Analysis: Unlike in Europe, One Size Doesn't Fit All in Asia's Post-COVID Economic Outlook

Key Takeaways

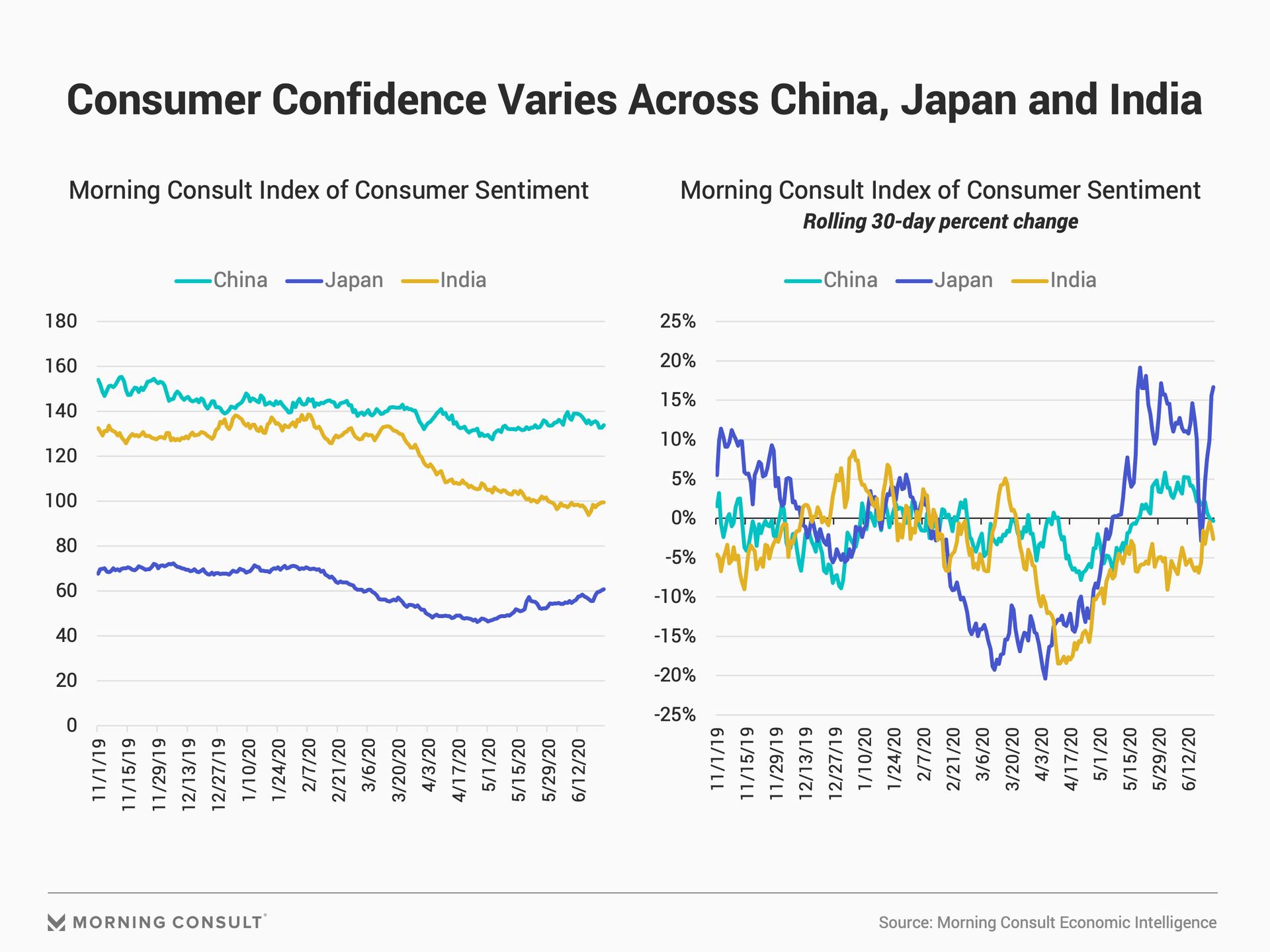

The Morning Consult Index of Consumer Sentiment (ICS) in China, Japan and India fell dramatically in each of these three countries over the past seven months as the coronavirus pandemic wreaked havoc on these countries and their economies. Consumers in all three countries remain less confident than they were prior to the onset of the pandemic despite modest recoveries in Japan and China.

The timing, severity and drivers of the decreases in confidence differ across countries, highlighting the high degree of structural, cultural and policy heterogeneity across the three largest economies in Asia.

These differences imply three starkly different near-term spending outlooks across the region. The rebound in the ICS in Japan supported by tight labor markets puts Japanese consumers in the strongest position to return to spending, whereas Chinese and Indian consumer confidence remains a drag on consumer spending in those countries.

This analysis was authored by Morning Consult Economist John Leer.

The current state of consumer confidence in China, Japan and India provides insight into the economic toll exacted by the coronavirus pandemic in those countries and the prospects for a rebound in consumer spending and economic growth through the end of the year.

Differences in consumer confidence across the three largest economies in Asia paint three starkly different pictures in terms of the likely strength of consumer spending in the coming months. Japanese consumers are in the best position to return to spending, followed by Chinese and then Indian consumers.

This outlook is important for global business leaders as they develop their post-COVID strategies in Asia. Contrary to trends observed in advanced economies, this data shows that a one-size-fits all strategy in Asia is not appropriate given the high level of cross-country heterogeneity. Consumers in China, Japan and India are experiencing the fallout from the coronavirus pandemic differently, and a successful strategy in Asia needs to account for these differences.

Such differences are also important to economic policymakers as they develop global growth forecasts to inform monetary and fiscal policy. Contrary to many of the other alternative data sources providing insight into the Chinese economy, Morning Consult’s data shows that the rebound among Chinese consumers did not begin until May and that recent surge in coronavirus cases in Beijing threaten the nascent recovery.

The China ICS exhibits a lower variance over the past year than the ICS in Japan or India so it must be normalized to directly compare it to the other two countries, but even without normalizing the data, the graphs above clearly show that the Morning Consult Index of Consumer Sentiment (ICS) in Japan is the only one of the three countries to exhibit a persistent rebound in confidence over the past month.

This data also shows no visible effect of the heightened military tensions between China and India on consumers in those countries or in China’s neighbor, Japan. Consumers do not believe that the June 15 border battle between the world’s two most populous countries, which killed 20 Indian soldiers, will affect business conditions in their own country as a whole or their own personal finances, which indicates that they do not believe tensions will further escalate.

The following sections dive deeper into trends in consumer confidence in China, Japan and India over the past seven months.

China

Chinese consumer confidence appears at first to have weathered the coronavirus pandemic relatively unscathed, but this initial analysis fails to account for the unique features of consumer confidence in China. Normalizing the data to control for differences in daily volatility reveals a dramatic decrease in confidence that only started to rebound on May 1, 2020, three weeks after Japan, the United States and Europe hit a bottom. The recent surge in confirmed cases in Beijing has put downward pressure on Chinese consumer confidence, jeopardizing the country’s economic recovery.

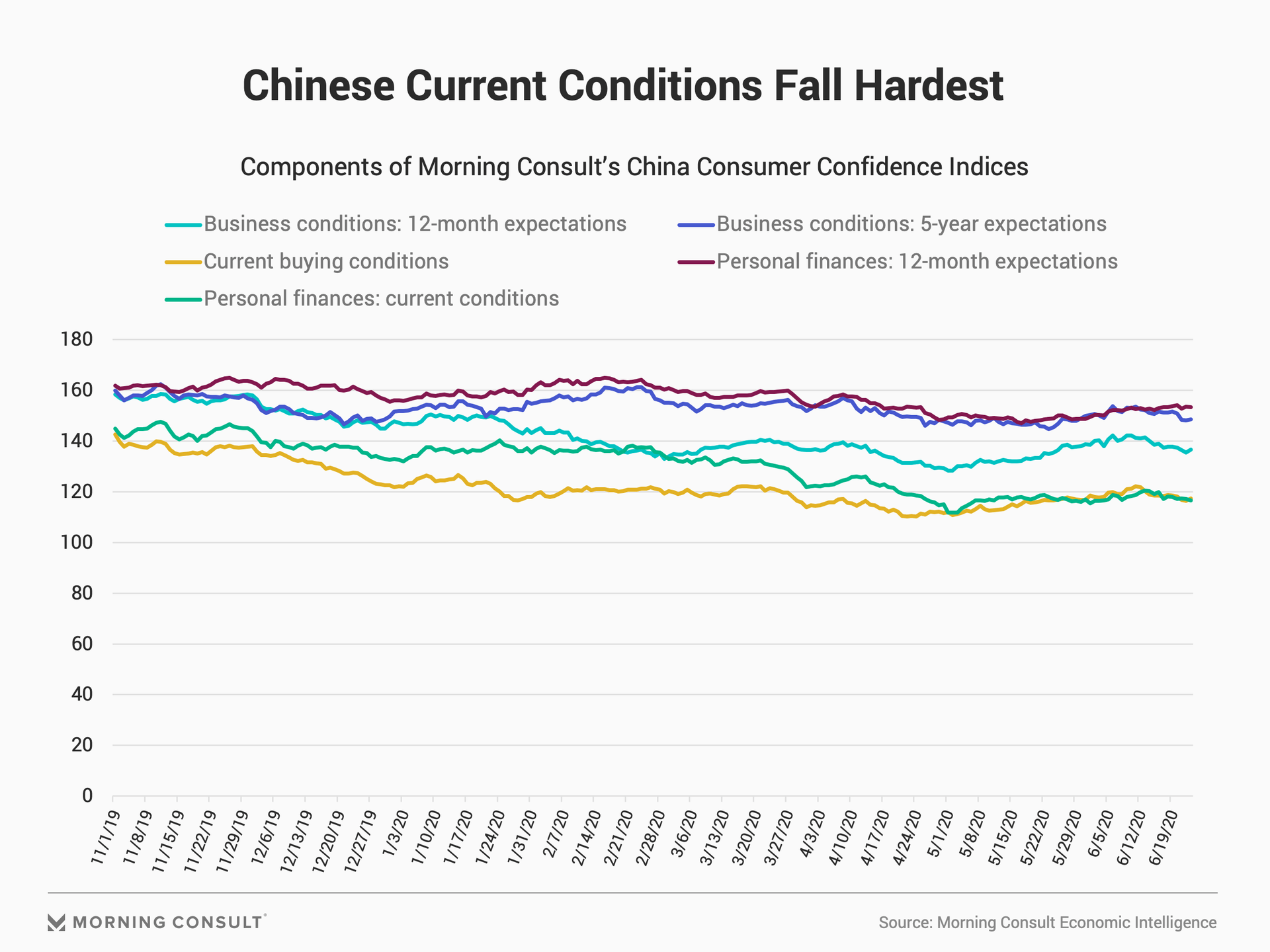

All five components of the ICS in China are below where they were on Dec. 1, 2019, before the identification of the coronavirus in Wuhan, and Chinese consumers’ views of current buying conditions and personal finances persistently deteriorated over the past seven months. However, none of the components exhibits an acute decrease. This result is surprising given the severity of the outbreak in Wuhan and the drastic measures taken to limit the spread of the virus.

These seemingly mild or moderate decreases in confidence have to be considered in the context of Chinese consumers’ relatively stable views of the economy compared to consumers in other Asian countries. Chinese consumer confidence is less volatile than it is in India or Japan. From March 1, 2019, through June 22, 2020, the coefficient of variation, which is ratio of the standard deviation to the mean, of the ICS in China is 0.05, compared to 0.12 in India and Japan. In other words, consumer confidence in India and Japan exhibits twice as much volatility as it does in China.

These cross-country differences in variation are not merely the result of differences in sample sizes. The average seven-day sample size during this time period in China (2,284) is larger than it is in India (1,691). Additionally, the average seven-day sample size in Japan (2,598) is larger than it is in China or India. If these differences in daily variation were the result of sample sizes, one would expect Japanese consumer confidence to exhibit the lowest coefficient of variation given the relatively large sample sizes and higher degree of cultural, demographic and geographic homogeneity in Japan compared to India and China.

There are different possible reasons that Chinese consumer confidence is more stable than it is in other countries. One potential explanation is that Chinese consumers do not have access to information and news sources from a free press to the same extent as consumers in other countries. Consumer confidence is a function not only of the underlying economic and financial conditions in a given country, but also the media coverage of those conditions. If Chinese consumers do not hear about bad economic news to the same extent as those in other countries, then they are less likely to change their views of their personal finances and business conditions in the country as a whole.

The coronavirus pandemic provides a few examples of how the Chinese government’s involvement in state media may be responsible for Chinese consumers’ relatively stable economic and financial assessments. For example, many Western media outlets have detailed the ways in which the Chinese government limited the coverage of the coronavirus outbreak and sought to portray the government’s response in a favorable light, with the latter creating a strong backlash against state media. Quite apart from managing media coverage, there are also reports that the Chinese government knowingly underreported the severity of the outbreak.

All of these stories support the narrative that Chinese consumers were unaware of the severity of the outbreak in Wuhan and its economic toll. If these recent practices are the norm rather than the exception, that may explain the difference in variation between Chinese consumer confidence and that of the two other countries.

Differences in economic experiences also potentially explain cross-country differences in the volatility of consumer confidence. For the past 15 years, the Chinese economy has grown by at least 6.9 percent per year, consistently achieving over 10 percent growth from 2003 through 2010. As American and European consumers dealt with the financial hardships surrounding the Great Recession between 2007 and 2010, the lives of average Chinese consumers improved. Thus, the economic experiences of most Chinese citizens tell them that the economy is most likely to develop as planned, regardless of what happens in the interim. The Chinese government is powerful and competent enough to guide the economy through tough times.

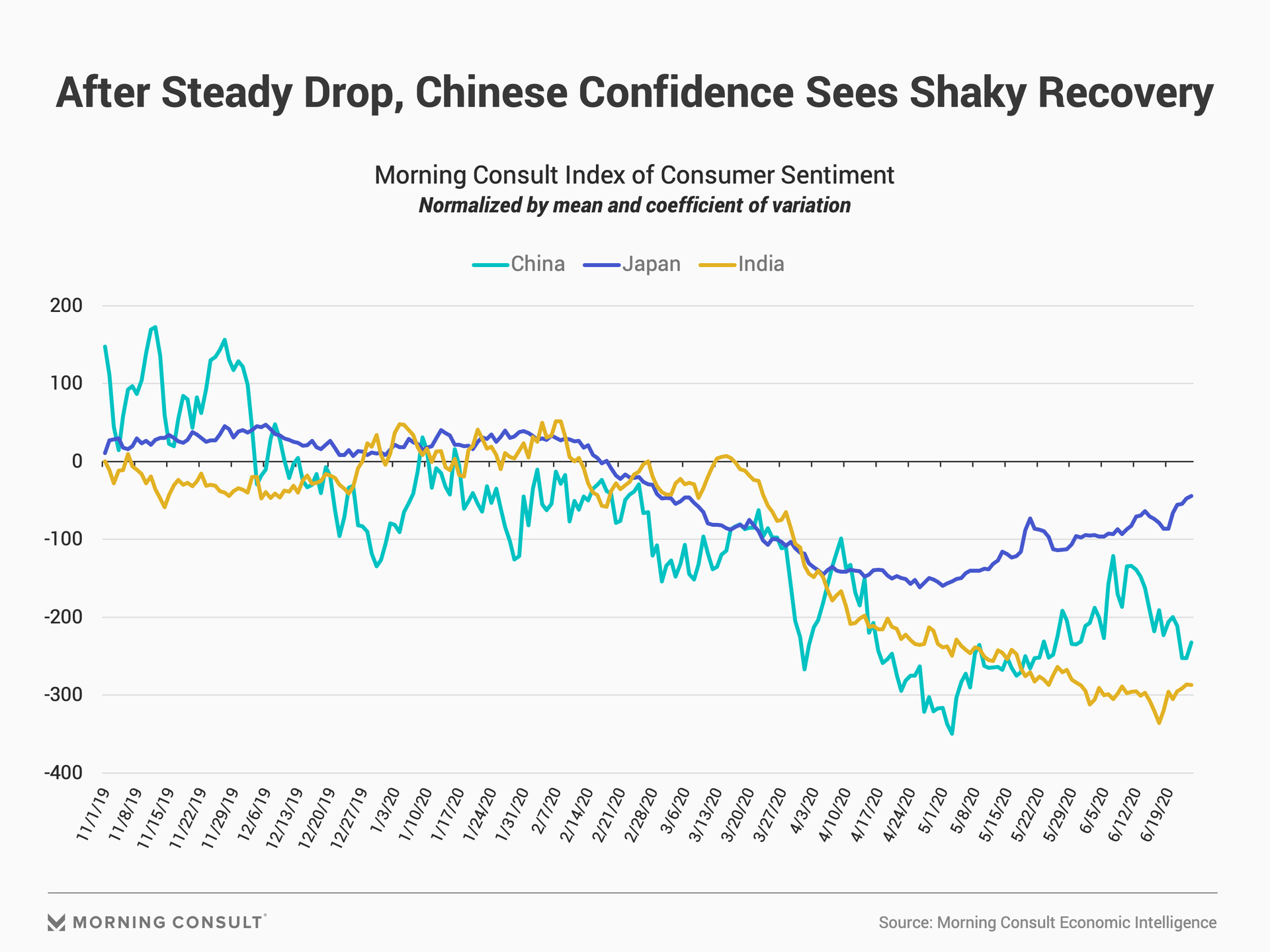

Regardless of the reason, it is empirically true that Chinese consumer confidence does not exhibit the same level of day-to-day variation as other countries in Asia. In that context, the response of Chinese consumers to the coronavirus pandemic becomes more significant. Normalizing these three series by subtracting their long run averages from the daily values and dividing by the coefficients of variation provides one approach of directly controlling for such differences in the volatility of consumer confidence across countries.

The y-axis on this chart reflects normalized values of the ICS. Similar to the standard ICS charts, the trend over time, as opposed to any particular value, provides the most insight into the state of consumer confidence in each of these three countries.

This transformation of the data reveals a different story in terms of the timing and severity of the downturn in consumer confidence in China. First, Chinese consumer confidence fell beginning in December 2019, several months before the fall in Japan and then later in India. It remains unclear exactly what ordinary people in China knew about the coronavirus in early December 2019, but this data shows that Chinese consumers grew increasingly wary starting that month.

Second, the severity of the fall in confidence is significantly greater in China than it is in India or Japan after normalizing the values. The Chinese economy is highly dependent on exports to the United States and Europe, which means that decreases in aggregate demand in those advanced economies jeopardize Chinese workers’ jobs and consumers’ incomes. Not surprisingly, confidence in China only began to improve once the situation in the United States and Europe stabilized and started to rebound, even though China had successfully contained the initial coronavirus outbreak before those two regions did.

Third, Chinese consumer confidence is once again on the decline, after rebounding for the past six weeks. The timing of this decline closely corresponds to the most recent outbreak in Beijing, which was first reported June 13. Thus, the increase in confirmed cases in Beijing poses a risk to the economic recovery throughout China.

Normalizing the China data also reveals a period of remarkable volatility in confidence from March 28 to April 9. The timing of this V-shaped response corresponds to the partial reopening of the city of Wuhan. Chinese consumers grew extremely concerned about their own economic prospects in the days following the initial reopening. Such concern could be the result of consumers learning more about the measures that were taken to limit the spread outside of Wuhan or it could have been driven by fears that the virus would spread throughout China once the government eased restrictions.

Japan

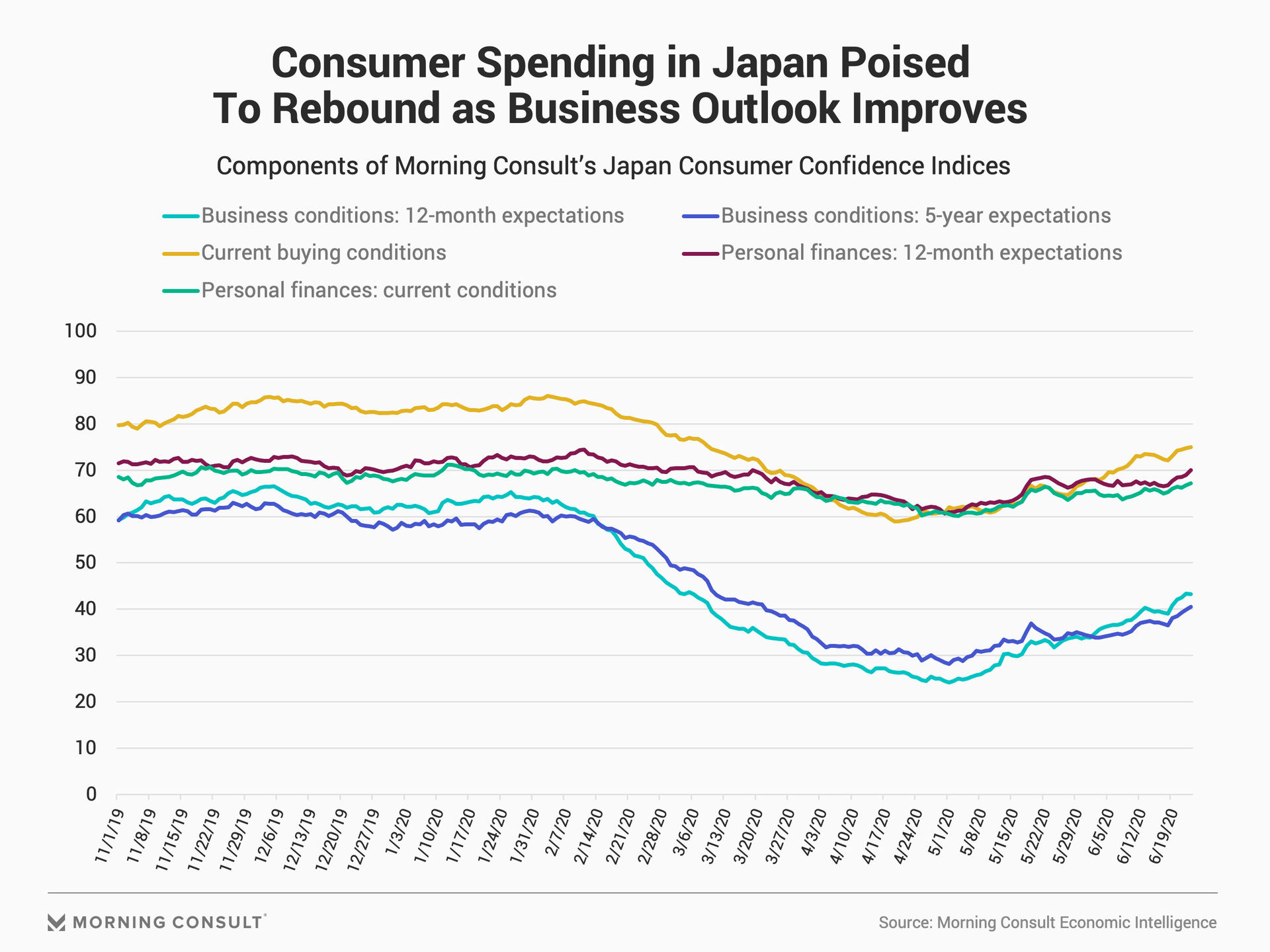

Japanese consumers are well positioned to increase spending over the next couple months as improvements in their expectations of business conditions drive confidence higher. Generous unemployment benefits and a tight labor market protected Japanese workers from the financial hardship felt by Indians and Chinese, which provides them with the financial means to return to spending.

Outside of China, Japanese consumers were the first around the globe to grow less confident, with Japanese expectations of business conditions in the country falling in early February, just days after the World Health Organization’s Jan. 30 declaration of a global public health emergency.

What is particularly remarkable in Japan is the volatility of the business conditions components compared to the stability of the personal finances components. Japanese consumers did not materially change their views of their current personal financial conditions or their expectations for their personal finances over the next 12 months even as they increasingly believed that the pandemic would hurt business conditions.

This New York Times report highlights structural, cultural and policy reasons why the coronavirus pandemic did not produce mass unemployment on pace with the United States. Notably, Japan suffers from a chronic labor supply shortage, which means that the unemployment rate is less sensitive to business cycle variation than it is in countries like the United States.

This data shows that Japanese consumers did not expect weaknesses in business conditions to affect their personal finances. In this sense, consumer confidence in Japan responded to the pandemic similarly to confidence in Europe, where widespread financial support for workers has also limited the employment impact of the pandemic.

Over the remainder of the summer, consumer confidence in Japan should support growth in consumer spending, which accounted for 55.6 percent of GDP in 2018. Japanese workers did not experience a decrease in their personal finances to the same extent as American workers, and in May they increasingly expected to be better off financially over the next 12 months. Heightened levels of financial security provide consumers with the willingness and ability to spend.

India

Indian consumers grew less confident after hearing the details of Prime Minister Narendra Modi’s underwhelming fiscal spending plan in mid-May, but Modi’s phase two reopening shows signs of boosting Indian consumer confidence. Of the three countries, India is the only one not to experience a period of stabilizing confidence since the onset of the pandemic.

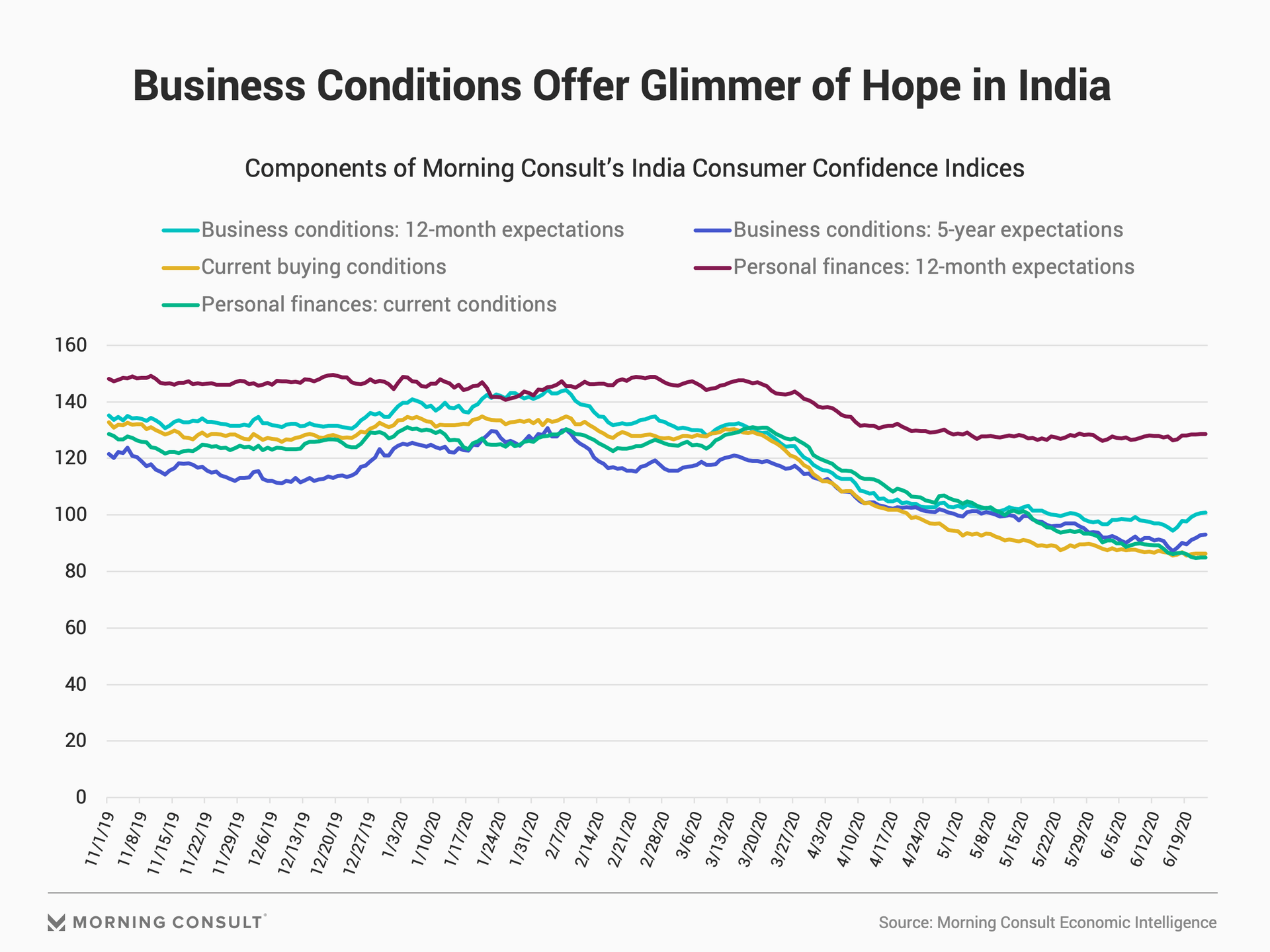

The consumer outlook in India is dire. Indian consumers have consistently grown more pessimistic about their personal finances and the economic conditions in the country as a whole since March 24, the day that Prime Minister Modi announced a nationwide lockdown for India’s 1.3 billion people. Unlike in China or Japan, consumer confidence in India continues to decrease. While both business conditions components surged after Modi’s June 17 announcement that he will move forward with the second phase of removing restrictions on social and economic activities, they remain below where they were 30 days prior.

This data also shows that Prime Minister Modi’s stimulus spending proposals have not materially influenced consumer confidence in India. Modi announced a $266 billion stimulus plan on May 12, which equates to roughly 10 percent of GDP. However, the details of that plan, released by the Modi government May 13-17 showed that Indians could only expect an additional 1.1 percent of GDP to be spent boosting short-term aggregate demand. The rest of the funds were earmarked for medium-term projects, liquidity provided by the Reserve Bank of India and budgetary expenditures that already had allocated funds.

Some in India have criticized Modi’s initial announcement as a stunt to boost consumer confidence by inflating the total value of stimulus spending. Morning Consult’s data shows that Indian consumers grew less confident on May 18, the day after the final details of the stimulus plan were revealed. Prior to that point, all five components of consumer confidence were in the process of stabilizing. In the days immediately following the release of the plan’s details, Indians’ expectations of business conditions and their views of their own personal finances further deteriorated.

From a policy perspective, this data shows just how severely consumer confidence has fallen since the Reserve Bank of India’s June 4 release of consumer sentiment in May, which reflects responses from May 5-17. In its survey, which is conducted every other month, the central bank reported a sharp contraction in confidence in May compared to March. Since the middle of May, Morning Consult’s India ICS has deteriorated even further, with all five components of consumer confidence decreasing over the past six weeks.

Persistent decreases in confidence put downward pressure on consumer spending in India. However, when thinking about the outlook for the Indian economy, it is also important to consider the effects of global economic developments on that outlook. The Indian economy is highly dependent on remittances from advanced economies. The coronavirus pandemic disrupted those economies, making it harder for those payments to continue supporting consumers in India. Thus, similar to China, the recent slowdown in global economic growth provides an additional headwind to the Indian economy.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]