Consumers Grow More Confident, but the Global Economic Outlook Hangs in the Balance (Report Preview)

Key Takeaways

The broad uptrend in U.S. confidence in place since July 2022 appears to have faltered in March as the banking sector upheaval rattled sentiment.

Consumers in most European economies are growing increasingly confident as inflation cools and recession risks recede.

Sentiment in China continued its rebound in March as strong retail and consumer spending prompted economists to revise up growth forecasts for 2023 and President Xi Jinping secured his third term in office.

This memo offers a preview of Morning Consult’s March Global Consumer Confidence Report. Morning Consult Economic Intelligence subscribers can access the full report here.

For full access to Morning Consult's consumer confidence data, see our listing on the Snowflake Data Marketplace.

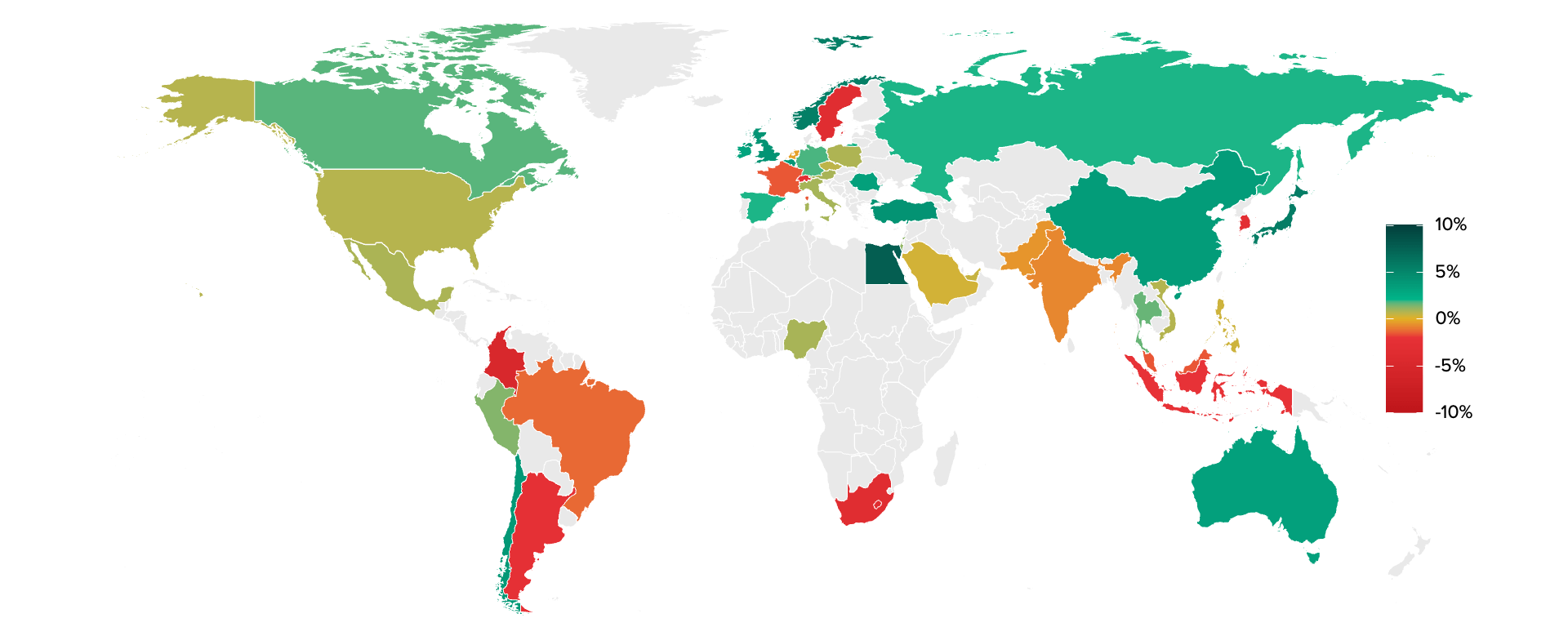

Global consumer confidence continued to gain steam in March, with Morning Consult’s Index of Consumer Sentiment rising in more than two-thirds of the countries surveyed. Among most of the world’s 12 largest economies, the ICS is now back to levels last seen in March 2022, before inflation had fully taken its toll on sentiment.

The uptrend in consumer confidence in the United States that has been in place since July 2022 appears to have stalled following March’s banking crisis as consumers braced for potential impact. Meanwhile, in Canada, stickier food price inflation and a sharp decline in housing prices are weighing on sentiment. Latin America’s two largest economies — Brazil and Mexico — have seen confidence stall since the start of the year.

Monthly % change (February 2023 to March 2023)

The Morning Consult Index of Consumer Sentiment continued its upward trajectory in March across most of the European countries tracked as the pace of inflation continues to slow. The ICS rose in 12 countries and declined in only four from February to March, with Norway, the United Kingdom and Belgium seeing the biggest gains. Looking ahead, falling energy prices have largely already been baked into headline inflation, and core inflation is proving more persistent than policymakers at the European Central Bank had hoped.

Consumer sentiment in China led the pack in the Asia-Pacific region in March, with strong retail and consumer sales data leading Chinese economists to raise growth forecasts for 2023 to an average of 5.4%. However, President Xi Jinping’s crackdown on corruption at the country’s largest banks may give rise to uncertainty.

Since the last few months of 2022, a broad decline in global inflation has been paired with historically low unemployment in many economies, providing global consumers direct financial relief. However, across the United States and Europe, core inflation has shown few signs of retreating, putting additional pressure on the Federal Reserve and ECB to continue raising interest rates until they see signs of a persistently cooler labor market. Consequently, further decreases in core inflation are likely to come at the cost of higher unemployment, placing consumers under a new type of financial strain. Furthermore, even if the Federal Reserve and ECB join the Bank of England in pausing interest rate hikes this summer, the global economy will face considerable headwinds from higher borrowing costs.

About this report

Morning Consult’s monthly Global Consumer Confidence Report provides a comprehensive assessment of the economic views and expectations of consumers across major global economies.

Businesses and investors rely on this report to understand emerging trends in consumer demand and personal finances.

The report draws on Morning Consult Economic Intelligence, a high-frequency data set reflecting more than 17,000 daily economic surveys across 43 of the world’s largest economies.

While the data in this report is primarily presented as a monthly average, the underlying data is collected, processed and reported daily as part of Morning Consult Economic Intelligence.

Full methodology and average daily sample sizes per country can be found here.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]

Jesse Wheeler previously worked at Morning Consult as a senior economist.