Job Growth Continues, but 2023 Outlook Dims (Report Preview)

Key Takeaways

The labor market remains tight, with Morning Consult’s Lost Pay and Income tracker near series lows after falling over the course of December.

Job search activity among employed U.S. adults remains elevated as optimistic workers continue to like their chances of gaining higher pay in the current job market.

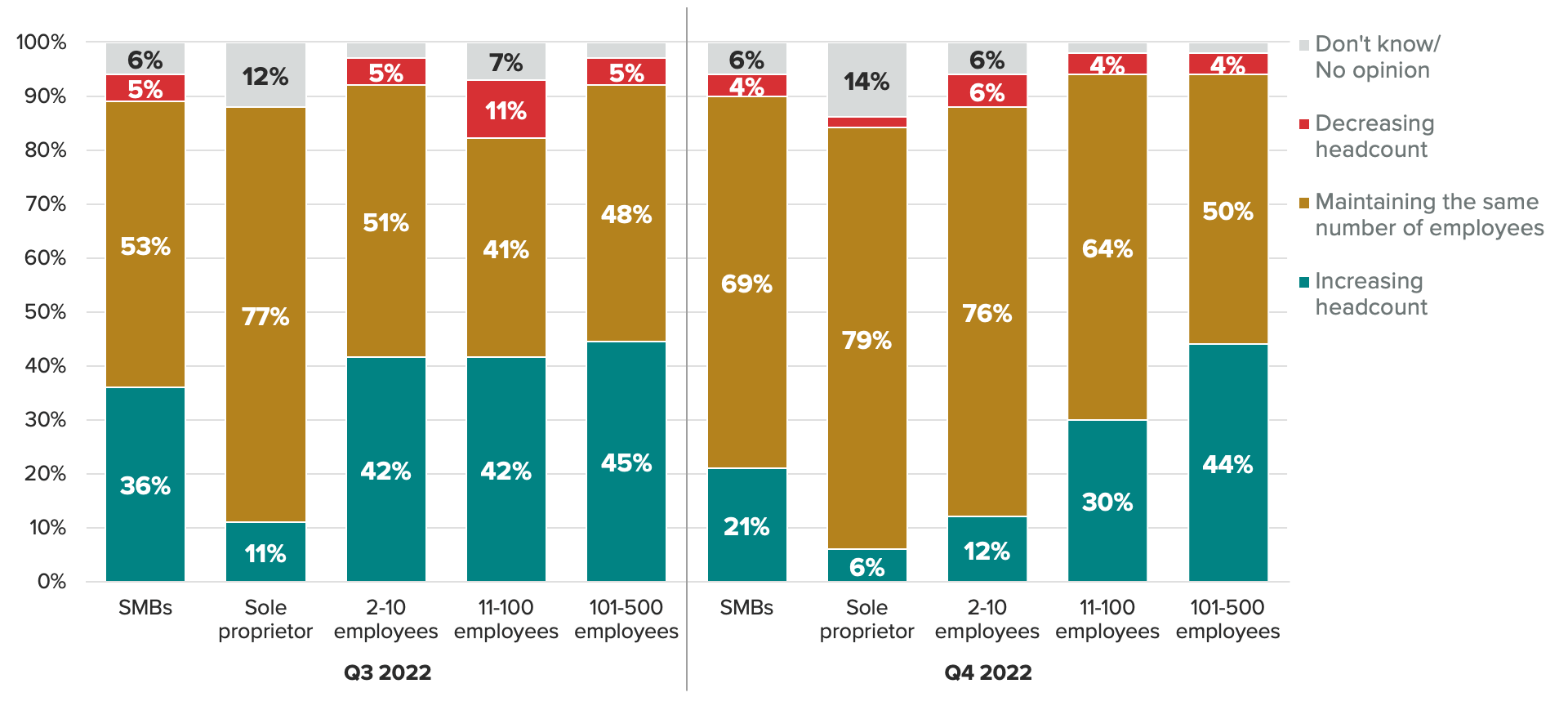

More challenging operating conditions are leading small- and medium-sized businesses to pull back on hiring, a likely bellwether for job growth moving into 2023.

This memo offers a preview of Morning Consult’s January U.S. Jobs & Labor Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Morning Consult’s labor market data is not flashing red, but it is no longer flashing green either as the incidence of lost pay and job loss expectations edge higher. Job growth has slowed but companies are still hiring on net, and job vacancies continue to outnumber those looking for work. Critically, nominal wage growth remains strong as businesses continue to compete to attract and retain workers. While this is positive for workers, it is a worrying sign for policymakers at the Federal Reserve who view the current pace of wage growth as inconsistent with inflation targets.

Continued tightness in the labor market may lead to even more tightening in the new year. As companies face higher borrowing costs and dampening demand for their goods, they will start to pull back — and data from Morning Consult’s Small- and Medium-Sized Business Survey indicates this is already happening.

Hiring Plans Among SMBs Were on the Decline Headed Into 2023

According to Morning Consult’s Small- and Medium-Sized Business Survey, SMBs are already facing challenging operating conditions in Q4 2022 and are increasingly planning to pull back on investment moving into 2023. This includes reducing the pace of hiring and reining in hiring plans for 2023. However, most companies are still adding to headcounts, despite reducing spending on other investments, signaling businesses’ reluctance to let go of workers in the wake of a historically tight labor market and widespread staffing shortages. How SMBs behave may well prove to be a bellwether for the broader labor market in 2023.

This memo offers a preview of Morning Consult’s January U.S. Jobs & Labor Report. Morning Consult Economic Intelligence subscribers can access the full report here.

About this report

Morning Consult’s monthly U.S. Jobs & Labor Report provides a detailed assessment of the current state of the U.S. labor market, featuring proprietary data that provides enhanced scale, frequency and depth to official data sets.

Businesses and investors rely on this report to identify emerging labor trends and better understand how to attract, hire and retain talent.

The report draws on Morning Consult Economic Intelligence, a high-frequency global economic data set reflecting more than 17,000 daily economic surveys across the 43 largest global economies.

Full methodology and average daily sample sizes per country can be found here.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]

Jesse Wheeler previously worked at Morning Consult as a senior economist.