Morning Consult Counter/Consensus: Global Political Risk Briefing, April 4, 2024

Overview:

Morning Consult Counter/Consensus is a biweekly briefing that leverages our global analysis and Political Intelligence data to spotlight counter-consensus takes on major (geo)political developments, and affirm consensus views on issues for which data has been scarce in public discourse or otherwise adds value.The briefing is intended to facilitate corporate scenario planning, market and asset price forecasting, and public sector decision-making. Clients are welcome to reach out directly with questions. You can subscribe here.

Key Takeaways

United States (Counter): When it comes to extreme ideology, America is no outlier

Australia (Consensus): Views of China have improved markedly amid wine duties removal

Germany (Counter): Germans’ special relationship with Israel is increasingly strained, with older Germans driving the recent change

Philippines (Consensus): The ongoing maritime dispute with Beijing has driven views of China to tracking lows

1. United States (Counter)

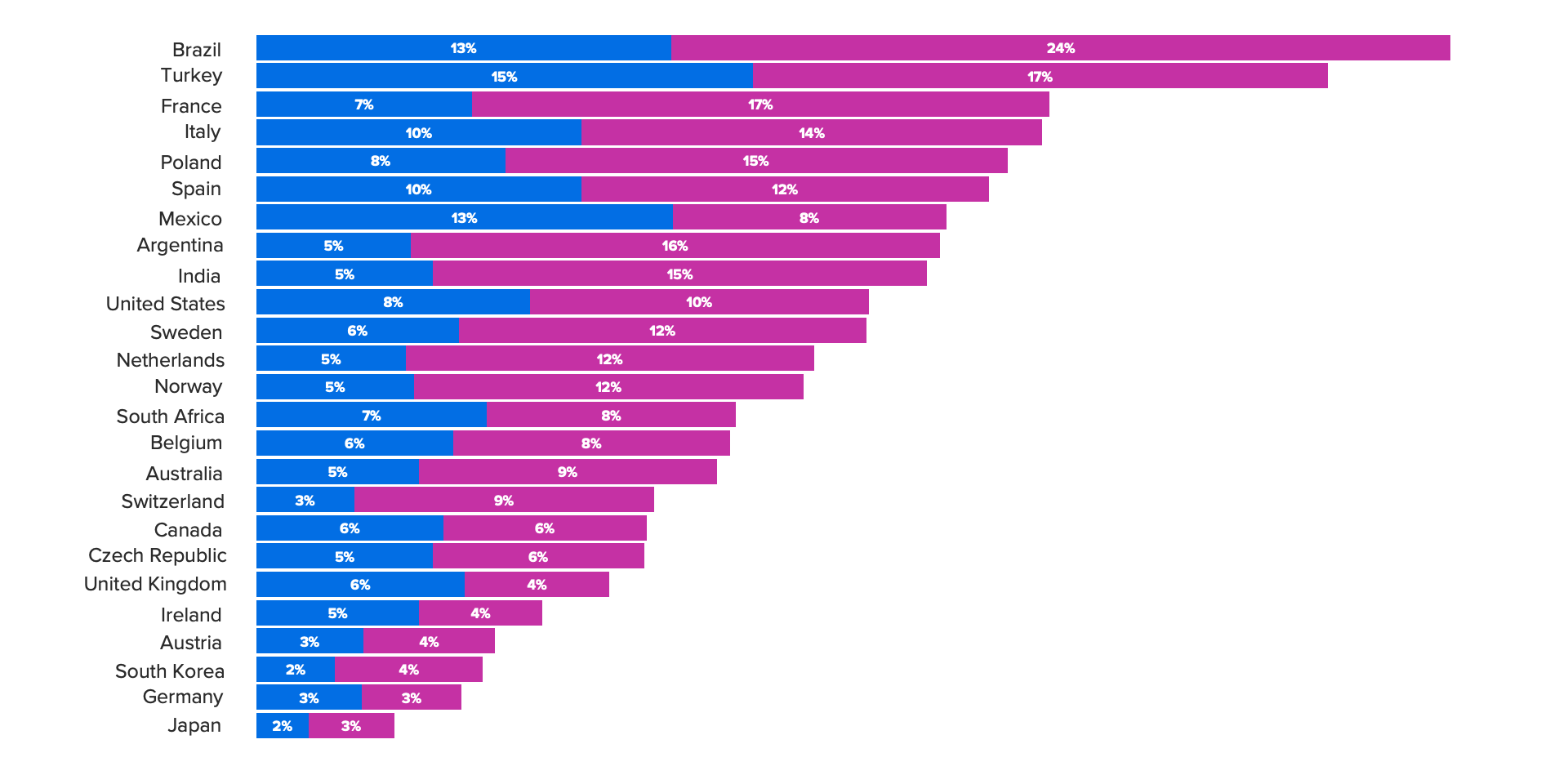

It’s a spectrum: U.S.-watchers could be forgiven for thinking that political life in today’s America is more polarized than in other major democracies. While research has established that partisan polarization in the United States is indeed more pronounced today than at any point in the past two decades, our own data finds that America — with 18% of U.S. adults espousing either far-left or far-right political views — is more “middle of the pack” than “top dog” when compared with overall levels of political polarization in the 25 democracies where we track it.

Global Political Polarization Rankings

Political polarization is associated with a range of ills, including democratic decline; it also tends to spike around elections, per research we conducted in support of our recently launched global political polarization tracker. The United States, with elections on the horizon in November, is unlikely to be an outlier on this front.

But for those doing business globally and keeping an eye on polarization as a potential driver of business risks — whether in the form of threats to physical assets and sales or simply policy change — it’s worth keeping things in perspective: While America is indeed polarized, the most acute risks lie elsewhere.

Those interested in a closer look at exactly where can find our global political polarization rankings, along with access to companion visuals and the underlying data, here.

2. Australia (Consensus)

Bilateral bacchanalia: Chinese oenophiles can quit whining: Following a gradual rapprochement, China has agreed to remove tariffs on Australian wine as of March 29. The reconciliation comes several years after a call to probe the origins of COVID-19 emanating from the government of the land down under caused relations to spiral.

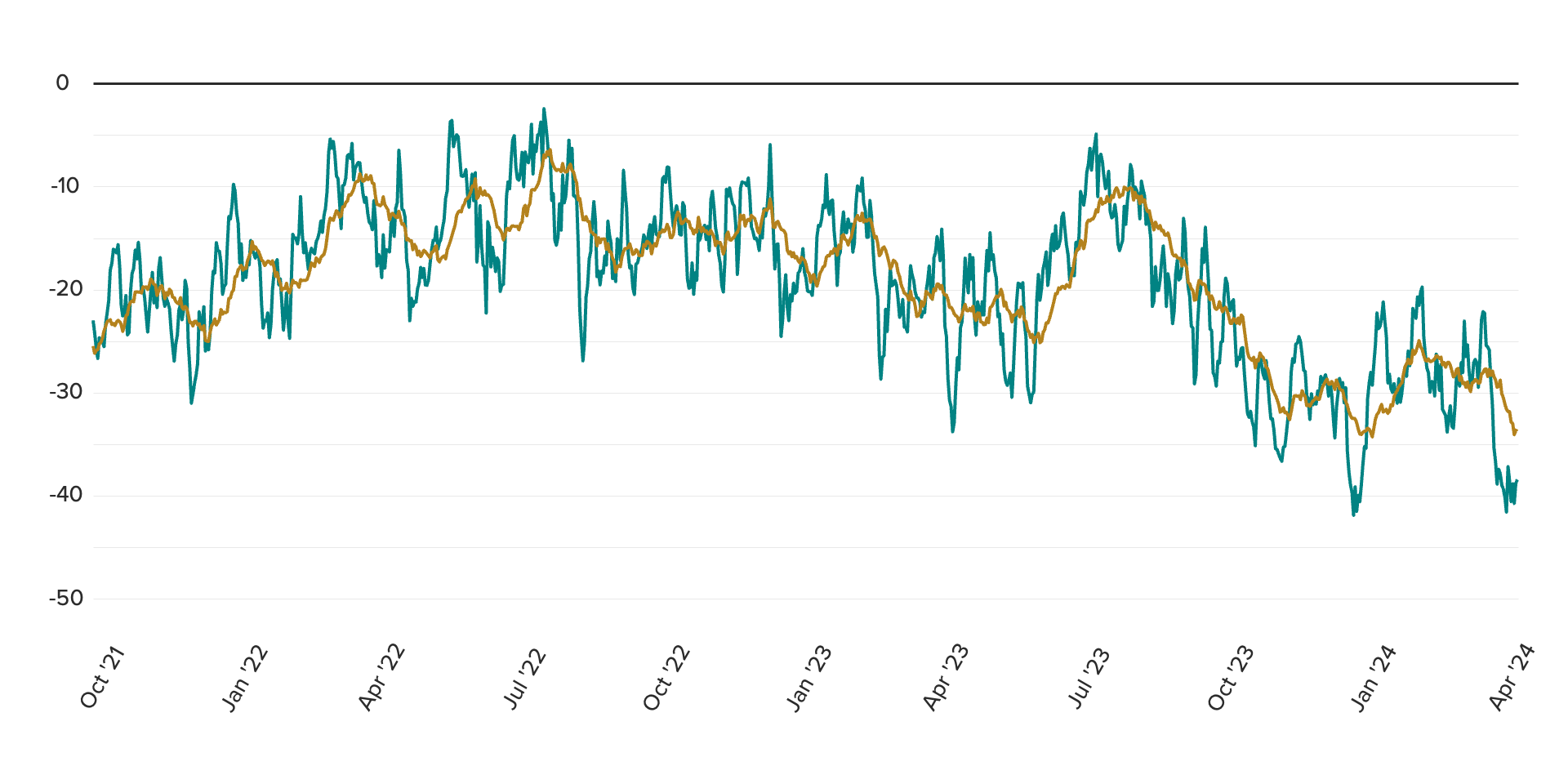

China’s policy reversal will benefit Australian winemakers. And we see some room for broader improvements in bilateral relations on the back of this relatively narrow development: Net favorability toward China among Australian adults is currently pinned near tracking highs following a gradual upswing over the past two years and a more notable uptick over the past 12 months, suggesting the public might be open to more if Canberra decides to pursue it.

Australia: Favorability Toward China

What exactly “more” looks like remains an open question. Softening barriers to exports of Australian beef and lobster, among other products, could serve as an initial confidence-building measure on the trade policy front. And signs of movement in that direction are worth watching as signals of the likelihood that bilateral economic ties will evolve in a favorable direction more broadly.

We nevertheless caution that progress beyond economic and business issues remains unlikely owing to relatively recent developments involving Australia in the security domain — notably its membership in the restarted Quad and the newly formed AUKUS — which will necessarily limit the extent to which relations can truly be repaired.

3. Germany (Counter)

Another Zeitenwende? Germany’s historically staunch support for Israel, defined by post-WWII shame over its role in the Holocaust, is being called into question by the ongoing conflict in Gaza. This overall reassessment of German-Israeli relations is not exclusive to the current moment, as much media coverage has characterized it. However, the current moment has been decisive in shifting views among older Germans.

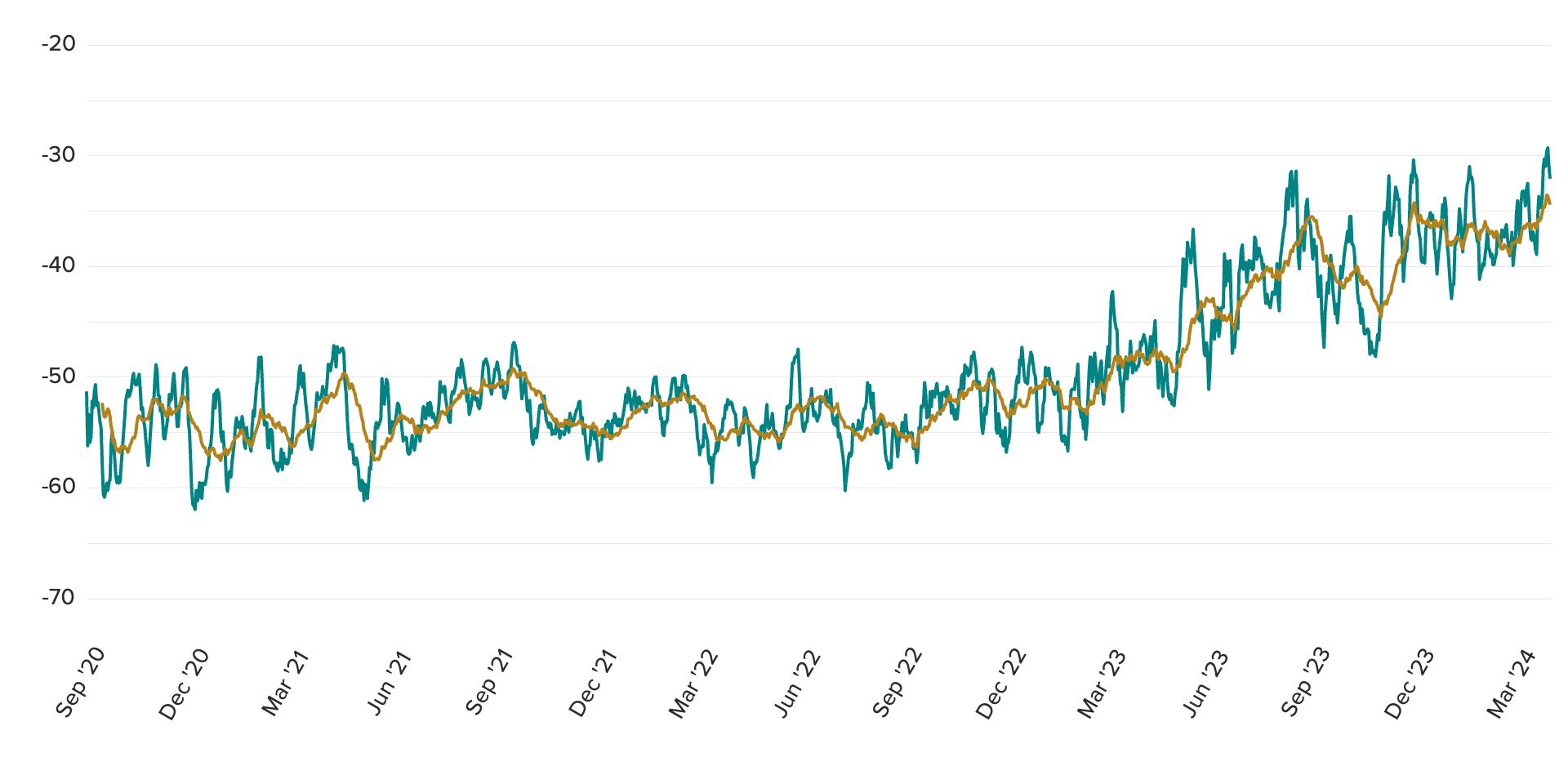

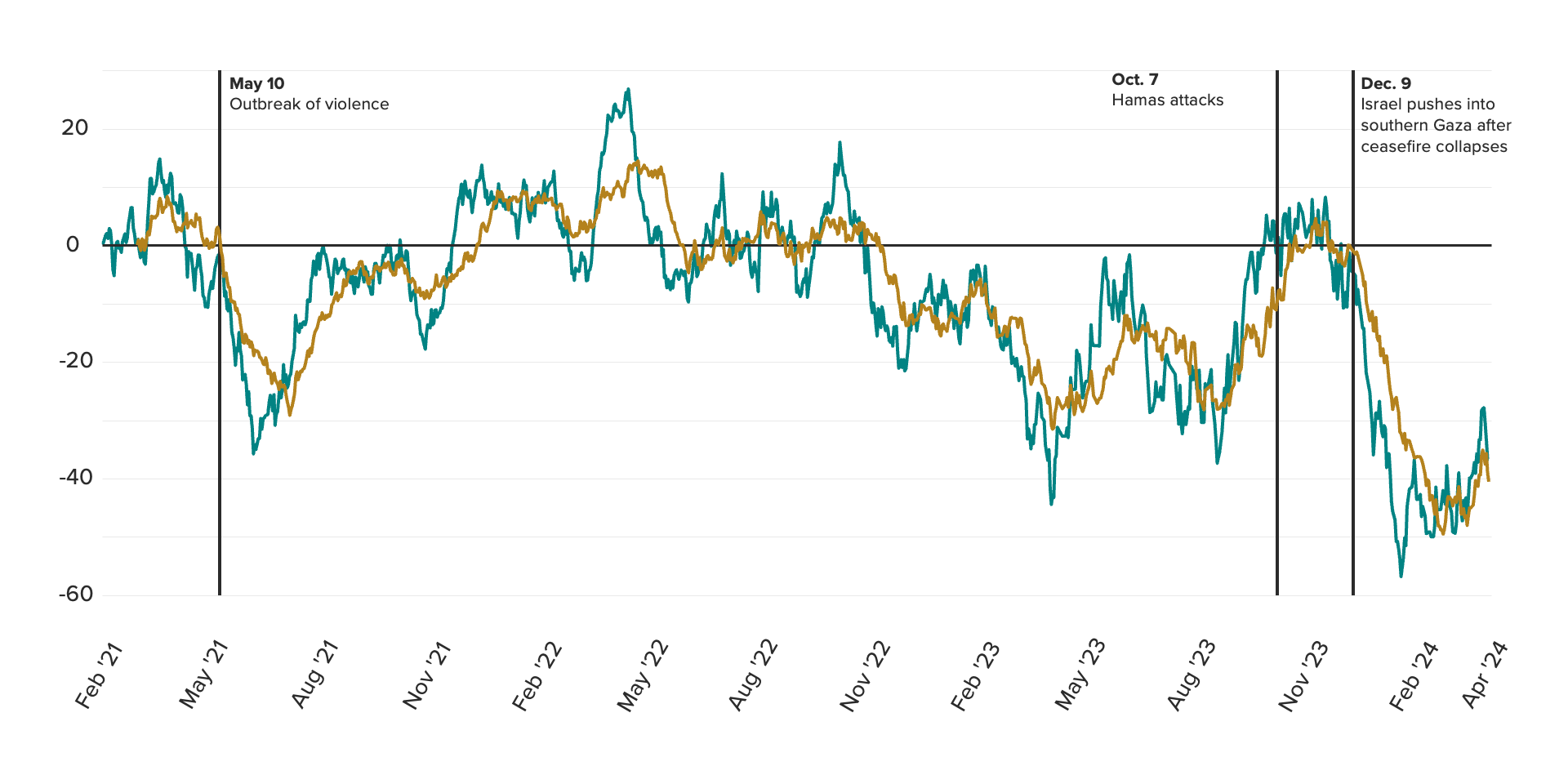

Germans’ views of Israel in recent years have topped out at roughly neutral net views. For comparison, views of the United States over the same period reached as high as +20 points. And Germans’ views have not in the past been unresponsive to the Israel-Palestine issue.

Germany: Favorability Toward Israel

During the 2021 Israel-Palestine crisis which lasted from May 10-21, net favorability toward Israel among German adults plummeted around 30 points, and slowly rebounded over the following year. But since mid-2022, German views have steadily slid into negative territory and remained around -20 points. German adults did not change their views of Israel immediately after October 7 when Israel was the victim of Hamas’ terrorist attacks. But around the acceleration of the ground offensive on December 9, German views of Israel dropped dramatically, akin to 2021.

In its most recent form, this shift is not being driven by young Germans. While narratives that Western youth are more likely to support Palestine are borne out by our data, that generational difference predates the current conflict. In Germany, the recent shift is driven primarily by older Germans’ changing attitudes.

Germany: Favorability Toward Israel

Germans in the 65+ age group specifically saw the biggest recent decline in favorability toward Israel, reaching an all-time tracking low during the December escalation of the Israeli ground offensive in Gaza. These Germans — made up of many of the children of Germans alive during WWII — previously held the consistently highest views of Israel of any age group.

Recent history suggests German views of Israel will rebound given a ceasefire. However, the depth of the current dip makes us doubtful that views will fully rebound to neutral levels anytime soon. And the generational difference alone points to the inevitability of a longer term change in German-Israeli relations.

4. Philippines (Consensus)

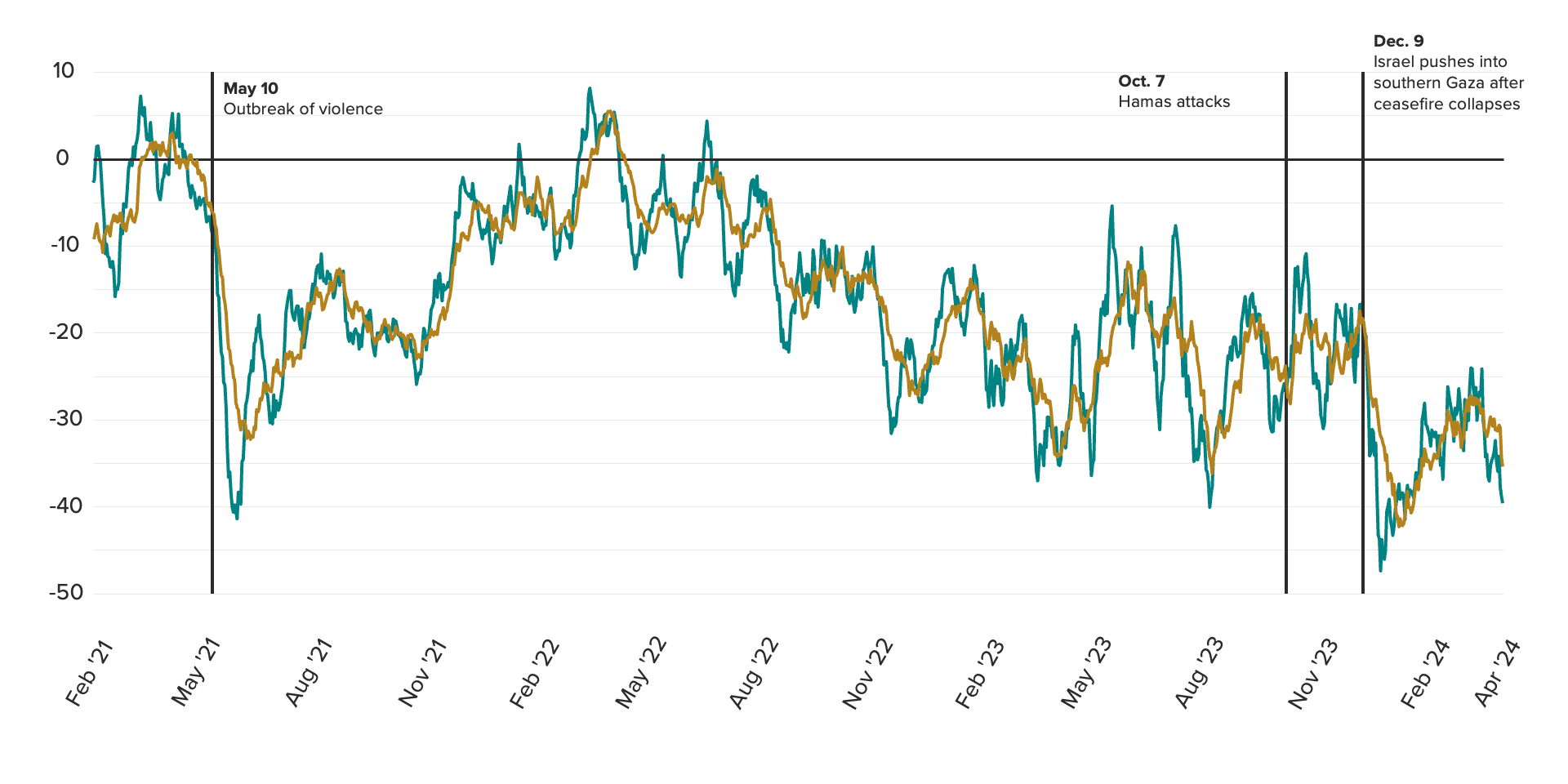

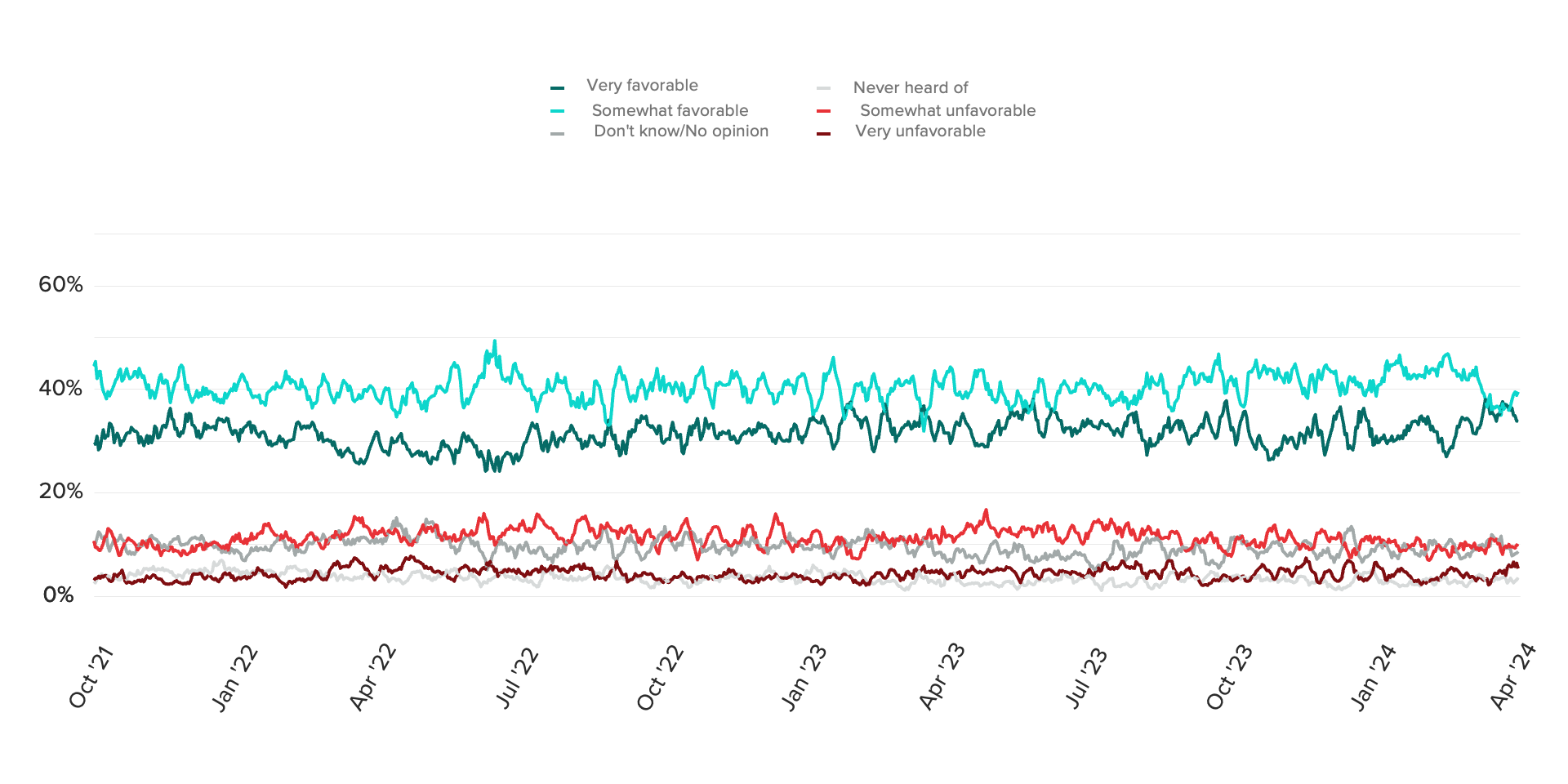

Sea change? Philippine views of China have worsened dramatically amid an ongoing maritime dispute in the South China Sea that saw Beijing-aligned vessels train their water cannons on the Philippine Navy this past week. Following a series of similar aggressions over the past several months, net favorability toward China among Philippine adults is now hovering near tracking lows on both a 7-day and 30-day rolling basis.

Philippines: Favorability Toward China

In response, Philippine President Bongbong Marcos has indicated his government would take action against China, and the U.S. government — in a clear sign of support — has issued a statement condemning the attacks. In the past, the Philippines has also held joint maritime patrols with American forces in response to such incidents, and upcoming trilateral plans involving Japan will take a step further in that direction. Not surprisingly, we expect that doing so will further inflame relations.

The bigger question mark surrounding the impact of these incidents is whether they are poised to further shift the balance of soft power away from China and toward the United States. To date, we have sees movement in relative rather than absolute terms. Regarding the latter, our data shows neither a dramatic increase in the intensity of favorable views toward the United States — i.e. an uptick in the share of Filipinos holding “very favorable” views of America — nor does it show a marked increase in net favorability.

Philippines: Favorability Toward the United States

But the Philippines-U.S. Visiting Forces Agreement, a long-running military pact between the two countries, is no longer on shaky ground under Marcos, as it was under former President Duterte (who repeatedly threatened to terminate it) and views of America remain more favorable overall than views of China. Our data suggests that, absent growing affection for the United States amid the latest incidents, this is a classic case of “the enemy of my enemy is my friend.”

Like our data?

Data is a dish best served cold (and ideally via API). That’s why we don’t do hot takes. Please contact us with inquiries regarding Morning Consult’s Political Intelligence data and companion syndicated products, including Morning Consult Pro, the home for our global and U.S. political analysis.

Jason I. McMann leads geopolitical risk analysis at Morning Consult. He leverages the company’s high-frequency survey data to advise clients on how to integrate geopolitical risk into their decision-making. Jason previously served as head of analytics at GeoQuant (now part of Fitch Solutions). He holds a Ph.D. from Princeton University’s Politics Department. Follow him on Twitter @jimcmann. Interested in connecting with Jason to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].