In the American EV Market, What Drives the Interested and Holds Back the Hesitant?

Electric vehicle-interested consumers tend to be younger, male and liberal, and the profile of those who aren’t interested is just as nuanced. Manufacturers need to take advantage of EV-interested consumers’ brand receptibility while filling in the knowledge gaps of those who remain yoked to gas-powered cars to win over new customers.

With gas prices still stubbornly high, consumer interest in electric vehicles (EVs) is spiking. Searches for EVs on the online marketplace Cars.com skyrocketed 173% in March, while Google searches for EVs also hit an all-time high. But setting aside the current reality of EV supply scarcity and inflated sticker prices that exclude the majority of the vehicle-buying population, automakers can prepare for a future supply deluge by becoming more familiar with those who are most likely to buy EVs, as well as those who — for the time being, at least — aren’t interested at all.

Between the interested and uninterested lies a deep divide

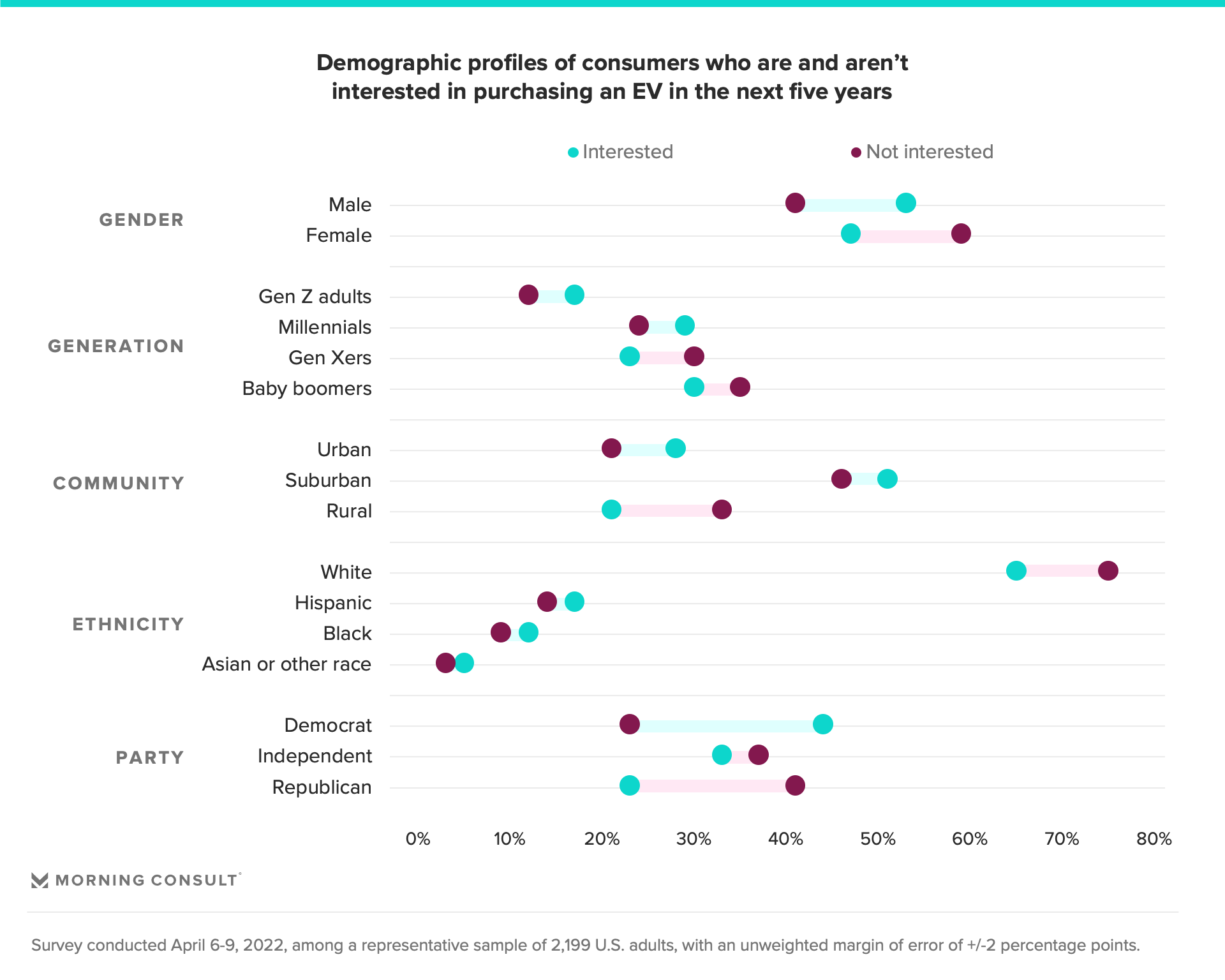

Morning Consult regularly surveys consumers on their interest in purchasing electric vehicles within the next five years. Our findings reveal an eager audience of younger, more ethnically diverse and more liberal adults who also tend to be more concerned about climate change. There are stark differences between this audience and those who express no interest in this mode of transportation.

There is a gender gap when it comes to EV interest, with 53% of men showing interest versus 47% of women. Interested consumers tend to be ethnically diverse, with 35% identifying as Hispanic, Black, Asian or another race, compared with 25% of those who are not interested identifying as nonwhite. Urbanites tend to be more interested in EVs, while those who are not interested skew rural due to concerns over the lack of charging infrastructure in such areas.

From a political standpoint, 44% of EV-interested consumers identify as Democrats, while 23% say they are Republicans. The difference may stem from opposing views on sustainability. Interestingly, the political divide is much narrower for those considering Tesla, the most dominant brand in the EV market. As of April, there was only a 2 percentage point gap between Democrats and Republicans who are considering buying a Tesla, according to Morning Consult Brand Intelligence data. And bucking general EV trends, Republicans trust Tesla more than Democrats do, likely because of the higher favorability of founder Elon Musk among the former group. Consumers' political profiles matter, especially when it comes to their consideration of sustainable products. As vehicle brands move toward becoming fully electric, they need to know where their target audience stands on the political spectrum.

Consumers need more education on the benefits of alternative propulsion to be enticed to purchase EVs

Morning Consult data reveals that many consumers don’t fully understand some of the key benefits of EVs. For instance, while 30% of EV-interested consumers consider ease of maintenance a key factor in purchase consideration, only 10% of those not interested in EVs feel the same way, indicating a potential lack of knowledge that EVs are easier to maintain due to the relative simplicity of electric motors.

purchasing one for the following reasons:

There is also a gap in understanding of charging availability: More than one-third of consumers with a household vehicle (35%) park in their garage, yet only 6% of this group report having continuous access to charging. This suggests many vehicle owners don’t yet grasp that any garage with a power outlet can provide regular charging. And given that 43% of those not interested in purchasing EVs cite a lack of charging infrastructure as a major reason why, more knowledge might bring new perspectives.

Looking ahead, EV manufacturers should connect with EV-interested consumers through persistent brand messaging. We know from our 2022 Super Bowl research that EV-interested consumers have shown consistently higher ad favorability and recall, and not just with messaging from automotive companies focused on EVs. At the same time, the EV-hesitant audience is still highly nuanced. Manufacturers should draw them in not only by addressing price and supply issues, but also by offering relevant education and community outreach programs.

Lisa Whalen previously worked at Morning Consult as an automotive and mobility analyst.