The State of Americans’ Finances as Biden Begins His Presidency

Key Takeaways

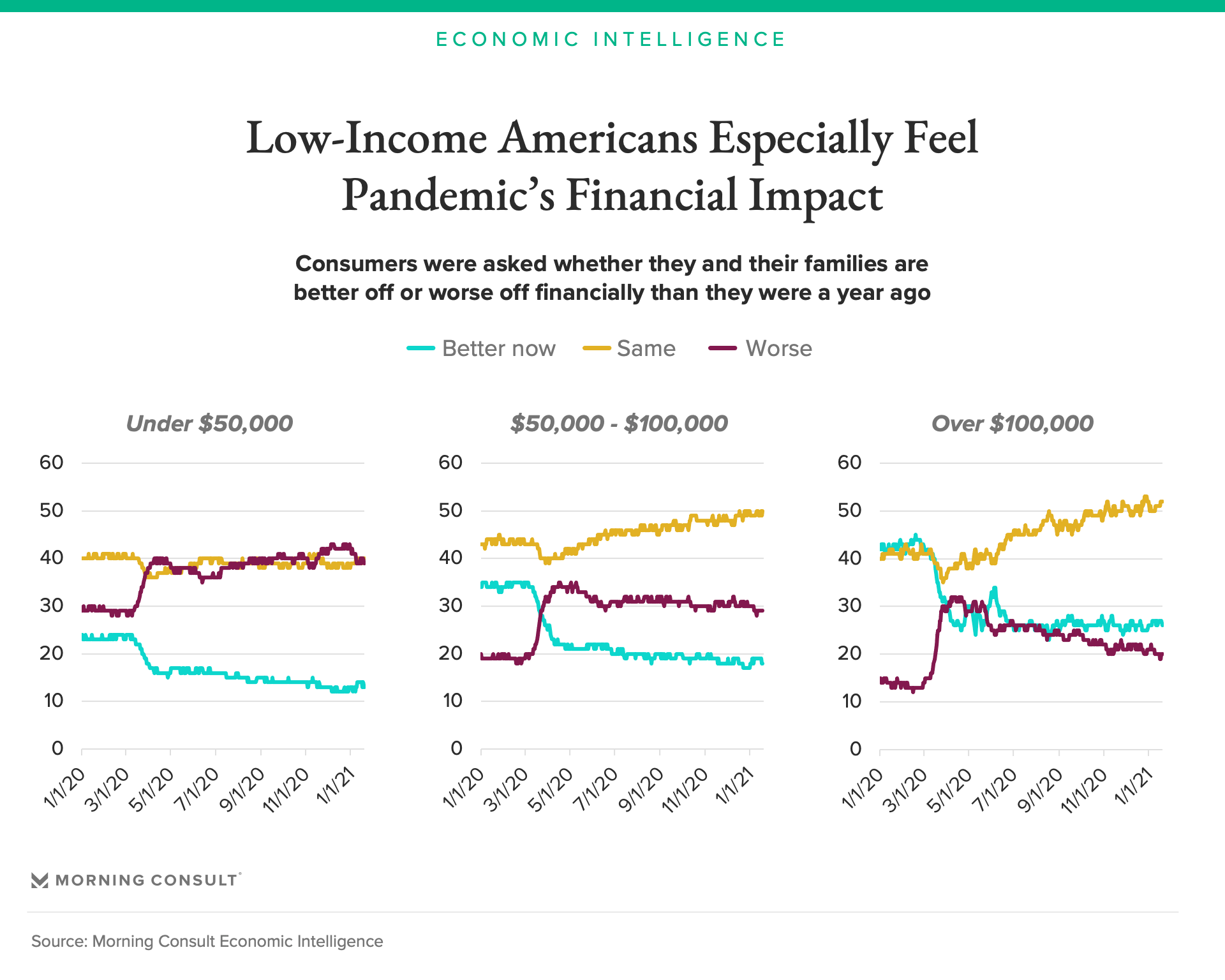

A growing share of low-income Americans report being worse off financially than they were a year ago, while middle- and high-income Americans experience greater financial stability since the onset of the pandemic.

Incomes fell short of expenses for 15% of Americans in December by $273 on average.

Savings remain depleted for low-income Americans.

On Inauguration Day, President-elect Biden will inherit an economy under tremendous strain, as seen in the weekly unemployment claims, which remain elevated by historical standards, and in the drop in monthly payrolls in December.

These decreases in income and employment income have taken a toll on Americans’ personal finances, but aggregate monthly statistics from the government can mask weaknesses and vulnerabilities in Americans’ finances. This analysis provides a snapshot of Americans’ finances at the micro level on the eve of President-elect Biden’s inauguration. It asks whether Americans have enough money coming in to pay their bills and adequate savings to cover their expenses. It also reports how Americans feel about their financial condition compared to a year ago.

What the data shows: President-elect Biden will inherit an economy characterized by financial weaknesses and vulnerabilities concentrated at the low-end of the income spectrum. The majority of middle- and high-income Americans are able to set money aside at the end of the month to build their savings and reverse the financial harm they experienced as a result of the pandemic, but the same is not true for low-income Americans.

From a policy perspective, this analysis is the first step toward measuring the likely impact of the stimulus checks included in Biden’s proposed economic rescue plan. Given the current state of American’s finances described in this report, economic policy responses to the ongoing pandemic should target those Americans most financially vulnerable, most of whom are low-income Americans.

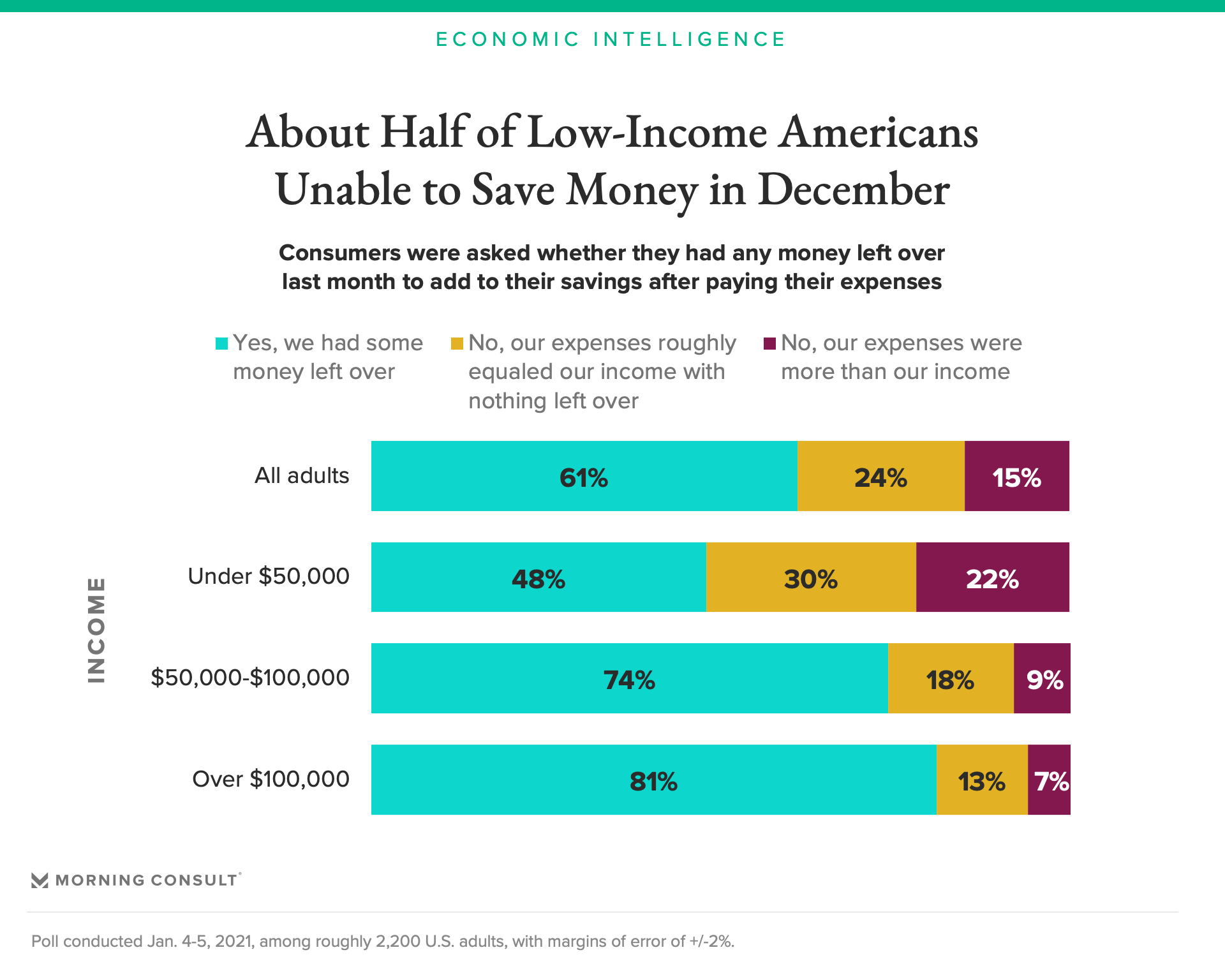

Incomes fall short of expenses for 15 percent of Americans in December, and low-income consumers are the most likely to report a shortfall. In December, 15 percent of Americans did not earn adequate income to cover their monthly expenses, which means that they would have needed to rely on savings, debt or charitable gifts to pay their bills. An additional 24 percent had no income left over to save after paying their expenses.

There are significant differences in the finances of Americans across the income spectrum: 22 percent of low-income Americans did not earn adequate income to cover their monthly expenses in December, compared to 9 percent and 7 percent of middle- and high-income American adults, respectively.

In addition to experiencing increased financial insecurity, Americans who do not have money left over at the end of the month after paying their expenses are unable to save or invest, thereby limiting their ability to benefit from rising stock and home prices.

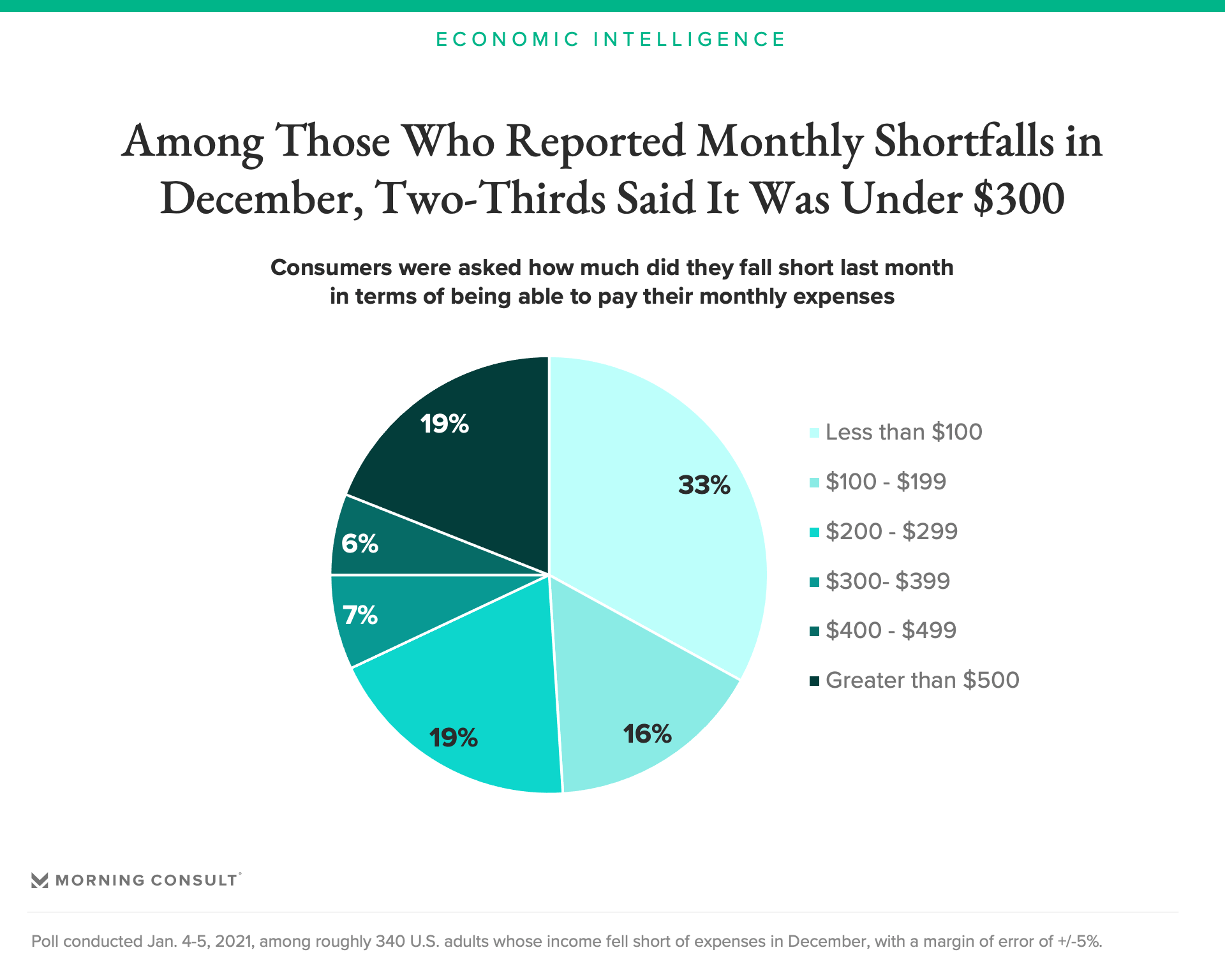

How to measure the severity of the problem: The distribution of monthly income shortfalls in December was heavily skewed to the two extremes. One-third of Americans with incomes below their expenses fell short in December by less than $100, while 19 percent fell short by over $500. In other words, there are significant differences in terms of the strength of Americans’ finances even among people who are unable to pay their expenses with their incomes.

For those Americans whose incomes fell short of their expenses in December, the average dollar value they fell short was $273.

The way this was calculated: Consumers who previously indicated that their incomes fell short of their expenses in December were asked in follow-up questions to indicate the range of the budget shortfall and then in an open-ended question to list the amount of their budget shortfall. Histograms of the open-end responses confirm that the dollar values are normally distributed within each of the value ranges, and that $700 is the outlier-adjusted average in the top dollar value category.

Thus, the average income shortfall in December reflects the share of respondents in each of the ranges multiplied by the midpoint of the dollar value ranges and the average in the top value category (e.g., $50, $150, $250, $350, $450 and $700). This average value is roughly consistent with the graph above that shows 68 percent of this group fell short in December by less than $300.

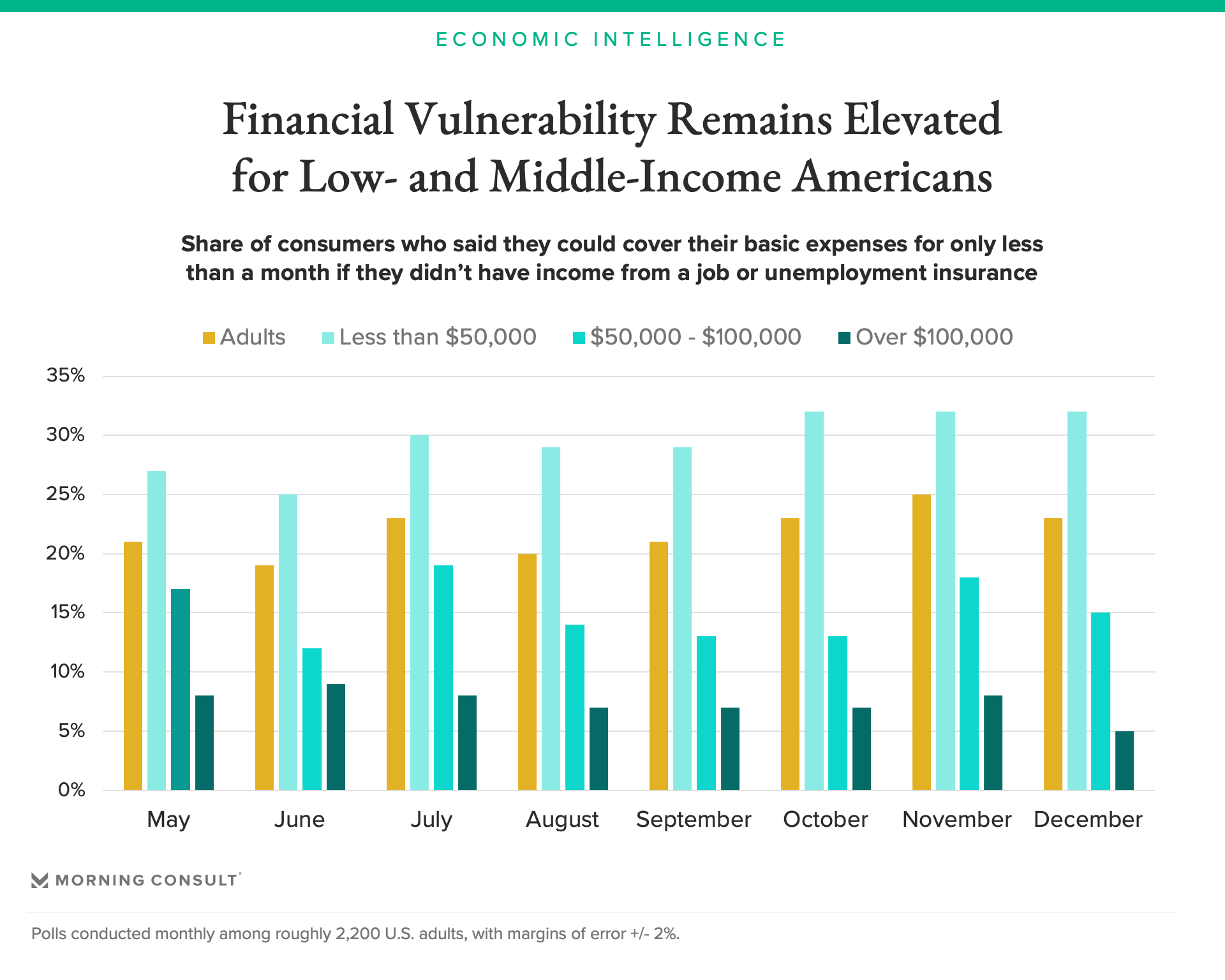

Savings are unlikely to provide a backstop for consumers who can’t cover their monthly expenses. Low- and middle-income Americans have eaten into their savings to pay their monthly expenses over the past five months. As of December, 32 percent of low-income Americans lack adequate savings to pay their basic expenses for a full month, up from 25 percent in June. In other words, Americans who are most likely to be unable to pay their expenses using their incomes are also the most unlikely to have savings they can use to help them pay their expenses.

Low-income Americans are the most likely to say that things have gotten worse for them. The share of low-income Americans who report being worse off financially than they were 12 months ago has gradually increased since July. As of Jan. 19, 40 percent of low-income Americans report that they are doing worse financially than they were a year ago, essentially erasing the improvements driven by the CARES Act in April. At the same time, the share of low- and middle-income Americans who report that they are doing better now financially than they were a year ago continues, while stabilizing among high-income Americans.

Even prior to the pandemic, low-income respondents were more likely to have fallen behind financially than they were to be doing better financially. The opposite is true of middle- and high-income respondents. Prior to the pandemic, 40 percent of high-income respondents indicated that their finances improved over the past year, compared to 12 percent who said that they were worse off. In other words, as income increases, it becomes more likely that Americans’ personal finances improve over time.

Methodology

The analysis relies on three data sources: the December installment of a monthly personal finances survey conducted Jan. 4-5, 2021; monthly labor market surveys from May-December 2020; and the personal finances current conditions component of Morning Consult Economic Intelligence. The monthly surveys relied on a representative sample of 2,200 U.S. adults, weighted to match age, gender, educational attainment and region. Each of the surveys’ margins of error is 2 percentage points. (The detailed methodology of Morning Consult Economic Intelligence is available here.)

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]