Analysis: Increases in COVID Cases Jeopardize Rebound in Consumer Confidence

This analysis was authored by Morning Consult Economist John Leer.

An analysis of Morning Consult’s consumer confidence data across all 50 states, with a focus on developments since the beginning of June, shows that while most states experienced a rebound in confidence early June, the size of the increase differs across the country. The differences across states and regions closely correspond to differences in the average daily number of cases of COVID-19.

Consumers living in states and regions reporting an increase in the average number of daily confirmed COVID-19 cases did not experience the same increase in confidence as those living in states or regions with stable or falling new cases. While other factors such as state-level differences in employment conditions are also likely to drive differences in consumer confidence, the Index of Consumer Sentiment (ICS) data finds a close relationship between the daily number of cases of COVID-19 and consumer confidence at the state level.

Key findings include:

- Consumer confidence increased across the country over the past two weeks, supporting a geographically broad recovery in consumer spending. That being said, some states have fared better than others over the past two weeks.

- Since June 1, consumer confidence has increased by 2.2 points on average. In six states (Montana, Minnesota, New Hampshire, Kansas, Connecticut and Iowa), confidence increased by over 5 points during that time period.

- Consumer confidence has decreased in only six states: Hawaii, Washington, Alaska, Nebraska, South Carolina and Oklahoma. Even though the average decrease among these six states was only 0.4 points, they are trending downward while the rest of the country enjoys a rebound in confidence.

- From the perspective of businesses and policymakers, this state-level data indicates that the rebound in consumer spending in June is likely to be stronger in the Northeast than it is in the South, the region that has the most states with increasing COVID-19 cases.

- This data complicates the challenges facing state policymakers. As they work to strike the right balance between easing restrictions on certain economic activities and mitigating future outbreaks of the virus, they also have to consider the second-order effects of fewer restrictions on consumer confidence.

Starting in the beginning of May, states began gradually reopening their economies and easing some of the restrictions in place designed to limit the spread of COVID-19. Over the past two weeks, 21 states have reported increases in the average number of new confirmed coronavirus cases per day in their states, prompting governors and mayors in some states to slow down or delay the pace of easing restrictions, with others threatening to reinstate restrictions that had already been eased.

An analysis of Morning Consult’s consumer confidence data across all 50 states, with a focus on developments since the beginning of June, shows that while most states experienced a rebound in confidence early June, the size of the increase differs across the country. The differences across states and regions closely correspond to differences in the average daily number of cases of COVID-19.

Consumers living in states and regions reporting an increase in the average number of daily confirmed COVID-19 cases did not experience the same increase in confidence as those living in states or regions with stable or falling new cases. While other factors such as state-level differences in employment conditions are also likely to drive differences in consumer confidence, the Index of Consumer Sentiment (ICS) data finds a close relationship between the daily number of cases of COVID-19 and consumer confidence at the state level.

Nationwide developments

Across the country, consumer confidence continues to gradually increase after bottoming out on or around April 15 in most states.

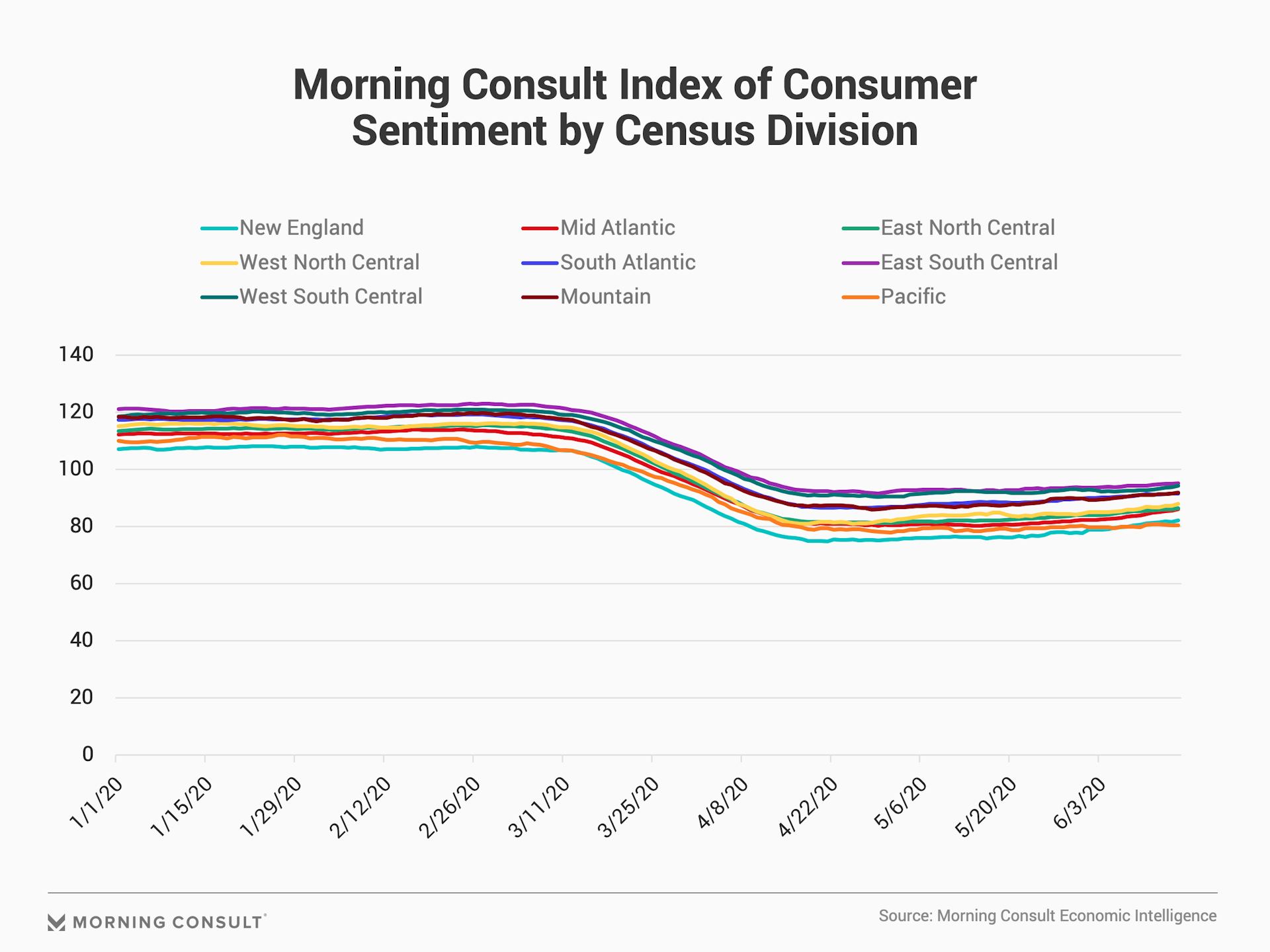

The graph below describes trends in consumer confidence across the country by grouping states into the nine U.S. Census Divisions and then calculating the daily average of consumer confidence within each of the nine divisions. The averages for each of the divisions are simple averages, not weighted to reflect the contribution of a given state to total economic activity or consumer spending in that division. For example, California and Alaska receive equal weighting in the calculation of daily average consumer confidence in the Pacific Division.

- The rank ordering of the divisions remains stable with a few notable exceptions. The average ICS across in the West South Central Division (Texas, Arkansas, Oklahoma and Louisiana) is now below the average in New England. This development is noteworthy since confidence in the West South Central division has historically been higher than in it has been in the New England Division. One likely explanation for the change lies in the differences in the COVID-19 situation in these two divisions. In the West South Central Division, all four states are experiencing an increase in the seven-day average of new confirmed COVID-19 cases, whereas the situation is stable in the New England Division.

- While confidence at the division-level exhibits similar trends, some states have fared better than others over the past two weeks. Since June 1, consumer confidence has increased by 2.2 points on average. In six states (Montana, Minnesota, New Hampshire, Kansas, Connecticut and Iowa), confidence increased by over 5 points during that time period, while it decreased in another six states (Hawaii, Washington, Alaska, Nebraska, South Carolina and Oklahoma). Even though the average decrease among these six states was only 0.4 points, they are trending downward while the rest of the country enjoys a rebound in confidence.

While regional averages provide an easily digestible snapshot to compare consumer confidence across the U.S., they mask underlying variation within a region. The following section examines state level consumer confidence within each of the nine U.S. Census Divisions and groups them into the four U.S. Census Regions (Northeast, Midwest, South and West).

A regional analysis of the data also provides the context necessary to identify changes in state-level confidence that are attributable to the unique characteristics of that state rather than the region as a whole. States that are geographically close to each other often share structural economic features such as the composition of their workforces or the importance of certain industries to their economies. Consequently, when the U.S. economy experiences a major shock like the coronavirus pandemic, consumers in states that are located next to each other are more likely to respond similarly. Comparing consumer confidence in a given state to the regional average helps identify state-specific effects.

Northeast

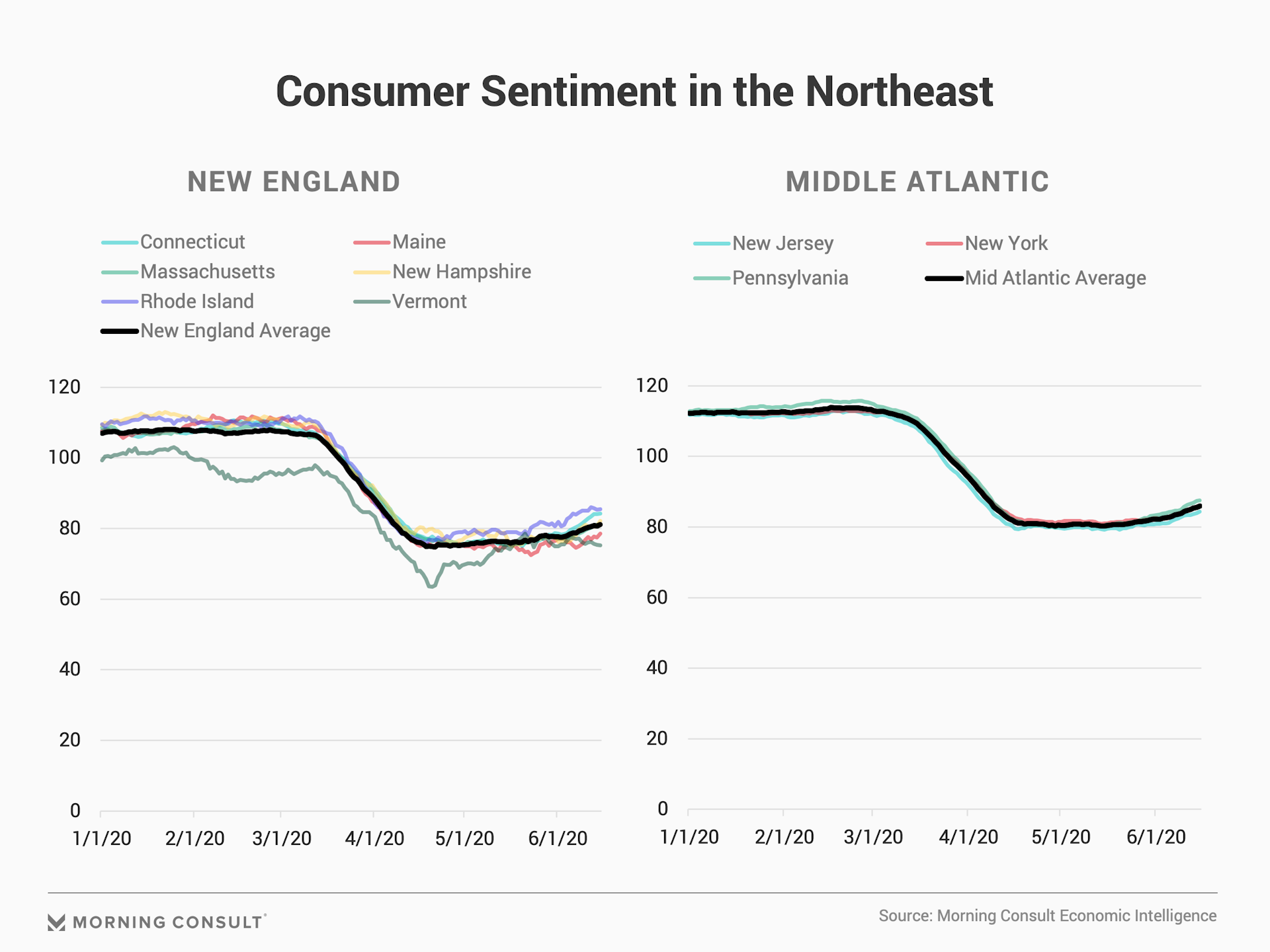

New England: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont

- Over the past two weeks, consumer confidence in the New England Division increased by 3.5 points on average, which is the second-largest increase, behind the Middle Atlantic Division.

- Consumer confidence is gradually reverting back to its pre-COVID-19 rank ordering with consumers in Rhode Island the most optimistic and those in Vermont the least optimistic.

- None of the six states in the New England Division is experiencing recent increases in the number of confirmed COVID-19 cases. However, that does not mean that these states are not feeling the economic effects of the pandemic. Consumer confidence in Maine remains well below the average for the division, which is not consistent with pre-COVID rank ordering. One likely explanation for persistently lower-than-average confidence in Maine is the state’s dependence on summer tourism, which continues to be adversely affected by the pandemic.

Middle Atlantic: New Jersey, New York and Pennsylvania

- Since June 1, consumer confidence in the Middle Atlantic Division increased by 3.7 points on average, which is the largest increase across the country. This increase corresponds to the initial reopening of New York state. All three states have also logged a decrease in the number of new cases over that period.

- What is unique about the Middle Atlantic Division is how similarly consumers in New Jersey, New York and Pennsylvania view the economy and their personal finances. The ICS for all three states is virtually identical since the beginning of 2020. Even as New York became the epicenter of the coronavirus pandemic in the United States, consumer confidence in New Jersey and Pennsylvania closely tracked consumer confidence in New York.

Midwest

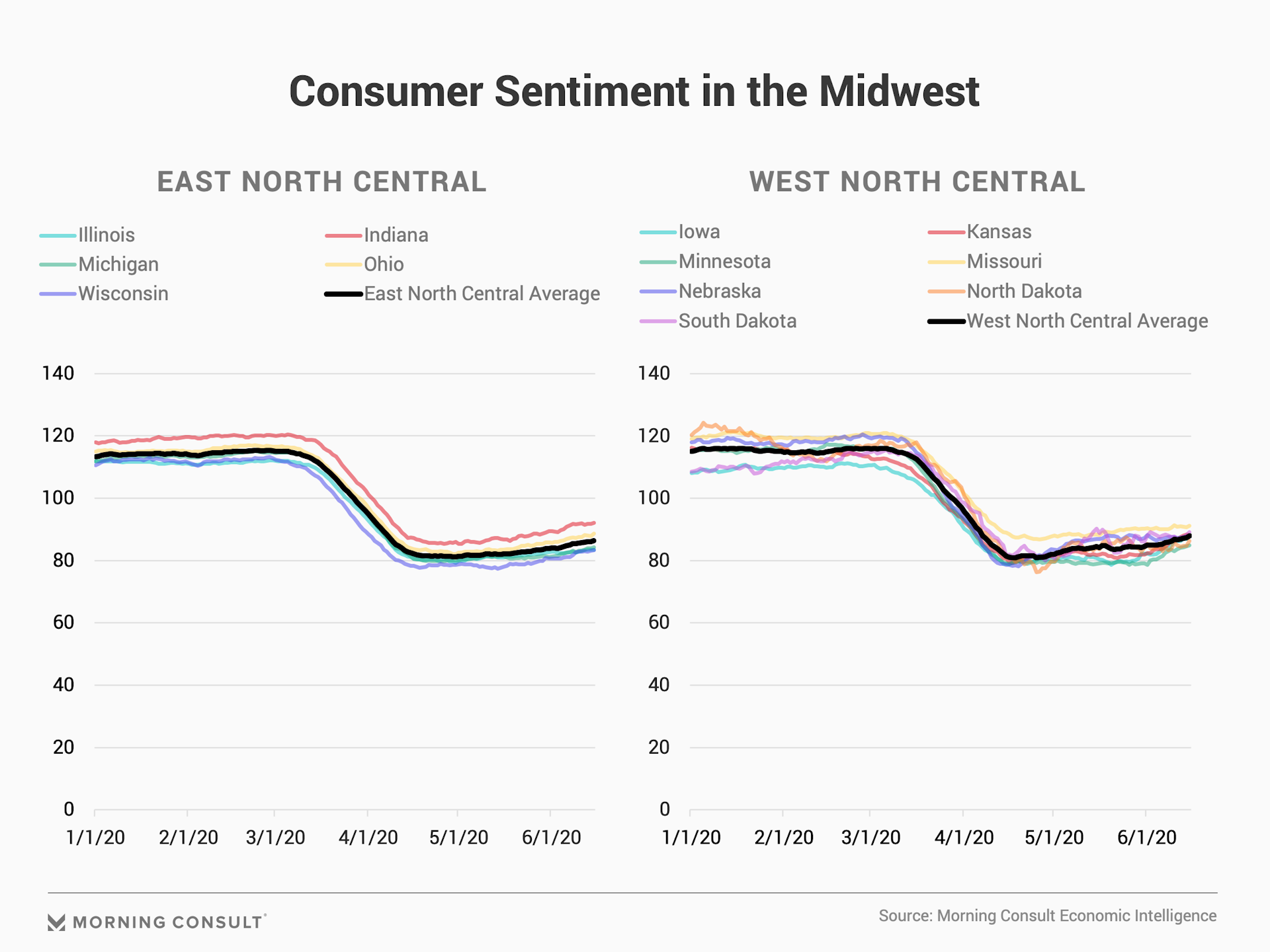

East North Central: Indiana, Illinois, Michigan, Ohio and Wisconsin

- Average confidence across the East North Central Division increased by 2.3 points since June 1, slightly above the average of 2.2. Consumers across all five states in the East North Central Division grew more confident over that period with no notable outliers.

- None of the five states in the East North Central Division is experiencing an increase in the number of new cases, and new cases are falling in Wisconsin.

West North Central: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota

- Average confidence across the West North Central Division increased by 2.9 points over the past two weeks.

- Consumer confidence among North Dakotans remains below the average in the West North Central Division despite consistently registering above-average values prior to the onset of the pandemic. North Dakota experienced a rise in confirmed new cases in late May, and that experience likely remains a drag on confidence in the state.

South

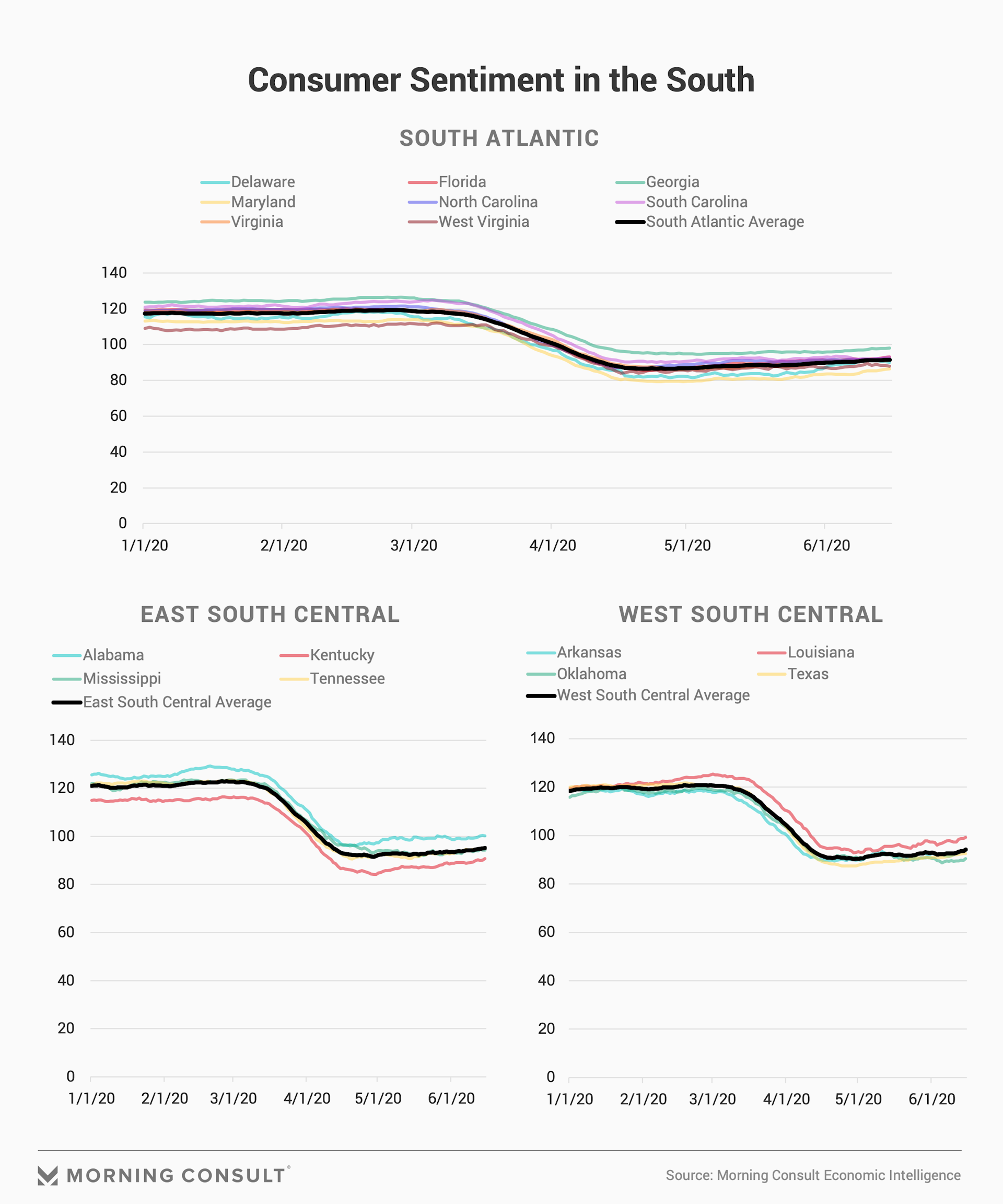

South Atlantic: Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia and West Virginia

- Consumer confidence increased by 1.5 points on average across the South Atlantic division, below the average increase of 2.2 points across the country.

- Florida, Georgia, North Carolina and South Carolina have all reported increases in the number of confirmed COVID-19 cases over the past two weeks, with Miami’s mayor slowing down the easing of restrictions on economic activity in one of the state’s most populous cities as a result.

East South Central: Alabama, Kentucky, Mississippi and Tennessee

- Consumer confidence increased by 1.6 points on average across the East South Central Division, below the average increase of 2.2 points across the country.

- Consumer confidence in Kentucky was late to bottom out compared to other states in the East South Central Division. It was not until April 30 that confidence began to rebound in Kentucky. However, once the tide turned, it experienced a greater increase in confidence than the other states in its division. Since May 1, consumer confidence in Kentucky has increased by 5.9 points, nearly double the next-largest increase in the division.

- Alabama and Mississippi have both experienced a recent increase in the number of confirmed COVID-19 cases. Consumer confidence in Mississippi remains essentially unchanged since the beginning of May, which runs counter to the national trend of increasing confidence over the past six weeks.

West South Central: Arkansas, Louisiana, Oklahoma and Texas

- Consumer confidence increased by 1.3 points on average across the West South Central Division, the second-smallest increase, behind the Pacific Division.

- All four states in the West South Central Division have reported recent increases in the growth rates of confirmed COVID-19 cases.

- Consumers in Louisiana exhibit the greatest increase in confidence in the division since the beginning of May, whereas confidence in Oklahoma has fallen below the average for the division.

West

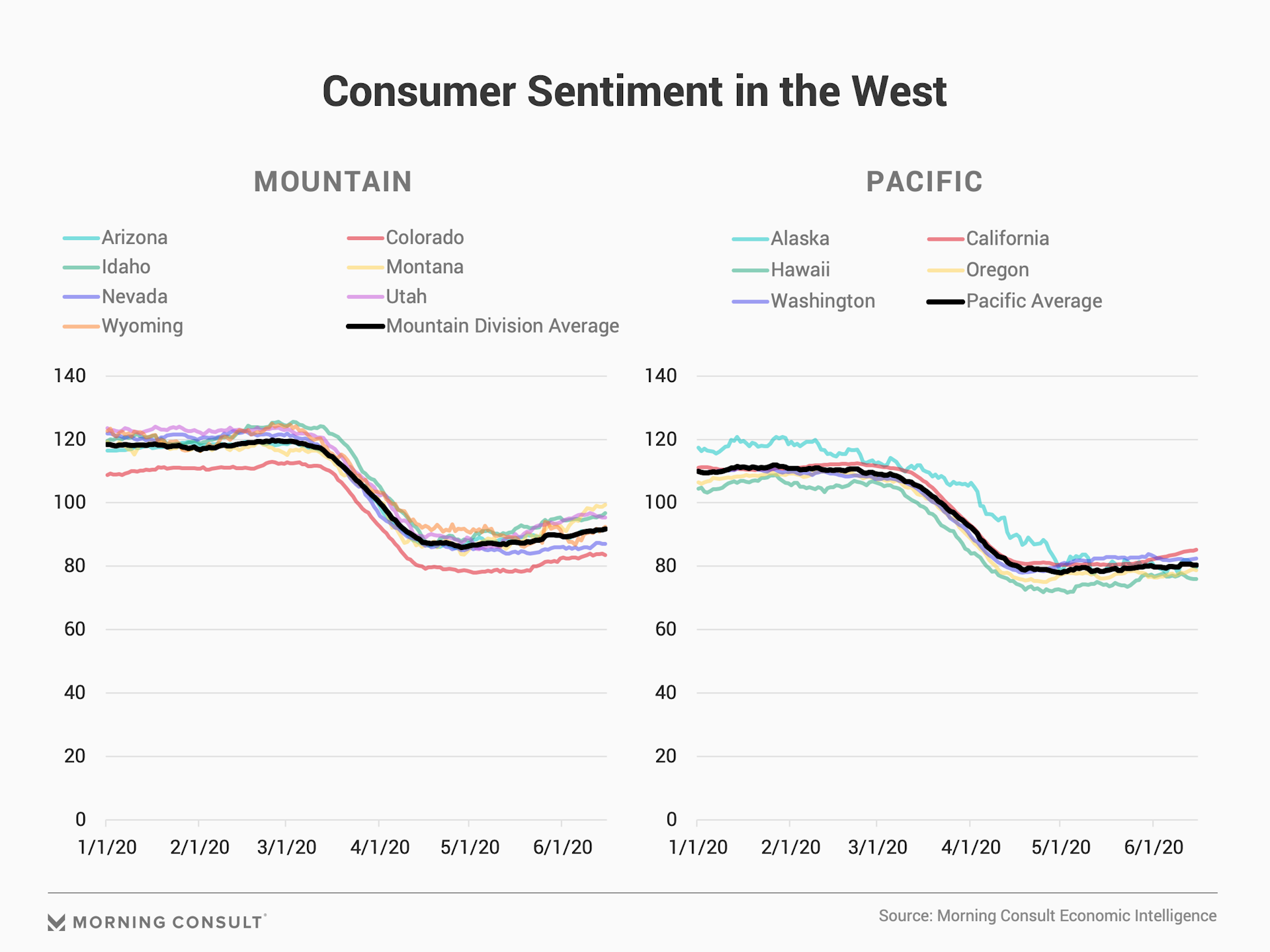

Mountain: Arizona, Colorado, Idaho, New Mexico, Montana, Utah, Nevada and Wyoming

- Consumer confidence increased by 2.4 points on average across the Mountain Division, the second-smallest increase behind the Pacific Division. This increase in confidence is surprising given that Arizona, Montana, Nevada, Utah and Wyoming all reported increases in the growth rates of confirmed COVID-19 cases in the first two weeks of June.

- Increases in confidence in Montana have driven the recent trend in the division. Consumer confidence in Montana increased by 7.7 points over the past two weeks. The increase in confidence in Montana is particularly notable given how closely confidence in Montana tracked average confidence in the Mountain Division since the onset of the pandemic. In other words, consumers in Montana are now more confident relative to other states in the division than they were prior to the onset of the pandemic.

Pacific: Alaska, California, Hawaii, Oregon and Washington

- Consumer confidence increased by 0.7 points on average over the past two weeks across the Pacific Division, which marks the smallest regional increase across all nine divisions.

- Consumer confidence in California increased by 2.9 points since June 1, which bodes well for the U.S. economy. The Californian economy is the largest in the United States, and strong increases in confidence in California should act as an accelerator to economic activity in the state.

- Alaska and Oregon are the two states in the Pacific Division to record an increase in the growth rate of COVID-19 cases since June 1. Consumer confidence in Oregon increased by 2.3 points over that period, while decreasing in Alaska by 0.4 points. Hawaii and Washington also recorded decreases in confidence.

The general trend in consumer confidence across the country is positive. The increases in confidence since June 1 should continue to support consumer spending. However, the differences across states are also relevant to businesses and policymakers as they allocate resources and face challenging cost-benefit calculations. From the perspective of retailers and marketers, recent trends in consumer confidence across the Northeast are likely to accelerate consumer spending in the region relative to the rest of the country.

This data complicates the challenges facing state policymakers. As they work to strike the right balance between easing restrictions on certain economic activities and mitigating future outbreaks of the virus, they also have to consider the second-order effects of fewer restrictions on consumer confidence.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]