Trust in Boeing Continues to Dip, but It’s Not Impacting Airlines

Key Takeaways

Net trust in Boeing among U.S. adults is just 9 percentage points as of February, down 16 points since December.

Business and first class flyers lost the most trust in Boeing following the 737 Max 9 blowout. The company now has a net trust rating of 16 points among this group, a 26 point decrease from Q4 2023.

A loss of trust in Boeing has not spread to the airline industry as a whole. In fact, airlines are seeing a bit of a trust rebound, among consumers and business and first class flyers, just in time for what looks to be a busy spring break season.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

Trust in Boeing continues to worsen following the January 737 Max 9 door plug blowout during an Alaska Airlines flight. Yet despite consumers souring on the aircraft manufacturer, the same isn’t true for the airline industry writ large. In fact, heading into a busy spring break travel season, trust in airlines is on the upswing.

Trust in Boeing slumps further following 737 Max blowout

The Federal Aviation Administration is putting more pressure on Boeing following the door plug blowout, giving the company just 90 days to come up with a comprehensive plan to improve quality control, and vowing to hold Boeing accountable every step of the way.

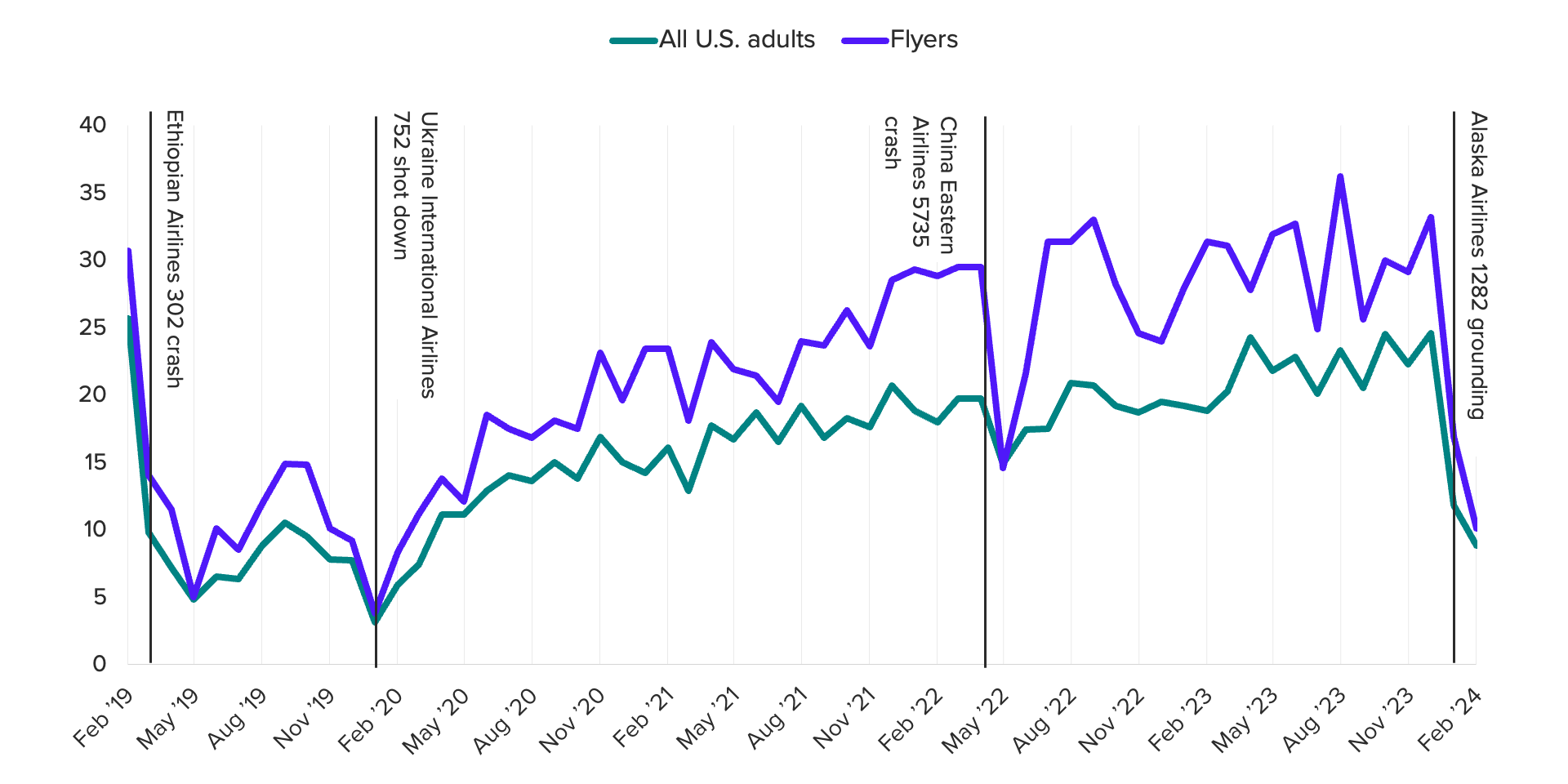

These headlines have clearly caught the attention of both flyers and consumers. Morning Consult Brand Intelligence data shows the company’s net trust rating, the share of U.S. adults who say they trust Boeing minus the share who say they distrust it, has fallen to 9 percentage points among U.S. adults, down 16 points from December. The shift is even more dramatic among U.S. adults who have taken a flight in the past year. The company’s net trust rating among flyers is 10 points, a 23-point drop from December.

Net Trust in Boeing Over Time

This downward shift was evident in the weeks following the recent 737 Max 9 blowout but is even more notable given trust has not rebounded. Two factors are likely contributing to this. First, federal scrutiny has created a steady stream of headlines, keeping the Boeing brand top of mind. Second, this is far from the first accident involving a 737 Max passenger jet. Multiple events over the past seven years could have consumers thinking this is part of a broader pattern as opposed to isolated incidents.

Boeing’s reputation is more tarnished among flyers and business travelers

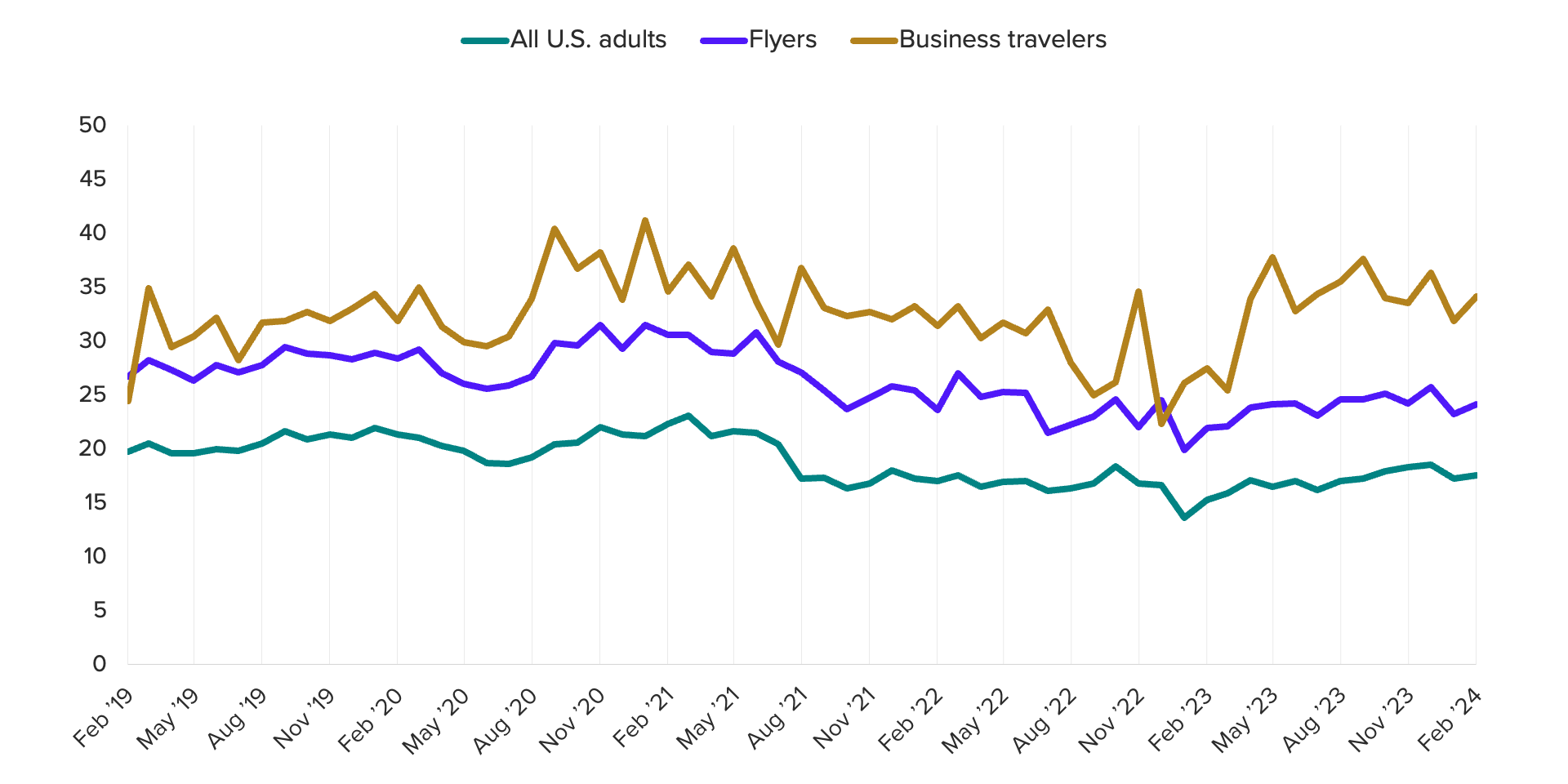

Two key groups are among those losing trust in Boeing: business and first class flyers. Net trust in Boeing among business and first class flyers is now 16 points, a 26 point decrease from Q3 2023.

Business Travelers Have Lost the Most Trust in Boeing

This shift is particularly noteworthy because business and first class flyers have historically had more trust in Boeing than both the general population and flyers. But that placement also meant the company had more room to fall. And while net trust among all groups fell double digits, the most drastic decline was among business and first class flyers.

Furthermore, business travelers are a hugely important audience for the travel industry given their outsized impact on revenue compared with leisure travelers. In other words, losing this audience’s trust could do more reputational damage to Boeing than others.

Airlines as a whole aren’t impacted by Boeing issues, in fact, trust is on the rise

Importantly for the travel industry, falling trust appears to be isolated to Boeing, and not impacting airlines as a whole. Airlines are actually enjoying a bit of a trust rebound, just in time for what looks to be a busy spring break travel season.

Net Trust in Airlines Over Time

This is a bit of a rarity for the airline industry, in which reputational collateral damage is more a norm. For example, post-pandemic travel surges and major disruptions led to declining consumer trust in U.S. airline brands from Q2 2022 to Q1 2023. When one airline faces a scandal, it often negatively impacts other airlines. To be sure, Boeing is a bit of an outlier, being an aircraft manufacturer.

The public now gives airlines a net trust rating of 18 points, a small (3 point) increase from a year ago and one worth noting, given how difficult it is for brands to build trust. This upward trend is even more present among business and first class flyers. Airlines net trust rating among this group increased by 6 points between February 2023 and February 2024.

This increase in trust, combined with typical spring break travel and an eagerness to travel to see the April 8 total solar eclipse, will likely lead to increased bookings this spring.

This memo utilizes data from Morning Consult Brand Intelligence, our flagship platform that every day asks thousands of consumers about core metrics for over 4,000 brands and products around the world. MCBI subscribers can further explore the data here.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].