Cryptocurrency Really Is a Trustless Asset After a Disastrous 2022

Key Takeaways

Net trust in cryptocurrency across 17 major markets declined over 2022 by a whopping 30 percentage points on average amid a series of high-profile bankruptcies and scandals.

But self-reported retail crypto use remains resilient globally.

Explanations for continued use vary by country but likely include a desire to preserve savings in high-inflation environments and to bypass currency and capital controls. Some investors may also have shifted their holdings into stablecoins or cold storage while awaiting a market rebound.

High global adoption coupled with cratering trust is a recipe for regulatory headwinds in 2023. While a number of authorities have already introduced or scoped crypto rules unilaterally, expect more international coordination on setting up guardrails.

Government intervention will dilute some of cryptocurrency’s perceived advantages, such as ease of entry and enhanced privacy. But harmonized international rules will benefit the industry by allowing for greater market scale and helping to reverse a major loss of trust in an ostensibly trustless asset.

As an asset class, cryptocurrency was riding high heading into 2022. With a combined market cap of over $2 trillion, adoption was growing internationally, and price expectations were robust. Cryptocurrency also had relatively high grassroots ownership, particularly in emerging markets.

Crypto’s successes drew attention to its possible geopolitical implications, both negative and positive. Boosters prophesied an imminent end to the inefficiencies of the state-centric international financial system, while detractors warned about the potential for sanctions busting, money laundering and a loss of monetary policy control.

Governments in a number of countries began to respond, ordering research, drafting regulations, banning some forms of cryptocurrency and scoping central bank digital currencies as state-led alternatives. Then, as major central banks began aggressively raising rates to combat inflation last spring, signaling the end of an era of easy money, cryptocurrency faced its first bear market.

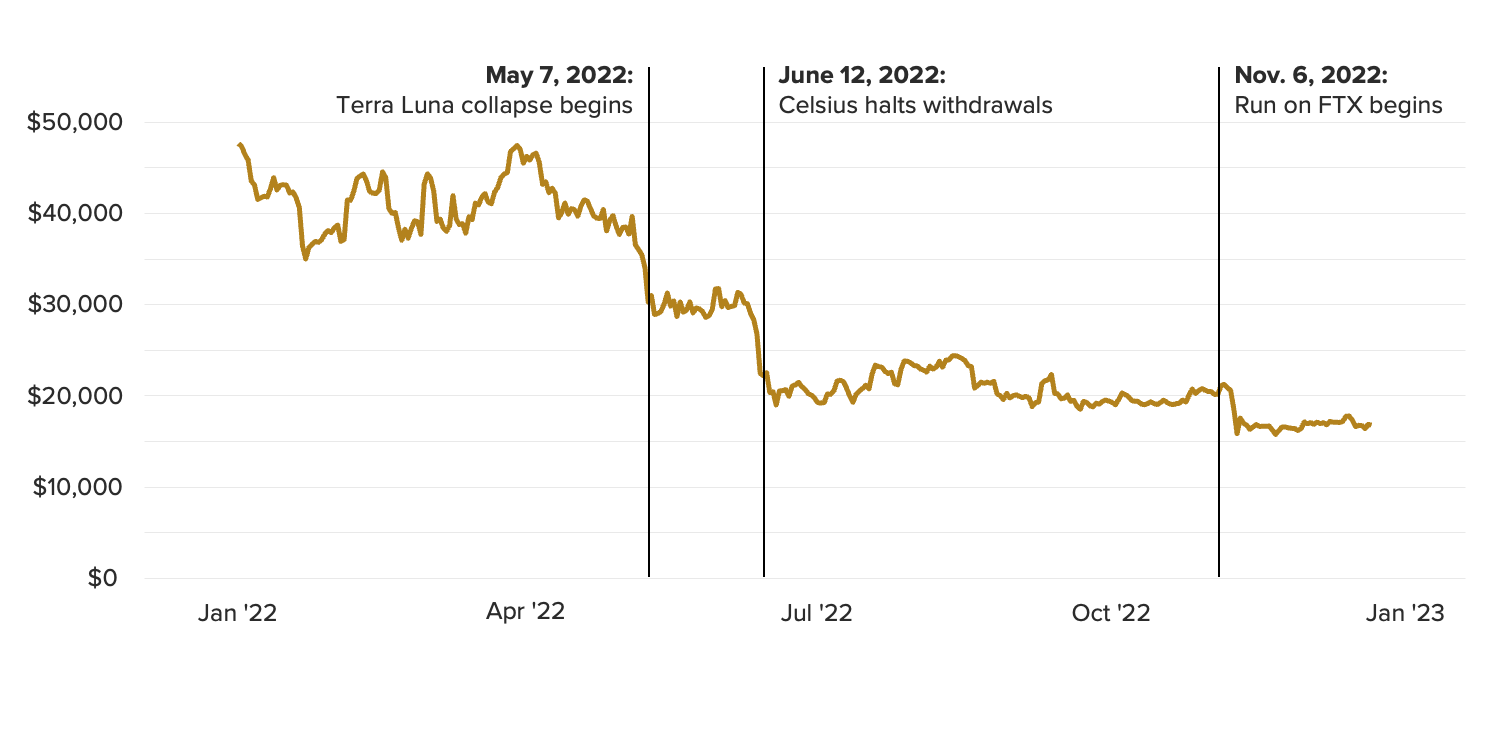

2022 was a bad year for crypto

Terra Luna’s collapse in May 2022 was the first major failure, precipitating those of Three Arrows Capital and Celsius five weeks later. The spate of bankruptcies stoked calls for tighter regulation in the United States as well as some other markets. FTX’s implosion in early November, amid allegations of large-scale fraud involving client funds, further shook the industry. To make matters worse for those seeking to mainstream crypto, FTX’s 30-year-old founder, Sam Bankman-Fried, had been a darling of the light touch regulation camp in Washington, squaring off against those who said government action would squash innovation, prior to the collapse of his exchange.

But among retail investors, the asset class shows no signs of disappearing

Aftershocks of the FTX collapse include the fall of BlockFi — previously rescued by Bankman-Fried after the Celsius failure — and a rash of layoffs at major cryptocurrency companies. The price of Bitcoin, largely seen as a proxy for overall cryptocurrency demand, tumbled during each of last year’s major collapses.

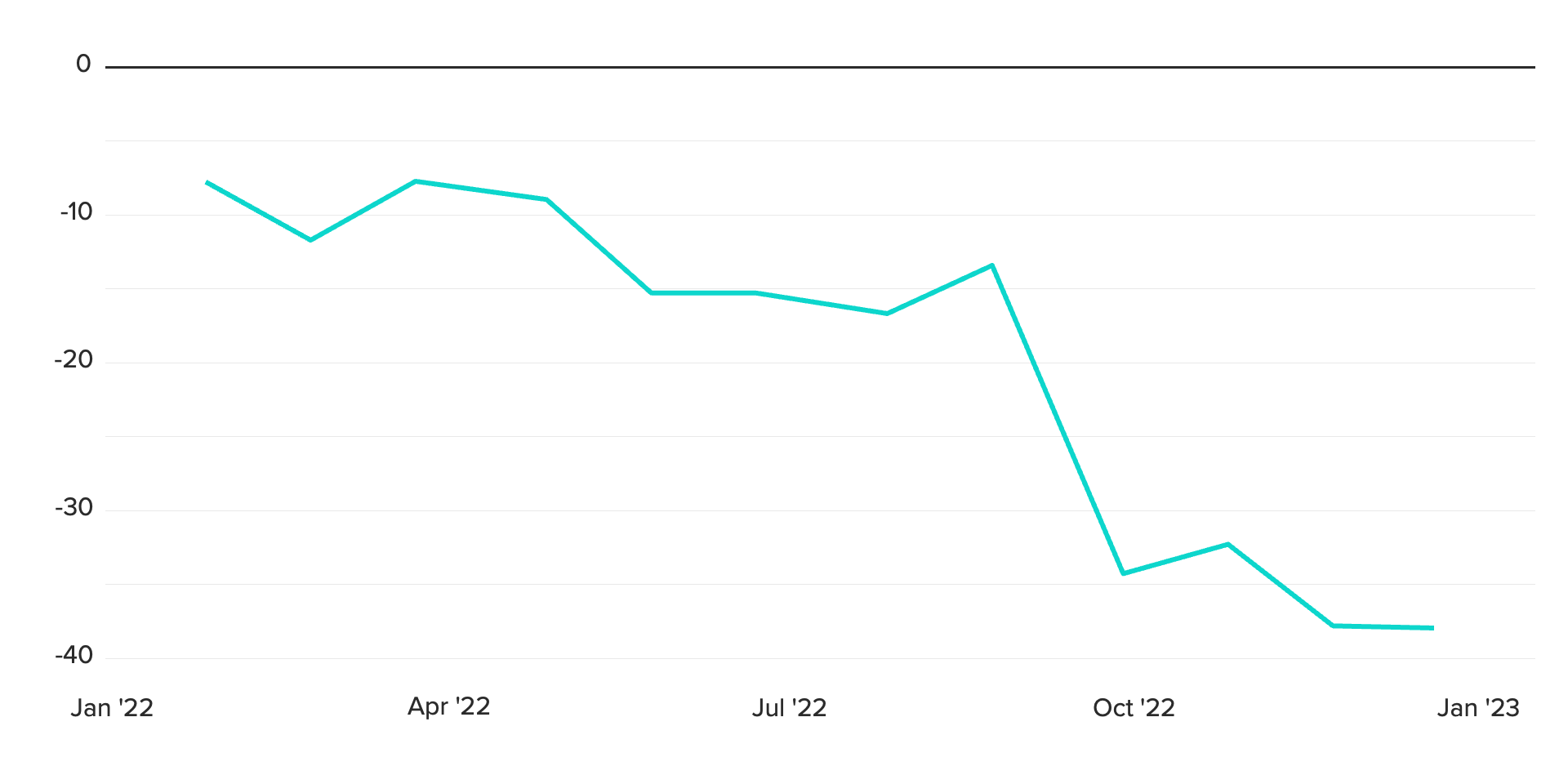

Over the course of 2022, trust in cryptocurrency fell off a cliff. Across 17 major markets, net trust plummeted from minus 8 to minus 38 percentage points. It saw its largest decline in October, as Bitcoin’s price settled just below the symbolic $20,000 mark, making it clear that a quick reversal was not imminent.

Net Trust in Cryptocurrency Across 17 Global Markets Collapsed Over 2022

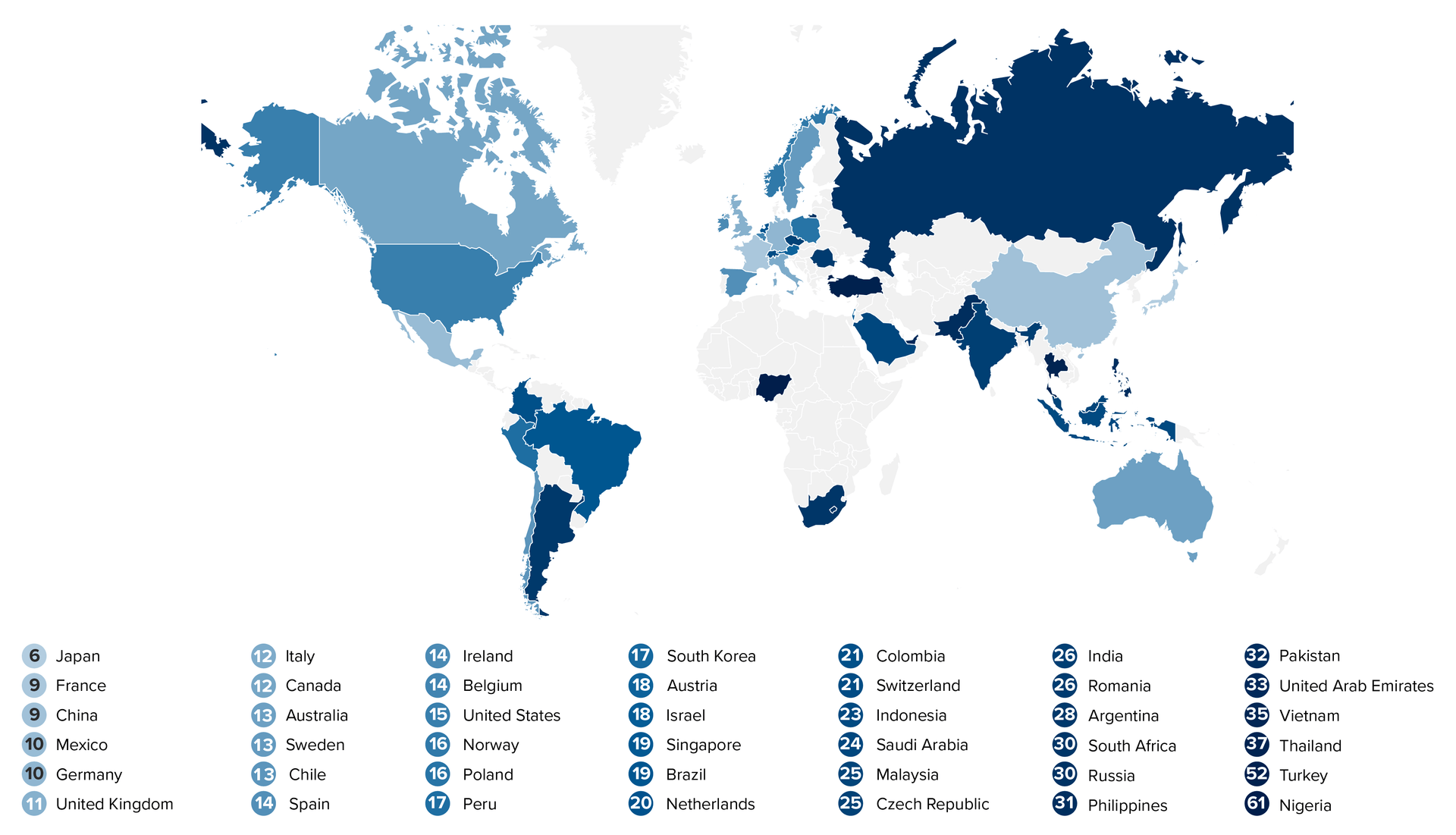

Globally, adoption of cryptocurrency nevertheless remains relatively high. In 18 of 42 countries where Morning Consult surveys on the issue, at least 1 in 5 adults reported being crypto users in H2 2022. As expected, low- and lower-middle-income countries in our sample have much higher average adoption rates as a share of the general population (35%) than upper-middle-income and high-income countries (19%), per the World Bank’s definitions. None of the top 10 adopters by share is a high-income country.

Grassroots Cryptocurrency Ownership Remained Relatively High in H2 2022

Moreover, despite 2022’s successive crypto failures, self-reported use of cryptocurrency declined by less than 5 percentage points in most countries over that year, and even increased in a few others, making global trends in usage virtually flat. Among the same 42 countries — which together account for over one-third of the global population — the share only declined by an estimated 24 million crypto users between March and December.

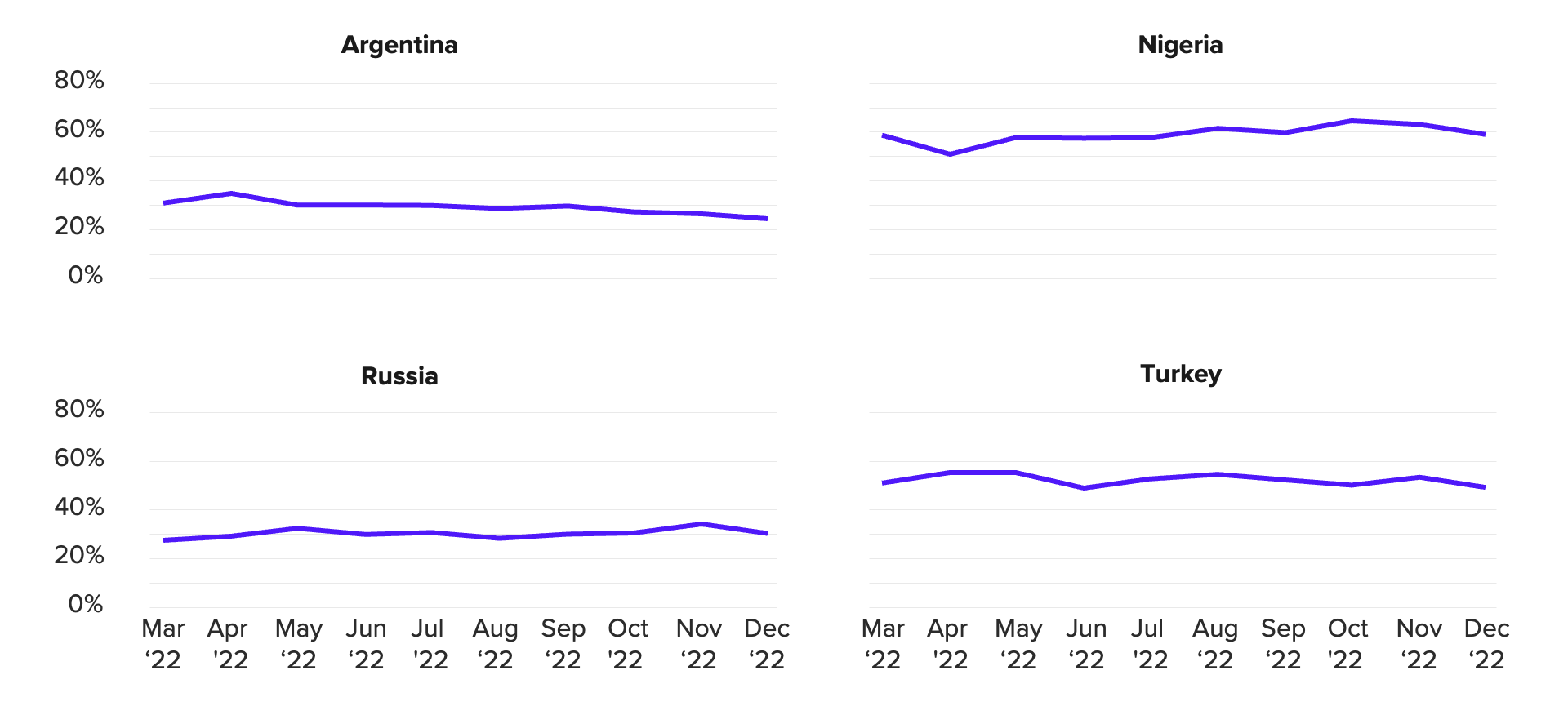

In some markets, economic turmoil could explain high ownership despite low trust

We see several potential explanations for persistent crypto adoption despite collapsing trust globally. While the relationship between inflation and cryptocurrency adoption is unclear, some evidence points to the preservation of savings in capital-restrictive, high-inflation environments as one use case. Accordingly, Argentina and Turkey, both countries with high inflation rates and foreign exchange controls, see high levels of grassroots cryptocurrency adoption. Facilitating cross-border commerce in countries facing sanctions, and serving as a store of value amid pronounced economic uncertainty unrelated to inflation, are two other potential use cases. Russia and Nigeria — two countries where grassroots crypto adoption rose in 2022 — both fit this mold.

Several Countries Experiencing Economic Disruptions See High and Resilient Crypto Usage

Movement into stablecoins or cold storage could also explain the trend

The relatively flat trend in global crypto usage may also be explained by some retail investors’ decisions to shift their holdings into stablecoins — cryptocurrencies pegged to another asset or fiat currency, usually the U.S. dollar — and away from unpegged coins like Bitcoin and Ethereum. Indeed, many crypto users fled to the perceived stability of pegged coins in the immediate aftermath of the major exchange collapses of 2022.

Alternatively, cryptocurrency owners who watched the value of their portfolios tumble in 2022 may be holding out for a rebound, either through bankruptcy proceedings or future price increases. In the United States, for example, increased numbers of cryptocurrency users said last June that they were putting their crypto into so-called cold wallets — offline storage devices for cryptographic keys — but not abandoning their holdings. This is bad news for exchanges that rely on transaction volume for fees, but it’s better news for the long-term future of the asset class than a major sell-off would be.

Persistently high adoption plus low trust portends global regulatory headwinds

High levels of popular ownership of an asset, coupled with large losses of value and trust, can supercharge regulatory processes. For example, in the United States in 2022, the meteoric rise and fall of meme stocks like GameStop stoked demand for new rules on brokerage trade flows.

Some jurisdictions like China and Egypt had banned most forms of cryptocurrency before 2022’s market turbulence. Meanwhile, the European Union and several other large markets were working on formulating tougher guardrails in the run-up to it. With retail investors — particularly those in emerging markets — making up the lion’s share of investors bearing losses from the 2022 rout, expect an acceleration of efforts to gain broader international buy-in for new rules for crypto.

International rules won’t hit fast, but they could hit hard

Heading into 2023, the International Monetary Fund, pointing to recent events, has repeatedly called for greater global coordination on cryptocurrency. And in December 2022, the departing head of the Financial Stability Board — an international body that monitors and makes policy recommendations on the global financial system — similarly signaled his preference for robust international cooperation on global standards for cryptocurrency in 2023, and expects them to materialize.

International financial diplomacy moves at a stately pace, but major world events can spur relatively prompt action, as in the case of the Basel III framework, which emerged fairly quickly in response to the international financial crisis of 2008. If the FSB announces a road map to new cryptocurrency regulation in the first half of this year, 2024 seems a reasonable time frame to expect major changes, as national authorities will need time to implement FSB rules via domestic channels after an international agreement materializes.

For cryptocurrency exchanges, a new set of rules would be a mixed bag. The fraud allegations surrounding FTX make stricter rules on the separation of custody and exchange activities particularly likely. Treating exchanges more like banks will subject them to more stringent requirements for customer onboarding, compliance and licensing, and documentation. For customers looking for safe havens from monetary policy in their home markets, coordinated controls will make it more difficult for them to move and protect their savings. On the flip side, reputable exchanges operating across jurisdictions will enjoy more regulatory clarity and should be able to scale with greater confidence. With net trust at a low ebb, crypto may, ironically, need to lean on regulators to regain the public’s trust after a harrowing year.

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].