Crocs Is Now One of the Fastest-Growing Brands for Virtually Every Generation

Each year, Morning Consult publishes the Fastest Growing Brands list, consisting of companies and products that have seen the biggest rise in purchasing consideration over the past year. In 2022, Crocs — yes, the brightly colored clogs — took the No. 2 spot.

This is an excerpt from Morning Consult’s annual Fastest Growing Brands report, the definitive measure of brand growth for both emerging and established names. Download the report to read about the wide range of companies and products that have accelerated their consumer appeal and awareness in 2022.

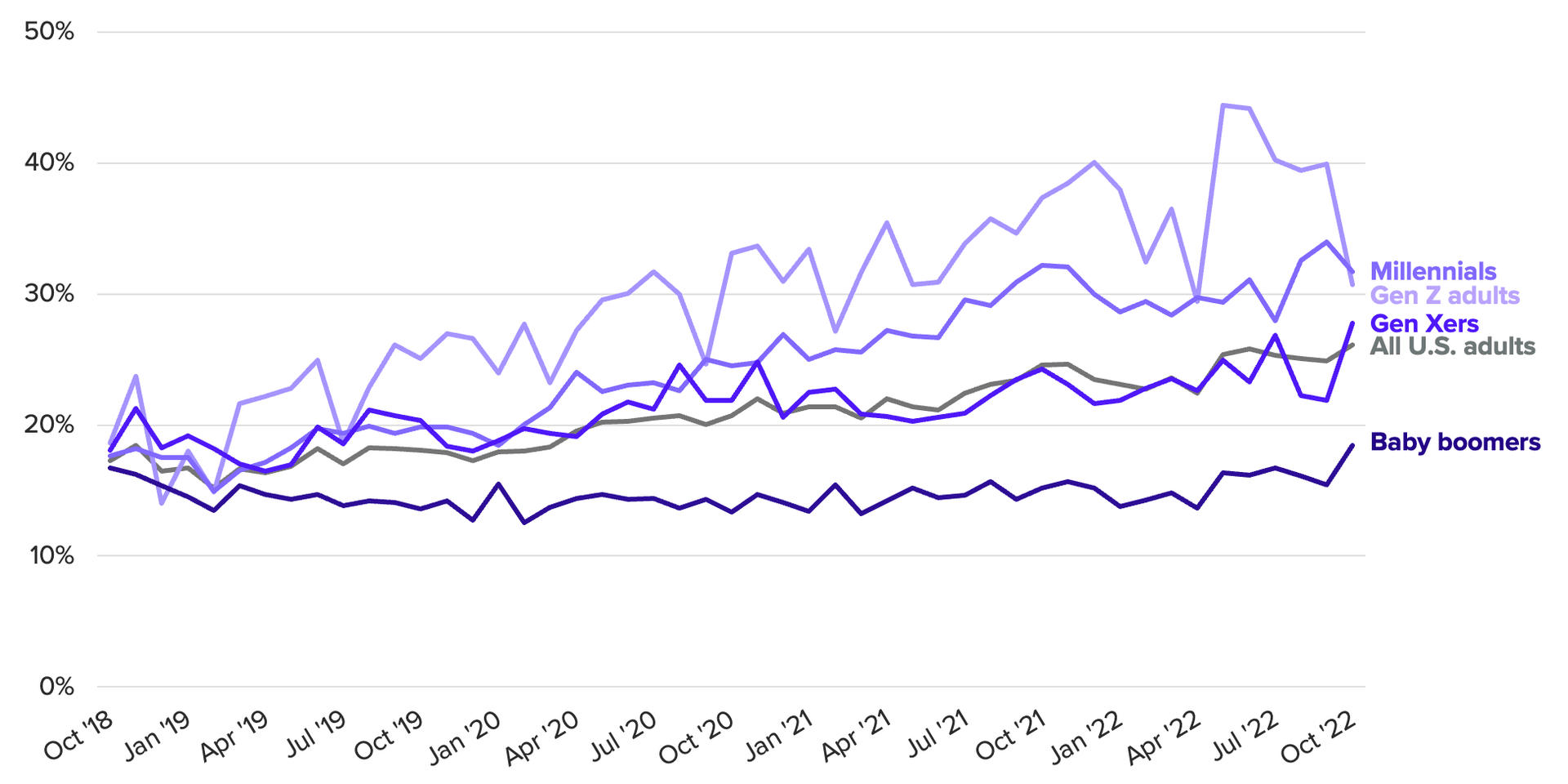

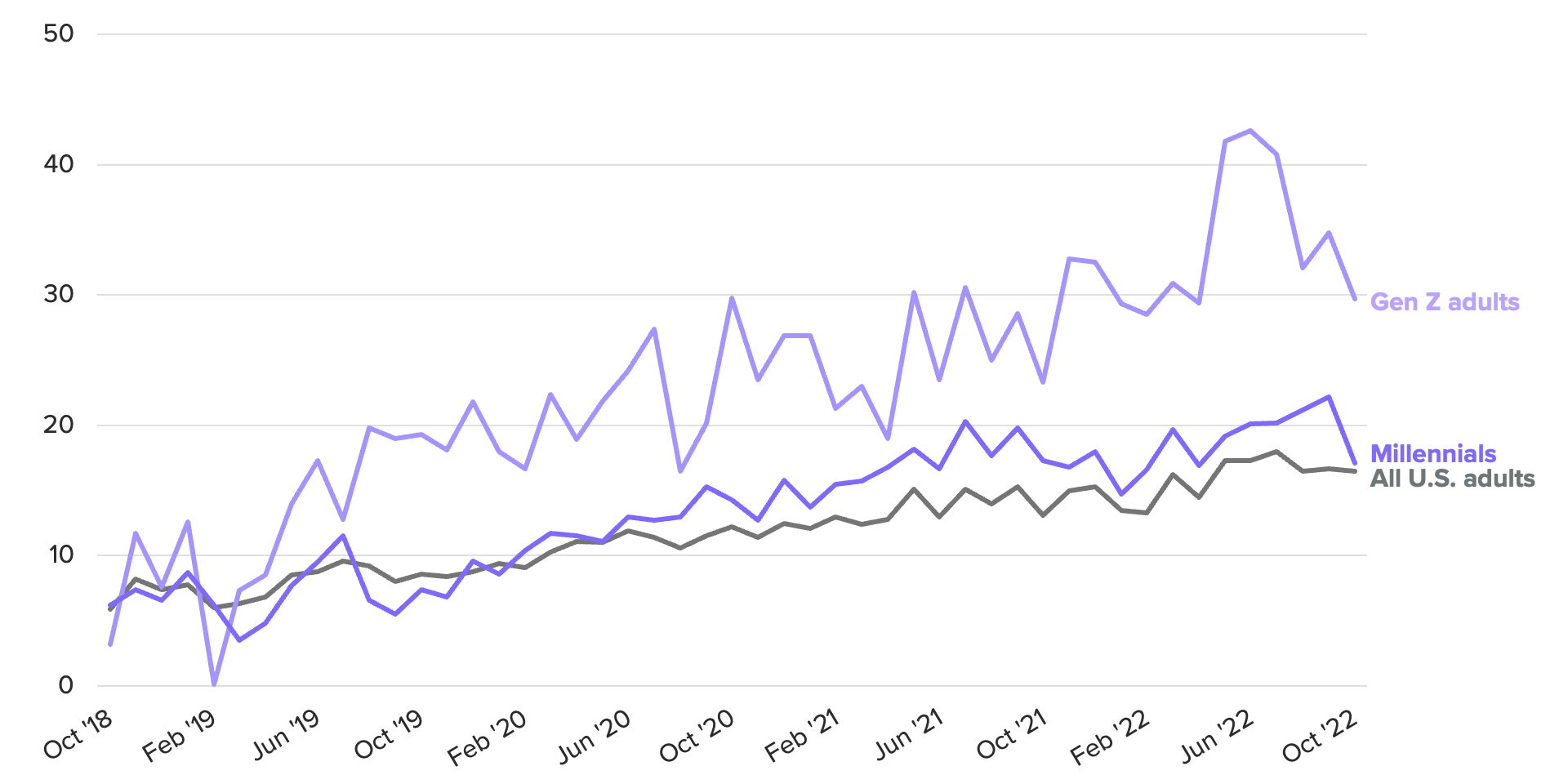

Crocs were undeniably trendy in 2022, but the company’s current moment is backed by years of steady growth in purchasing consideration across generations. No longer just your aunt’s favorite gardening shoe, Crocs takes the No. 2 spot on this year’s overall Fastest Growing Brands list. It’s also a fastest-growing brand for each generation except for Gen Z — and that’s just because the shoes are already so popular with young adults. This is the second year in a row that the shoe brand has appeared on the millennial list: In 2021, it took 16th place.

Why Crocs shoes are so popular with Gen Z and with older generations

Crocs won out on multigenerational growth in purchasing consideration by speaking to brand fans’ uniqueness and creativity. It offers customization options via Jibbitz charms, and opportunities for self-expression via brand and celebrity collaborations. This is reflected in Crocs’ consumer base: Those who say they pride themselves on their creativity tend to show higher purchasing consideration for the Colorado-based footwear brand.

Even though Crocs didn’t make Gen Z adults’ fastest-growing brands list, its level of purchasing consideration is higher for Gen Z than for older generations — simply put, the brand’s popularity among our youngest consumers was already high when we started measuring this year’s trends. Gen Z’s embrace of comfortable, less-streamlined fashion rejects older shoppers’ common priority of “flattering” styles that focus on slimness and elongation. Gen Zers don’t shy away from looks that add bulk or ones that deprioritize the more traditional norms of placing body proportions at the forefront. This extends beyond older generations’ embracing function and comfort over form, and leans into a countercultural aesthetic that the Crocs brand fits neatly into.

Crocs’ current share pricing also reflects the brand’s trajectory: After a significant drop in share price beginning in late 2021, Crocs’ healthy financial results and outlook propelled the stock out of a mid-year low. Crocs’ leaders attribute the company’s success to a turnaround plan that began six years ago and focused on key consumer audiences, capturing both trend-driven shoppers who attach to the brand’s collaborations and those that appreciate the core product. The splashy collaborations include CPG brands like Hidden Valley Ranch and Cinnamon Toast Crunch; retailers like 7/11, Madewell and Barneys New York; beloved entertainment properties like “Cars” and “Hocus Pocus”; fashion labels like Christopher Kane; and celebrities including Post Malone, Saweetie and Justin Bieber. Some of these collaborations kept to a limited release to generate maximum buzz and exclusivity, while others offered wider availability to avoid alienating fans with sellouts.

Furthermore, a strong social media presence helps potential customers overcome styling challenges of these nontraditional shoes. Crocs is a popular brand on TikTok, with nearly 800,000 followers and posts tagged #crocs earning 6.1 billion views. All those views do make an impact: Morning Consult data shows that people who scroll TikTok several times a day are more likely to have a favorable impression of Crocs than those who do not (58% versus 40%). These combined efforts help to keep brand buzz consistently high, particularly among Gen Z adults.

Crocs versus Nike Jordans — how do their consumer appeal and retail strategies compare?

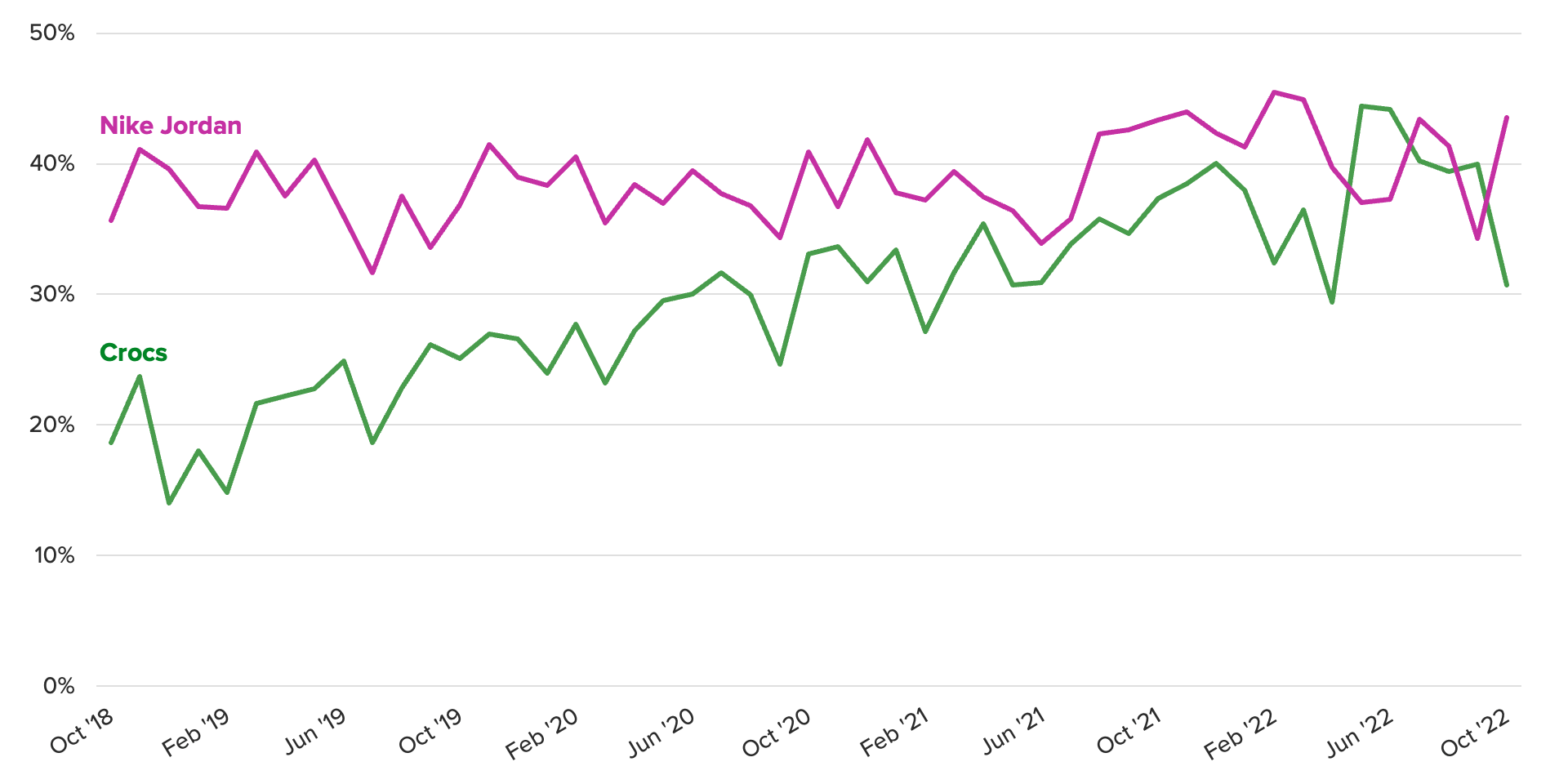

When compared to Nike Jordans, a classic footwear brand with similar widespread appeal and resale value, albeit stronger net favorability, the Crocs story really shines. Crocs trailed Jordans in purchasing consideration among Gen Z adults for years until May 2022, when Crocs shifted into sport mode and surpassed the basketball brand. This trend holds for all U.S. adults, though Crocs have been consistently higher in purchasing consideration than Jordans for baby boomers.

From a retail strategy perspective, unlike many brands targeting young shoppers that emphasize digital direct-to-consumer experiences, Crocs’ strategy is to be as omnipresent as possible, including an Amazon.com brand store and many retailer partnerships in addition to its own direct business. Getting the product in front of as many eyes as possible and making it easy to purchase is the name of the game to keep brand growth momentum. Crocs also has a strong presence in the resale market, with some styles selling for several times over their retail value.

In contrast, in recent years Nike has shifted more of its business to a direct-to-consumer strategy. Nikes is pursuing profitability, brand control and customer connection via shifting the business to prioritize direct sales, but its established brand strength has enabled the company to make that change.

What’s the future for Crocs?

Ultimately the secret to Crocs’ success is in iterating on trend-driven styles and accessory options without alienating a core fan base attracted to the shoe’s function and comfort. It’s this approach that will keep the brand relevant into the future, even as fickle Gen Zers’ trends evolve. As we turn the calendar to 2023, the threat of a recession looms, and with it the likelihood of dampening consumer spending. Crocs’ low price point for the footwear category and ability to offer shoppers cheap thrills should buoy the shoe brand through choppy waters ahead. We just can’t wait to see what collabs it comes up with next.

Morning Consult’s Fastest Growing Brands of 2022 is the definitive measure of brand growth for both emerging and established brands, showcasing a wide range of companies and products that have accelerated their consumer appeal and awareness in 2022. In this report, we rank the top 20 fastest-growing brands that have seen the biggest rise in purchasing consideration this year, how that is playing out across generations and which brands have seen a lift in purchasing consideration, even if it didn’t translate to an immediate or direct increase in buying.