Energy

Even Public Transport Is Struggling With Inflation

Despite increased comfort in shared mobility and high gas prices driving down personal mobility in favor of public transportation, inflation headwinds are curbing growth in this sector, showing that no industry is safe from economic uncertainty

Cutting through muscle to bone, rising inflation is curbing public transportation usage and spending, proving that even budget sectors are prone to attrition as consumer behavior shifts to cut costs.

To be sure, public transportation has rebounded since the pandemic hit. Increased consumer comfort in public spaces, offices welcoming employees back to work and the sting of high gas prices have made this mode of movement an attractive alternative to personal transport — which has been a much-needed boon after two-plus years of COVID-19.

But as inflation has taken over consumers’ lives and checkbooks, many have crossed off public transportation as a service they regularly use, following a pattern of trade-offs in personal and shared mobility. Spending on public transportation also continues to decline, although less severely in April and May as prices have climbed.

Automotive leaders should note this trend. A dip in overall public transportation use and spending impacts private and shared modes of transportation in personal mobility. Consumers often use multiple modes of movement in their journeys, so pulling back on one link may increase or decrease reliance on another. And if consumers are driving fewer miles, they won’t need to service or replace their vehicles as often, resulting in missed revenue opportunities.

Looking at the role of the vehicle in the broader transportation value chain, these stakeholders can keep their customers driving by offering credits on public transportation, particularly to those in urban areas who use a vehicle to get to the nearest station. Similarly, there’s an opportunity to provide short-term incentives such as gas cards to ease economic difficulty, or service credits to encourage consumers to maintain their vehicles even when they are staying parked more often.

Public transportation usage and spending vary by community, generation

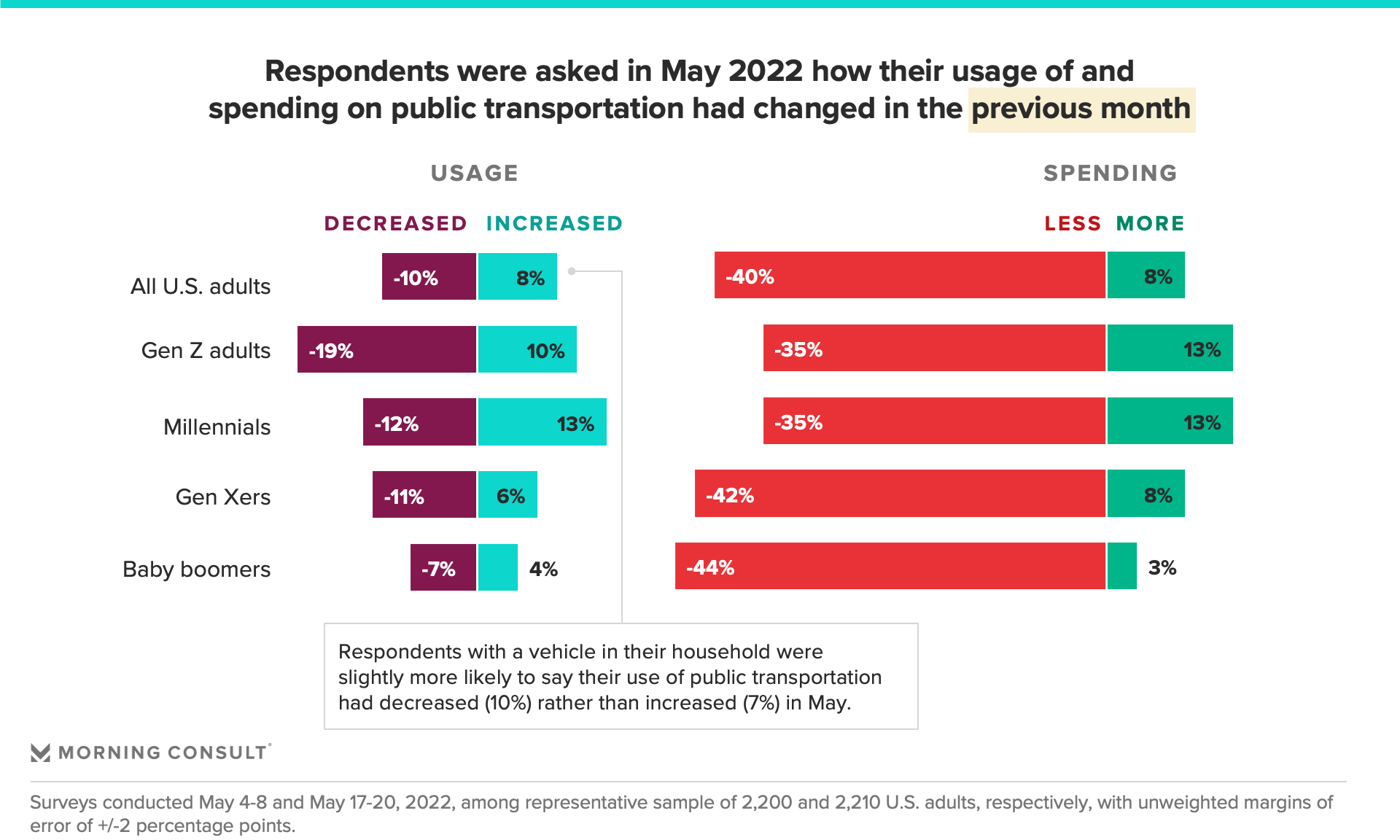

Consumers reported less spending on public transportation in May than in the previous month, with 40% of adults allocating funds elsewhere. Gen Z adults and millennials reported the smallest decrease in spending (35%), probably because these groups are less likely to own or have access to personal vehicles. Vehicle manufacturers looking to win over Gen Zers, many of whom are students, could partner with public transport operators to provide student credits to keep this group on the move in the near term, and offer rebates on vehicle purchases to secure them as future customers.

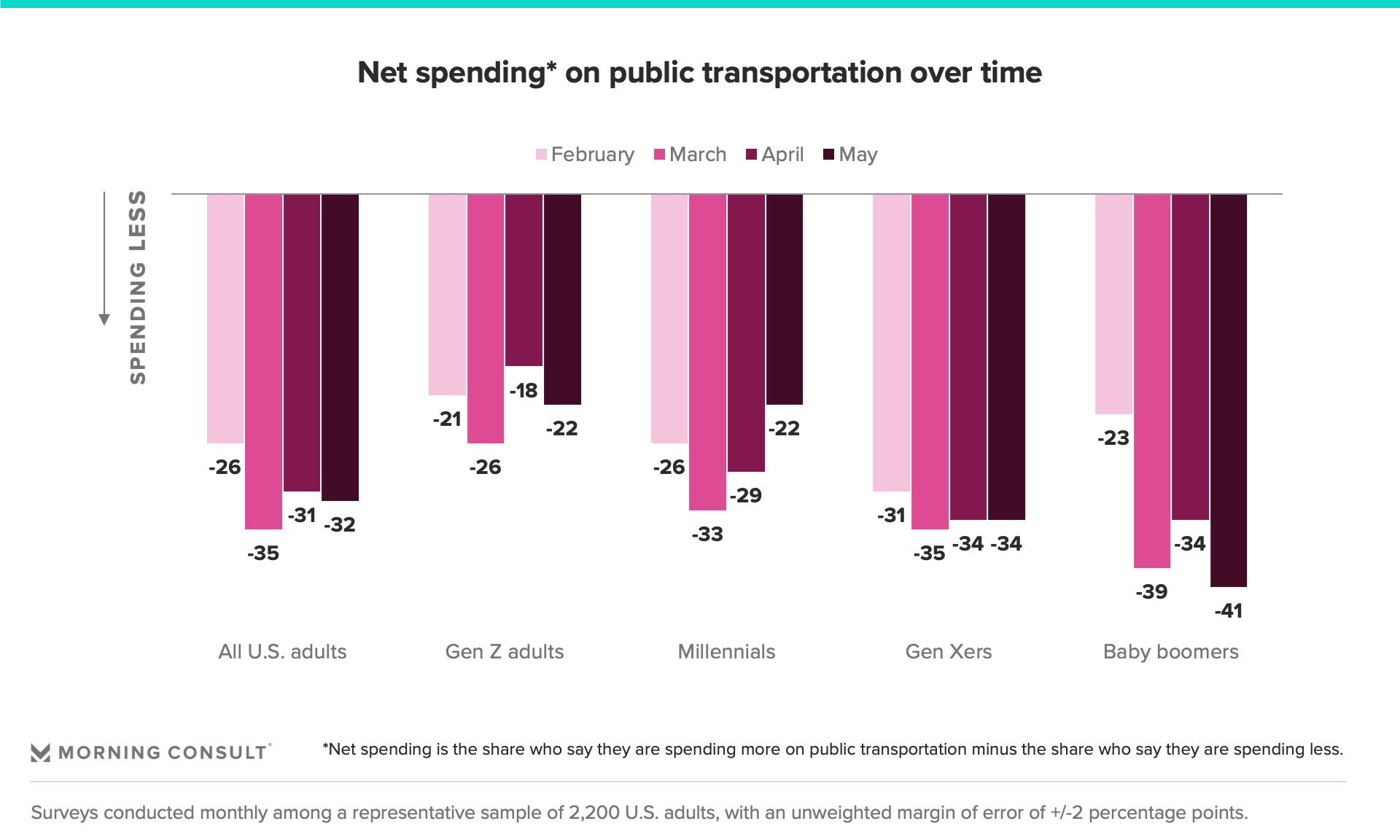

Looking at trended data, net spending remains contractionary — less than zero — although the decline is inconsistent. This could be due to a combination of higher prices on public transport forcing up spending for those who continue to use it, as well as diminishing month-over-month decreases as consumers have begun to bottom out their adjustment.

Consumers have also downshifted public transportation use, indicating that inflation headwinds are dampening personal mobility tradeoff tailwinds. While 8% of respondents said they are using public transportation more (tailwind), 10% said they are using it less (headwind).

Gen Z adults reported the biggest decrease in public transportation usage at 19%, despite 10% of this group saying they used it more. Millennials, meanwhile, experienced the most balance between decrease (12%) and increase (13%). Millennials are in their peak working years, with more fragile wallets, and are less likely to trade off this cheaper mode of transport.

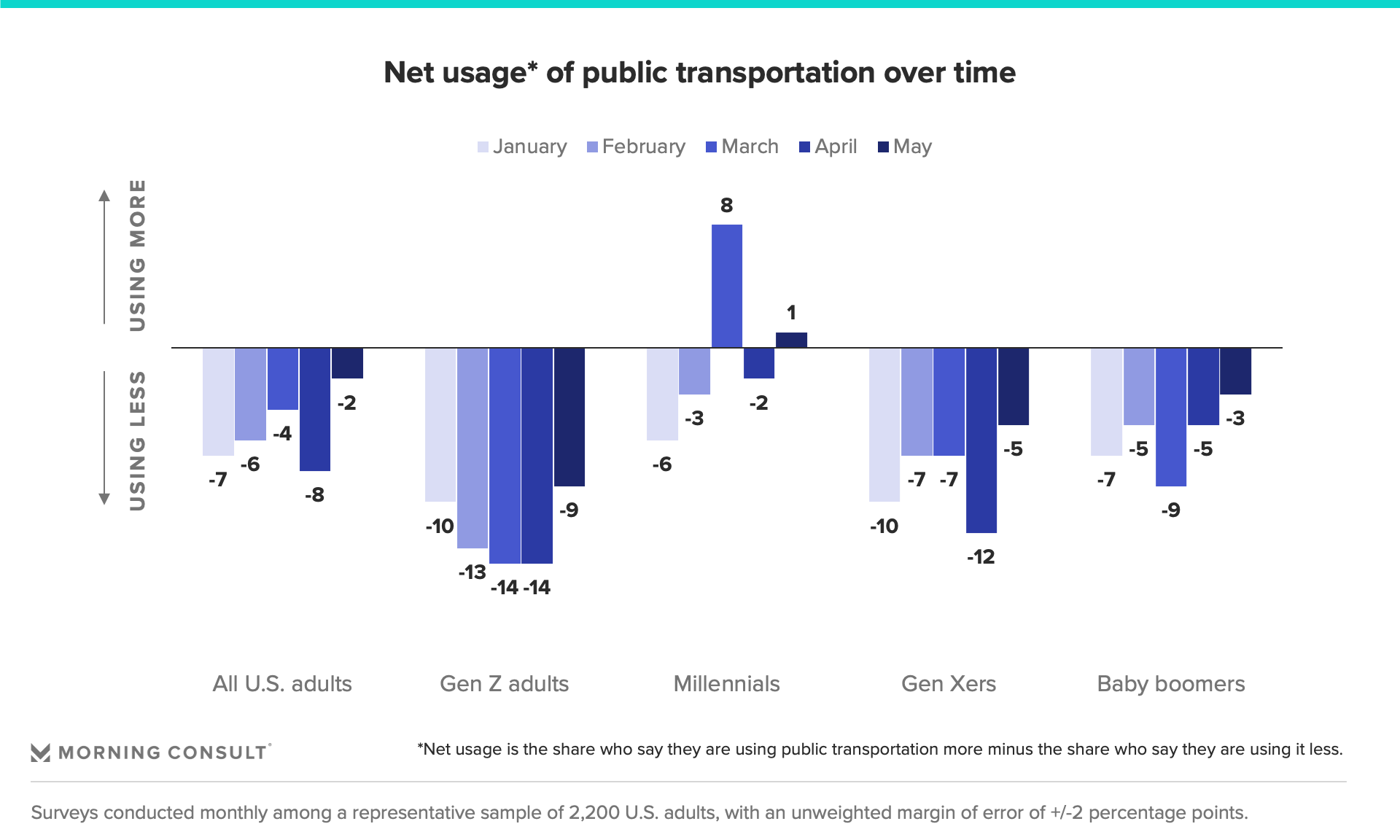

Trended over time, net usage of public transportation remains negative overall, although less so than earlier in the year. This may signal that consumers have adjusted downward as much as they can in current conditions. If economic conditions worsen, we are likely to see further falloff.

Millennials and those concerned about how gas prices will affect the purchase of their next vehicle seem most persistent in public transportation usage. Urbanites, unsurprisingly, tend to use public transportation much more than their suburban and rural counterparts, as it is a vital alternative to vehicle ownership in congested areas with limited parking options.

Notably, having a vehicle in the household does not predict significantly lower usage of public transportation. In May, 11% of those with a household vehicle reported using the subway in the past month, nearly equal to the 12% of the general population who said the same. Automotive manufacturers should not think of public transportation as a competitor, but rather as an essential piece of the transportation ecosystem that keeps consumers mobile.

Looking ahead, although many Americans heavily favor the convenience of personal transportation, others find public mobility a viable option — or at least a sufficient backup — as surging gas prices drive up the cost of vehicle ownership. Still others who don’t own vehicles find public transportation necessary, and it is therefore harder for them to adjust their usage and spending past a certain threshold despite inflationary pressures. High vehicle ownership costs, coupled with increased comfort in occupying shared spaces, should continue to provide some underlying boost to public transportation against the spending woes holding it back. But the outlook overall remains cloudy as the threat of recession looms.

Lisa Whalen previously worked at Morning Consult as an automotive and mobility analyst.