Chinese Consumer Confidence Takes a Tumble

Key Takeaways

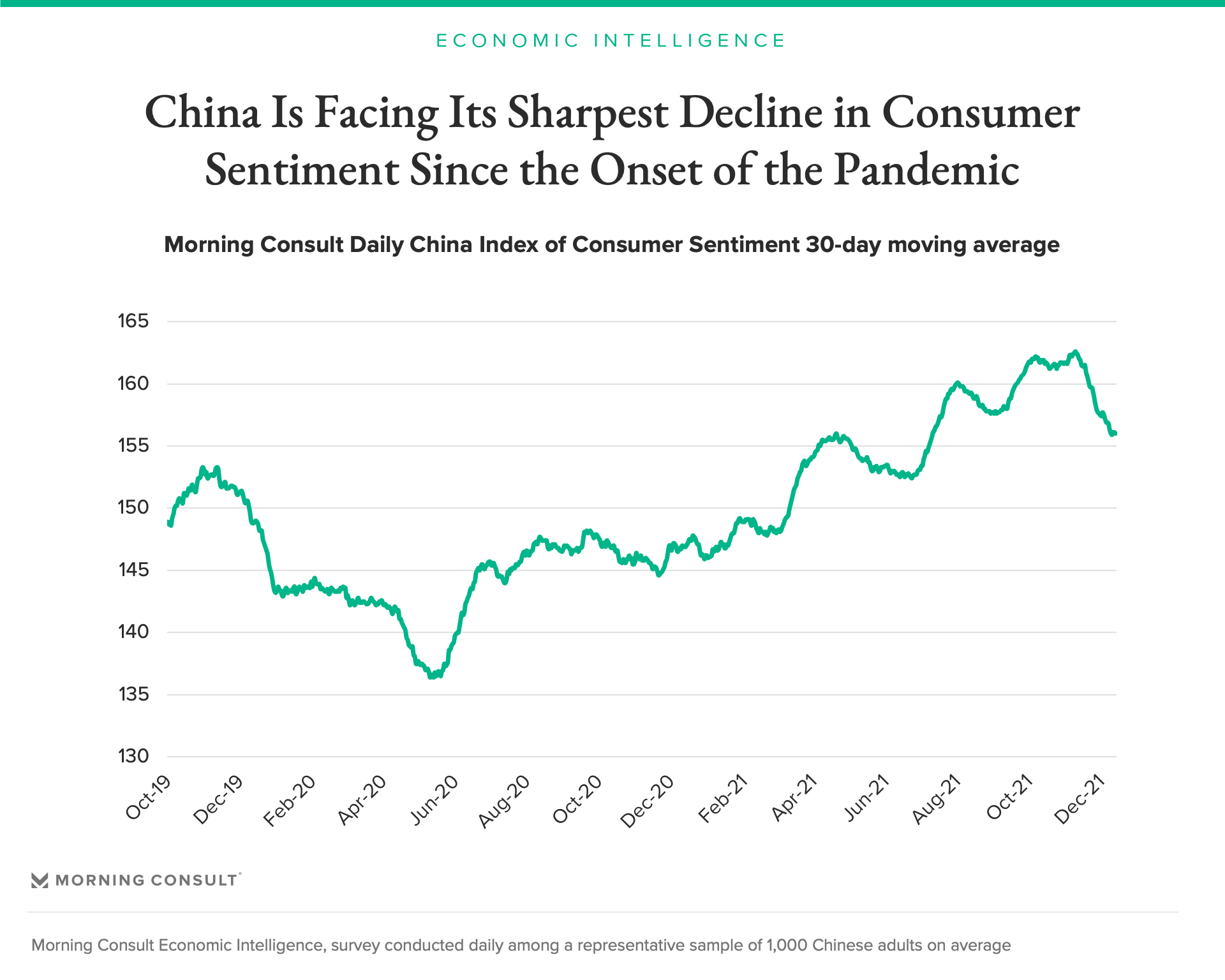

During the last 30 days Chinese consumer sentiment has fallen at the fastest pace seen since around the onset of the pandemic nearly two years ago.

COVID-19 outbreaks and concerns over the critical real estate market appear to be taking a serious toll on confidence and spending.

Given recent reports that the vaccine from Chinese manufacturer Sinovac is less effective in protecting against the omicron variant, confidence and economic activity could fall further, especially if Beijing implements additional lockdowns.

COVID-19 outbreaks and real estate market jitters have been exerting downward pressure on Chinese consumer confidence in recent weeks. Since Morning Consult’s China Index of Consumer Sentiment (ICS) reached a pandemic peak on Nov. 10, its 30-day average has fallen from 162.6 to 156.0. On Dec. 11, the 30-day change in the index registered a decline of 4.1 percent, the fastest pace of deterioration since January 2020. The rapid pace has slowed moderately in the last couple of days, but the index is still falling.

The sharp decline in confidence in November and early December comes amid increasing reports of COVID-19 outbreaks and related lockdowns, including disruptions to critical transportation and manufacturing hubs. Additionally, a Hong Kong study released on Dec. 15 claims to show that Sinovac’s CoronaVac vaccine is largely ineffective against omicron, with China having just reported its first cases of the new variant the day prior. Access to vaccines has broadly supported consumer confidence globally, but the vaccines would need to maintain their efficacy in order for this to hold true. While these new omicron cases were detected among individuals in quarantine, public health and economic risks are rising as Beijing maintains its zero-tolerance approach to COVID-19.

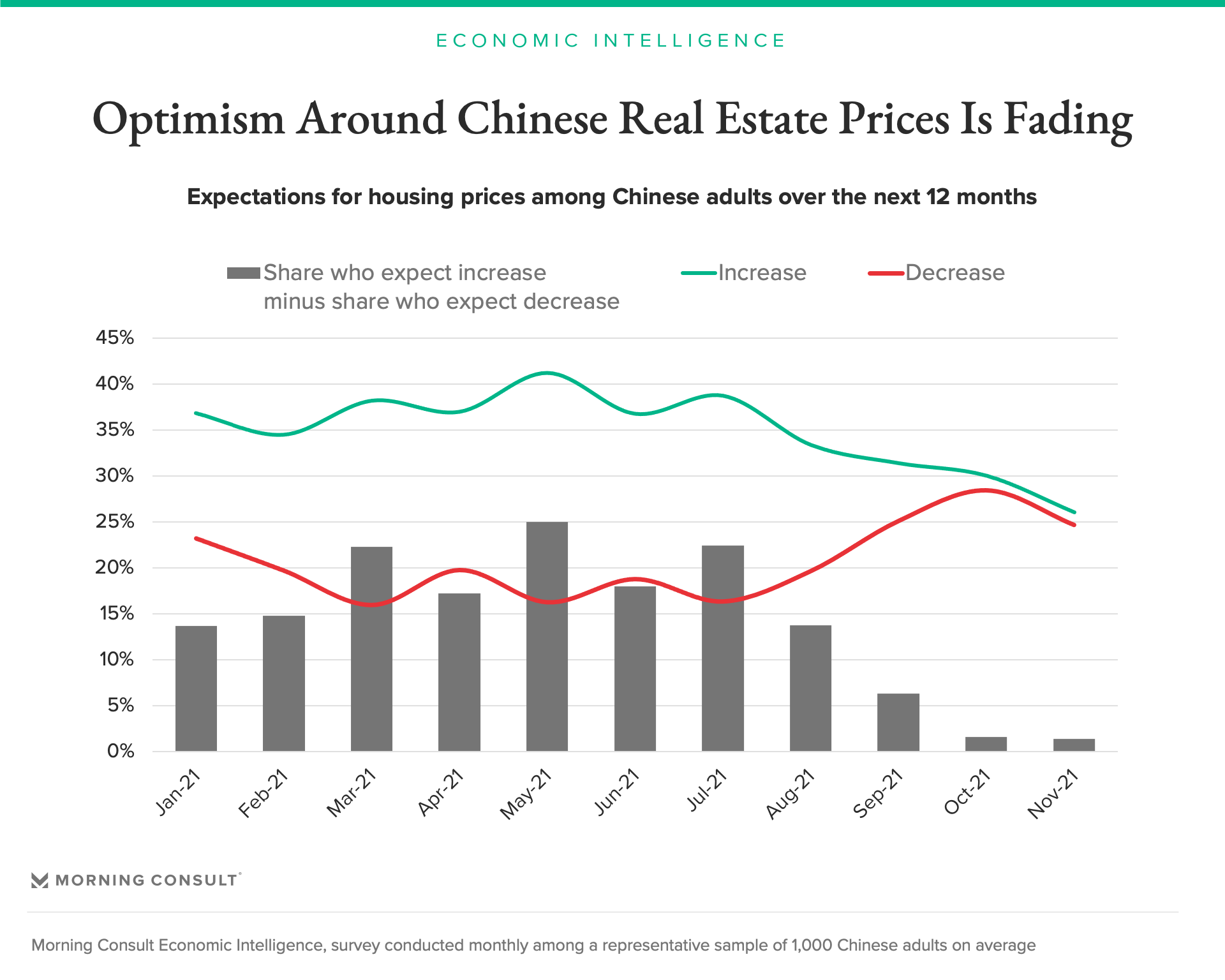

Pandemic concerns are being compounded by mounting headwinds from China’s real estate industry. Since news of Chinese property developer Evergrande’s financial troubles attracted wide attention in July, the net share of Chinese adults who expect the price of houses and apartments to rise over the next 12 months fell from 22 percent to just 1 percent.

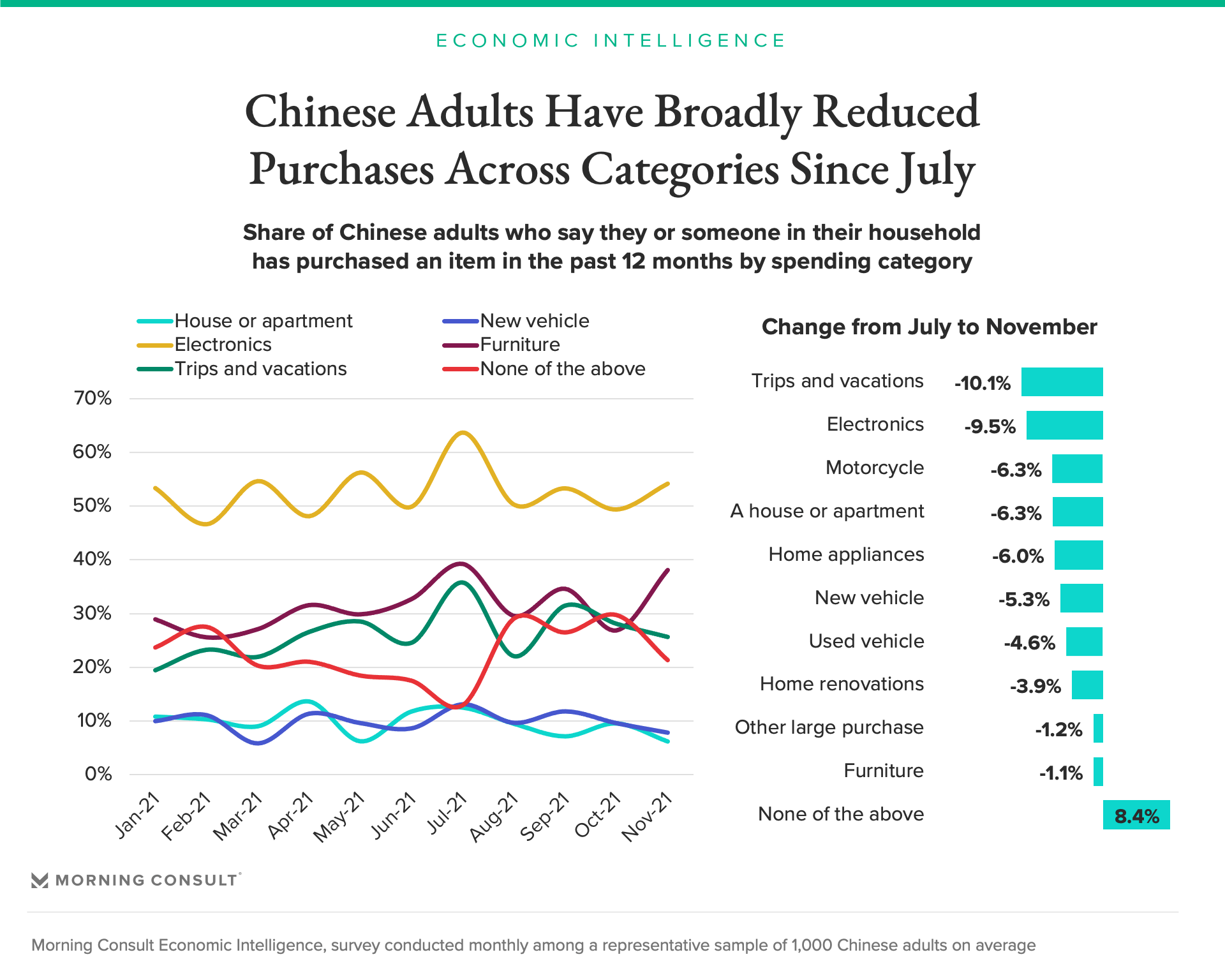

The downward turn in housing market sentiment coincides with a broad drawback in purchases across categories since July. With a large portion of Chinese household savings invested in the domestic housing market, nervous consumers appear to be tightening their belts until they can be sure the housing market jitters will blow over. From July to November, the share of Chinese adults who said they or someone in their household purchased major items fell for all categories tracked by Morning Consult, with the share saying they purchased within none of the categories rising from 8.4 percent.

Mounting risks in the Chinese economy are becoming a paramount concern for businesses and investors, as a downturn in the country has the potential to derail a fragile global recovery. Not only is China the world’s second-largest economy and largest consumer of raw materials, but its manufacturing centers are also at the core of global supply chains, and any disruptions could further drive rising prices globally.

Furthermore, the lack of transparency with respect to COVID-19 cases and macroeconomic data out of China adds to uncertainty around one of the world’s most critical economies. This data update provides a crucial window into the mindset of the Chinese consumer, who is becoming increasingly pessimistic as risks continue to mount.

Jesse Wheeler previously worked at Morning Consult as a senior economist.