Report Preview: Now Is the Time to Prepare for a Recession

This is a preview of Morning Consult's monthly U.S. Economic Outlook report, which provides an integrated assessment of the strength of U.S. consumers, workers and households. Download the full report here.

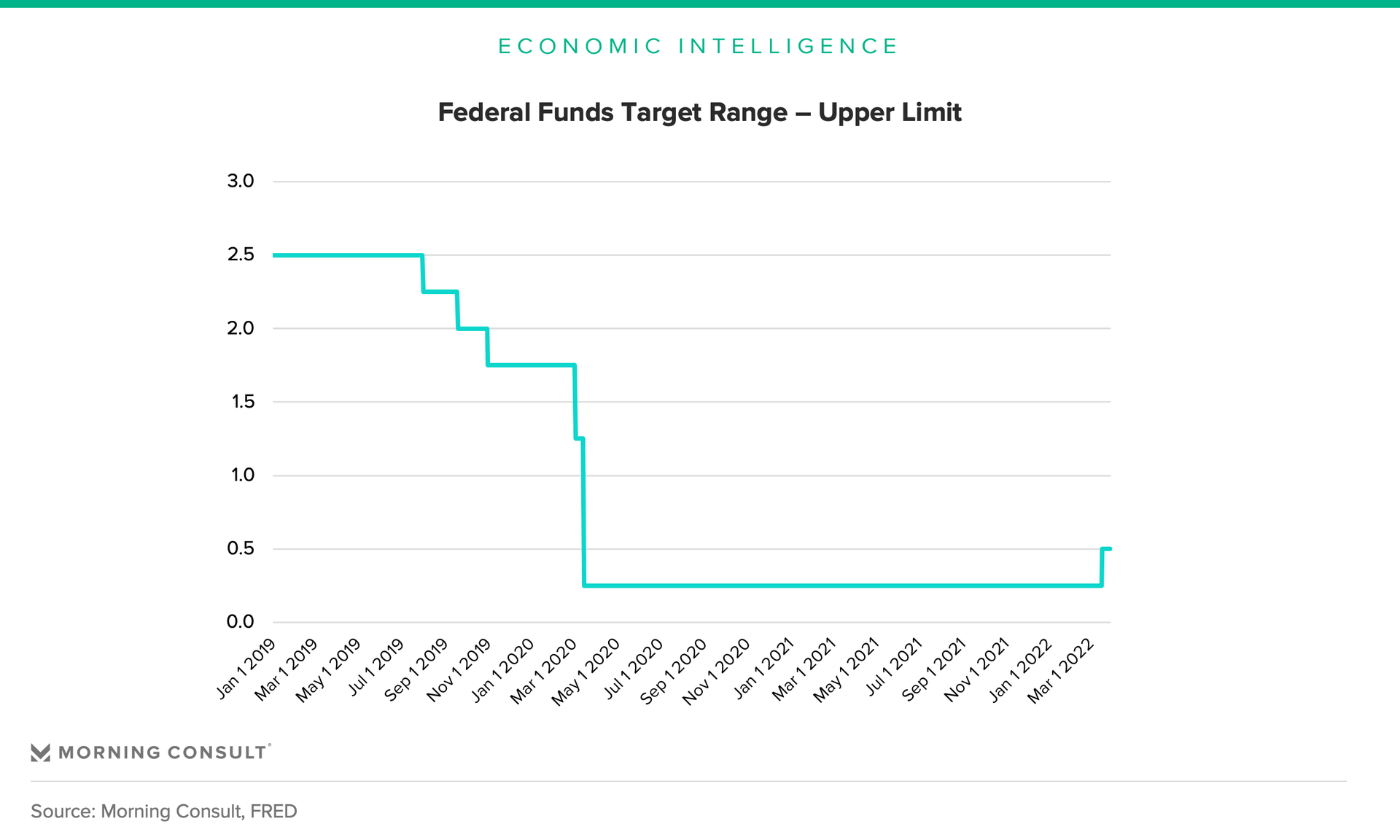

After consecutive months of the highest inflation in 40 years, the Federal Reserve began raising interest rates to fight inflation during its mid-March meeting. The Federal Open Market Committee (FOMC) raised the Federal Funds Target Range by 25 basis points, starting the process of reversing the highly accommodative interest rate policy in effect since the onset of the pandemic in March 2020.

Despite the interest rate increase in March, there is growing evidence that the Fed is going to need to act more aggressively to curb inflation. Since Chairman Jerome Powell’s March 16 press conference, a chorus of FOMC members have spoken in support of 50-basis-point hikes at multiple upcoming meetings, sending financial markets to price in upwards of an additional 200 basis points by year end.

Stated differently, what we learned since the FOMC met in mid-March is not that interest rates are going to rise this year. We knew that already. The new information from the second half of March is that interest rates are going to rise by even more than financial markets expected at the beginning of the month.

While rising rates should help curb inflation, they also risk sending the economy into a recession. Thus, the challenge for the Federal Reserve is achieving a so-called “soft landing”: raising interest rates to slow down the economy and fight inflation without tipping the economy into a recession.

This is a report preview. Download the full report here.

It's too early to know if the Federal Reserve can successfully achieve a soft landing. It will take months for the full impact of higher borrowing costs on economic activity to be felt, and borrowing costs are projected to rise throughout 2022, making 2023 the earliest potential read of the Federal Reserve’s success. In the meantime, factors other than interest rates — such as a war-torn Europe, sluggish confidence or high inflation — may push the economy into recession this year before the Federal Reserve raises rates to its intended target.

Financial markets convey conflicting recession signals

This is a report preview. Download the full report here.

In order for the Federal Reserve to succeed, it needs to maintain credibility with financial markets. When markets think the economy is headed for a recession, the economy tends to experience a recession.

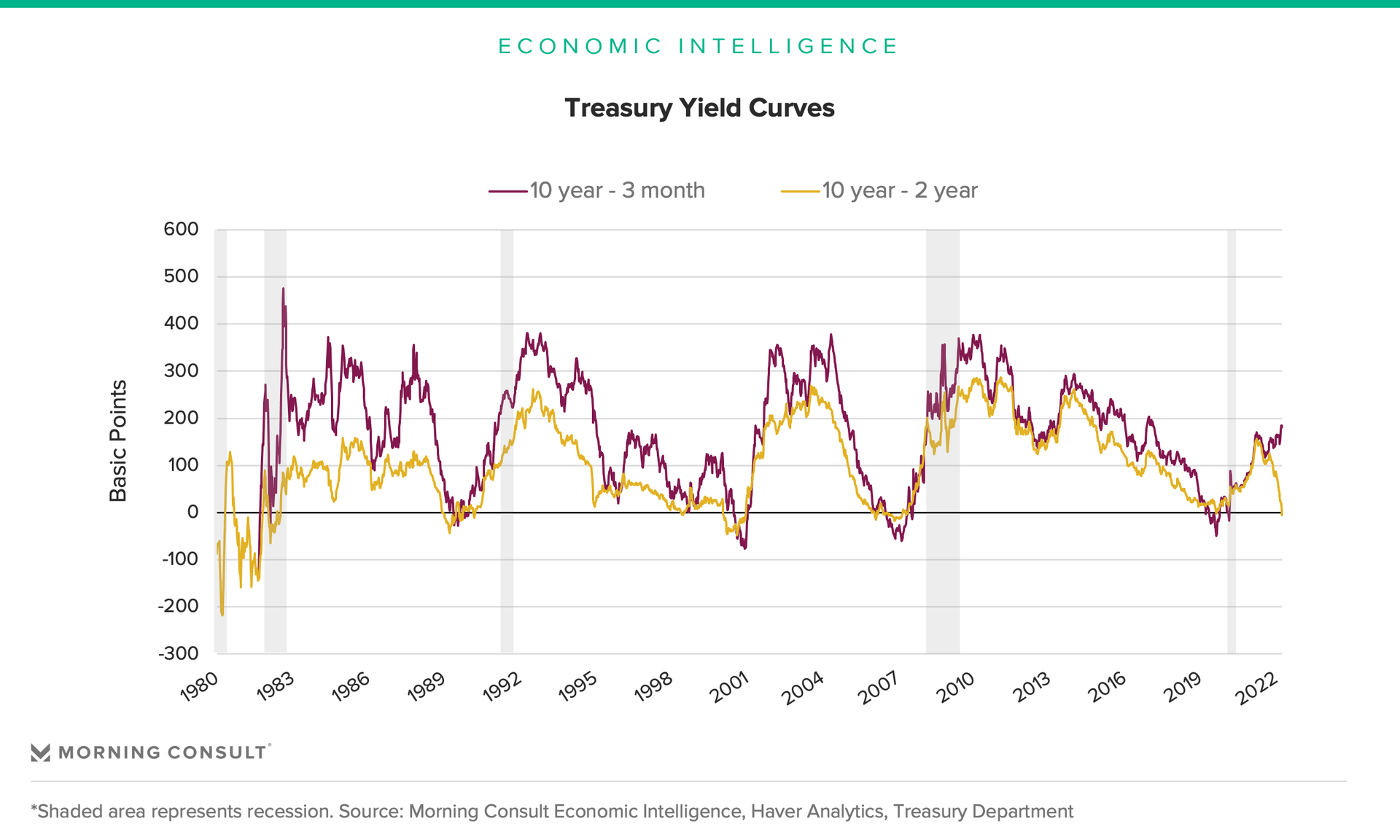

As rate hikes have increasingly been priced into the markets, the spreads between various Treasury market yields have diverged to tell different stories about the future path of the economy.

On the one hand, a flattening of the spread between 2-year and 10-year Treasury yields has caught the attention of financial markets and economists alike who often cite this occurrence as a reliable signal of an impending recession: When the yield curve inverts, it has traditionally signaled that investors have lost confidence in the economy’s growth outlook.

Others point out that the spread between the 3-month and 10-year yields has widened, suggesting a very different outcome — one where investors anticipate some combination of stronger growth, higher inflation and higher interest rates.

Which path the economy is heading for will soon be resolved by incoming economic data — we’ll be closely watching the extent to which the pace of hiring, consumer spending, business investment and manufacturing growth slow.

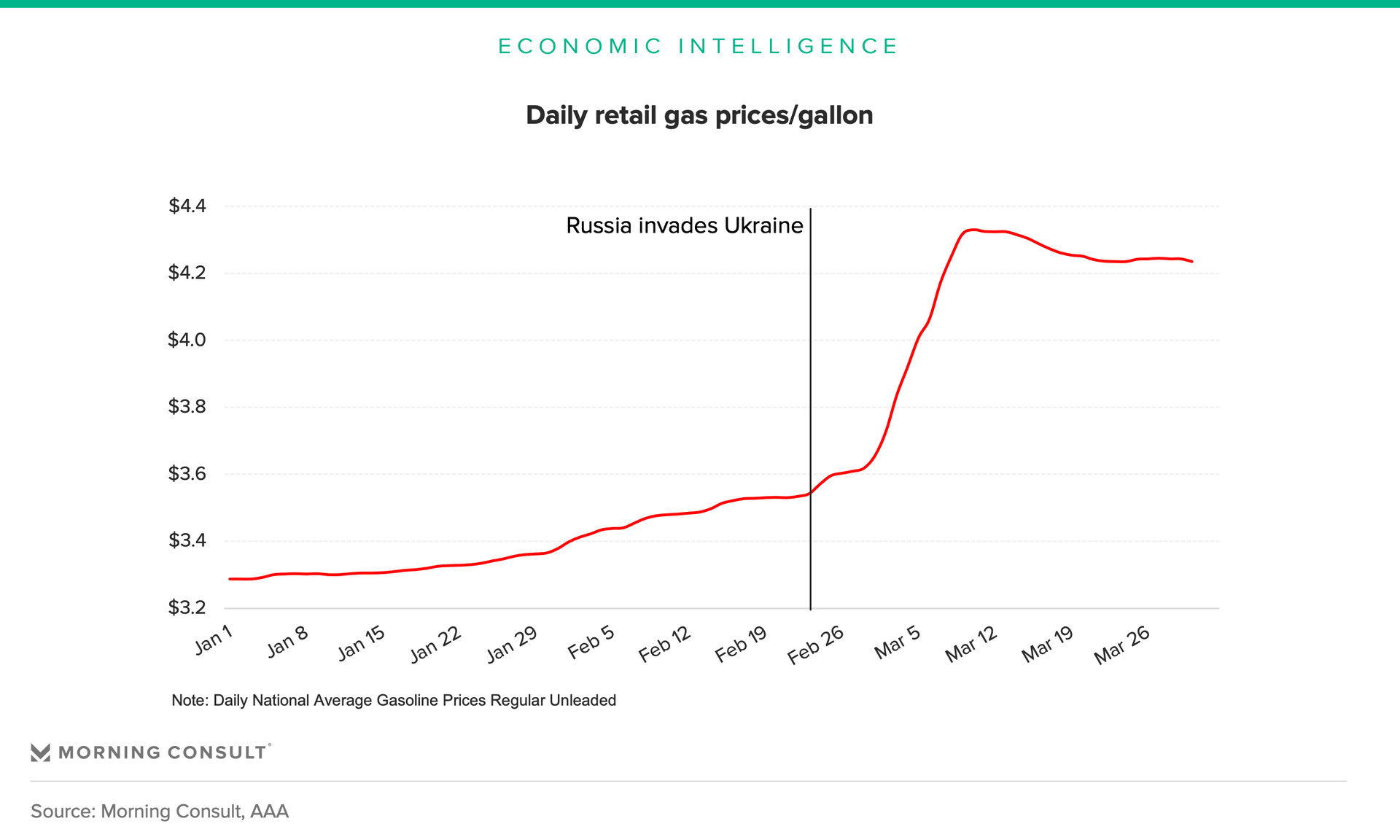

Elevated gas prices complicate the Fed’s Goal

Elevated gas prices and widespread supply constraints complicate the Federal Reserve’s objective of achieving a soft landing. Increases in interest rates curb inflation by limiting demand, but they are less well suited to addressing prices of nondiscretionary purchases driven by inadequate supply, such as gas. Thus, even as interest rates increase, the most recent surge in the commodity complex promises to pressure end-consumer goods and services prices for some time.

This is a report preview. Download the full report here.

While falling below the March high, retail gas prices have stabilized at roughly $4.20 per gallon, up by $0.63 versus a month ago, $1.38 versus last year and $2.22 versus two years ago. In other words, the consumer has been struggling not only with the degree to which prices for this one category have risen, but also the duration of which it has remained high.

This is a report preview. Download the full report here.

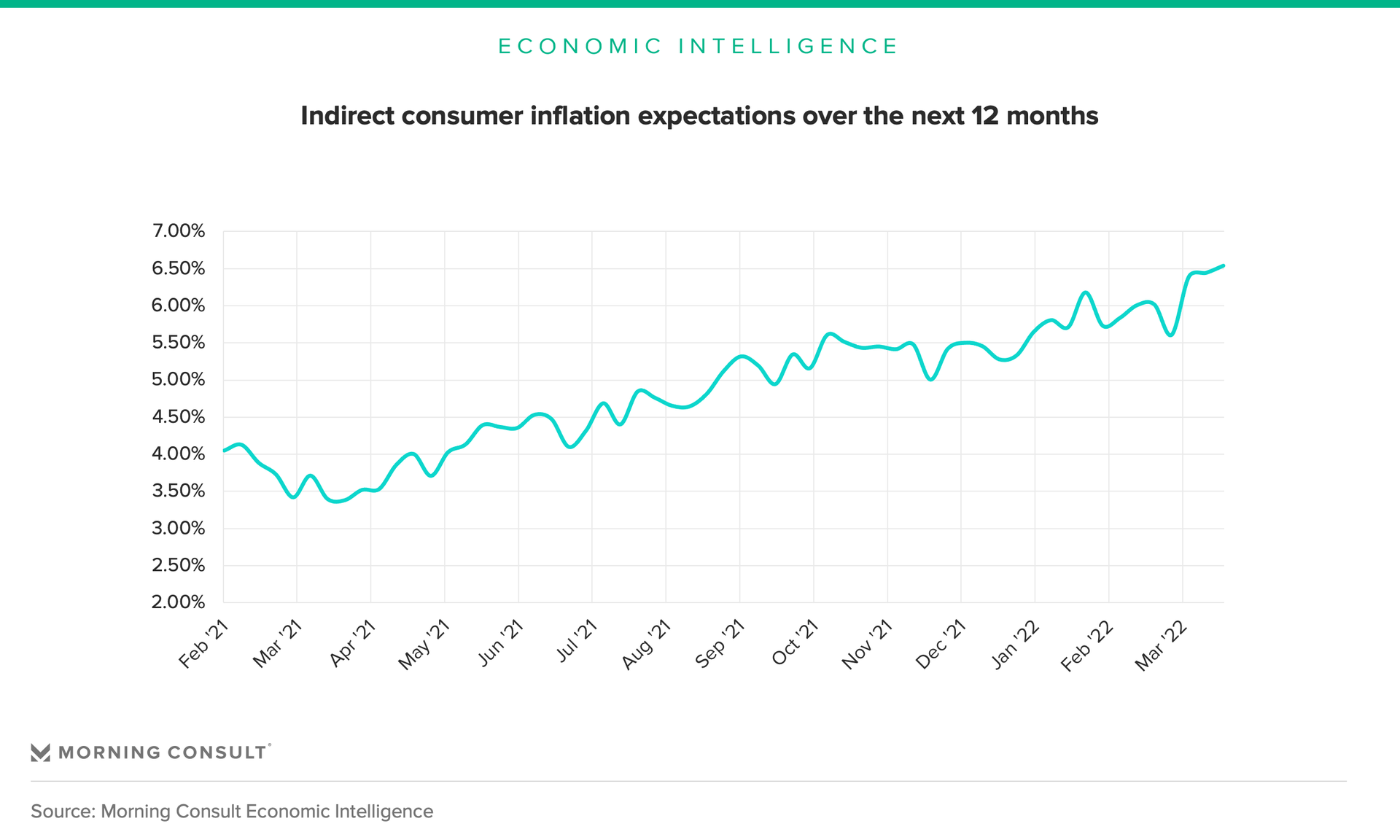

The Federal Reserve’s toolkit offers little to combat the external forces driving commodity prices higher — particularly war and supply chains, helping explain why Americans’ inflation expectations continue to increase. For the week ending March 26, indirect consumer inflation expectations were 6.54%, a series high. The data reflects a collaboration between Morning Consult and researchers at the Cleveland Federal Reserve.

Persistently elevated gas prices erode consumers’ purchasing power, making it more difficult for real consumer spending to grow, particularly in the face of rising interest rates.

Labor market strength offers case for optimism

The strength of labor markets offers the strongest case for optimism. As of March 2022, the U.S. economy has averaged more than 562,000 net new jobs per month since January 2021, significantly above pre-pandemic trends.

Robust jobs growth continues to provide workers with money to spend and to give companies the workers they need to operate and expand. As noted in last month’s report, barring direct U.S. or NATO intervention, the Ukraine war is unlikely to materially influence U.S. jobs growth due to the relatively limited trading relationships between the United States and Russia and the United States and Ukraine.

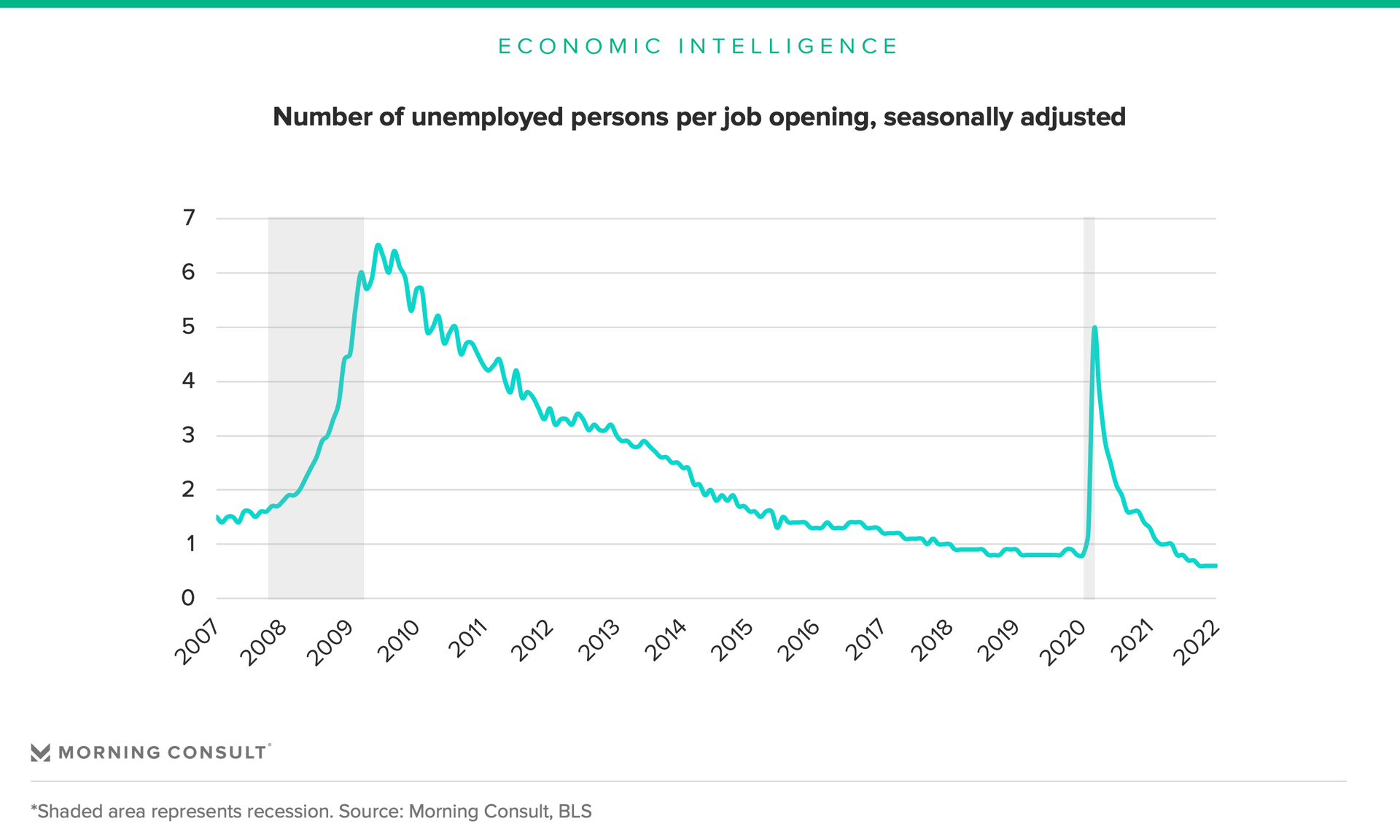

Under normal circumstances, rising interest rates would pose a risk to jobs growth. By raising interest rates, the Federal Reserve increases borrowing costs, which tends to slow businesses’ demand for workers. However, given the unusually and persistently high number of job openings, demand for workers could slow without materially limiting the pace of jobs growth.

In February, there were roughly 11.3 million job openings and only 6.3 million unemployed, with the ratio of unemployed persons per opening in the United States falling well below pre-pandemic levels. In this extremely tight labor market, the prospect of a higher wage is drawing many employed workers to also look at switching jobs. During the week ended March 26, 18.5% of employed adults were actively looking for a new job (see slide 32).

This is a report preview. Download the full report here.

While the current, unique circumstances of U.S. labor markets conceptually allow slowing demand for workers along with simultaneous jobs growth, the actual outcome remains far from certain. For example, weakened labor demand may slow wage growth, disincentivizing workers from returning to work, thereby exacerbating labor supply limitations. The Federal Reserve also faces daunting implementation risks: Turning down the heat just enough to slow jobs growth from a boil to a simmer is difficult, and there’s a risk that it goes too far.

Now is the time to prepare

Given the unique circumstances that the Federal Reserve must navigate, uncertainty and volatility are likely to characterize the U.S. economy as it seeks to achieve a soft landing. Since inflation is largely being driven by commodity prices and supply constraints, interest rate increases will be less helpful curbing inflation. On the other hand, since jobs growth is being held back by labor supply, it is possible that interest rate increases will not harm jobs growth as much as they have in the past.

Not only does the Federal Reserve need to maintain credibility with financial markets, but it also needs to successfully contend with inflationary pressures on commodity prices and supply chain disruptions, both of which are outside its control. Finally, the ability of the Federal Reserve to engineer a soft landing also depends on its ability to increase interest rates without materially increasing unemployment.

The degree to which the economy can digest higher interest rates without falling into a recession will be bourn in the economic data over the coming months. The extent to which growth in hiring, investment and spending among other indicators slow will reveal how well the Federal Reserve has managed to engineer a soft landing.

Even if the United States avoids a recession, the risk of recession is material enough to warrant businesses devoting additional time and resources to scenario planning. If the United States experiences a recession, how will it affect businesses and industries? If the Federal Reserve is unable to curb inflation, how will persistently elevated inflation impact businesses’ customers across different market segments? In this sense, the debate regarding the Federal Reserve’s ability to achieve a soft landing misses a critical conclusion, namely that businesses have an obligation to start preparing for a hard landing.

This is a report preview. Download the full report here.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Jesse Wheeler previously worked at Morning Consult as a senior economist.

Lori Helwing is the Financial Markets Economist for Morning Consult, where she leads the company’s analytical and forecasting efforts for the broader economy. She brings over 20 years of experience on Wall Street and specializes in a non-traditional, bottom-up approach that quickly incorporates real-time data for more accurate near- and medium-term forecasts of economic growth. Lori’s prior roles include serving as Chief US Economist at Point72 Asset Management where she worked closely with in-house traders and portfolio managers, a US Economist position at Merrill Lynch/Bank of America generating research for institutional clients, and a Global Economic Analyst at Wellington Management working with a broad array of fixed income and equity investors.