Inflation and a Possible Recession May Cement BNPL in Consumers’ Wallets Forever

Industry leaders should expect BNPL purchases to remain steady even as consumers’ purchasing power and outlook on the economy deteriorate. In addition to the current macroeconomic headwinds, there are significant tailwinds that will buoy the payment method through the summer and beyond, to a place of permanence in consumers’ wallets.

As valuations of big-name “buy now, pay later” providers drop and industry leaders ponder the future of these companies, their outlooks range from lukewarm to pessimistic.

While the headwinds facing BNPL (inflation, a possible recession and softened consumer demand for big-ticket items) are undeniable, there are also strong tailwinds in the short term that will bolster BNPL payments and companies — namely, strong consumer balance sheets despite inflation, the consistency of BNPL use so far this year, expected blockbuster sales from major retailers this summer and the appeal of low- to zero-interest payments as credit card interest rates climb.

Last year saw the meteoric rise of BNPL as many consumers encountered and experimented with the payment method for the first time. But if current BNPL usage trends continue for the next several months, this may be the year that consumers truly adopt BNPL as a regular payment method in their arsenal — an alternative to credit cards during an increasingly unpredictable economic climate and ever-rising interest rates. And it will mean that BNPL is here to stay.

The macroeconomic environment — inflation, a looming recession and record-low consumer confidence — does pose a challenge to BNPL providers

Elevated inflation remains top of mind for U.S. consumers, who are increasingly having to dip into their savings or fund purchases with credit, according to data from Morning Consult Economic Intelligence.

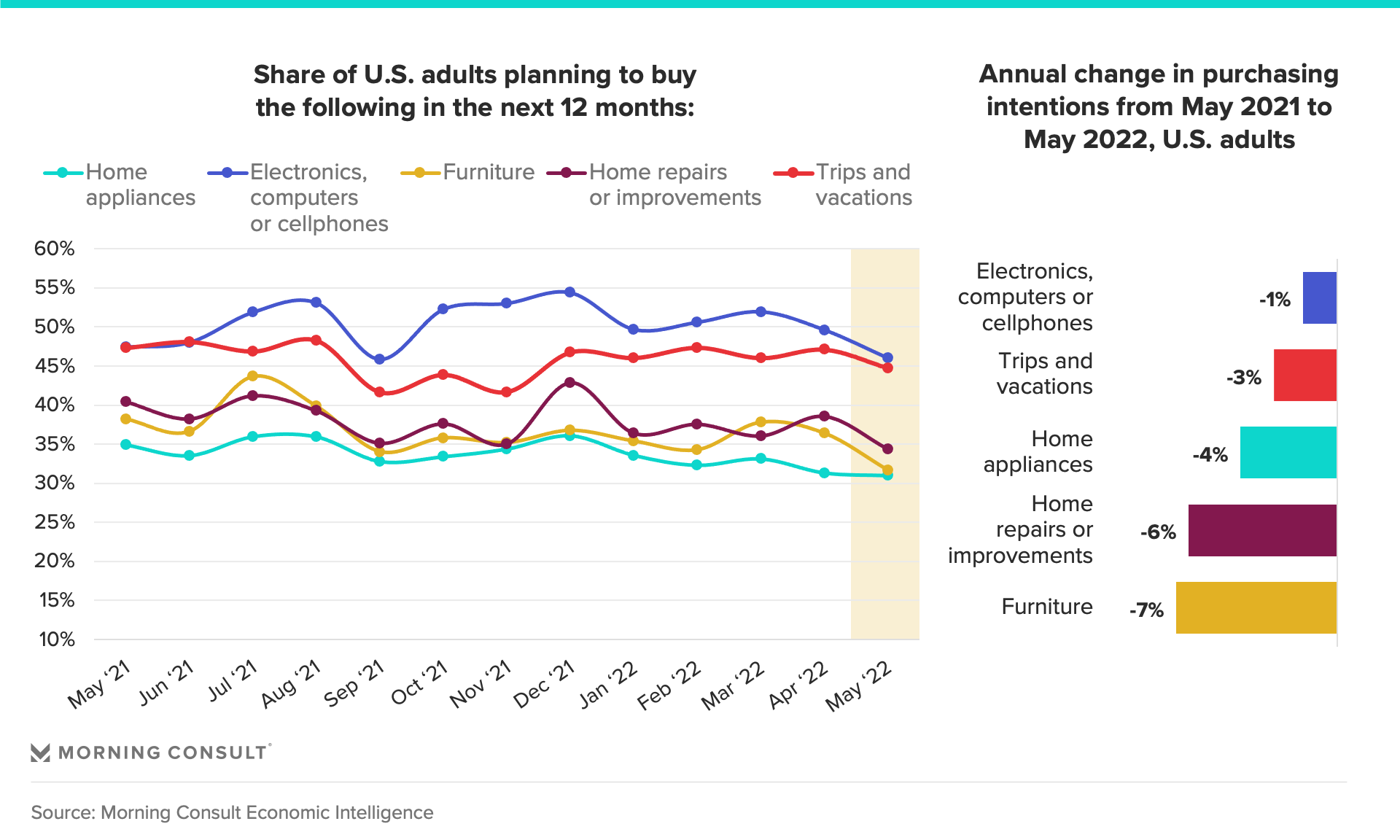

As a result, U.S. consumer sentiment has fallen to new lows, and consumers are reprioritizing their future purchases: Intentions to buy big-ticket items such as electronics, trips and vacations, home appliances, and furniture have all dropped since last year.

On the surface, this spells trouble for BNPL providers. Higher prices equate to an overall contraction in spending, meaning potentially fewer purchases made using BNPL.

But strong consumer balance sheets and seasonal sales will propel BNPL through the summer and beyond

For the time being, consumer balance sheets are historically strong. Although U.S. consumers no longer have government stimulus support and inflation continues to erode wage growth, Federal Reserve data shows that net wealth as a share of disposable income is near a record high, and household debt as a share of total assets is at its lowest level in nearly five decades.

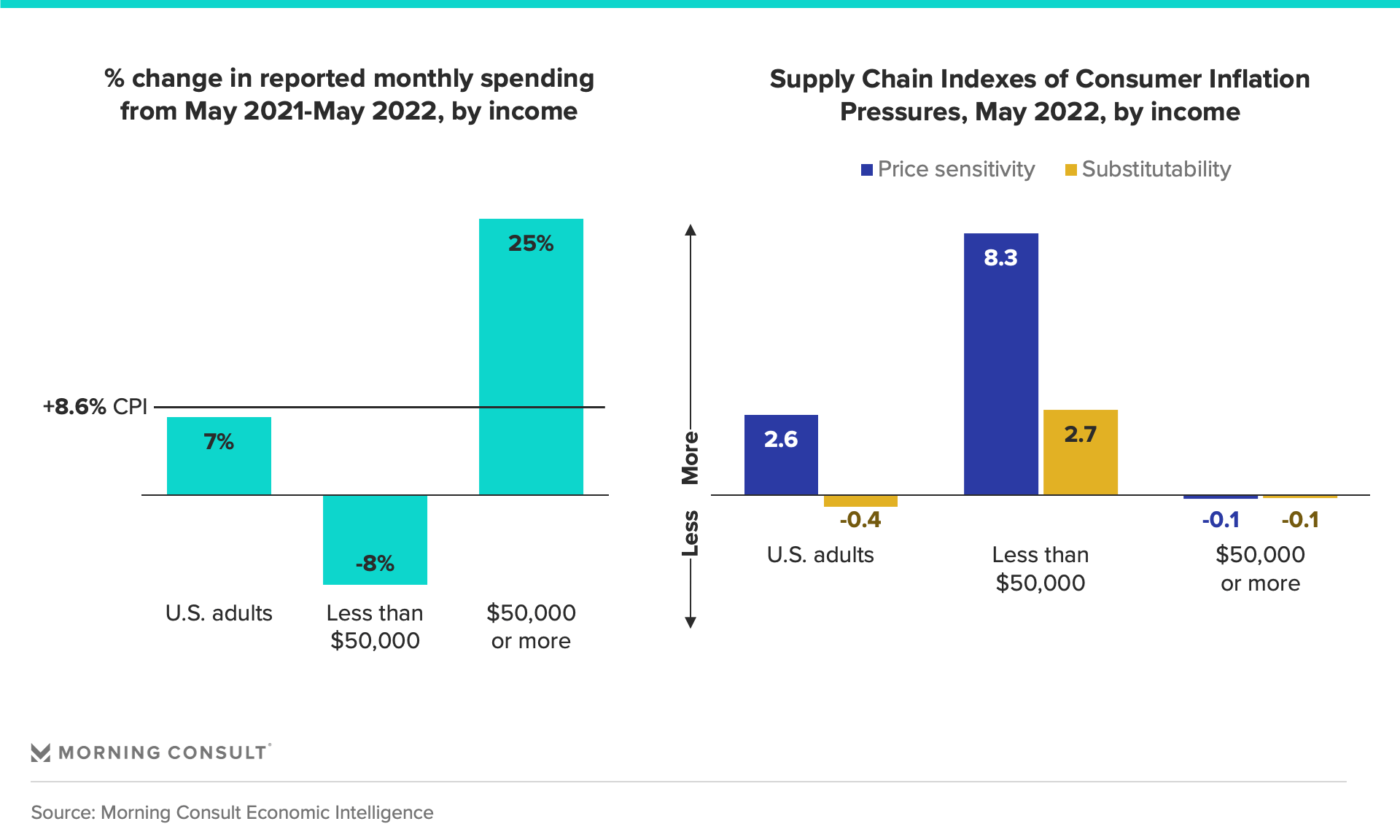

That’s why U.S. adults are currently better able to cope with price increases than they otherwise would be. Instead of cutting back across the board on spending, our recent Household Finances & Spending Report shows that consumers, especially those from higher-income households, are increasing both spending and expected spending. For example, households with annual income of at least $50,000 reported a 25% increase in monthly spending from May 2021 to May 2022, notably higher than the 8.6% consumer price index increase over the same period.

These same consumers have so far shown very little price sensitivity or substitutability, according to our June U.S. Supply Chains & Inflation report, meaning they are willing to pay higher-than-expected prices and not trade down to cheaper alternatives.

To put it simply: People still have the means to buy things, but they are expecting items to cost more. And Morning Consult data indicates that they’re using BNPL to pay for some of them. The consistency with which U.S. consumers have used BNPL to fund their purchases throughout 2022 indicates that the payment form may be helping to keep their price sensitivity and substitutions at bay, and should be viewed as an indicator of the staying power of BNPL.

The share of U.S. adults who reported using BNPL to fund a purchase at least once in the past month has not dropped below 16% in 2022, and adults from households with annual income between $50,000 and $99,999, as well as those with annual income of $100,000 or more, are even more likely to have used BNPL (21% and 20% in June, respectively).

Consumers’ intentions to use BNPL providers in the future haven’t softened either — in fact, they’ve grown since last year. Since June 2021, the shares of consumers considering purchasing with Affirm and Afterpay have risen 4 percentage points each, while consideration of Klarna has held steady at 11%. And PayPal’s BNPL product, PayPal Pay in 4, has maintained purchase consideration among approximately 18% of adults since its release in November 2021.

As more retailers partner with BNPL providers and more payment providers create their own BNPL offerings, adoption and strong usage will likely continue.

Furthermore, softening purchases of big-ticket goods won’t have as much of an impact on BNPL use as many expect: Consumers use BNPL for a wide variety of purchases, not just expensive items like furniture and electronics. Among those who reported using BNPL in the past year, a plurality of respondents (35%) said they had done so to purchase apparel, followed by electronics (32%).

Finally, many major retailers faced with excess inventory are planning big sales in July to encourage consumers to make larger purchases, which they may be tempted to fund using BNPL. Certainly credit cards will be an option, but they will become less appealing to many shoppers as interest rates continue to rise. Consumers are already increasing their credit utilization — the share of U.S. adults with a credit card balance climbed 5 percentage points compared with a year ago — and will likely look for opportunities to manage that utilization by diverting some purchases to BNPL.

Charlotte Principato previously worked at Morning Consult as a lead financial services analyst covering trends in the industry.