The Jobs Numbers Were Disappointing. Here’s Why

Key Takeaways

Employers only added 266,000 jobs in April, down from over one million in March, and the unemployment rate actually ticked up one percentage point to 6.1%.

Morning Consult’s high frequency indicators have shown that the demand for workers remained stubbornly weak throughout April.

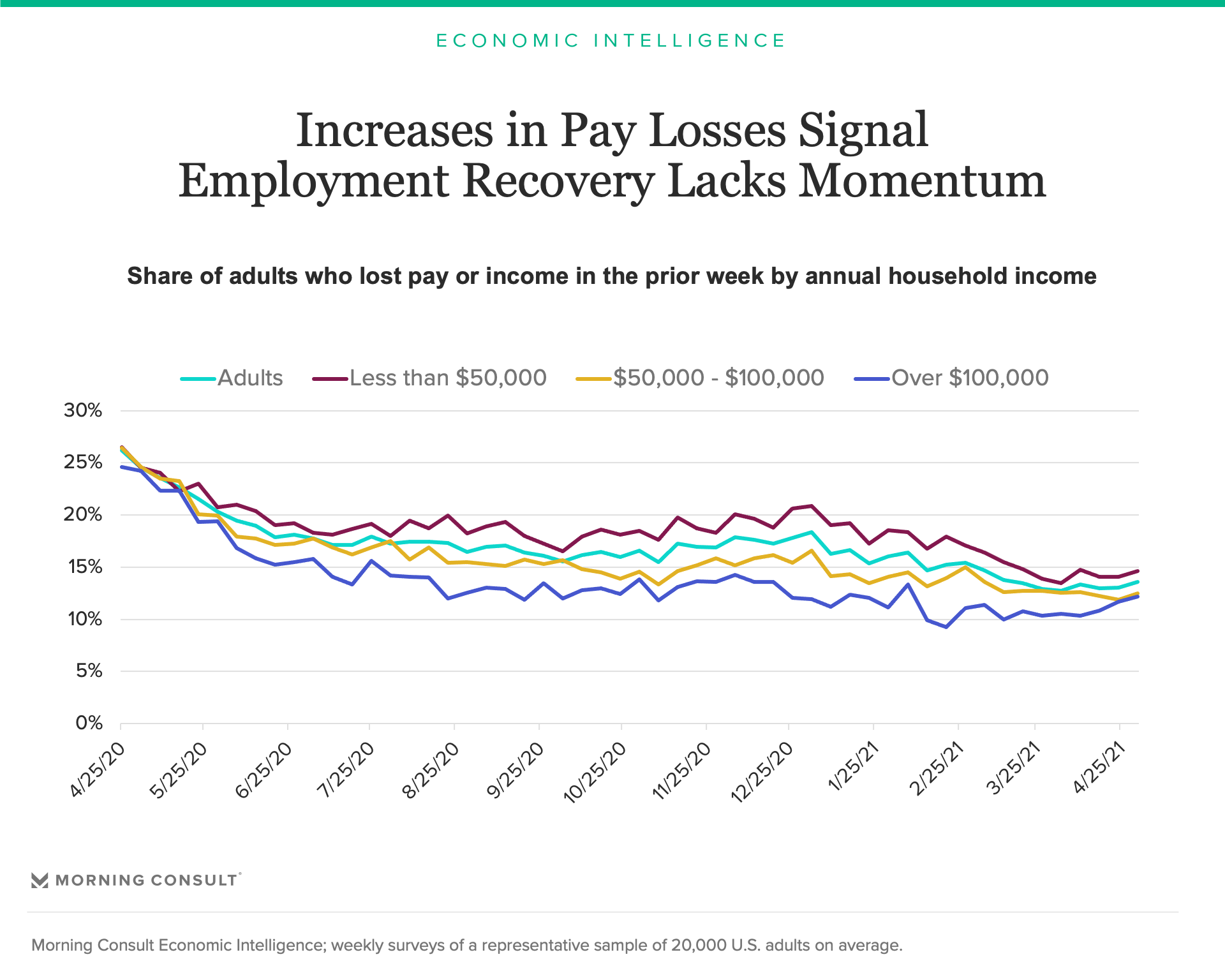

In April, we saw an increase in pay losses across the income spectrum, and a growing share of employed workers expect to lose pay or income in the next month - signaling that the recovery is losing momentum.

The following analysis is based off of Morning Consult's high frequency economic indicator data. Read more from our April 2021 U.S. Consumer Outlook report.

What happened?

Employers only added 266,000 jobs in April, down from over one million in March, and the unemployment rate actually ticked up one percentage point to 6.1%.

What Morning Consult’s data says

Morning Consult’s high frequency indicators have shown that the demand for workers remained stubbornly weak throughout April:

- Weekly pay losses remained elevated across the income spectrum, actually ticking up toward the end of the month among high-income adults.

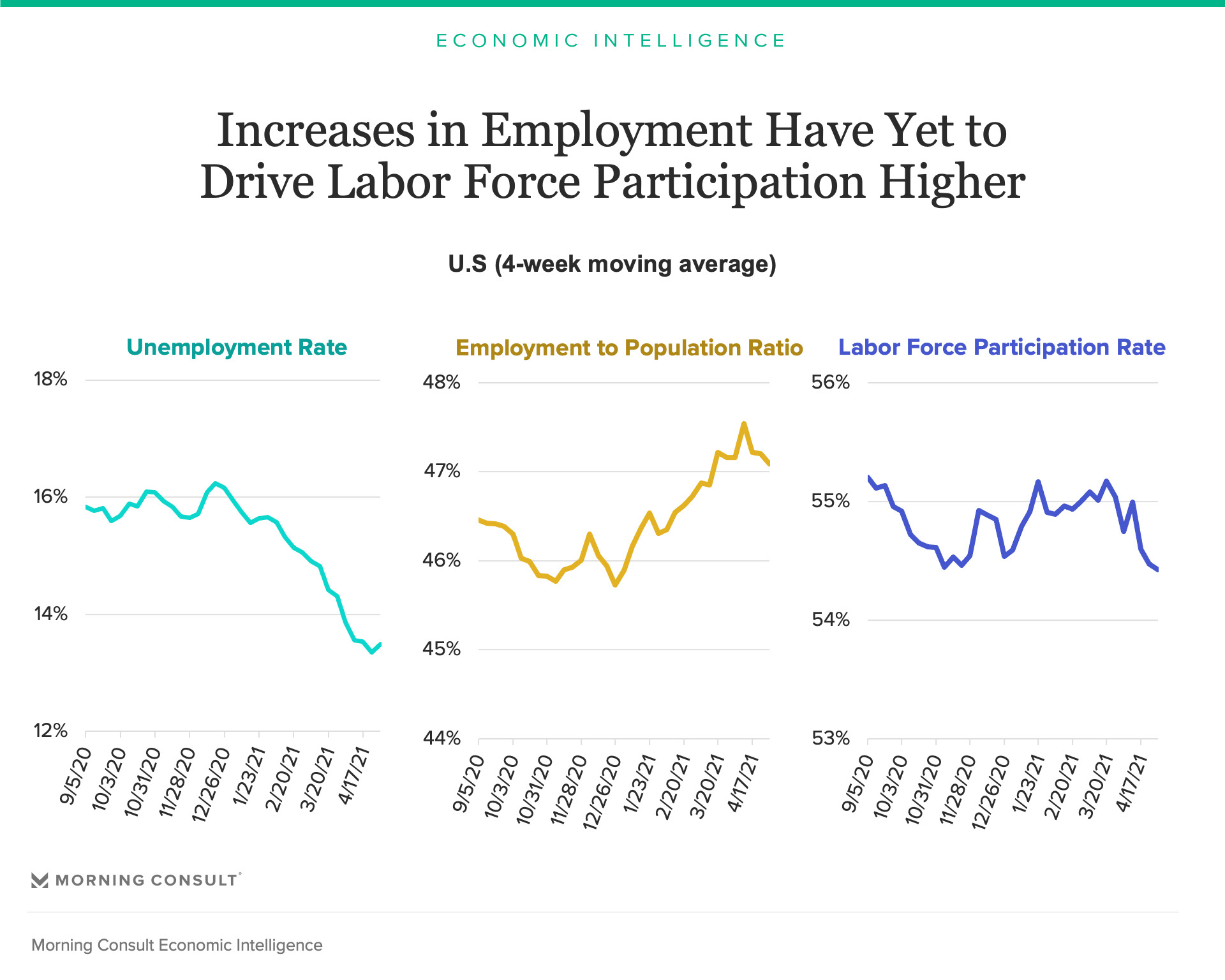

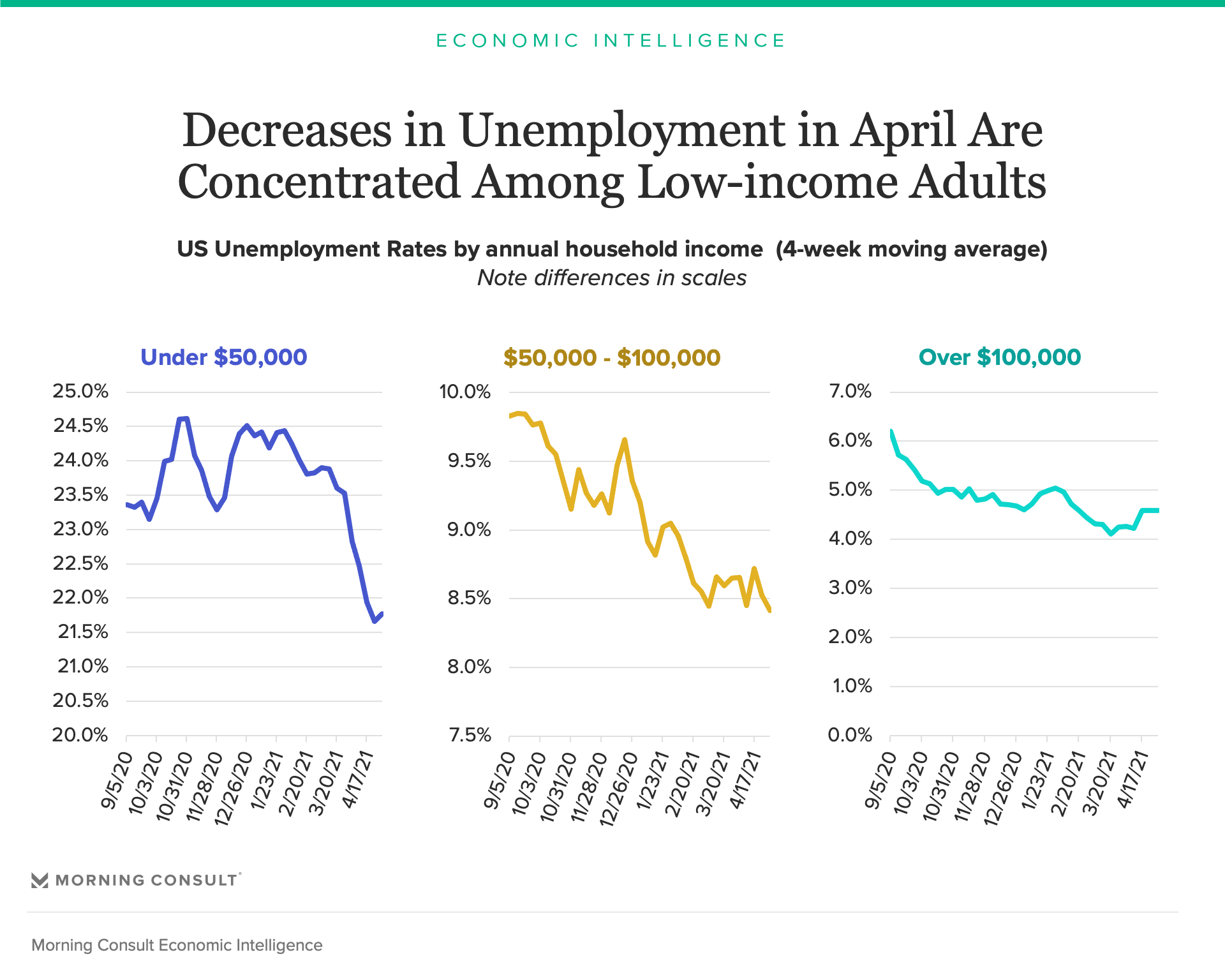

- Limited decreases in unemployment among low-income earners were not enough to meaningfully boost labor force participation.

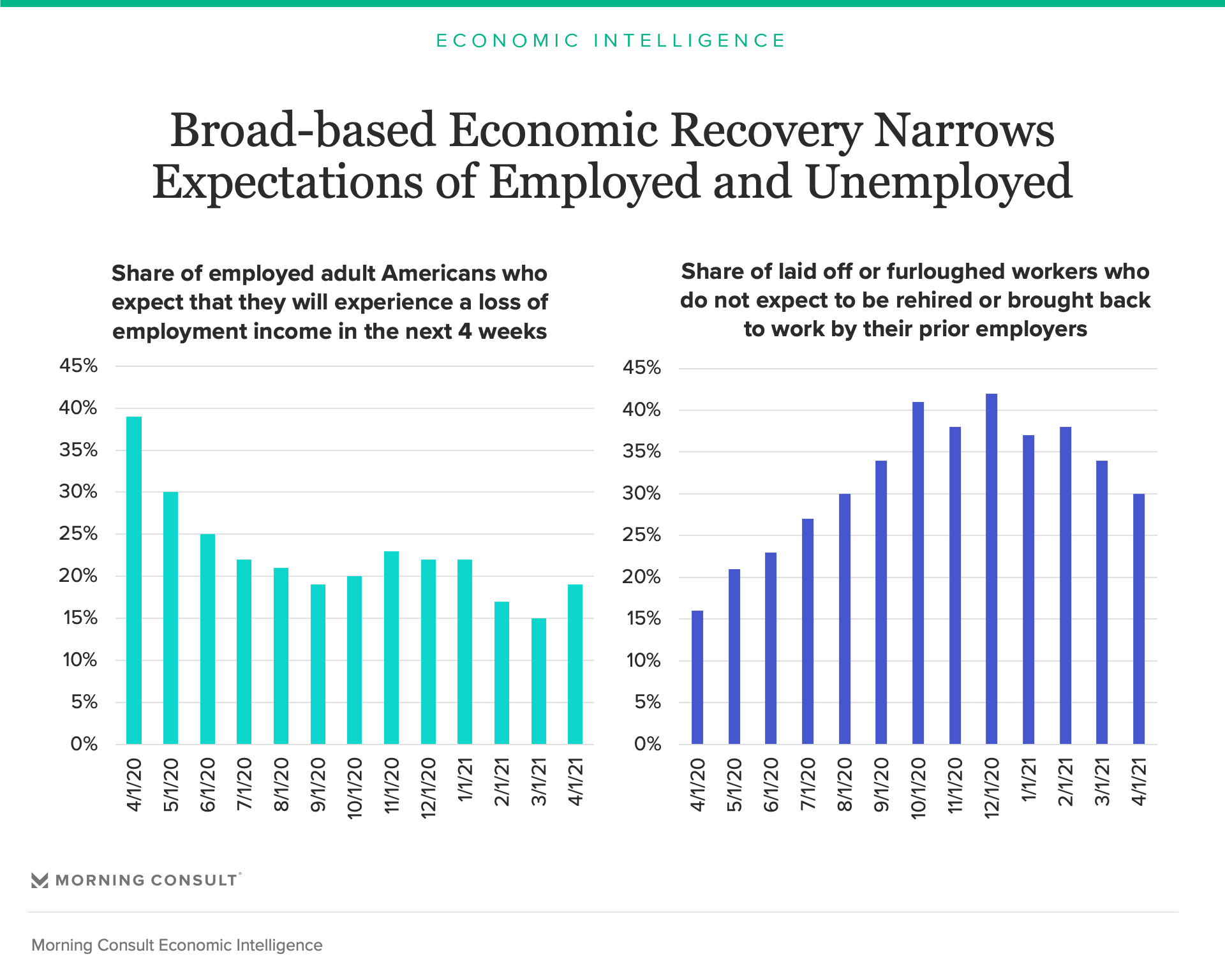

- A growing share of employed workers expect to lose pay or income in the next month.

Additionally, even if demand for workers were to increase, childcare responsibilities, health concerns and commuting obstacles all pose serious barriers to unlocking the full potential of the workforce.

What should we expect next?

- As stimulus checks run out and vaccination rates plateau, it looks increasingly likely that the jobs recovery will play out slowly over the remainder of the year.

- Discouraged workers aren’t going to come in from off the sidelines until they stop seeing their friends and neighbors lose their jobs or they have access to affordable childcare.

- Until then, we’ll remain stuck in a paradoxical world of labor shortages in some parts of the economy and weaknesses in labor demand in others.

Read more from our April report on the U.S. consumer outlook.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]