Morning Consult Counter/Consensus: Global Political Risk Briefing, March 21, 2024

Overview:

Morning Consult Counter/Consensus is a biweekly briefing that leverages our global analysis and Political Intelligence data to spotlight counter-consensus takes on major (geo)political developments, and affirm consensus views on issues for which data has been scarce in public discourse or otherwise adds value.The briefing is intended to facilitate corporate scenario planning, market and asset price forecasting, and public sector decision-making. Clients are welcome to reach out directly with questions. You can subscribe here.

Key Takeaways

India (Consensus): Modi remains on top as India heads to the polls

Japan (Counter): Japanese public support for gay marriage is both lower and weaker than in peer countries

Nigeria (Consensus): Tinubu is in trouble

1. India (Consensus)

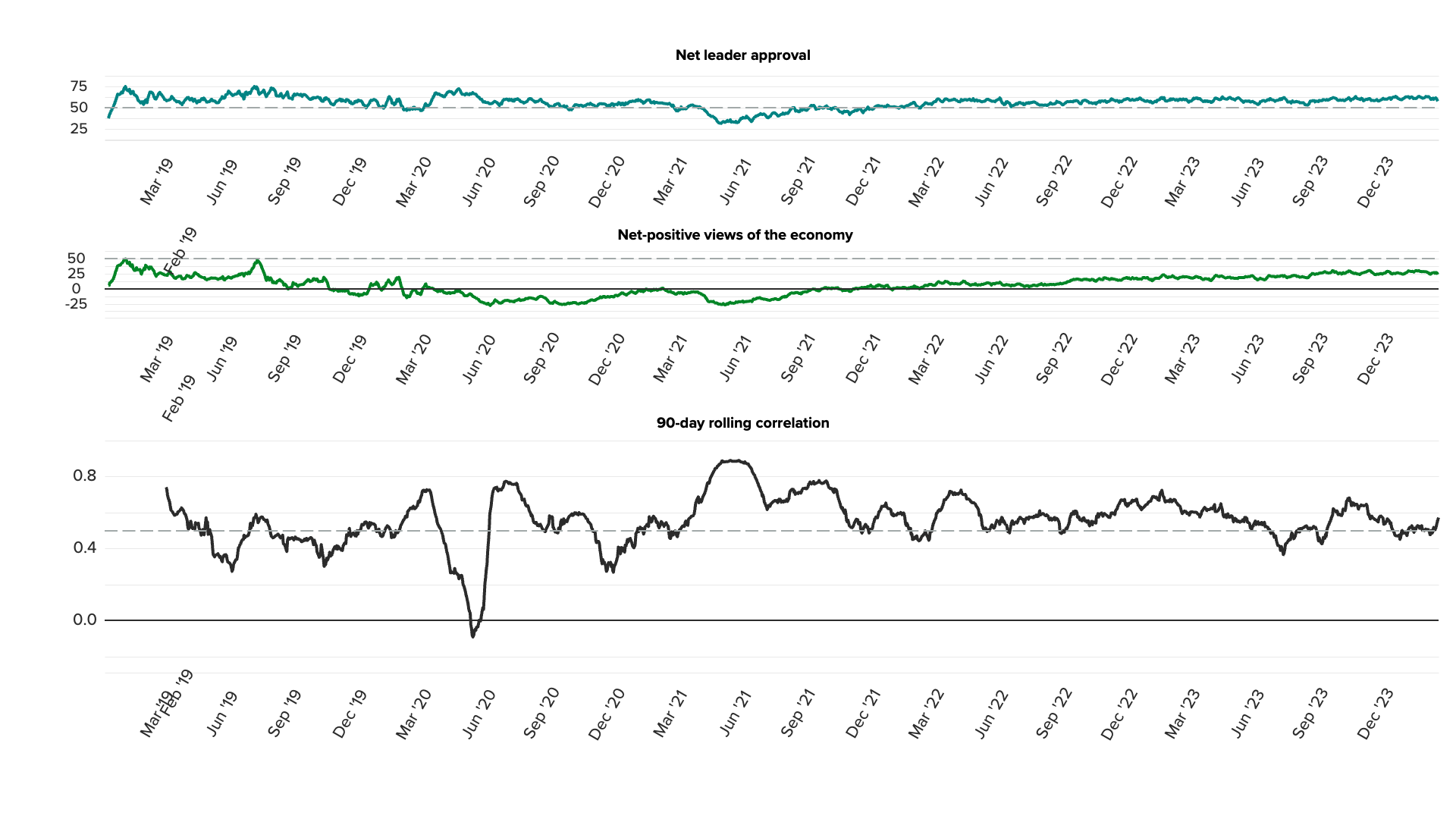

Third term’s the charm: India’s general elections will kick off on April 19. While Rahul Gandhi and the Indian National Developmental Inclusive Alliance (I.N.D.I.A.) would like to think they have a chance to steal the limelight from incumbent Prime Minister Narendra Modi and his Bharatiya Janata Party (BJP), our data affirms the consensus narrative that it’s Modi’s race to lose: Though down from tracking highs, his net approval rating continues to hover in sharply positive territory (around 60), making him one of the most popular global incumbents we track.

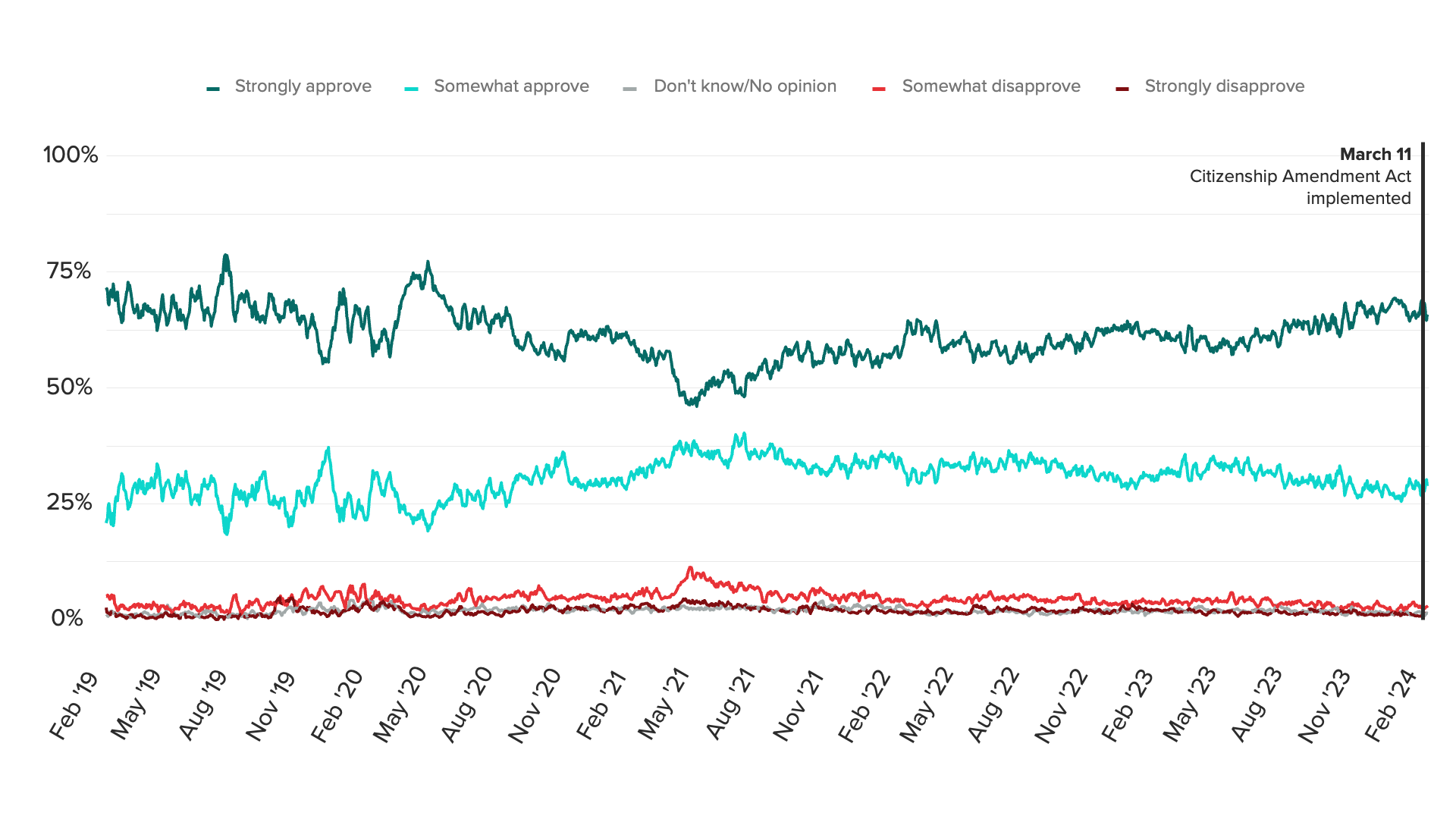

India: Leader Approval

The Citizenship Amendment Act (CAA) — which Modi’s government moved to implement this past week, and which is widely viewed as anti-Muslim — has revealed a small chink in Modi’s armor: Since the Act’s implementing rules were promulgated on March 11, Modi’s net approval rating has fallen 3 points (from roughly 60 to 57). The overall decline coincided with sharply worsening views of Modi among Congress Party supporters: In the window surrounding the act’s implementation, our data shows a 12-point increase (from peak to trough) in the share of Congress supporters who “strongly disapprove” of Modi.

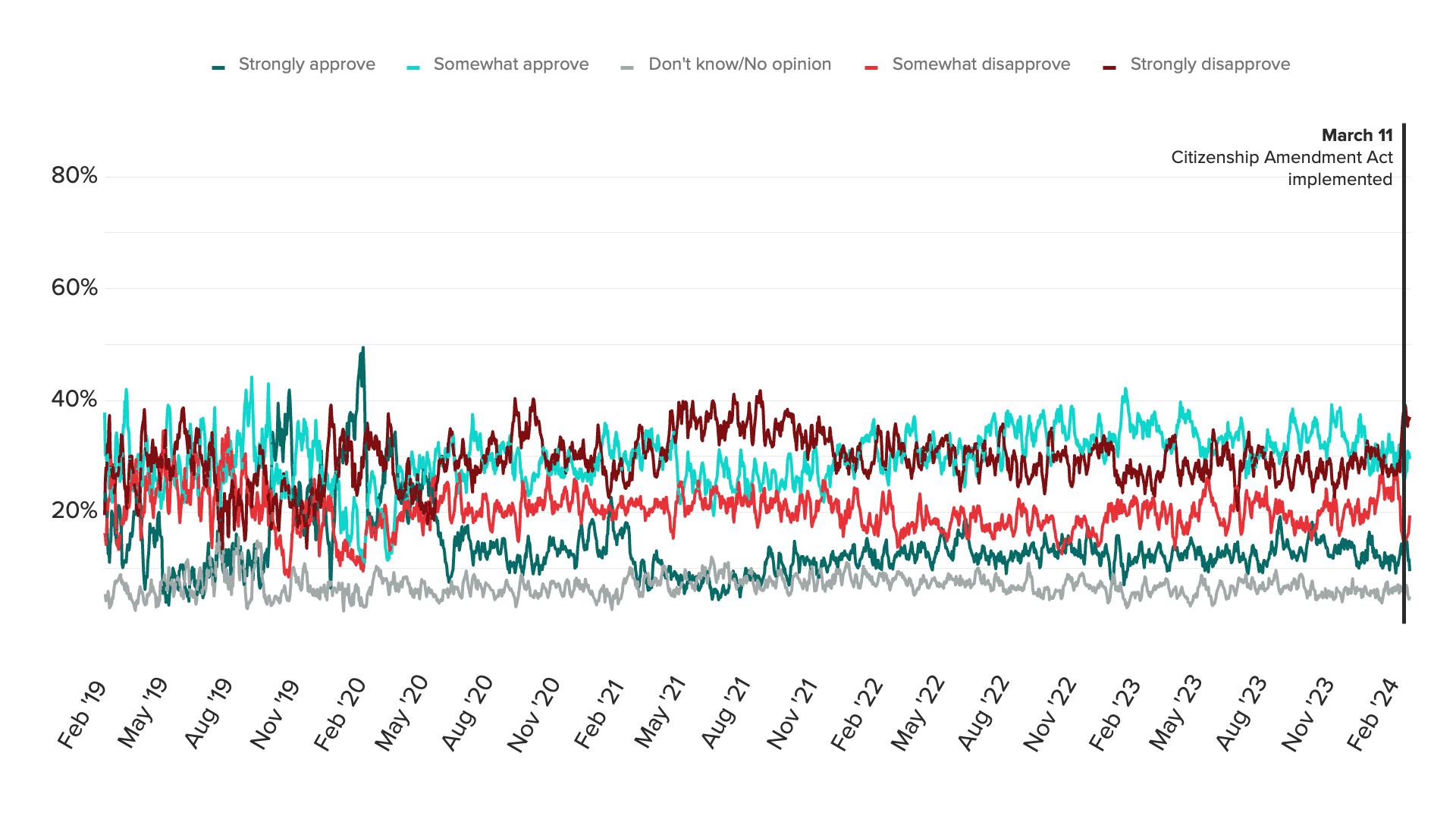

India: Leader Approval

But BJP supporters’ endorsement of Modi remains robust (second figure above), and most Indian adults continue to align themselves with the party (62% as of March 19, compared with only 13% for Congress). And Modi’s approval rating remains consistently positively correlated with public views of the economy — measured by the share of Indian adults who describe it as “excellent” or “good” — on a 90-day rolling basis. The strength of that relationship, plus a blockbuster growth forecast for 2024, means that I.N.D.I.A. will continue to face an uphill battle when it comes to wielding non-economic issues like the CAA’s passage and the long-anticipated Ram temple consecration as cudgels against Modi.

India: Leader Approval

India: Correlation Between Leader Approval and Economic Perceptions

Much to the opposition alliance’s chagrin, the signals in our data suggesting that Modi’s third act is just around the corner could hardly be clearer.

2. Japan (Counter)

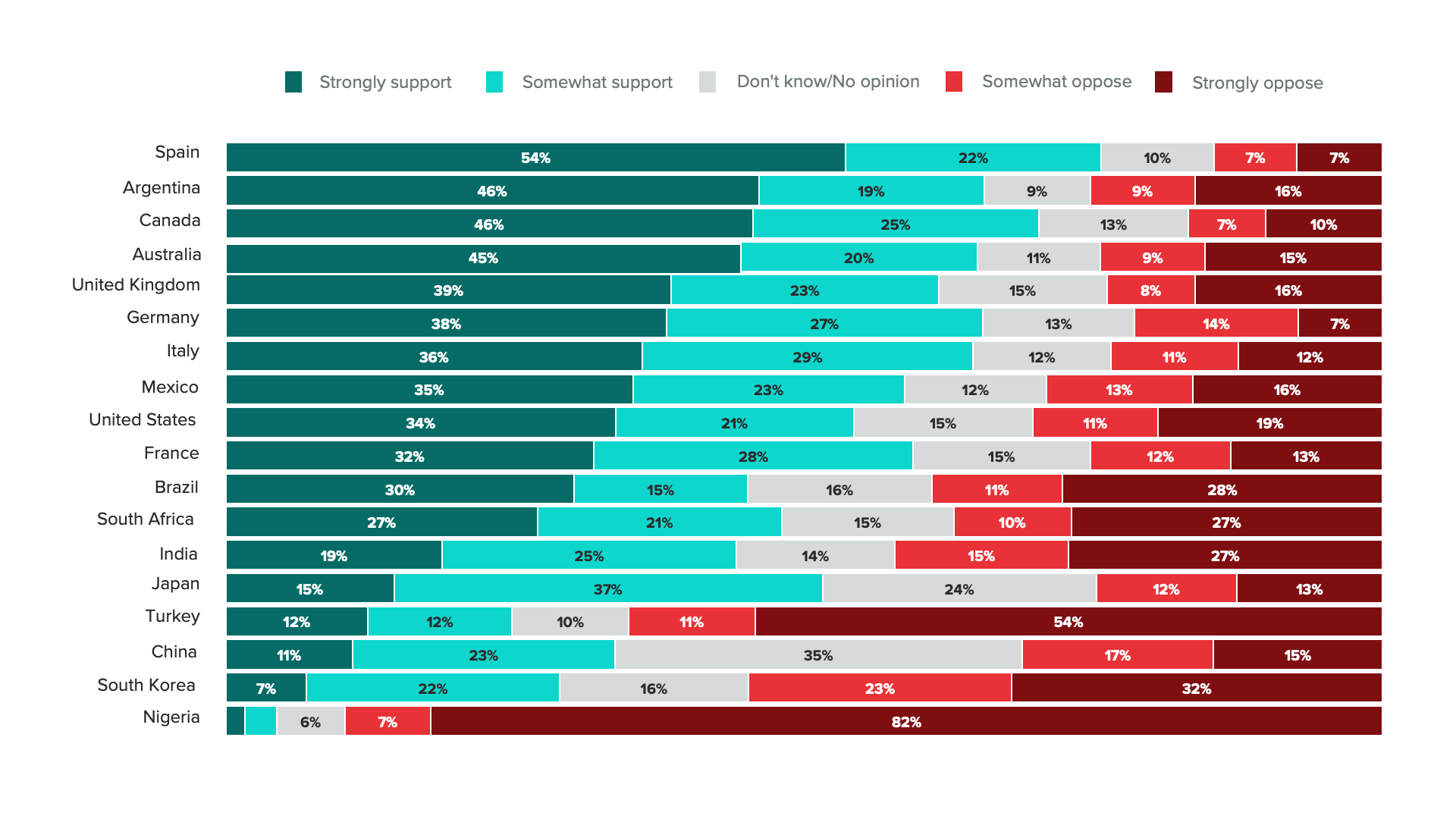

Pride and prejudice: Courts in Japan court ruled once again that a ban on same-sex marriage was unconstitutional this week, sparking hope for liberalization. But action to legalize the unions would need to come from legislators, and so is more dependent on public opinion relative to court decisions.

Reporting on the issue points out that high shares of Japanese adults support same sex marriage. But this support is both much lower than in other G7 countries, all of which have legalized gay unions, and also of much lower intensity compared with other advanced economies.

Global Views on Gay Marriage

Only 15% of Japanese adults said they “strongly” support gay marriage in our Jan. 2024 tracking survey, while another 37% “somewhat” support it. In contrast, over 30% of adults strongly support gay marriage in every other member of the G7: Canada, France, Italy, Germany, the United States and the United Kingdom.

Social views can and do change rapidly, so Japan’s low support does not mean that a lifting of the ban is impossible in the near future. However, reports of existing high societal support appear to have been much exaggerated.

3. Nigeria (Consensus)

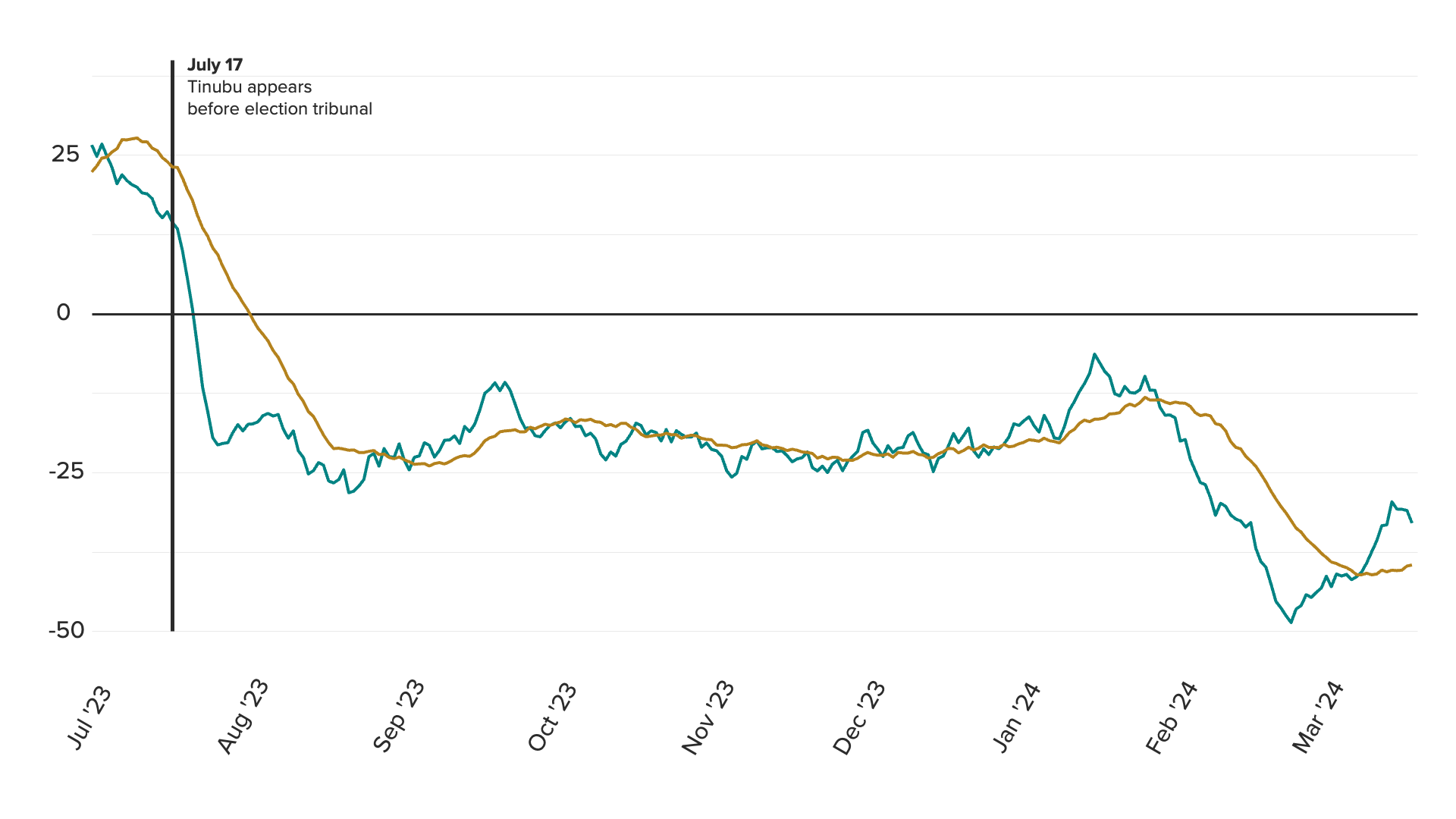

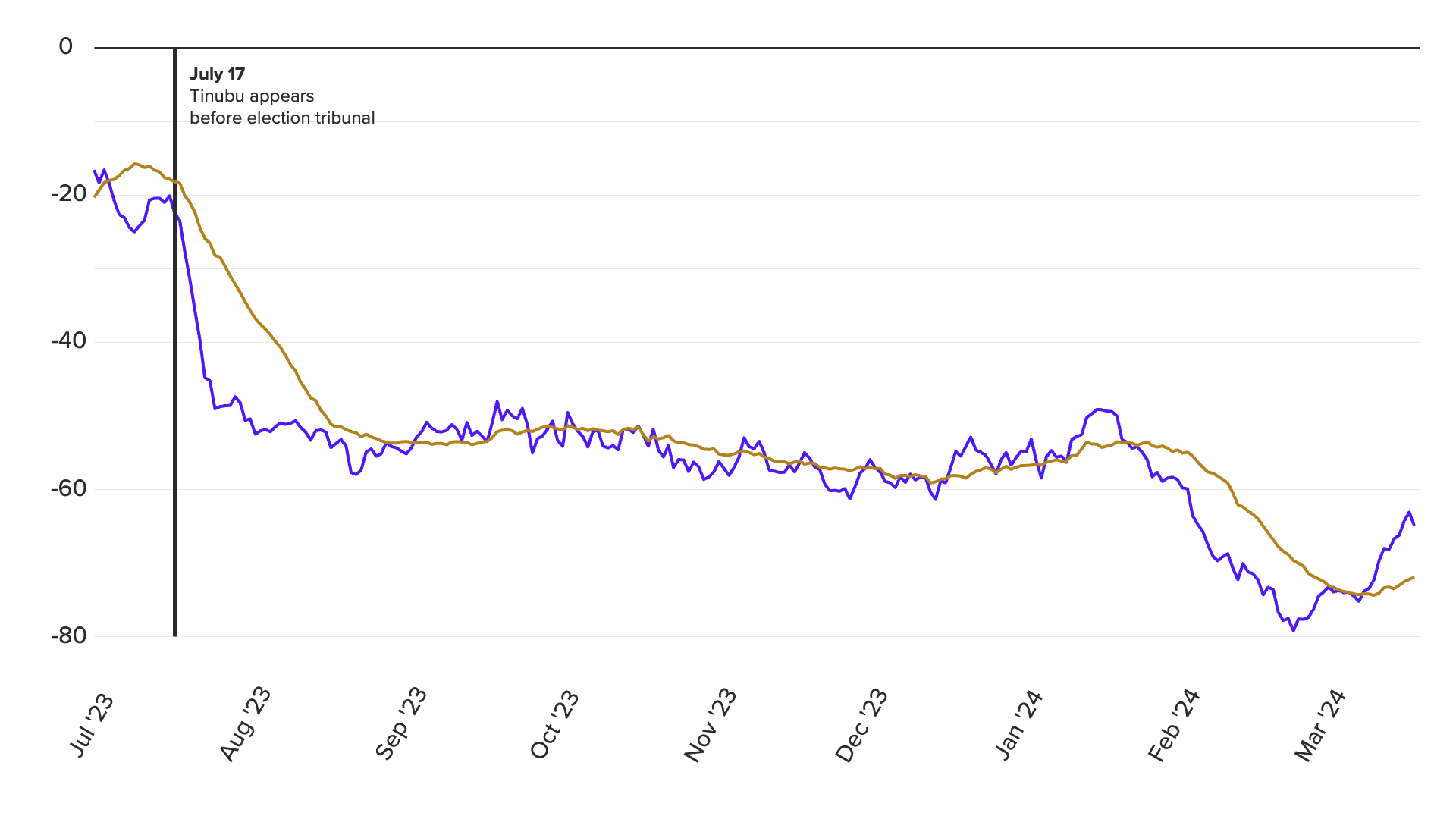

Tick tock for Tinubu: Back in November, we forecast that Bola Tinubu’s election tribunal travails would cut short his post-election honeymoon. Now it seems like the marriage is truly on the rocks. The Nigerian president’s rapid scrapping of a costly but popular fuel subsidy and dismantling of a parallel exchange rate system have sparked the highest inflation in over 25 years (as of January) and stoked a growing cost-of-living crisis. At the same time, insecurity appears to be rising once again in the volatile northwest as nearly 300 students were kidnapped en masse earlier this month.

Tinubu’s already low approval took a nosedive in mid-January to roughly -48 on a net basis. In tandem, the net share of Nigerians who say their country is headed in the right direction reached a truly abysmal -80. A young population holding such a dim outlook amid widespread economic pain is a recipe for further insecurity and instability.

Nigeria: Leader Approval

Nigeria: Country Trajectory

Like our data?

Data is a dish best served cold (and ideally via API). That’s why we don’t do hot takes. Please contact us with inquiries regarding Morning Consult’s Political Intelligence data and companion syndicated products, including Morning Consult Pro, the home for our global and U.S. political analysis.

Jason I. McMann leads geopolitical risk analysis at Morning Consult. He leverages the company’s high-frequency survey data to advise clients on how to integrate geopolitical risk into their decision-making. Jason previously served as head of analytics at GeoQuant (now part of Fitch Solutions). He holds a Ph.D. from Princeton University’s Politics Department. Follow him on Twitter @jimcmann. Interested in connecting with Jason to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].