Inflation Redirects Consumer Spending Toward Household Staples

Key Takeaways

Consumers are allocating a higher share of wallet to goods and services that meet basic needs as inflation pressures household budgets.

Spending is trending lower for discretionary categories as escalating price concerns push consumers toward affordable alternatives, such as substituting groceries for restaurant meals.

Rising costs look likely to continue shaping spending allocations, though patterns may shift as wage costs and services prices increasingly steer the trajectory of inflation.

The following analysis is based on Morning Consult’s proprietary consumer spending, purchasing intentions and price expectations data series. Read more in our February 2022 U.S. Consumer Spending Report.

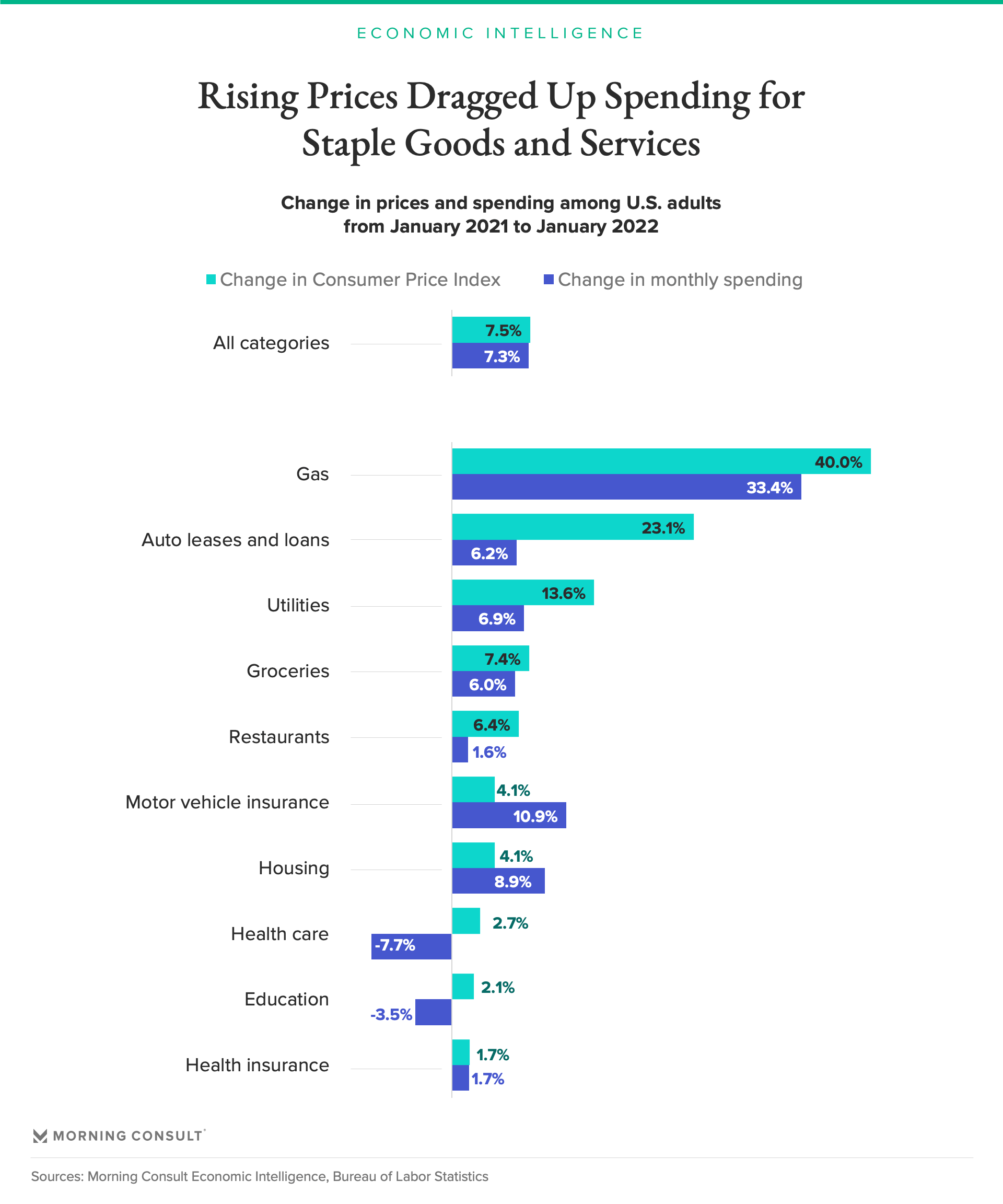

The annual rate of inflation in the United States rose 7.5 percent in January, the fastest pace since 1982. Widespread price growth, brought on by burgeoning consumer demand and broad supply constraints, is driving up the cost of living, with some of the largest monthly household expenses facing steep increases.

Robust employment and wage growth has supported spending growth to an extent, but financial vulnerability increased in January as U.S. adults reported a jump in lost income tied to the spread of the COVID-19 omicron variant. As affordability slips, inflation concerns are increasingly shaping consumers’ monthly spending allocations.

Consumers are spending more on basic needs

As U.S. adults encounter rising prices across a growing share of categories, they are concentrating their spending on goods and services aimed at fulfilling their households’ basic needs. Housing, grocery and car-ownership prices climbed sharply over the past year, and because shelter, sustenance and transportation are critical living expenses, consumers have little choice but to pay more for these items.

Lower-income adults are especially vulnerable to affordability challenges. Rising prices for housing have disproportionately driven up spending for those earning under $50,000, who tend to be renters and are therefore exposed to price increases more frequently than homeowners. Rents usually increase when lease terms expire, whereas homeowners’ monthly payment amounts are more or less fixed until they decide to move.

Some of the sharpest price increases over the past year were in categories associated with car ownership and driving. Spending on gas increased 33 percent between January 2021 and January 2022, only slightly trailing the 40 percent jump in prices. Despite higher driving costs, consumers are showing little sign of opting for public transportation instead. Car ownership rates increased from 79 percent to 83 percent year over year in January, while spending on public transit dropped 8 percent over that same period.

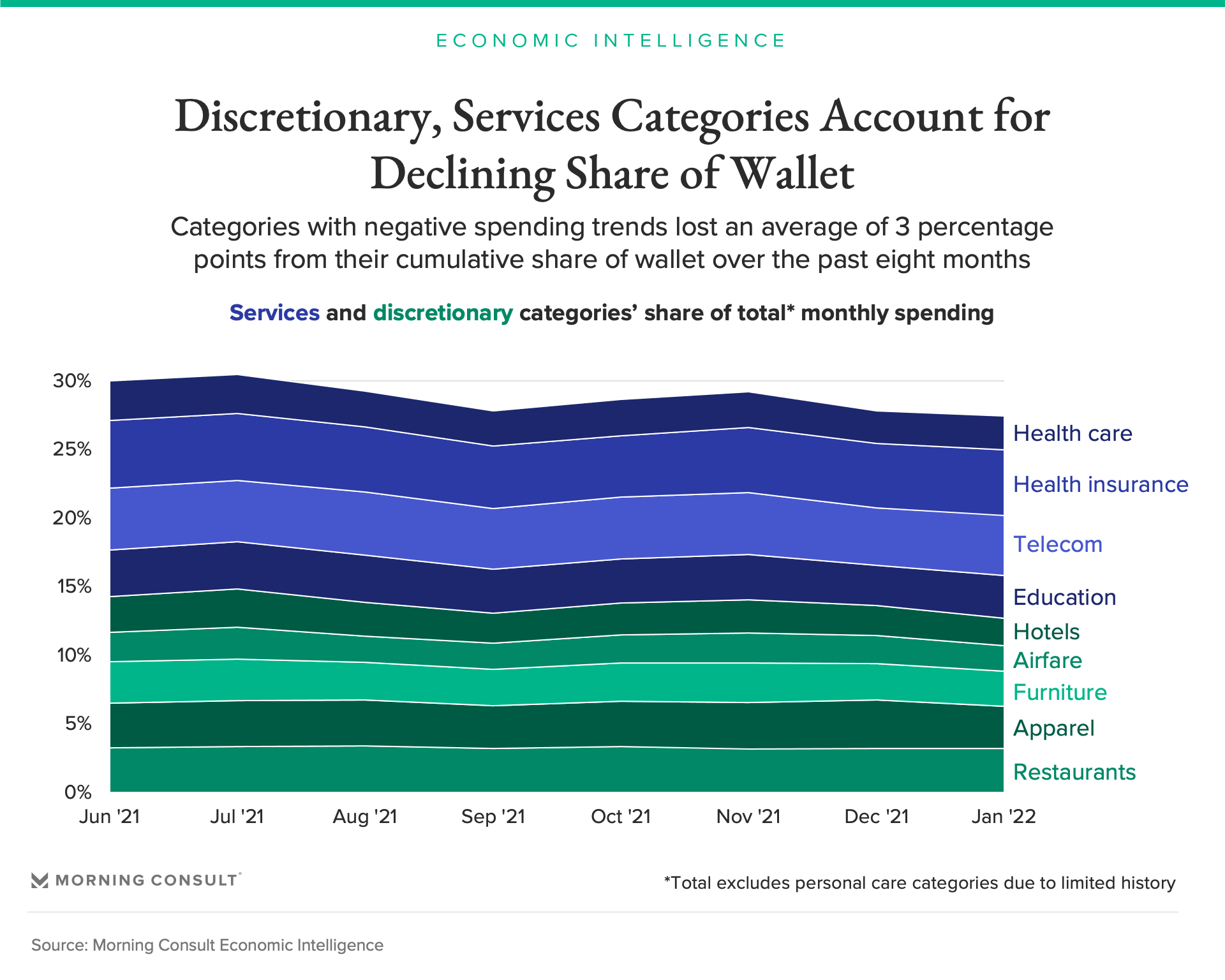

Households cut back on discretionary spending

Higher spending on increasingly expensive staple goods and services is leaving less space in monthly budgets for other categories. The share of wallet allocated to discretionary purchases — including apparel, furniture and travel — has trended lower over the eight months since Morning Consult began collecting spending data on these categories.

Certain services that registered more modest inflation levels over the past year are also accounting for a shrinking share of spending. Health care, telecommunications and education costs haven’t risen as sharply as inflation overall, helping to offset increases for other household staples.

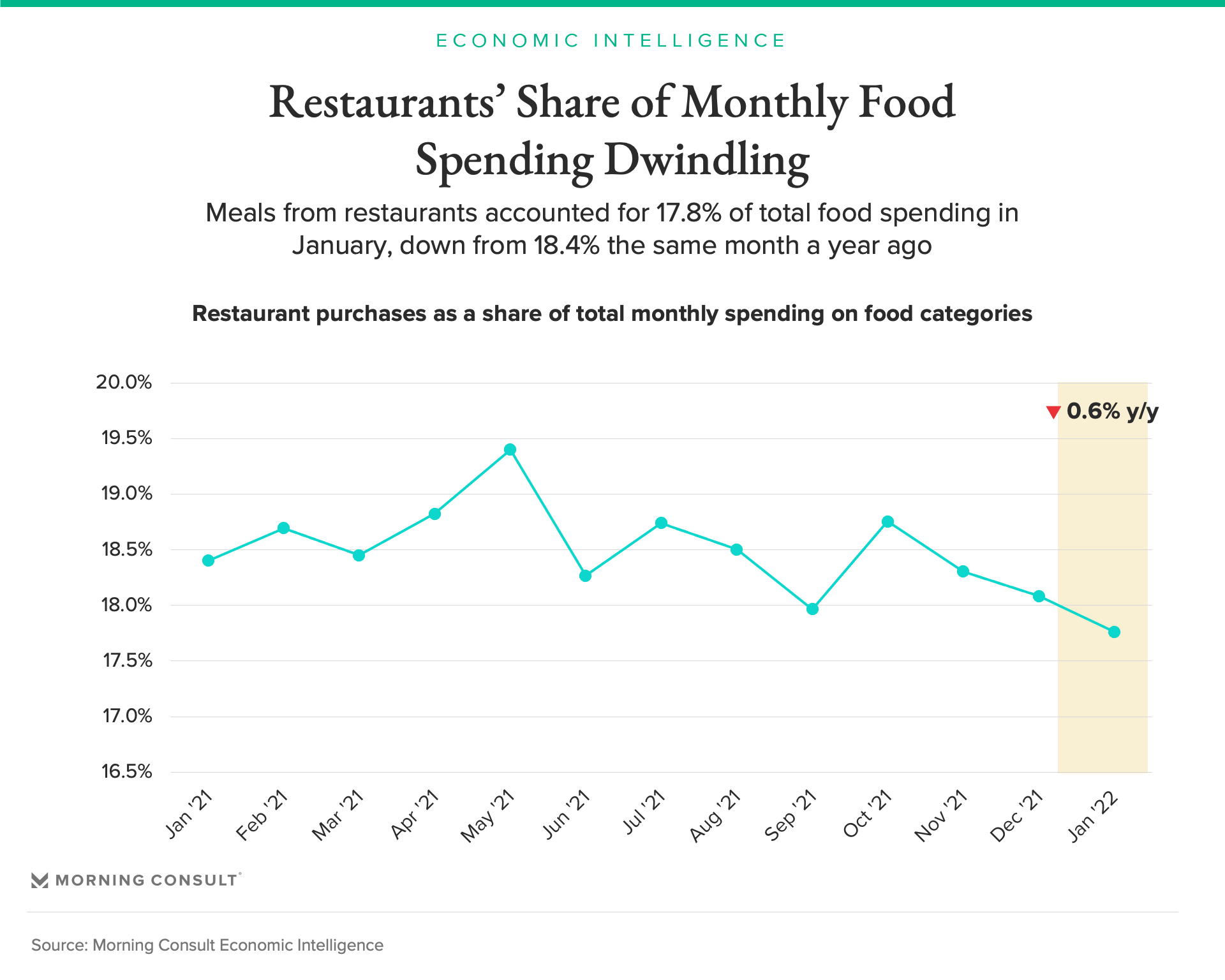

As inflation pressures challenge household budgets, consumers are also increasingly substituting groceries for restaurant meals in an effort to stretch monthly food budgets. In January, the share of total monthly food spending allocated to restaurants fell to 17.8 percent, its lowest level in more than a year and 0.6 percentage points below where it stood during the same month in 2021 — despite consumer comfort with dining out having risen significantly over the same period.

Inflation pressures likely to linger

The inflation rate looks unlikely to fall much in the near term, but the categories predominantly driving inflation may gradually shift from goods to services. Over the past year, price growth for tangible goods like food, gas and cars has accounted for much of the rise in inflation. Going forward, higher wage levels will compel businesses to further lift prices — especially in service industries, where labor accounts for a large share of total input costs.

Even as goods shortages from supply disruptions begin to ease, inflationary pressures are therefore likely to persist. As spending categories jostle for space in monthly budgets, asymmetrical price growth for various goods and services will continue to play a role in shaping spending patterns.

For more information on the methodology behind Morning Consult's U.S. Consumer Spending and Personal Finances Survey, please see the February U.S. Consumer Spending Report.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]