Americans Are Spending Less on Just About Everything as Persistent Inflation Hits Their Wallets

Key Takeaways

- Despite a strong start to the year, consumers continued to pull back on spending amid high prices and economic uncertainty.

- Household finances flash mixed signals, with savings rates and incomes recovering but expenses and credit balances still high compared with last year.

- After months of sizable year-over-year declines, annual inflation remained steady from March to April. The primary driver of monthly price growth is still core inflation.

Morning Consult’s measure of total spending continued its downward trend last month: Real spending decreased by 1.3% in April following a sharp decline in March and a slowing of momentum in February. Spending for services, durable goods and nondurable goods have all seen monthly declines in Morning Consult’s data, which is often directionally indicative of what to expect from the Bureau of Economic Analysis’ Personal Consumption Expenditures report.

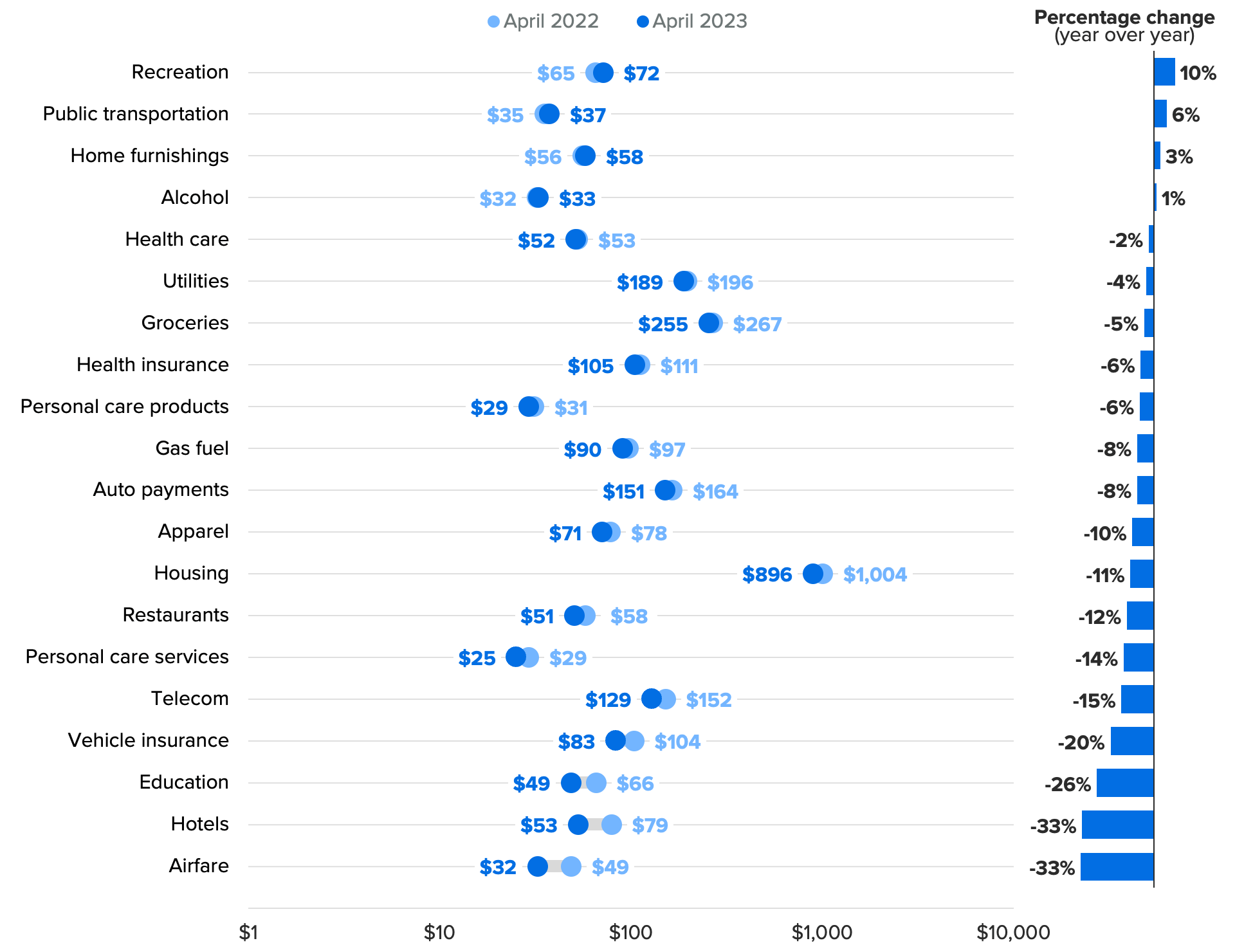

Annual Spending Growth Declined Among Most Goods and Services Categories

Spending on vacations declined substantially from 2022 highs

As inflation continues to grow at an elevated rate for services, consumers are pulling back on spending on most services categories. Spending on pandemic-affected sectors like restaurants, hotels and airfare is beginning to run out of steam, with two consecutive months of large year-over-year declines. Declines in spending may be in part due to high prices, as Morning Consult’s Substitutability Index score for vacations and travel has also increased for all income groups, indicating that consumers are more likely to trade down to cheaper alternatives on higher-than-expected prices. Members of all income levels increased their trading-down behavior for vacation spending over the past year. However, low-income earners are increasingly more likely than their counterparts to substitute cheaper alternatives on their vacation spending.

Adults of all incomes dipped into savings, but real incomes continue to climb

Real disposable income increased for a ninth month in a row in March, reaching its highest level in nearly two years. In addition, the personal savings rate increased to its highest level in over a year. Despite improvements in financial well-being, consumer budgets continued to face strains in April. Morning Consult’s data showed that 49.9% of adults had money left over to save in April, 5.5 percentage points less than this time last year and down 12.6 points from 2021, suggesting that increases in the BEA’s personal savings rate may flatten out or decline in the coming months.

Recent trends in savings ability varied by income. High earners, who showed the biggest jump in being unable to save, have shown recent signs of financial instability in Morning Consult’s proprietary data including higher rates of lost pay, with a larger share reporting their finances are worse off than the previous year and registering sharper increases in price sensitivity.

Monthly inflation rebounded last month, but core inflation appears to be settling in too high

Monthly inflation ticked up in April from its unexpected softer print in March. After nine months of consecutive declines, year-over-year inflation remained steady around 5% in April, well above the Federal Reserve’s 2% target and underscoring that the fight against inflation is far from over. The primary driver of price growth remains core inflation, which excludes volatile food and energy categories. Core goods experienced the highest growth in several months, largely driven by used car prices.

Conversely, core services experienced a slowdown compared with the previous nine months. Given the Fed’s close monitoring of core services, softening in this category is a positive signal for the trajectory of price growth. If core services continue its downward trend, the Fed would likely be more comfortable pausing interest rate increases at future meetings.

This memo offers a preview of Morning Consult’s May U.S. Consumer Spending & Inflation Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]