How Patriotism Impacts Global Consumer Demand for Domestic Products

Key Takeaways

Younger generations of U.S. consumers tend to be less patriotic.

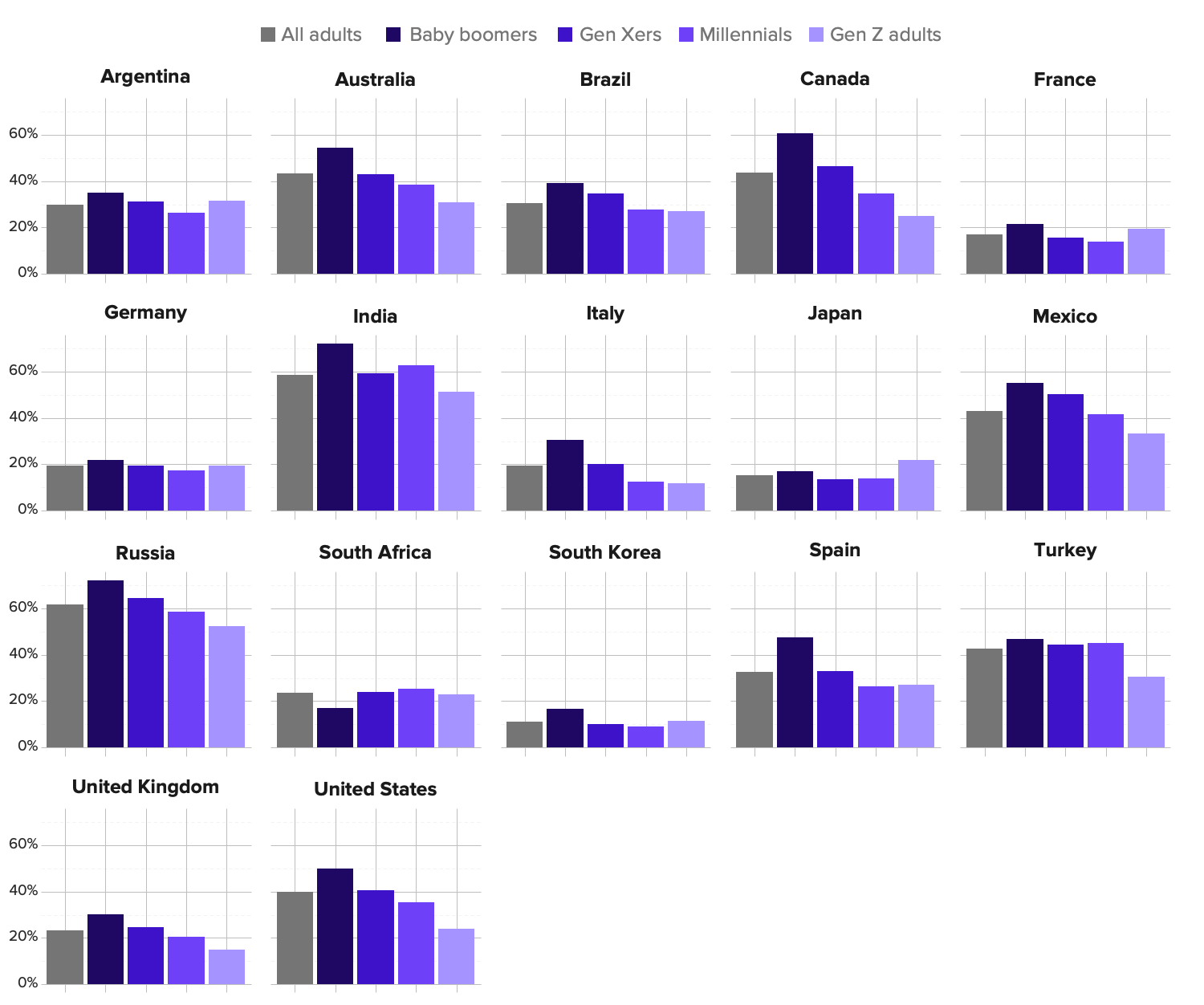

Our data shows the trend also holds globally: Across 17 countries in which we collect data on national pride, smaller shares of Gen Z adults and millennials tend to say they are “very proud” to live in their country relative to older cohorts, baby boomers specifically. Cross-country variation in patriotism among the average consumer is also pronounced.

These findings have material implications for global multinationals owing to positive relationships between national pride and consumer demand for domestic goods and services, both within and across most countries.

Within countries, companies should expect older generations to go out of their way to buy goods and services from domestic competitors more often than younger consumers.

Across countries, companies should expect the average consumer to be more likely to favor domestic competitors in markets whose residents are more patriotic.

Highlighting local job creation and, in certain cases, a company’s country of origin are two viable strategies for winning over reticent consumers.

Sign up to get our analysis and data on how business, politics and economics intersect around the world.

Gen Z is America’s least patriotic generation

Younger generations of U.S. adults tend to be less patriotic than older cohorts, with our data finding that smaller shares of Gen Zers are proud to live in America compared with any other generation surveyed. The shift has been attributed to everything from gun violence and changing subject matter taught in U.S. schools to worsening race relations and overseas wars in Iraq and Afghanistan. Others say no shift has taken place, instead arguing that younger generations will become more patriotic as they age.

Our data suggests the phenomenon is not unique to the United States and provides signposts for foreign companies seeking to better navigate both generational and cross-country variation in patriotic sentiment that could advantage domestic competitors.

Globally, younger generations tend to be less patriotic

Generational patriotism is not strictly a U.S. phenomenon. Smaller shares of Gen Zers and millennials tend to say they are “very proud” to live in their country relative to older cohorts — and baby boomers specifically — in 17 countries where we collect data on national pride (Japan and South Africa are the two outliers). For about 2 in 5 countries surveyed, however, Gen Z is not the least patriotic generation.

Younger Generations Tend to Be Less Patriotic Globally

Cross-country variation in patriotic sentiment is also substantial. Russians of all generations are among the most proud globally, likely due to a “rally around the flag” effect in the wake of Moscow’s invasion of Ukraine. Meanwhile, countries in continental Europe and East Asia see lower patriotism overall, with millennials expressing somewhat less national pride than Gen Z adults. We view post-World War II wariness of unbridled nationalism as one likely explanation. Elsewhere, we observe idiosyncratic patterns, such as Indian Gen Xers expressing less pride compared with other generations, perhaps due to backlash against perceived anti-pluralism.

National pride can impact economic outcomes both positively and negatively

Much like trust, national pride is an abstract psychosocial concept that can have tangible economic impacts. Pride has been associated with positive outcomes like increased tax compliance and negative ones like beggar-thy-neighbor policies that come at the expense of overall national prosperity.

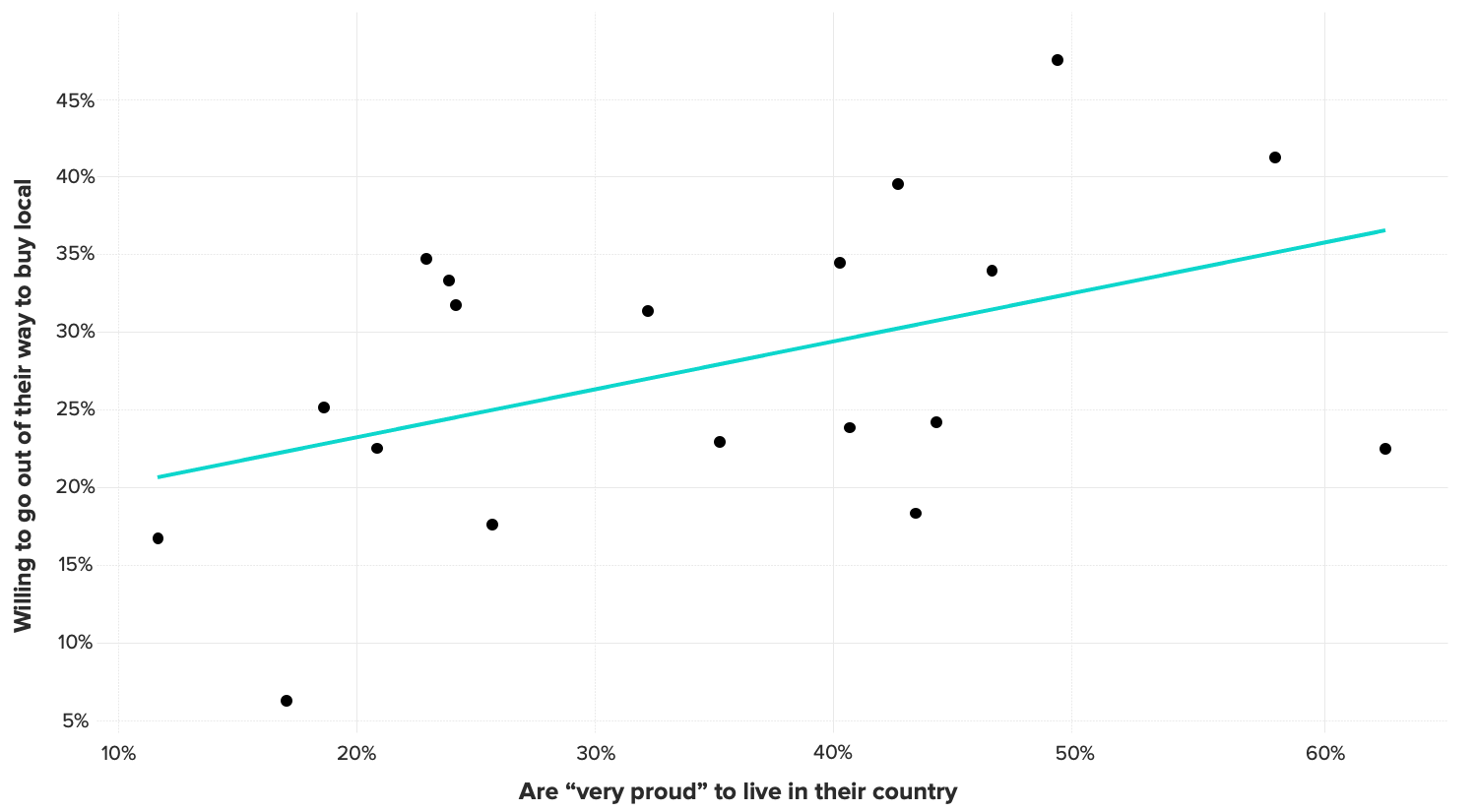

Particularly relevant for consumer-facing companies, our data finds a clear positive relationship between national pride and consumers’ interest in buying domestic goods and services, both in America and in most other countries.

The Average Consumer Is More Likely to Favor Domestic Competitors in Countries Whose Residents Are More Patriotic

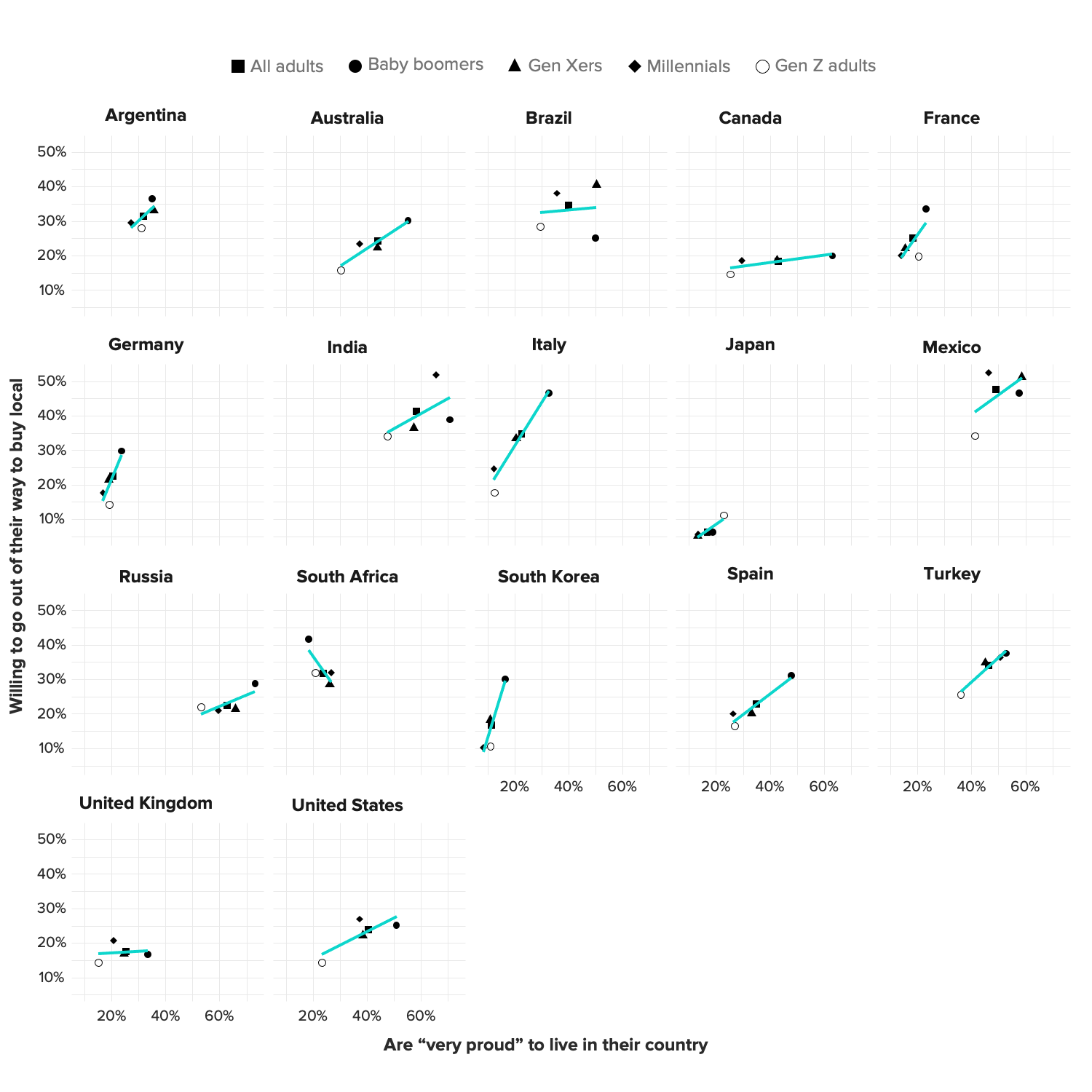

In the United States, consumer demand for “Made in America” goods is higher among more patriotic generations. A similar relationship holds for most global markets: On average, less patriotic generations are less inclined to go out of their way to buy domestic goods and services. South Africa is again an outlier.

Patriotism Positively Correlates With Consumer Demand for Domestic Goods and Services in Most Countries

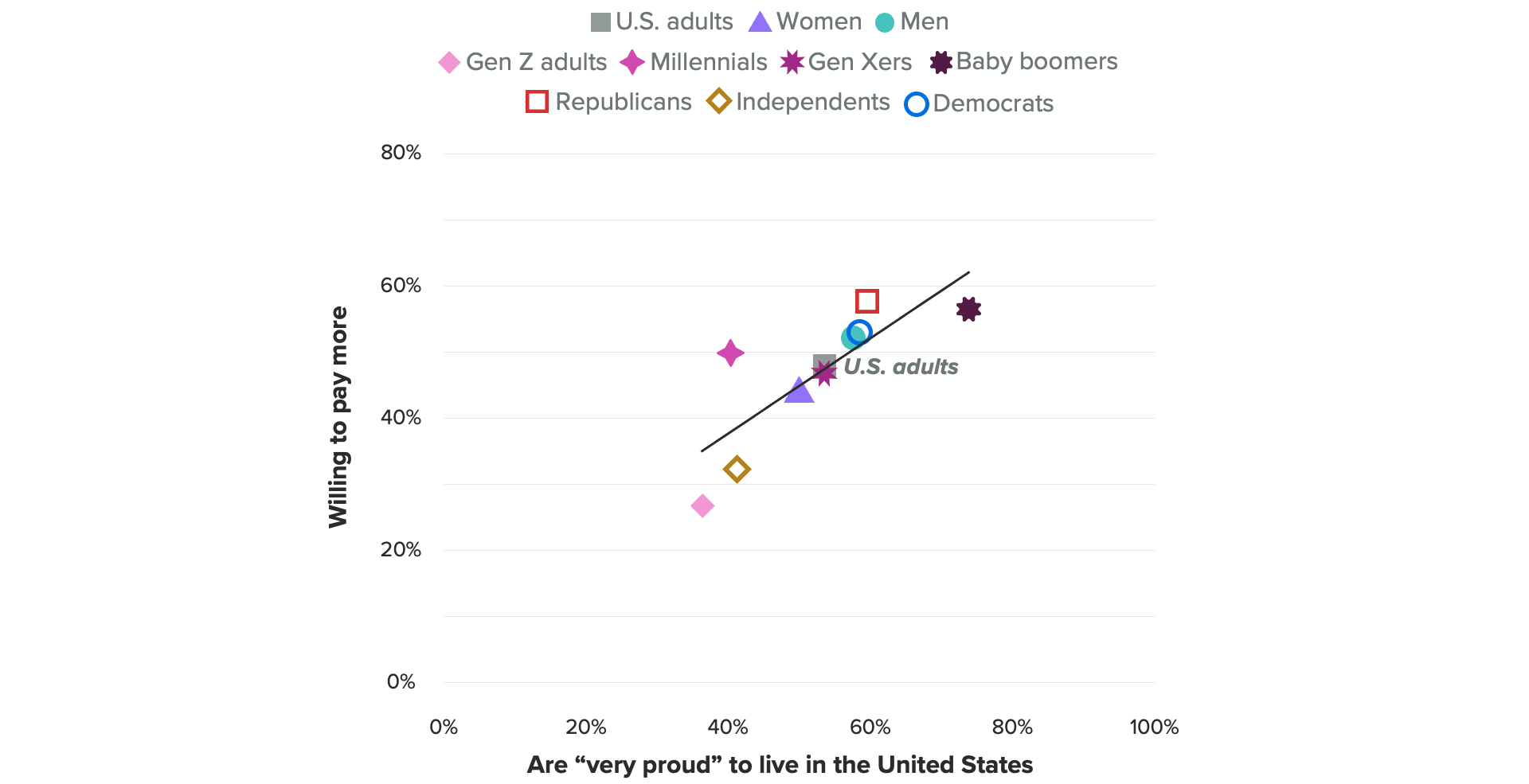

Evidence from our recent Made in America Report further suggests that more patriotic consumers would also be willing to pay more (though not drastically so) for domestically produced goods.

Patriotic Consumers Are More Willing to Pay Extra for ‘Made in America’ Products

Strategies for contending with patriotism

Consumer-facing companies will benefit from remaining attuned to these dynamics as many countries turn inward amid worsening geopolitical tensions. Across countries, foreign companies should expect consumers to favor domestic competitors offering comparable products in cases where residents are more patriotic. Our recent research on Chinese consumer boycotts highlights analogous risks that some companies could face while tensions remain elevated. Within countries, foreign multinationals should expect older consumers to go out of their way to purchase goods and services from domestic competitors more often than younger ones, though the trend does not hold in every market.

We survey worldwide: Global data used in this analysis is available exclusively in Morning Consult Intelligence, an online platform tracking consumer attitudes daily on key indicators in 40+ markets. This survey asks respondents about their demographics, political beliefs, economic sentiment, brand perceptions and more.

Why our data is strong: What you’re reading reflects daily global tracking in each country, a data set unique to Morning Consult. No other company surveys daily at this scale in as many markets as Morning Consult does.

Foreign companies struggling to reach young consumers in light of these dynamics are not without options. In the United States, our data suggests that companies can highlight local job creation to help win over hesitant consumers. Highlighting country of origin can also help in situations where companies do business in countries that are friendly with their own. As was the case with the strength of the relationship between patriotism and consumer demand for domestic goods and services, the ability of these and other strategies to win over consumers is likely to vary by country. Our data offers a starting point for identifying both the countries and generations where patriotism is likely to drive headwinds (or tailwinds) for foreign companies doing business in such markets, positioning them to plan and strategize accordingly.

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].