The Plant-Based Meat Industry Faces More Challenges Ahead — Here’s Why

Key Takeaways

Consumers’ interest in purchasing Beyond Meat has declined by only 1 percentage point over the past year, from 15% in January 2022 to 14% in January 2023, despite headlines about the brand’s struggles.

But the year ahead will be challenging, given the current economic environment and consumers’ negative cost associations with the category.

If plant-based meats want to grow their market share, they need to address not only cost, but also other barriers to purchase, like perceptions that they are less tasty and nutritious than traditional meats.

Beyond Meat had a challenging 2022. The company’s struggles, from layoffs to executive turnover to declining stock prices, have captured the attention of mainstream media and are prompting broader conversation about the future of not only the brand, but the entire faux meat industry.

Yet, despite these recent struggles, consumers’ attitudes toward the brand haven’t dramatically shifted. In fact, purchasing consideration for Beyond Meat has remained relatively unchanged year over year — no small feat given the difficult economic environment of 2022.

However, consumer research also reveals that the category faces significant hurdles in terms of perceptions about taste and cost. Brands will need to overcome these barriers, as well as improve health messaging, to remain relevant going forward.

Awareness of plant-based meat companies has skyrocketed, yet purchasing consideration lags

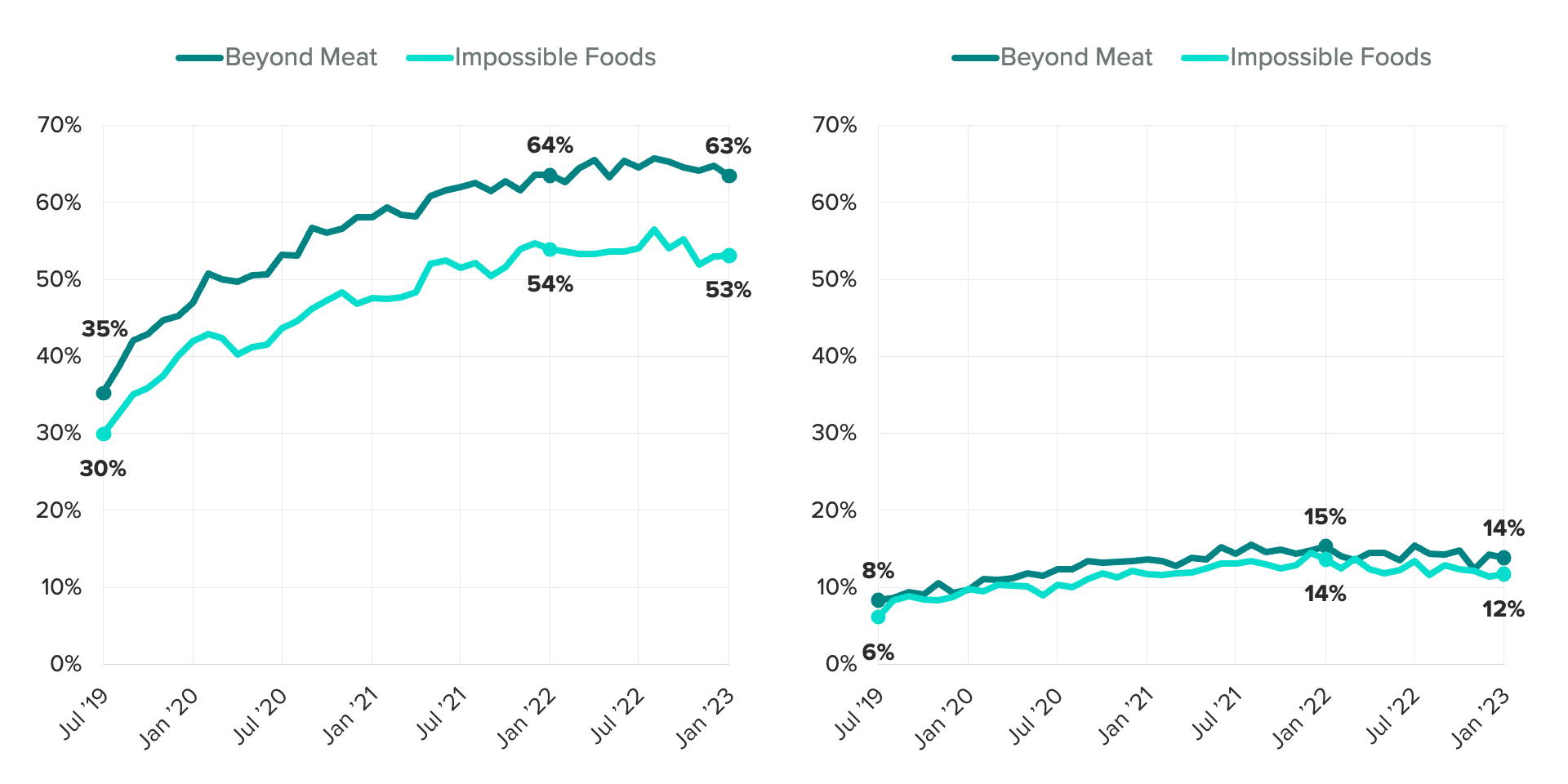

Morning Consult started tracking perceptions of plant-based meat brands in 2019, the same year Beyond Meat had its initial public offering and the Impossible Burger debuted in Burger King. Since then, plant-based meats have experienced tremendous growth in awareness. Now, just over 6 in 10 U.S. adults are aware of Beyond Meat, a 28-point increase since July 2019. But the same can’t be said for purchasing consideration. Over the same time period, the share of U.S. adults who said they would consider purchasing from the company only increased by 6 points.

Zooming in on more recent data, neither Beyond Meat nor Impossible Foods experienced growth in awareness or purchasing consideration from January 2022 to January 2023, but, notably, they also did not experience declines. In other words, the share of U.S. adults who expressed interest in purchasing either brand remains relatively unchanged since this time last year.

This leveling off in the data could speak to the potential niche appeal of plant-based meat, but the challenge of growing a pricey category amid persistent inflation in 2022 is probably more to blame.

Taste and cost are key factors impacting plant-based meats’ future growth

As is often said in the food & beverage industry, taste is king, and plant-based meats have a taste problem.

When asked whether the term “tasty” is more closely associated with plant-based or traditional meats, a majority of respondents (53%) said the latter. By positioning themselves as a direct competitor to traditional meat, a category most Americans generally agree is quite tasty, plant-based meats invite taste comparisons they just aren’t winning. When asked another way, 62% of U.S. adults said “tasty” describes traditional meats very well, whereas only 17% said the same about plant-based meats — a 45-point gap. This has always been a central challenge to the category, and there’s still a large divide to close in consumers’ minds.

As with so many categories in the past year, cost is also an issue. Amid persistent inflation, 65% of grocery shoppers said in December 2022 that they bought less meat to save money. This could easily translate into fewer purchases of plant-based meats as well, as they are perceived to cost even more than traditional meat products. Consumers are more than twice as likely (52%) to say they believe plant-based meats cost more than traditional meats than they are to say they cost the same or less (23%).

What’s more, inflation is discouraging shoppers from trying out new items at the grocery store. The share of U.S. adults who said they tried a new packaged food product in the past month declined from 22% to 18% year over year in December. And this is likely impacting meat even more than other grocery categories, as it doesn't inspire a lot of experimentation. Only 17% of grocery shoppers said in December that they make an effort to try new brands in meat, compared with 31% in snacks, a category more driven by branding, novelty and product innovation.

Consumers know plant-based meats are better for the environment, but they’re divided on the health benefits

Consumers know that environmental benefits, like helping to reduce greenhouse gas emissions, are a key part of plant-based brands’ missions, and as such, they are much more likely to associate plant-based meats with being good for the environment: 40% of consumers said they are, compared with 17% who said the same about traditional meats.

There’s also been a lot of conversation about the health benefits and nutritional value of plant-based meats. From a consumer perspective, there appears to be confusion on the topic. While 31% of consumers said “healthy” is better attributed to plant-based meats, compared with 24% for traditional meats, the near inverse is true for the attribute of “nutritious.”

But it’s important to note that factors like sustainability and health and wellness often take a back seat to taste and value when consumers are making purchases. More recently, these factors have taken a bit of a hit in the current economic environment as consumers prioritize more immediate needs over higher-order concerns. The importance of healthy eating among U.S. adults declined from 86% to 81% year over year in December, and the importance of food sustainability declined from 79% to 76% during the same time period. While these shares are still high, the dip indicates these issues might be less pressing for cash-strapped consumers, thus exacerbating plant-based meats’ challenges over the past year.

The future of plant-based meats

Significant hurdles remain for Beyond Meat and the wider plant-based meat industry if they hope to stake a permanent place in consumers’ diets. In the near term, when consumers start to shift their focus away from pinching pennies and back to health and sustainability, interest in the category may get another boost. In the long term, overcoming concerns around taste, cost and health is imperative.

But one constant truth is the ever-evolving nature of this category. Plant-based meats aren’t the only alternatives to traditional meats. The choice set is increasingly competitive, both with other plant-based options and emerging innovations like cultivated meat. Whatever the meat alternative, it will have to meet consumers’ demands to stay on retailers’ shelves.

Emily Moquin previously worked at Morning Consult as a lead food & beverage analyst.