Chinese Appetites for Combative Foreign Policy Have Diminished, Mirroring the Party Line

Key Takeaways

China has signaled a softer diplomatic touch in its relations with the West to help lure back foreign business and jump-start growth.

Recent trends in public views mirror the party line: On average, the share of Chinese adults who support a confrontational approach to diplomacy and foreign policy has fallen more than 10 percentage points since November 2022, while most continue to believe their country needs more diplomatic partners.

But declining public support has translated into greater uncertainty about the merits of combative foreign policy more so than outright repudiation, and concerns about Western encirclement remain pronounced.

Over half of Chinese adults (56%) also continue to see value in cooperating more closely with non-Western countries, viewing them as natural allies.

Foreign investors should remain cautious given these trends, which are more likely to portend a near-term softening of attitudes than a dovish about-face.

Has China changed its tune?

After years of aggressive posturing, China has recently signaled a slightly softer foreign policy tone, damping its incendiary rhetoric and sidelining prominent “wolf warrior” diplomats whose pugnacious defense of China’s interests had become a hallmark of President Xi Jinping’s push for national rejuvenation. China watchers have widely interpreted the charm offensive as an attempt to incentivize foreign investment and jump-start growth.

Xi’s more conciliatory tone appears to be resonating with a public whose nationalist impulses and self-assurance have likely been tempered by domestic uncertainty and a challenging macroeconomic climate, as our recent research suggests. However, the geopolitical tensions underlying China’s relations with the West remain unresolved, and the recent tonal shift is unlikely to presage long-term dovishness.

Chinese adults are weary of confrontation and wary of a cold war

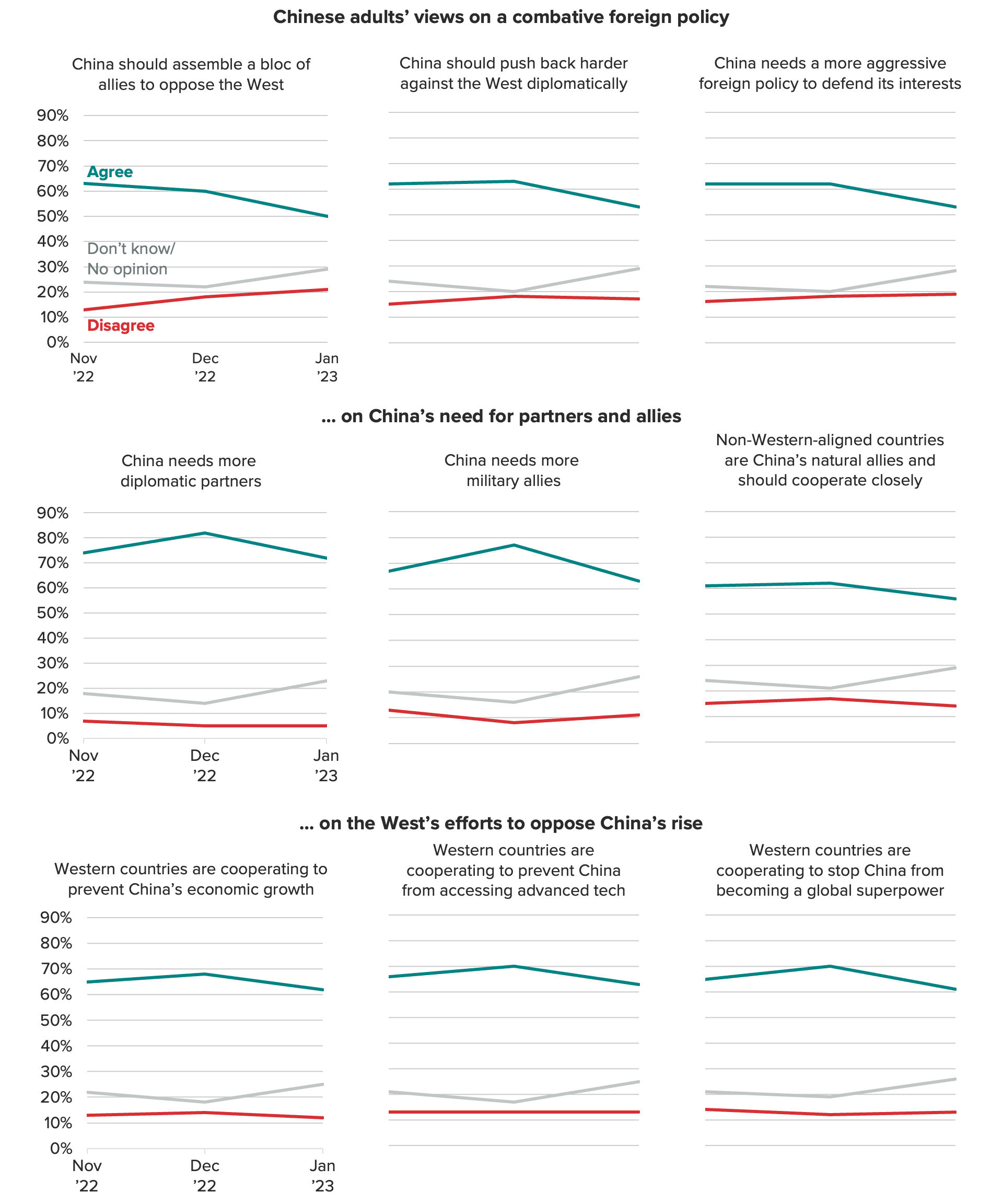

Between November 2022 and January 2023, we surveyed Chinese adults monthly to gauge their foreign policy attitudes on three fronts: support for a combative foreign policy, China’s general need for more diplomatic partners and allies, and perceptions of Western intentions to circumscribe China’s rise.

Chinese Foreign Policy Attitudes Have Recently Become Less Combative

Recent trends in Chinese attitudes toward foreign policy aggression mirror the party line. Between November 2022 and January 2023, the average share of respondents who said they agree with statements about China’s need for a more combative foreign policy fell by roughly 10 percentage points. Downward movement was most pronounced when they were asked whether China should assemble a bloc of allies to oppose the West, a polarizing posture reminiscent of the Cold War. The share in agreement fell 13 points, while the share in disagreement rose 8 points.

China’s diplomatic pivot has bred uncertainty as much as softer views

With China facing economic headwinds as it reopens after “zero-COVID,” the above trend points toward decreasing public appetites for policies that could foment a cold war mentality and potentially limit China’s access to Western capital and export markets, including from its top individual trading partner, the United States.

But this shift has coincided with a slightly larger rise in uncertainty about the merits of aggressive diplomatic posturing more than anything else: The average share of Chinese adults who disagree with the above propositions about embracing a more combative approach climbed 4 percentage points over the past three months, while the share expressing uncertainty rose by 5 points over that same time frame, and by 8 points in the last month.

In parallel, Chinese views on their country’s need for diplomatic partners and allies, including non-Western ones, barely budged. Since November, well over a majority of Chinese adults have continued to support greater cooperation with non-Western countries and especially the pursuit of diplomatic partners more generally. The latter item sees the largest shares in agreement out of any of the nine foreign policy issues we surveyed.

Chinese beliefs that Western countries are strategically cooperating to circumscribe China’s great power ambitions also held relatively steady on net from November through January, in a nod to the fact that major geopolitical tensions between the two sides remain largely unresolved.

Taken together, these trends suggest that Chinese adults remain wary of Western efforts to constrain their country, even as they are decreasingly confident that isolationism and heightened diplomatic aggression are the best responses. At the same time, China watchers should not mistake the moderate softening of Chinese attitudes we observe — specifically when it comes to support for a more aggressive foreign policy — for a volte-face. Chinese adults have not become markedly more supportive of a dovish turn. Instead, it’s more likely that they have become increasingly uncertain about their views, suggesting that hostilities will rebound.

Despite favorable trends in some areas, baseline hostilities remain high

While Chinese sentiment about foreign policy has trended in a friendlier direction over the past few months, it remains relatively strident in absolute terms.

Chinese Foreign Policy Views Remain Strident Overall Despite a Recent Softening

As of January, 53% of Chinese adults said they want their government to pursue a more aggressive tack to better defend the country’s interests (first item in figure). An equal share said Beijing isn’t pushing back enough against the West. And despite worries over isolationism and the potential costs of a cold war, half of Chinese adults said they support their country assembling and leading a bloc of allies to oppose the West.

Plus ça change …

Reeling from the pandemic’s economic fallout, China has lately softened its tone in hopes of luring back foreign investors and retaining existing ones. However, public opinion still broadly favors an adversarial foreign policy that conceptualizes the world as a zero-sum system divided between East and West. In light of the recent softening of public views, China may make nice for a while. But this “era of less bad feelings” is likely an interregnum.

While China hopes to reassure spooked foreign investors in the short term, the market remains a long-term risk for these very reasons. Moreover, given that underlying geopolitical tensions between China and the West remain unresolved, it seems unlikely that Xi Jinping’s long-term foreign policy thinking and ambitions have changed radically in the last few months, and suggests tensions are likely to flare again in the future. Multinationals drawn to the idea of a “friendlier” China would do well to keep this in mind. Indeed, recent events — improbably involving an errant spy balloon — have already undercut trust between China and the United States, and scuppered one opportunity for high-level diplomatic engagement.

China is a country that famously takes the long view strategically. We counsel multinationals enticed by recent shifts to do the same. This does not mean complete disengagement is necessary or even prudent. But companies considering maintaining, if not expanding, their China operations in the short term would do well to hedge their long-term risks by exploring other options.

Scott Moskowitz is senior analyst for the Asia-Pacific region at Morning Consult, where he leads geopolitical analysis of China and broader regional issues. Scott holds a Ph.D. in sociology from Princeton University and has years of experience working in and conducting Mandarin-language research on China, with an emphasis on the politics of economic development and consumerism. Follow him on Twitter @ScottyMoskowitz. Interested in connecting with Scott to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].