Analysis: The Four Phases of the 2021 U.S. Economy

The U.S. economy in 2021 will experience four distinct phases driven by the spread of the virus, the distribution of the vaccine and the adequacy of policy responses. The initial spending increases from the second coronavirus relief package will wear off by the middle of April, gradually exposing weaknesses in households’ finances. Once the vaccine is widely distributed, consumers will return to basic activities like going out to eat and traveling, unleashing a wave of economic activity through the end of the year.

By December, the party is likely to be over, and we’ll see for the first time how well unemployed workers are able to navigate the new normal. These four phases will shape companies’ operating environments over the course of the year.

Phase 1: Stimulus high (January-April)

The economy will shake off its malaise during the first quarter of 2021 due to the soon-to-be enacted coronavirus relief bill. Stimulus checks and unemployment insurance payments will offset the negative economic consequences of the rapid spread of the virus and restrictions on economic activity. Consumers across the income spectrum will grow more confident in the economy once the money hits their accounts, driving increases in consumer spending and employment through the middle of April.

Phase 2: Vulnerability (April-June)

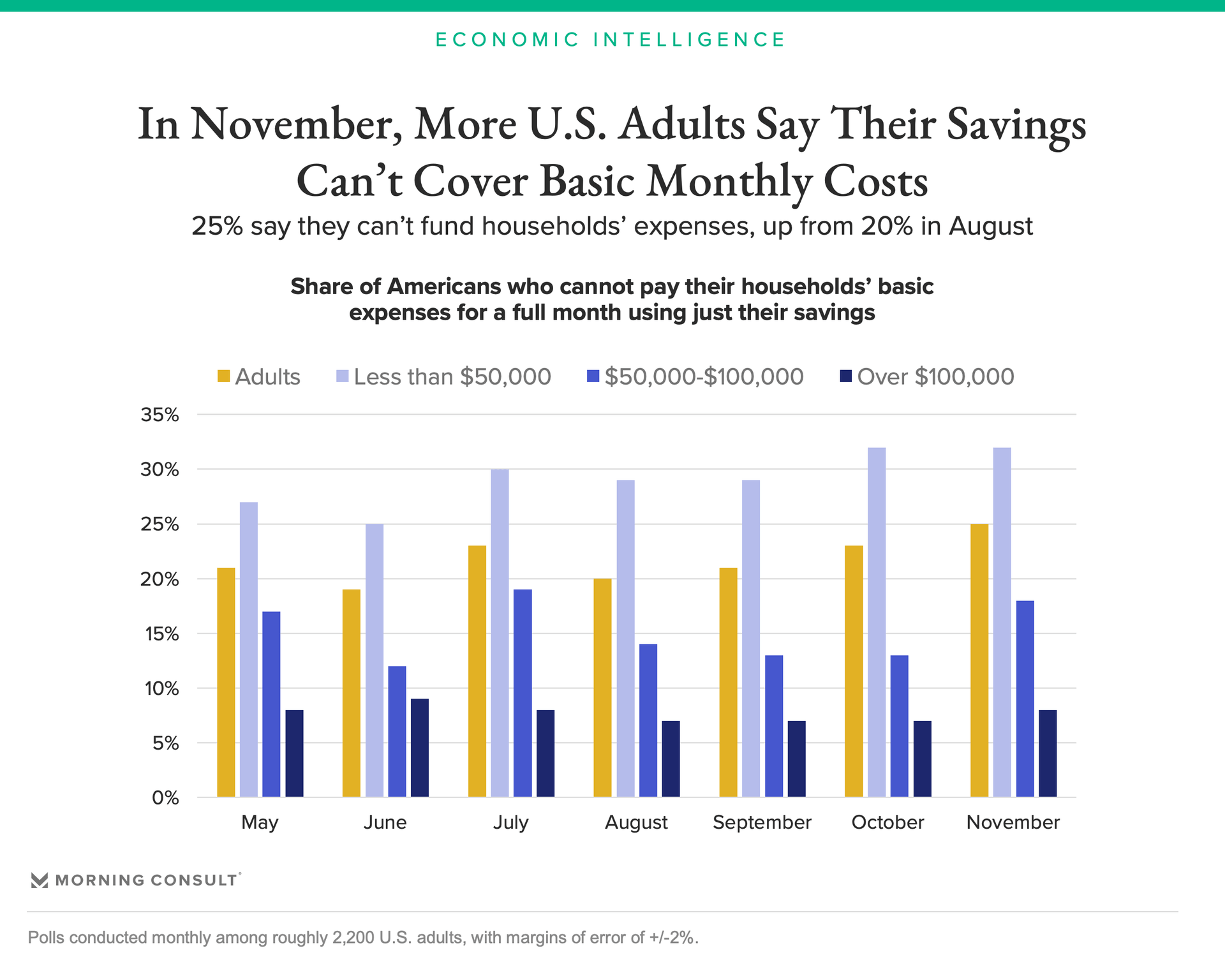

Personal finances and consumer spending are likely to weaken in late April as the effects of the second coronavirus relief bill wane. The size of the stimulus checks and value of the federal unemployment insurance payments included in the most recent package are half the size of those included in the CARES Act in March. Consequently, when the $300-per-week benefits expire in the middle of March, economic activity is likely to slow more rapidly than it did over the summer unless Congress passes an additional stimulus bill, straining households’ finances.

Phase 3: Bounce back (July-October)

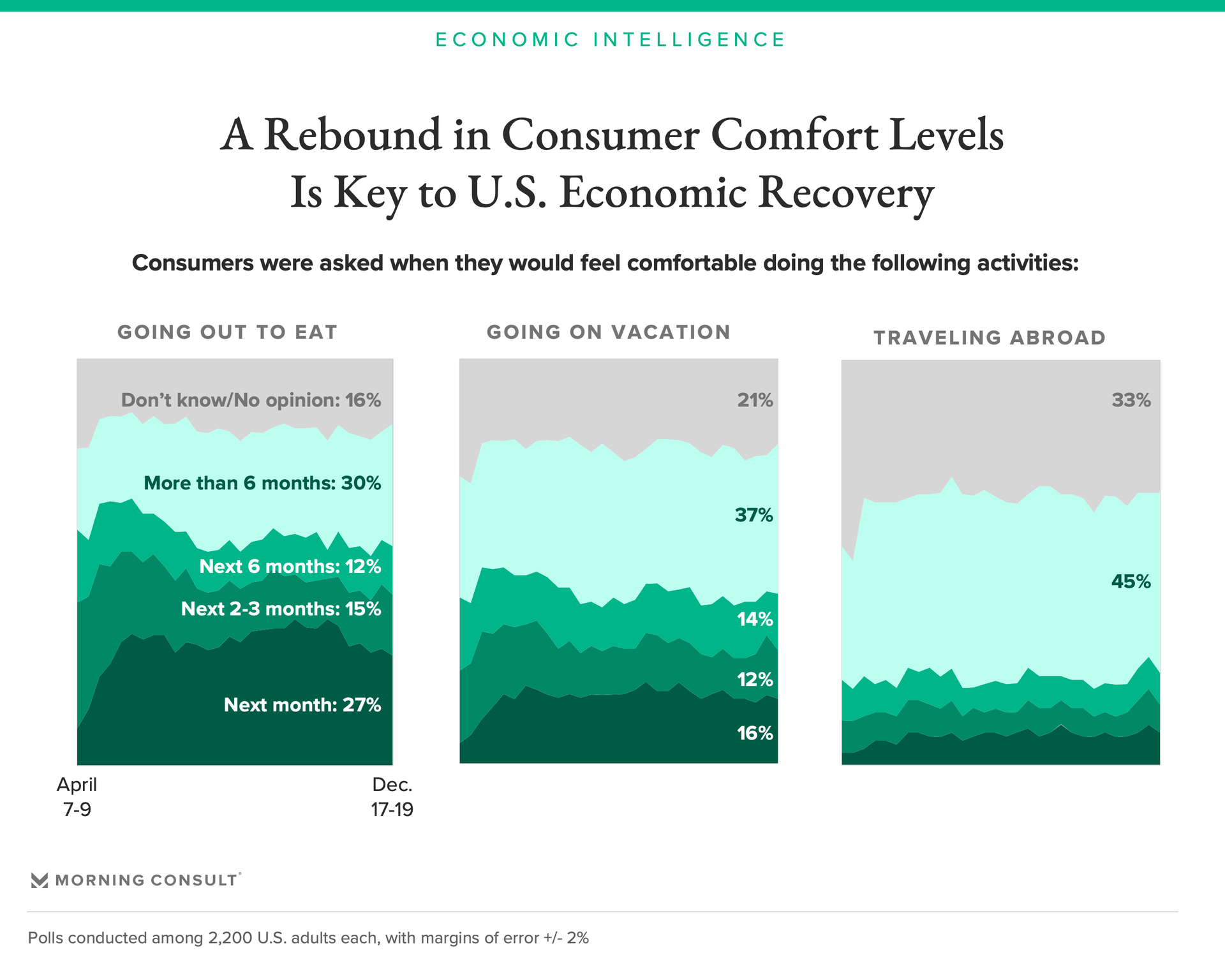

The United States is on pace to achieve widespread inoculation by the end of the second quarter, driving a dramatic rebound in economic activity during the third quarter. The robust rebound will last through most of the remainder of the year as consumers grow comfortable engaging in standard activities. Businesses like restaurants and gyms are likely to be the first to see a resumption of activity, with international travel happening later in the year. This cascading effect will fuel the economy through the end of the year.

Phase 4: Normalization (December-2022)

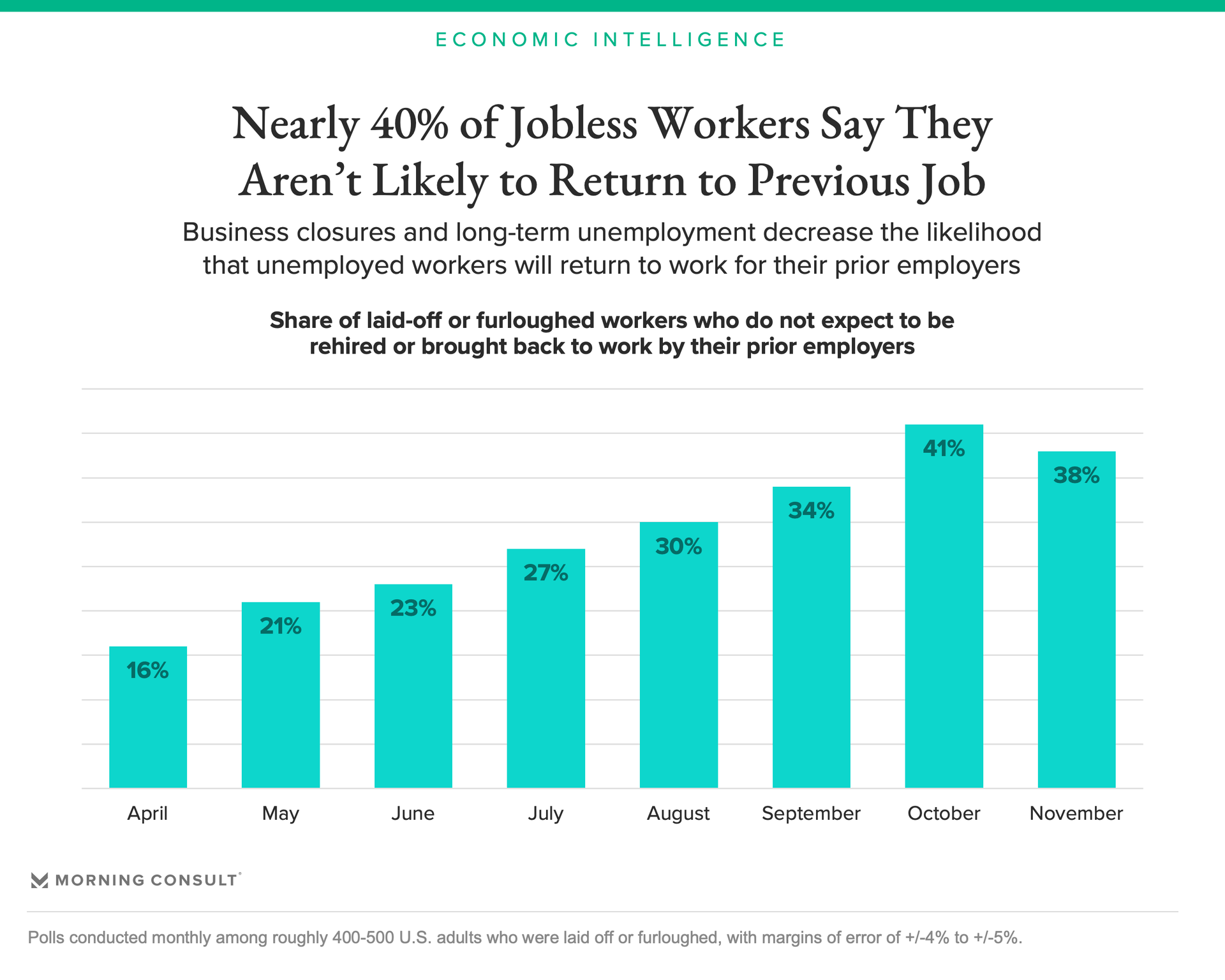

The end of 2021 will provide the first indication of the strength of the economy after the pandemic. If large groups of unemployed workers are not able to find work for new companies or in different industries, then the economic scars of the pandemic are likely to limit potential economic activity heading into 2022.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]