Global Consumer Confidence Braces for the Red Sea Storm

Key Takeaways

On the heels of a strong end to 2023, consumer confidence in the United States remained relatively steady in January. Across the border in Mexico, confidence is still a bright spot for the region despite recent softening due to rebounding inflation and high interest rates.

Consumer sentiment increased in 12 out of 16 countries tracked by Morning Consult in Europe, building on last month’s increases. However, Europe’s two largest economies began to flash warning signals.

Robust domestic demand, solid growth forecasts, and a credible disinflationary environment contributed to an upward trend in consumer sentiment in several APAC countries including Malaysia and Thailand. Singapore recorded the largest increase in confidence for the APAC region at 6.1%.

This memo offers a preview of Morning Consult’s January Global Consumer Confidence Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Globally, consumers generally grew more optimistic in January about their countries’ business prospects and their own personal finances. The Index of Consumer Sentiment (ICS) increased in 33 of the 43 countries tracked by Morning Consult Economic Intelligence. However, the recent escalation of tensions in the Red Sea pose a risk to this broad improvement in sentiment as it presents direct economic risks to the global fight against inflation.

After surging from October through the end of 2023, consumer sentiment for the United States remained somewhat stable through January. Although inflation has eased from its highs in 2022, prices continue to be a pain point for consumers. In addition, the Consumer Price Index ticked up slightly at the end of 2023, with certain services such as housing and auto insurance keeping inflation elevated above the Federal Reserve’s 2% target.

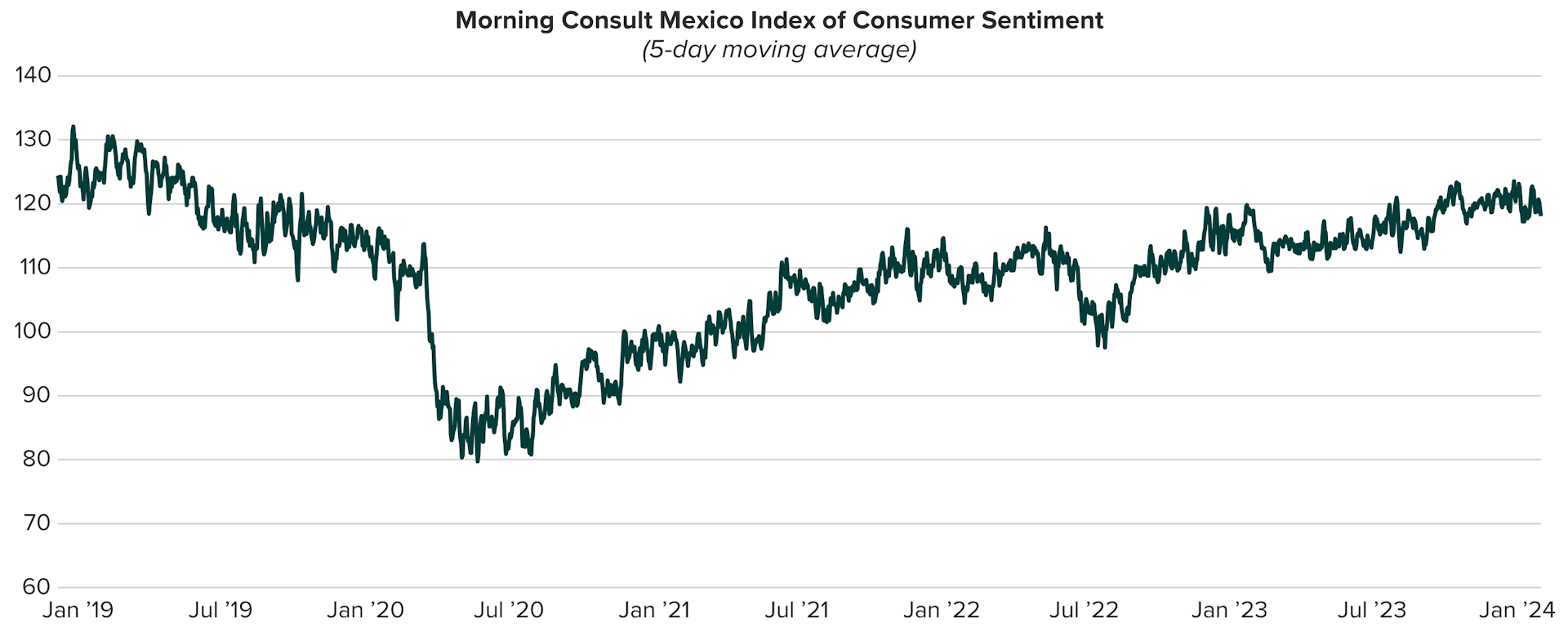

Mexico’s Consumer Sentiment Hovers Above Jan 2020 Levels but Faces Downside Risks

Mexican consumer confidence continues to be a bright spot in the region, with sentiment hovering slightly above the January 2020 levels. Low unemployment, a strong peso, and increased investment have fueled a Mexican economy which has outpaced expectations for most of 2023. Mexico became the U.S.’s largest trading partner last year in part due to ‘nearshoring’, or the phenomenon where companies relocate overseas operations to Mexico for increased proximity to the U.S. However, some downside risks are beginning to materialize as sentiment softens somewhat in January: GDP in the final quarter of 2023 grew less than expected, inflation has trended up since October, and high interest rates may be beginning to dampen demand.

Akber Khan is an economist at decision intelligence company Morning Consult, where he supports the research efforts of the Economic Intelligence team by applying a combination of data science, data engineering and econometric forecasting methods to deliver insights into global macroeconomic trends. Previously, he worked for the Federal Reserve Board as a financial analyst, covering issues such as banking and finance, short-term funding markets, and monetary policy. He received a bachelor’s degree in economics from Bentley University.

Follow him on Twitter @AKhanMC. For speaking opportunities and booking requests, please email [email protected]

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]