Food & Bev Briefing: Brand Switching, Recipe Discovery, Culinary Travelers & more

Sign up for our food & beverage briefing newsletter. This monthly email curates our latest research into the industry, helping you stay ahead of the most important consumer trends.

Welcome to our food & beverage insights briefing,

In this monthly email, we will curate the most important insights from our team of industry, political and economic experts and deliver them right in your inbox. Consider it your one stop shop for the data you need to know about the food & beverage industry.

Today, we uncover what’s causing consumers to abandon their favorite restaurant and grocery brands (hint: money, money, money). Plus, we have tons of fresh Gen Z data, from how they discover new recipes to the key demographics of wellness enthusiasts.

Read on for recent insights into these topics and more, or download our full reports for a deeper dive.

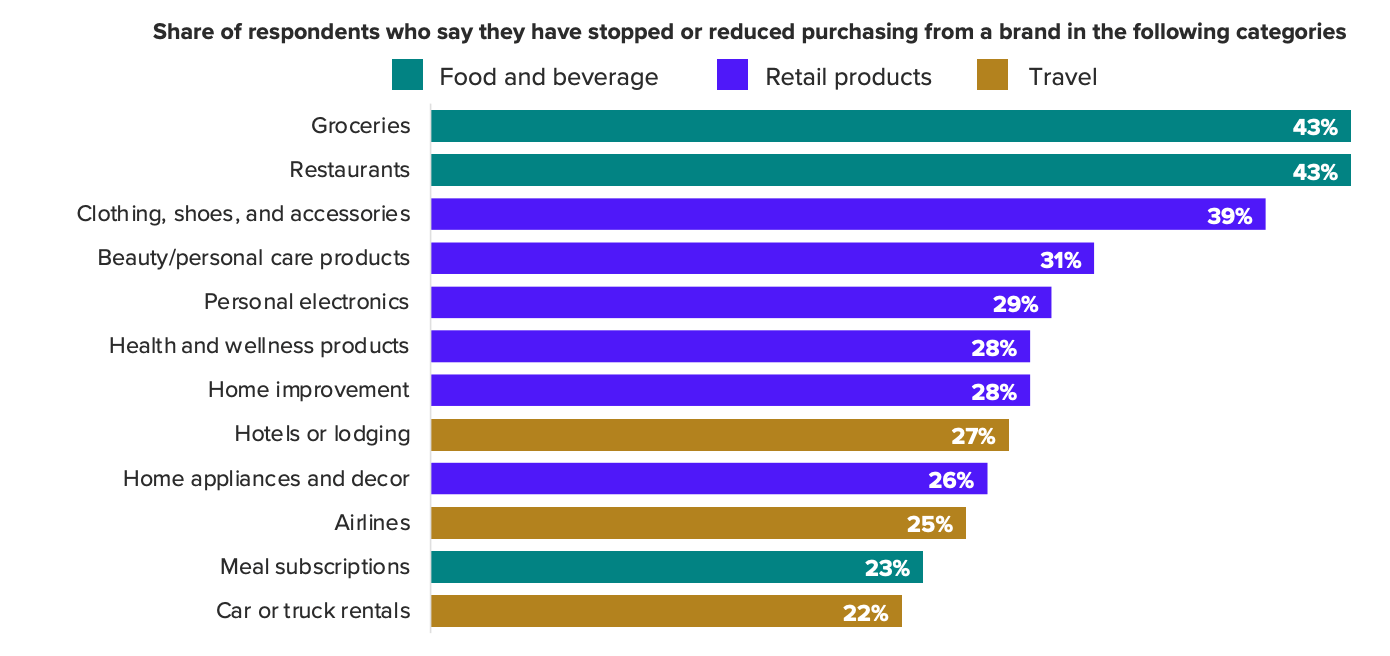

Increased spending on groceries and restaurants is leading customers to abandon their favorite brands

Increasing cost of living is the primary reason shoppers are abandoning their favorite brands. Consumers say they’ve been spending more money first and foremost on groceries, restaurants and apparel. These are the same categories where shoppers say they’ve either stopped shopping from a brand or shopped that brand less frequently. Cutting back on food leads the list, where consumers are giving up brands in order to save money. Most (66%) shoppers who have reduced their shopping with a brand say they’re just buying less frequently and haven’t given up on their favorites entirely. Download our full report to see how customer loyalty is shifting.

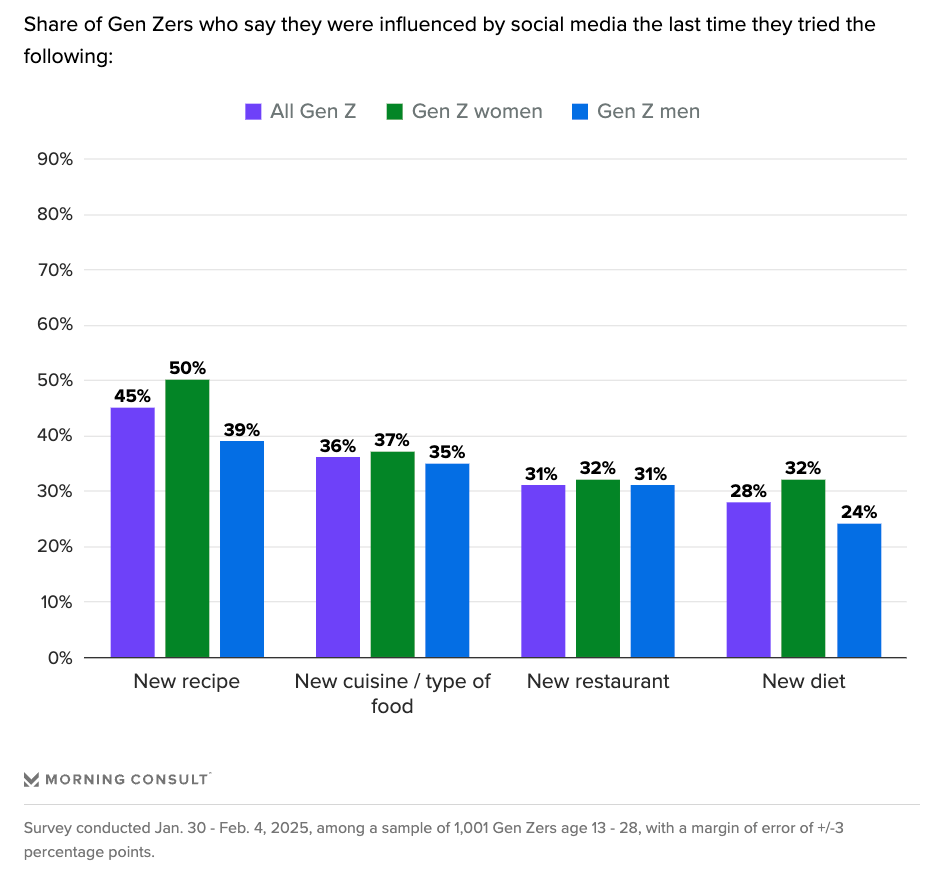

Recipes are a key path to connect with Gen Zers on social media

Gen Zers are chronically online, so it’s logical that social media has an influence on the way the generation interacts with the food and beverage category. Whether it’s discovering a new recipe from an influencer or learning about a restaurant from a friend on TikTok, Gen Zers are discovering everything from new types of food to new approaches to healthy eating from — where else — the internet.

The influence of social media is strongest when it comes to recipes and cooking. Nearly half (45%) of Gen Zers say they were influenced by social media the last time they tried a new recipe. And despite their comparative youth, the generation is cooking often. Roughly one-fifth (21%) say they had tried five or more new recipes in the past month, some of which can be attributed to the fact that they’re newer to cooking at home than older generations so recipes are new by nature, but is also reflective of their general exploratory approach to food. Read more about how social media factors into Gen Z’s recipe and restaurant discovery.

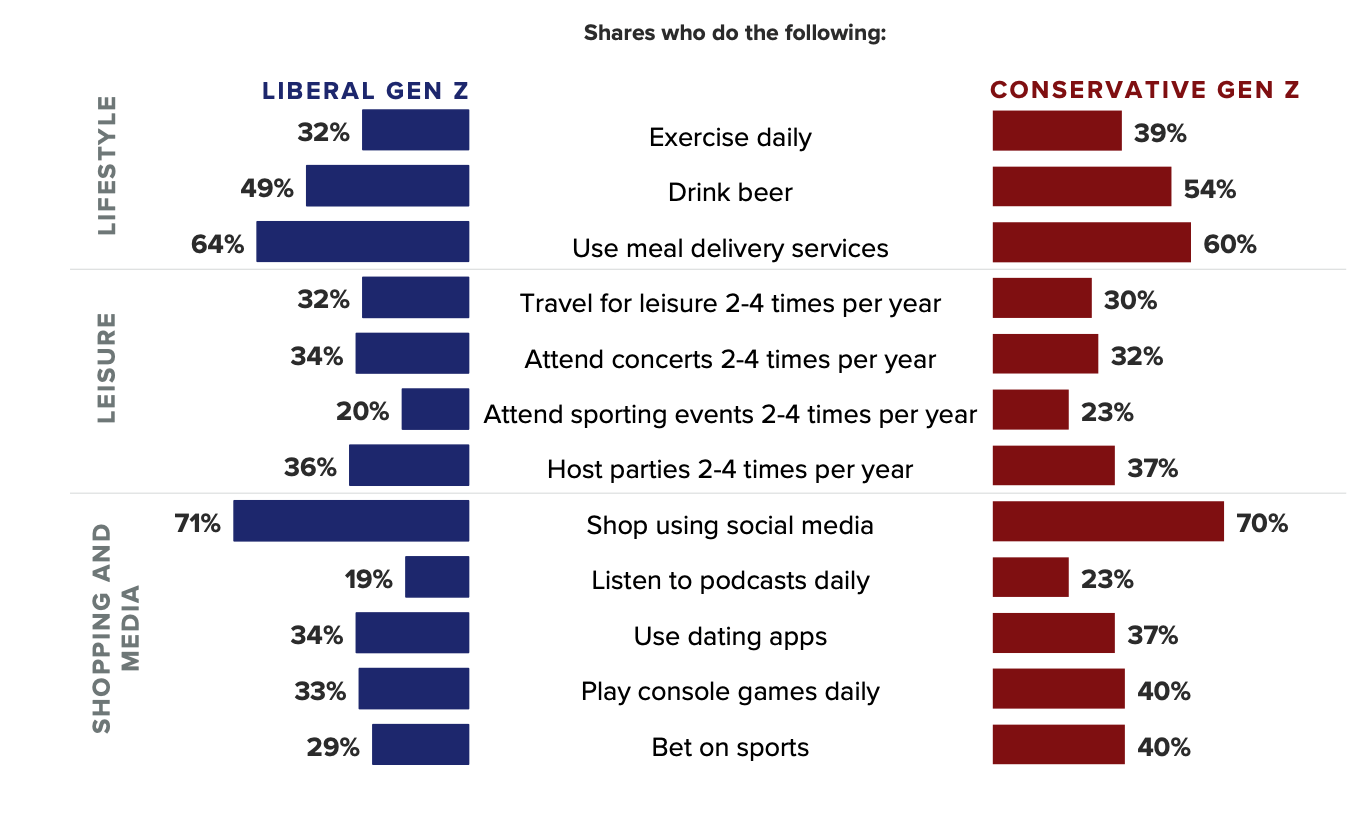

Are there “blue” and “red” Gen Z behaviors?

To some extent, yes — but only when these behaviors are traditionally tied to a specific gender. For example, we know young conservatives skew male. We also know that sports fandom skews male. So, it’s unsurprising that conservative Gen Zers are several points more likely than their liberal counterparts (who skew female) to say that they do things like exercise daily, regularly attend sporting events and bet on sports. That said, the influence of gender weakens when it comes to bigger-tent consumer activities like online shopping, traveling and hosting get-togethers. Roughly equal shares of both groups report participating in these behaviors at the same frequency. Download our full report for a deep dive into Gen Z's shifting ideology, and what it means for leaders in the public and private sector.

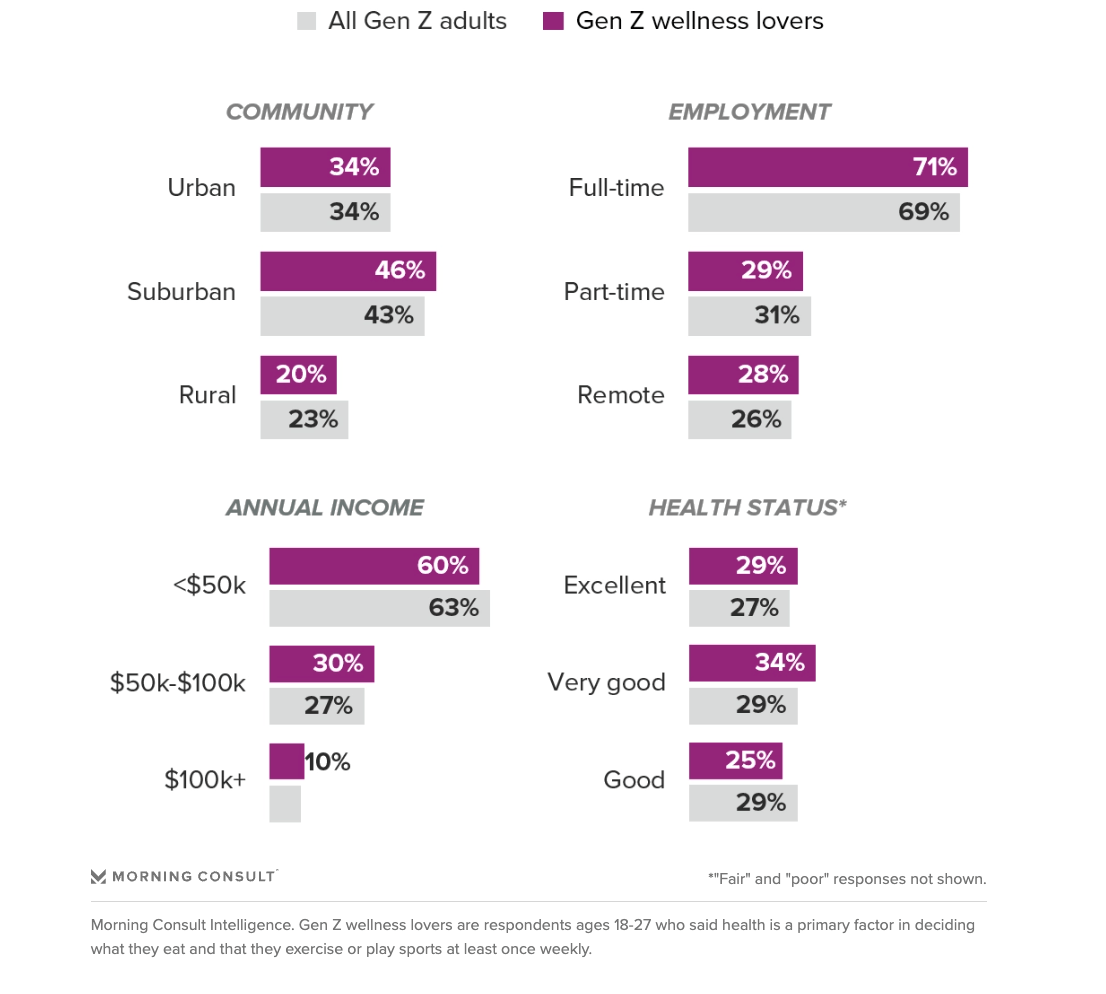

Gen Z wellness lovers by the numbers

When it comes to general demographics, Gen Z wellness lovers — defined in this analysis as those aged 18-27 who report eating healthy and exercising or playing sports at least weekly — don’t differ all too much from their larger generational cohort. They hold college degrees and reside in various settings (urban, suburban, rural) at roughly equal rates. And while Gen Z wellness lovers are slightly more likely to be employed full-time and make at least $50,000 annually than all Gen Z adults, the most notable gap comes (unsurprisingly) in relation to how they categorize their well-being: More than 3 in 5 (63%) of the former describe their health as “excellent” or “very good,” compared to 56% of the latter. Learn more about the Gen Zers obsessed with wellness here.

Culinary travelers see food and drinks as a conduit to culture

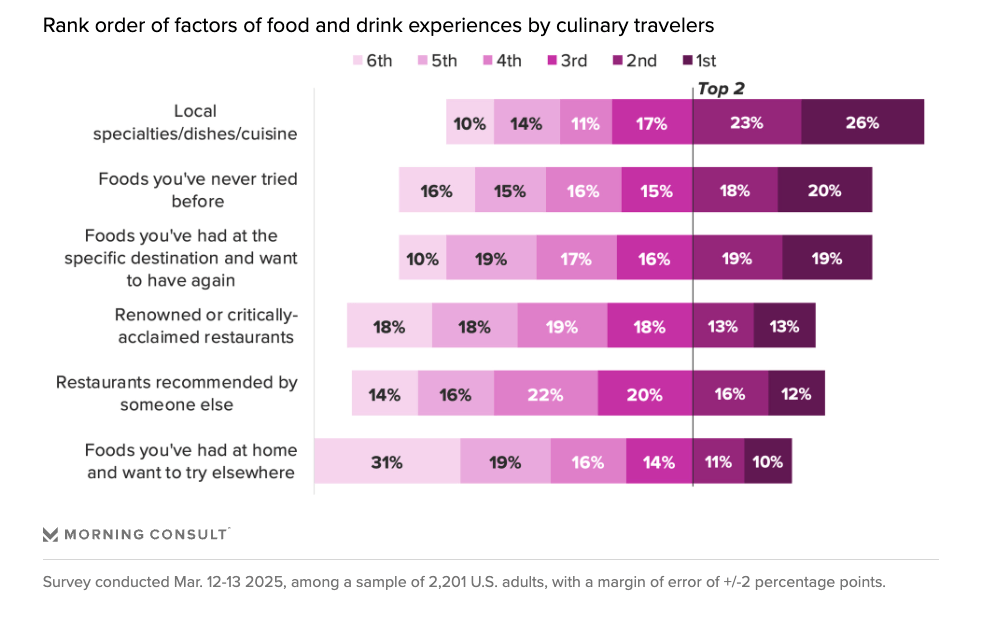

Foodie travelers’ focus on understanding culture while traveling is reflected in their eating and drinking preferences. When asked to rank six elements of a culinary experience in order from most to least preferred, this cohort was most likely to put local specialties or dishes at the top: About half (49%) said it was their first or second preference.

They also display a balance of adventure and familiarity, as trying new foods and seeking out specific favorites from past visits were very similar in their ranking. Falling more towards the bottom were renowned restaurants and those recommended by others, as well as foods from home that travelers want to try elsewhere. That’s not to say these things aren’t important — in fact, recommendations are key in pushing travelers to certain locations. But it shows that the food itself is the priority when seeking culinary experiences. Discover more about the priorities of traveling foodies.

Want more insights? Dive into additional analysis from our team of experts below.

- Most Trusted Brands 2025: Our definitive ranking of the brands that lead the way on consumer trust, including for key demographics like Gen Z and millennials.

- Made in America Report, 2025 Edition: Our new "Made in America" report provides an in-depth assessment of U.S. consumers' attitudes toward the “Made in America" product segment and the demographic and political drivers of consumer behavior when it comes to buying domestic.

- Tracking U.S. Consumers' Views on Tariffs: A comprehensive look at U.S. consumers’ attitudes, including topline support, inflation expectations, spending behavior, corporate messaging and political sentiment.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].