A Year Into Rate Hikes, There Are Few Signs of a Cooling Labor Market (Report Preview)

Key Takeaways

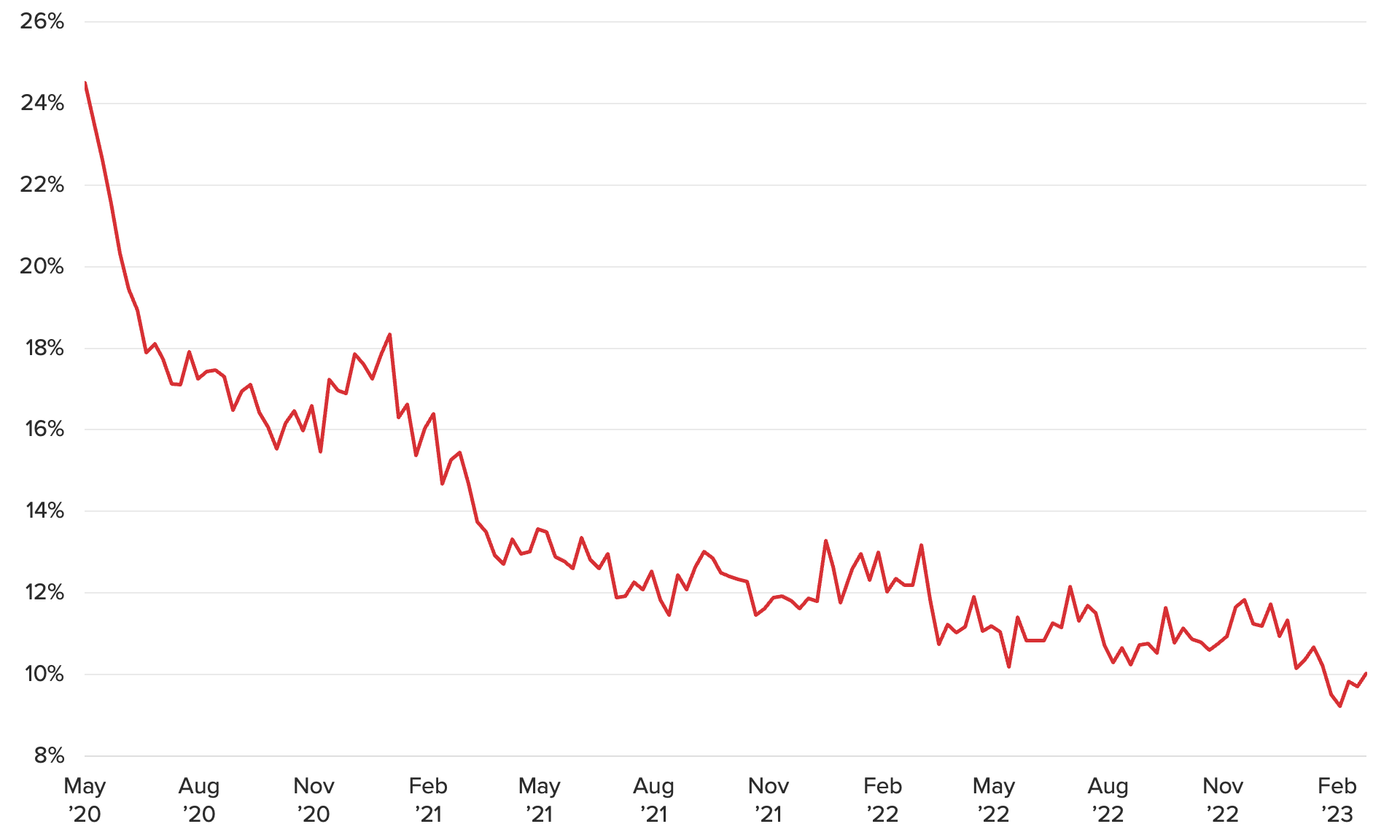

In February, broad-based labor indicators remained strong. Morning Consult’s Lost Pay and Income Tracker dropped to a new series low, with the share of U.S. adults experiencing pay losses falling to 9.7%.

Job search activity also bounced higher in February. 19.8% of employed adults were actively applying for new roles, with the increase including industries with recent headline-grabbing layoffs such as tech and finance.

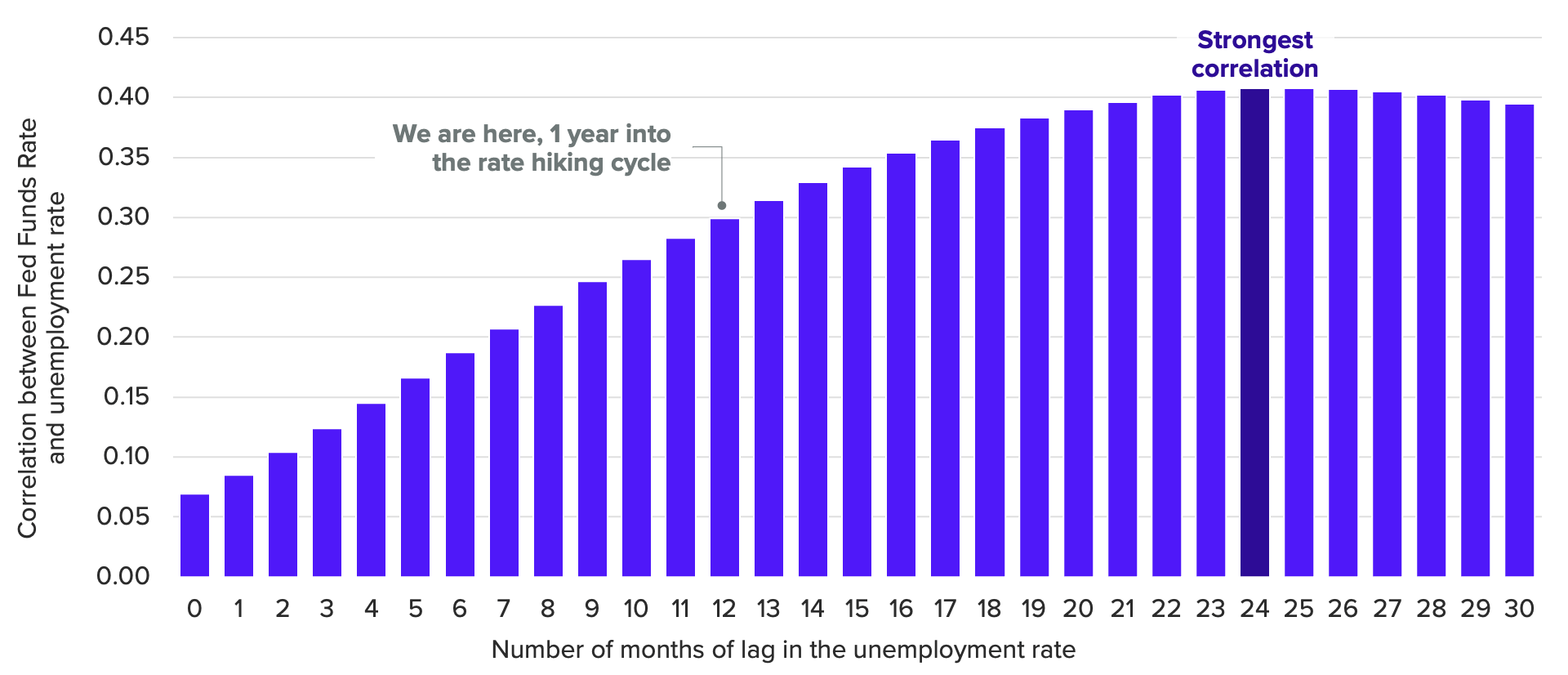

We are now 12 months into the Fed’s rate hiking cycle, and unemployment is at the lowest level since 1969. While it remains unclear how this hiking cycle will ultimately impact the labor market, market expectations for a Fed pivot in Q4 2023 line up well with historical precedence.

This memo offers a preview of Morning Consult’s March U.S. Jobs & Labor Report. Morning Consult Economic Intelligence subscribers can access the full report here.

The U.S. labor market is still very strong a full year after the Federal Reserve began raising interest rates. High-frequency measures of the U.S. labor market showed no signs of weakness through the first two months of 2023. Initial unemployment insurance claims have fallen in recent weeks along with Morning Consult’s Lost Pay and Income Tracker. The series dropped to a new low in February, with less than 10% of U.S. adults reporting pay or income losses for the first time since we started collecting data in May 2020.

The Share of Americans Reporting Lost Pay Hit a New Series Low in February

Job search activity bounced higher in February, with 19.8% of employed adults actively applying for new roles. The increase in search activity showed up in most industries tracked by Morning Consult, including industries with recent headline-grabbing layoffs such as tech and finance.

However, recession risks remain. Rapid interest rate hikes have historically been successful at putting the brakes on an overheated economy, and this hiking cycle has already weighed heavily on the housing market and business investment. But the labor market — which is one of the primary channels by which rate hikes are intended to slow price growth - remains unfazed.

Interest rate hikes pass through to the labor market by reducing aggregate demand and business investment via increased borrowing costs and tighter financial conditions. As businesses pull back, slower hiring will reduce upward pressure on wages, reducing input costs for companies and weighing on workers’ incomes. As a result, there is a positive correlation between the Federal Funds Rate set by the Fed and the unemployment rate. However, the passthrough process takes time, with the historical relationship suggesting it takes up to 24 months before the effects of interest rate changes are fully felt in the labor market.

How Long Does It Take for Interest Rate Hikes to Impact Employment?

Last month, we placed a 50% probability on a job growth contraction over the next three to six months — and while Morning Consult’s proprietary labor metrics continue to flash green, we maintain our view that 2023 will severely test the U.S. labor market’s resilience. A soft landing remains possible, but even a relatively small increase in the unemployment rate could entail millions of Americans losing their jobs.

About this report

Morning Consult’s monthly U.S. Jobs & Labor Report provides a detailed assessment of the current state of the U.S. labor market, featuring proprietary data that provides enhanced scale, frequency and depth to official data sets.

Businesses and investors rely on this report to identify emerging labor trends and better understand how to attract, hire and retain talent.

The report draws on Morning Consult Economic Intelligence, a high-frequency global economic data set reflecting more than 17,000 daily economic surveys across the 43 largest global economies.

Full methodology and average daily sample sizes per country can be found here.

Jesse Wheeler previously worked at Morning Consult as a senior economist.