Inflation Continues to Face Upside Risks in 2024

Key Takeaways

As price relief from the supply side fizzles out, strong demand may add upside risk to inflation this year.

Strong consumer demand is adding upside risk to inflation as many U.S. adults appear less determined to resist price increases for most categories.

Measures of supply tightness have improved, however the loosening cycle for inventories is showing signs of stabilizing – potentially indicating less price relief from goods in the coming months.

This memo offers a preview of Morning Consult’s February U.S. Inflation & Price Pressures Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Cooling inflation was the story of 2023, with the annual rate falling from 6.4% in December 2022 to 3.3% a year later. However, there continues to be upside risk to achieving and maintaining the Federal Reserve's 2% target for topline price growth. Several categories showed signs of solidifying price growth in recent months as many of the factors helping cool inflation – such as the unwinding of supply disruptions – are becoming less prevalent. At the same time, consumer spending and wage pressures remain robust, presenting a combination that, if persistent, could hinder sustained moderation of inflation.

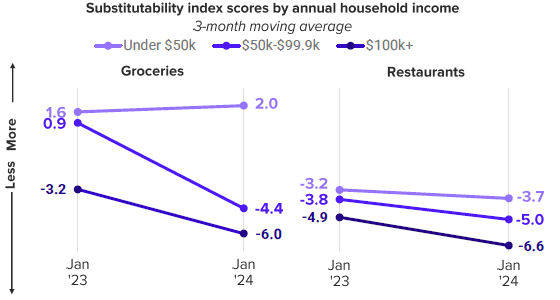

Inflation expectations remain elevated as U.S. adults grow accustomed to paying more for goods and services, and diminishing sticker shock is helping support demand. Fewer consumers report surprise over prices, corresponding with less price sensitivity and trading down compared with a year ago. Improving purchasing power is helping to boost demand for everything from restaurant purchases to homes and autos.

Most Consumers Are Getting Used to Food Prices, but Low Earners Continue To Trade Down

Recovering goods supply has been a major contributor to slowing inflation, however this source of price relief could be less of a helper going forward. Morning Consult’s indexes for Purchasing Difficulty and Delivery Delays, which track supply tightness, continue to show improvement compared with a year ago. However, global supply chain pressures have been heating up, with potential to impact consumer purchases. Furthermore, the loosening cycle for inventories is showing signs of stagnating – potentially indicating less price relief from goods in the coming months.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]