Previewing Back-to-School Shopping This Year and the Influence of Economic Uncertainty

In this preview of Morning Consult’s forthcoming report on back-to-school shopping, we already see early indications that consumers’ inflationary concerns are influencing an increase in back-to-school budgets this year. Parents’ anticipated spending has shifted upward, meaning parents of school-age children will likely have to make purchasing trade-offs to stay within their budgets.

View 2023 data on back-to-school shopping budgets amid high inflation.

The dual threats of inflation and a looming recession should have retailers on alert for the 2022 back-to-school shopping season. Consumers’ wallets are feeling squeezed from higher prices for essentials, leaving less room for discretionary spending. And while fresh pencils and notebooks are absolutely necessary for the new school year, a new backpack might not be.

Morning Consult’s upcoming back-to-school shopping report, launching in July, will measure consumer sentiment, spending and behavior across the spring and summer as shopping for the 2022-2023 school year picks up in earnest. Preliminary research shows that inflation is already shaping how much parents intend on spending, while almost one-third of those who participate in back-to-school shopping have started making purchases for the 2022-2023 school year.

Parents plan for higher back-to-school spending in 2022

Inflation hasn’t impacted back-to-school categories like apparel, electronics and paper goods in the same way that it’s hitting gasoline prices, but family budgets are adjusting to accommodate rising prices by spending less on discretionary goods. As of early May, more parents than in previous years are planning to spend at least $250 on back-to-school shopping, indicating that they’re anticipating how inflation will impact their purchases and know their kids will still need new supplies and clothing.

While it’s still early for parents to start seriously evaluating their back-to-school budgets, we know that U.S. adults are making trade-offs to make ends meet. They’re still buying key items like apparel and electronics, but are making substitutions for less expensive alternatives in these categories. For retailers, featuring in-stock — if not brand-name — options where possible in marketing efforts will attract increasingly budget-savvy shoppers.

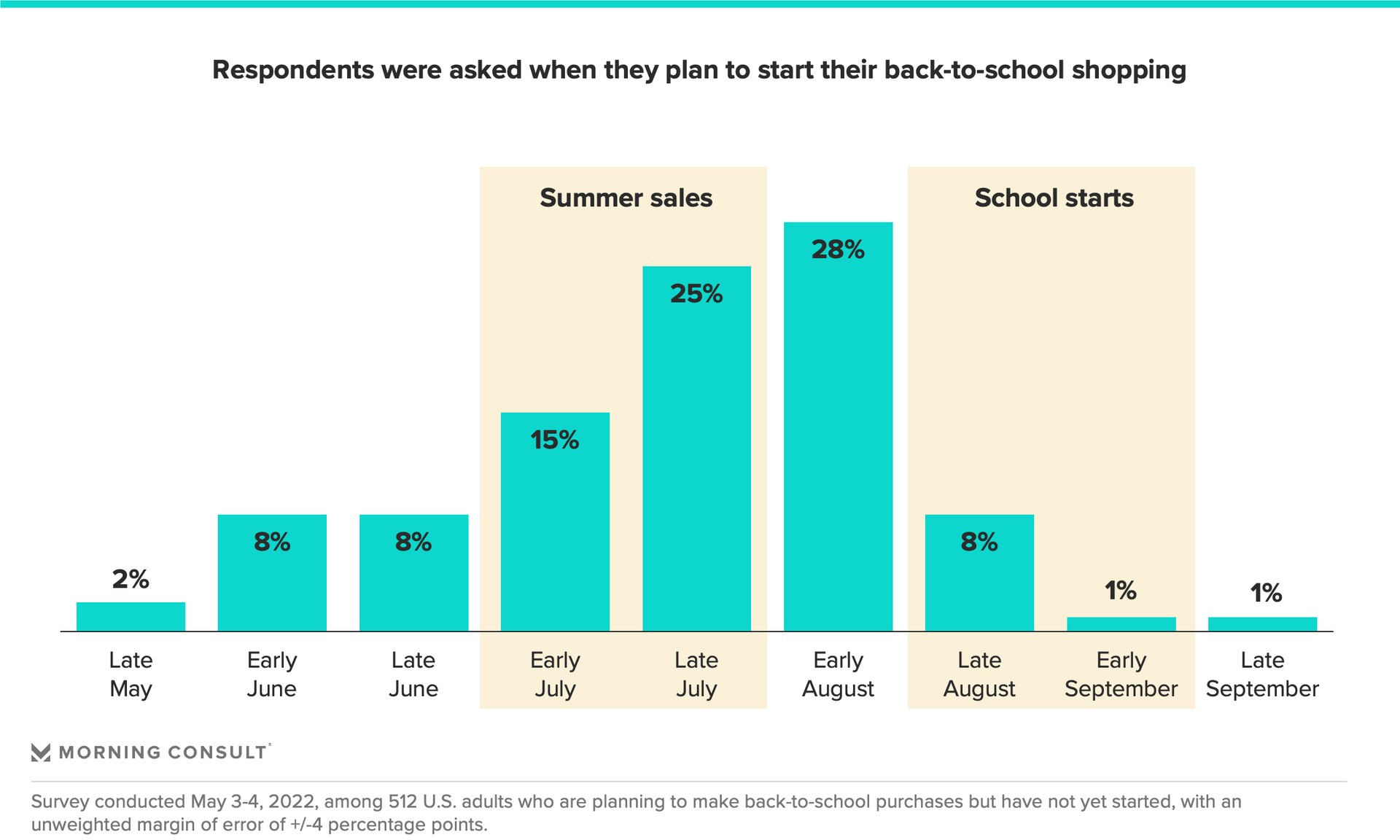

Most shopping will happen in late July and early August

For readers who think it's too soon to talk about going back to school, 29% of people planning to do shopping for the new school year have started already. Still, most shopping will happen later this summer.

A plurality of adults (43%) who are planning back-to-school shopping told us they’re looking to shop during this year’s Amazon Prime Day, which Amazon recently announced will return to its usual July slot. About 1 in 3 each said they’re waiting for Labor Day and other summer sales holidays, respectively.

Last year, our research showed that parents were more excited than usual about back-to-school shopping, buoyed by the promise of a semi-normal school year after the pandemic forced students into remote learning: The share of parents who said they were excited increased 10 percentage points from 2020 to 2021.

This far ahead of the school year, parents are a little more ambivalent, with about 2 in 5 each saying they are excited or stressed about back-to-school shopping. Early shoppers (58%) are much more excited than those who have not begun shopping (39%). But as more families begin their back-to-school shopping, we expect the realities of inflation and strained household budgets to tip these numbers toward stress. Retailers should expect heightened demand for budget-friendly alternatives to dominate the back-to-school season.