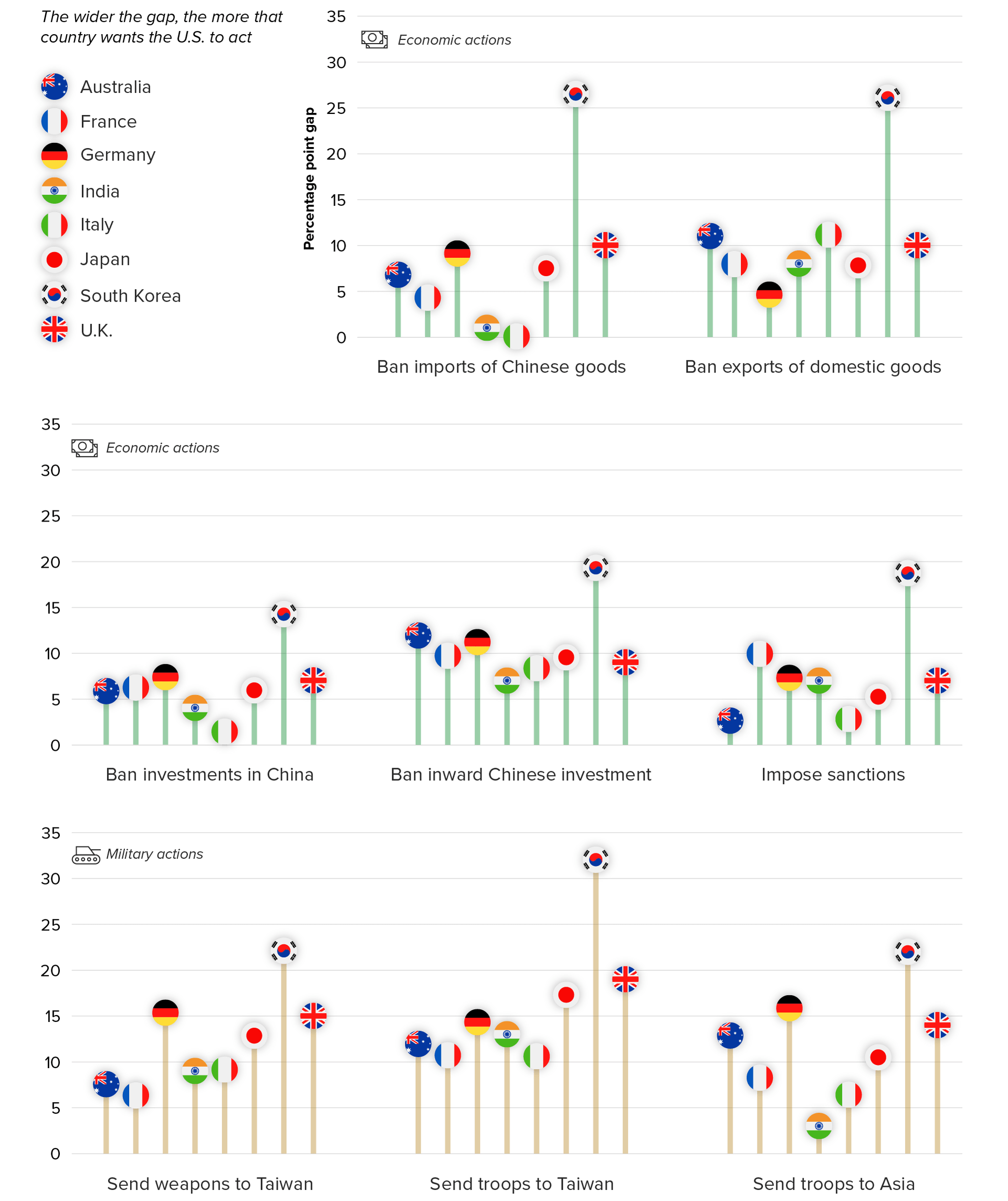

Relative Demand for U.S.-Led Retaliation Against China

Military action is least likely to receive multilateral support

On average, the risk that major U.S. allies and partners would hesitate to join coordinated efforts to retaliate against China is higher for military options than for economic ones. Across all three types of military retaliation we examine — sending weapons and troops to Taiwan, and deploying troops in Asia — the premiums placed on U.S.-led actions are larger for the former.

Among various economic options, the smallest gap is observed for banning investments in China, followed by imposing sanctions on its government officials and companies and banning imports of Chinese goods. By contrast, banning exports of goods to China and restricting inward investment from China see higher levels of public hesitancy when it comes to one’s own country taking action. If the U.S. government were to assemble a coalition of the willing to push back against China, this finding suggests that economic retaliation would be the most promising starting point.

Demand for U.S.-Led Retaliation Against China by Policy Option

Chinese companies are poised to suffer more than Western ones

Strong public support for banning investment from China, alongside moderate support for banning imports from China, bodes poorly for multinationals that route their supply chains through China or contract Chinese suppliers to sell goods elsewhere. By contrast, companies that sell to Chinese consumers would likely face a more limited risk of curtailed market access owing to a larger gap in public opinion when it comes to support for banning China-bound exports.

On net, Chinese companies are likely to suffer the most due to relatively robust public support for sanctions, extensive joint ventures between Western and Chinese companies that would struggle under investment bans, and public enthusiasm for sharply curtailed market access for Chinese exports.

Intracountry trends provide insight into America’s most and least willing partners

Economic Retaliation

Aside from Indians, Australians are the most willing to take action against China, while South Koreans are the most adamant about their desire for U.S leadership, even as their support for their own country taking action rivals that of Australians in most areas. Geographic proximity to China and historical tensions with it likely drive both countries’ outsize sensitivity to a hypothetical conflict, while South Korea’s long-standing reliance on U.S. defense in other areas (e.g., managing relations with North Korea) could drive expectations of U.S. action when it comes to Taiwan. South Koreans’ heightened economic dependence on cross-border trade with China could also contribute to their wariness, given the outsize economic pain China could inflict if Seoul took action on its own.

In Europe, U.K. adults are slightly more willing than adults in other European countries to punish China economically. U.K. sentiment toward retaliation against China mirrors the United Kingdom’s greater support for sanctions against Russia compared with most continental Europeans, despite being highly exposed to energy inflation. As home to one of the world’s major financial hubs, the United Kingdom may view sanctions as a go-to foreign policy tool in lieu of military intervention. Meanwhile, China’s new position as the E.U.’s largest trading partner has increased the risk of an E.U.-China decoupling and may be causing continental Europeans to think twice about retaliation led by their own governments.

Public Support for Economic Retaliation Against China if It Invades Taiwan

Surveys conducted Aug. 31-Sept. 1, 2022, in Australia, France, Germany, Italy and Japan; Aug. 12-13, 2022, in India and the United Kingdom; and Aug. 31-Sept. 3, 2022, in South Korea, among representative samples of 1,000 adults in each country, with unweighted margins of error of +/-3 percentage points. Figures may not add up to 100% due to rounding.

Military Retaliation

With respect to military retaliation, South Koreans once again lead demand for U.S. action, particularly when it comes to stationing troops in Taiwan and Asia more broadly. This finding is unsurprising: Since the Korean War, many South Koreans have become habituated to a significant U.S. military presence in and around their country, which they rely on to contain North Korea and as a bulwark against China.

Outside of India, South Korea has the largest shares of respondents who express support for stationing their own country’s troops throughout Asia, though they are less enthusiastic than Australians about sending troops to Taiwan. Geography could play a role. South Korea’s close proximity to China means it is more likely than Australia to suffer military repercussions if Beijing invades Taiwan and Seoul retaliates.

Of the Asian countries we surveyed, Japan is the least likely to support military intervention in a conflict over Taiwan. This is potentially a function of Japan’s adherence to the values of its post-World War II constitution, which restricts the country to maintaining a national “self-defense force” that is prohibited from external adventuring.

Relative to adults surveyed in other European countries, U.K. adults exhibit a similar demand for U.S. military intervention, but they are less enthusiastic about sending British troops to Taiwan. This may be a manifestation of an isolationist turn in the post-Brexit political climate. Alternatively, U.K. adults may also be gun-shy about jumping into another U.S.-led conflict abroad after years of supporting U.S. military intervention in the Middle East.

Germany’s reluctance to intervene militarily in Taiwan is in line with its overall reluctance to position itself as a military power since the end of World War II, Zeitenwende notwithstanding. Italians are the most consistent of the Europeans we surveyed. While they still show a greater desire for U.S.-led military intervention as opposed to their own, Italians expressed the smallest difference between the response desired of their own government and that of the United States.

Public Attitudes Toward Military Retaliation Against China if It Invades Taiwan

Surveys conducted Aug. 31-Sept. 1, 2022, in Australia, France, Germany, Italy and Japan; Aug. 12-13, 2022, in India and the United Kingdom; and Aug. 31-Sept. 3, 2022, in South Korea, among representative samples of 1,000 adults in each country, with unweighted margins of error of +/-3 percentage points. Figures may not add up to 100% due to rounding.

Companies should plan for a patchwork of policies

If China were to invade Taiwan, our data suggests that most Americans would expect the U.S. government to follow a playbook that mirrors the one it deployed when Russia invaded Ukraine. To a large degree, U.S. efforts to constrain Russia both militarily and economically — including sending weapons to Ukraine, imposing sanctions on Russian officials and companies, and severing commercial relationships — have been bolstered by coordinated action among U.S. allies and partners. An even greater degree of coordination would likely be necessary in the event of a conflict with China, owing to its far larger economy, deep integration with global supply chains and, increasingly, its military prowess.

Should such a conflict materialize, our data suggests the U.S. government could struggle to mount a coordinated multilateral response, to the detriment of many companies. A conflict over Taiwan would be disastrous for global supply chains regardless of whether such a response materialized. But a united front would provide greater clarity for multinationals and financial market actors with commercial dealings and financial holdings in China, and that are seeking to minimize the risk of running afoul of sanctions, relative to a scenario that entails managing compliance with a patchwork of global policies.

While the former outcome would yield greater commercial efficiencies, our data suggests companies should plan for a more piecemeal response.

India is omitted from the global average shares computed in this chart due to pervasive acquiescence bias.

Sam Elbouez is a senior data visualization designer at Morning Consult.

Jason I. McMann leads geopolitical risk analysis at Morning Consult. He leverages the company’s high-frequency survey data to advise clients on how to integrate geopolitical risk into their decision-making. Jason previously served as head of analytics at GeoQuant (now part of Fitch Solutions). He holds a Ph.D. from Princeton University’s Politics Department. Follow him on Twitter @jimcmann. Interested in connecting with Jason to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].

Scott Moskowitz is senior analyst for the Asia-Pacific region at Morning Consult, where he leads geopolitical analysis of China and broader regional issues. Scott holds a Ph.D. in sociology from Princeton University and has years of experience working in and conducting Mandarin-language research on China, with an emphasis on the politics of economic development and consumerism. Follow him on Twitter @ScottyMoskowitz. Interested in connecting with Scott to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].