Media & Entertainment Briefing: Fandom, video games, AI & more

Sign up for our media briefing newsletter. This monthly email curates our latest research into the industry, helping you stay ahead of the most important consumer trends.

Welcome to our media & entertainment insights briefing.

In this monthly email, we will curate the most important insights from our team of industry, political and economic experts and deliver them right in your inbox. Consider it your one stop shop for the data you need to know about the media & entertainment industry.

This month, we dive deep into many unique audience segments — ranging from die-hard fans, to AI super users to video game players. We’re also exploring sustainability, social media shoppers and more.

Read on for recent insights into these topics and more, or download our full reports for a deeper dive.

Twitch and Discord users are super engaged fans

Americans like to be entertained, and the options can feel endless. Whether they’re watching a Saturday afternoon game or listening to a new podcast, Americans are seeking out lots of entertainment, both online and offline.

However, not all consumers are created equal, and a small subset of entertainment fans has an outsized influence on culture, from what gets adapted for the big screen to which athletes brands partner with, die-hard fans are increasingly shaping these decisions. New research — done in partnership with Axios — found that Gen Zers are much more likely than the average U.S. adult to say they’ve done fandom-related actions. The same is true for Twitch and Discord users. Read more of our research into die-hard fans and how they participate in fandom.

Gamers mostly mirror the broader population, but skew a bit younger and more male

While gamers tend to be slightly younger and more likely to be men, their income levels don’t differ from the general population’s. This indicates that gaming is a hobby that doesn’t segregate by income, even though it can get expensive. At the same time, brands partnering with gaming properties should understand that not all partnerships will have the same reach potential, as ultra-expensive products may be out of reach for some. Read more of our audience demographic deep dive into gamers, including how PC, mobile and console gamers differ.

Social media shoppers’ standout brands

For many consumers social media and e-commerce are inextricably linked, whether through in-app checkouts or influencer affiliate links. About half (51%) of U.S. adults say they’ve made a purchase through social media, up 12 percentage points from the beginning of 2022.

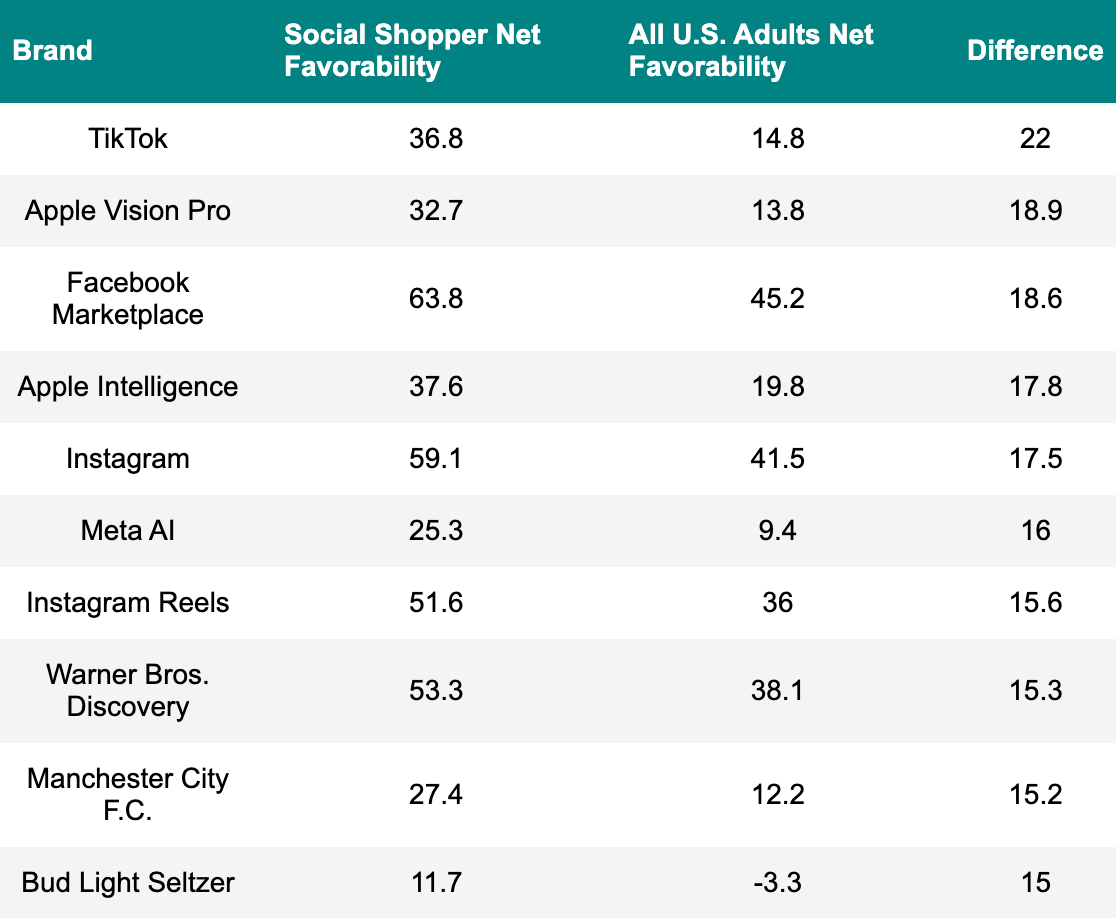

The brands that stand out from the pack for social media shoppers, or those with the largest favorability gap between social media shoppers and the general population, favor tech and social media companies. TikTok tops the list, and Apple brands like Vision Pro and Intelligence are highly ranked. Meta’s Facebook Marketplace, AI and Instagram and Reels also all made the top ten. Read more into how social media and online shopping are increasingly connected.

Consumers see all industries — including the entertainment industry — as a net positive on environmental sustainability

Some brands will have an easier time gaining credibility for efforts to reduce their environmental impact than others. When companies label products as “eco-friendly” or “sustainable,” consumers are generally trusting: About half (51%) of consumers believe that products labeled as such are “much better” or “somewhat better” for the environment. About a third (34%) of consumers said that they think these products are “slightly better” or “not better” for the environment, and 16% said they didn’t know.

That trust runs across industries: On the whole, consumers have a net positive perception of sustainability in all types of businesses tested, including (but just barely) oil and coal. Read more about how consumers are thinking about sustainability in 2025, including how engaging customers through sustainability-efforts can bolster connections.

Widespread adoption of AI threatens consumer trust

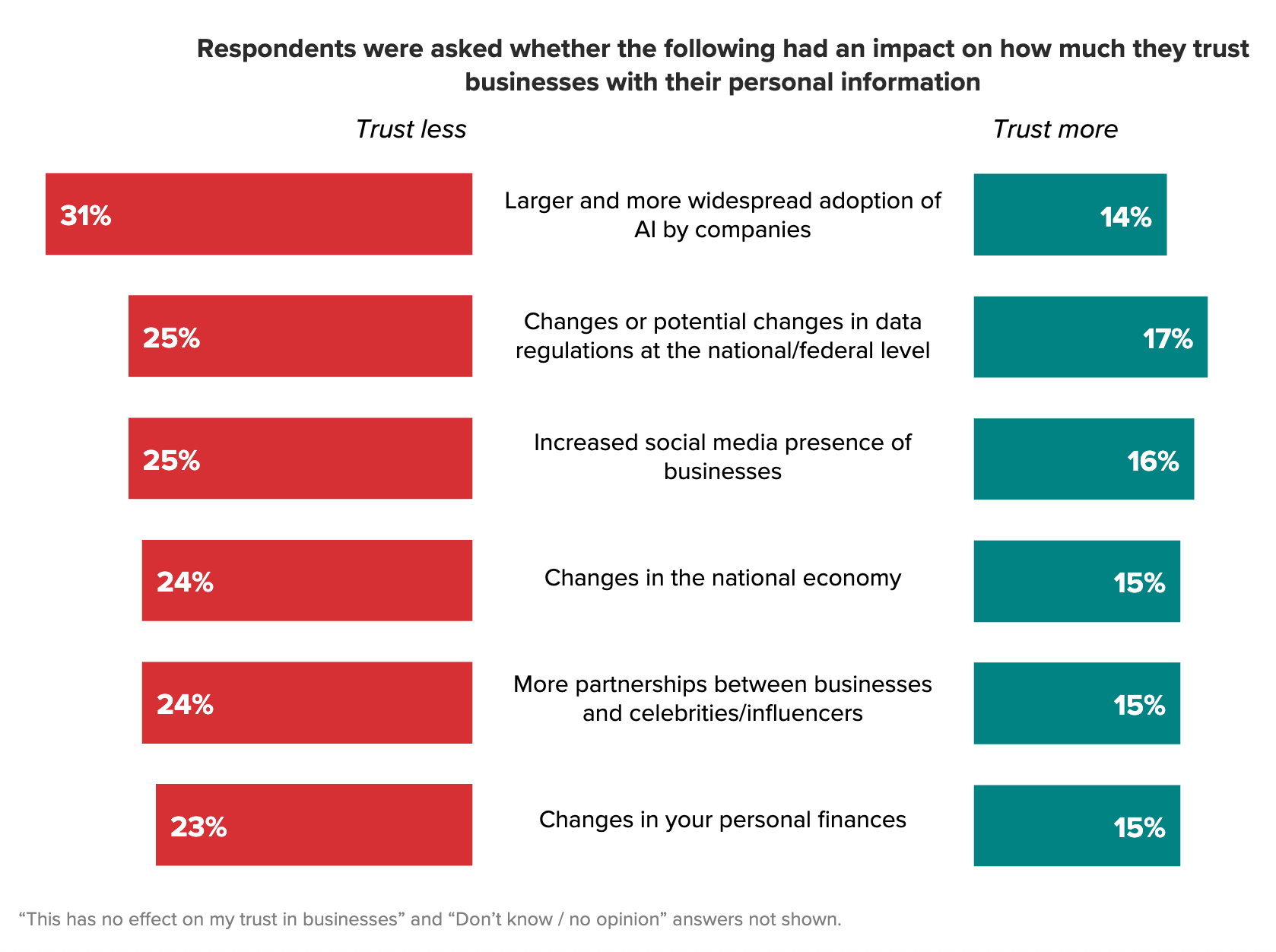

When asked whether several changes impacted their trust in business, the element most likely to push consumer trust to the negative side is larger and more widespread adoption of AI by companies: more than 3 in 10 said it would make them trust businesses less with their personal information. But other factors — like partnerships between businesses and celebrities or influencers and increased social media presence of businesses — also had a net negative impact on trust. Read more from our report exploring consumer trust in the age of AI.

Consumers are posting to social media less often

Roughly one-third of all social media users report posting less on their preferred platform compared with last year, with nearly twice as many of them saying they go online to be entertained as to post. Morning Consult’s data shows that it is increasingly becoming a form of passive entertainment produced by a select few. As such, brands need to rethink how they show up across platforms, particularly when the goal is to drive organic buzz. Read more about how passive scrolling is becoming more commonplace, and which demographics buck that trend.

Want more insights? Dive into additional analysis from our team of experts below.

- Tracking U.S. Consumers' Views on Tariffs: Overall support for tariffs among U.S. adults and most sub demographics saw a bump during the 90-day pause of reciprocal tariffs set to expire on July 9. Only Republicans and baby boomers slightly decreased their support for tariffs in general in this period. Public awareness of tariffs remains very high.

- How Social Media Factors Into Gen Z’s Recipe and Restaurant Discovery: Nearly half (45%) of Gen Zers said they were influenced by social media the last time they tried a new recipe, but search has more impact than influencers for restaurant discovery.

- Losing Loyalty: Why Consumers Are Walking Away From Brands: Inflation-weary consumers are fed up and making big changes to accommodate their budgets. For brands, that unfortunately means losing formerly loyal customers. We set out to understand how customer loyalty is shifting and heard one thing loud and clear: everything is too expensive.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].