Retail Briefing: Back-To-School Budgets, Discount Shoppers & More

Sign up for our retail briefing newsletter. This monthly email curates our latest research into the industry, helping you stay ahead of the most important consumer trends.

Welcome to our retail insights briefing.

In this monthly email, we will curate the most important insights from our team of industry, political and economic experts and deliver them right in your inbox. Consider it your one stop shop for the data you need to know about the retail industry.

Patriotism may have been on full display last week as Americans celebrated the Fourth of July holiday, but that sentiment doesn’t look to extend to consumer shopping habits. Our new research finds that demand for “Made in America” products is waning. Plus, see what is making consumers walk away from brands and an early look at parents' back-to-school shopping priorities.

Read on for recent insights into these topics and more, or download our full reports for a deeper dive.

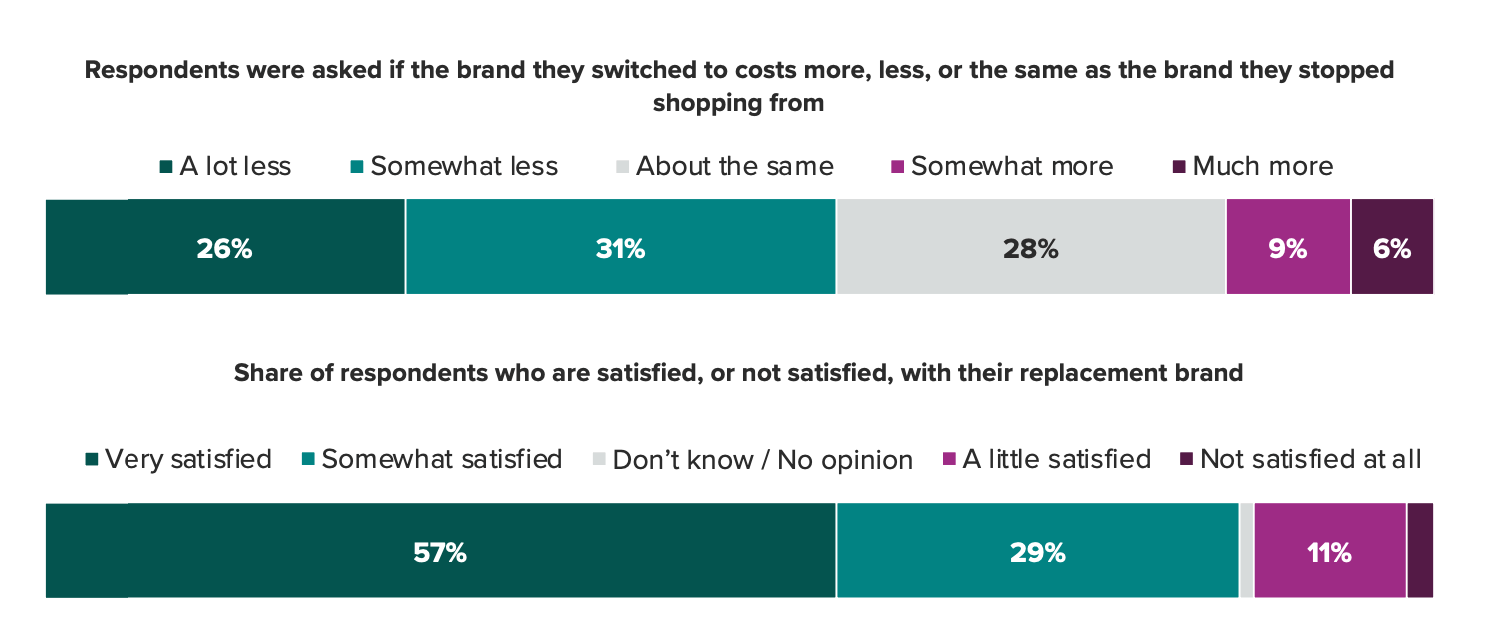

Shoppers are switching to cheaper brands and they’re pleased with their new choices

Consumers are walking away from their favorite brands to save money. Among consumers who say they swapped one brand for another, 57% reported that their new brand costs less. Saving money isn’t the only benefit to shoppers, they’re also satisfied with their new brand of choice. Plus, it doesn’t seem to be a particularly arduous task to find a replacement. Most (86%) shoppers said they found an alternative they liked within the first three new brands they tried.

Worse for brands, some customers are just biased toward novelty, making winning their loyalty even harder. Gen Zers in particular are prone to trying new brands. This is especially true in apparel, where 51% of Gen Z respondents said they’d reduced or stopped their shopping from a particular brand. Download the full report to see more insights about what causes shoppers to walk away from brands.

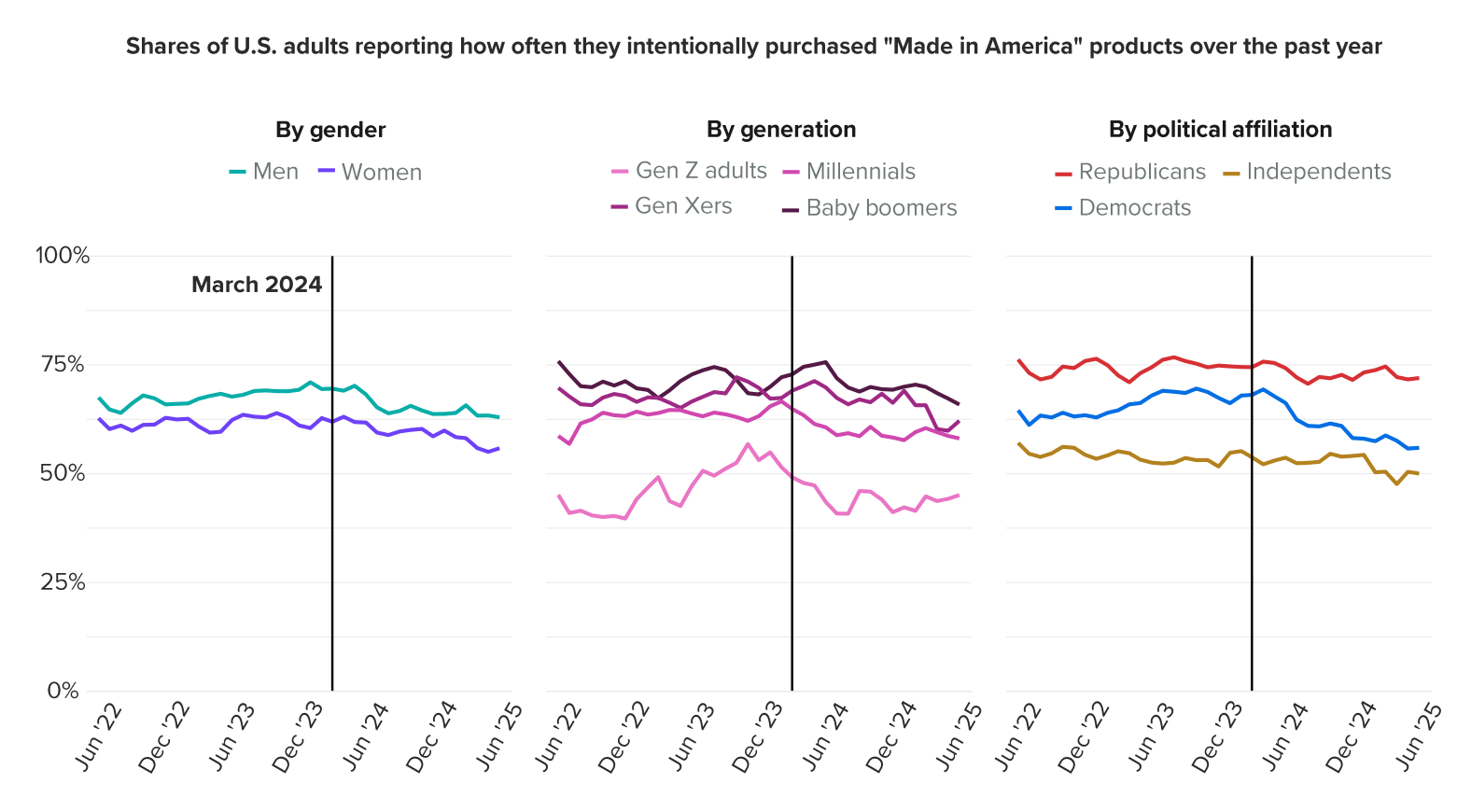

Demand for “Made in America” products is waning

Declining enthusiasm for “Made in America” products among U.S. consumers is widespread. Relative to the start of our tracking three years prior, and particularly from Q2 2024 onwards, U.S. consumers’ demand for “Made in America” products has fallen across nearly all consumer demographics we examine. Democrats show the most pronounced decline. But GOP-aligned consumers also exhibit waning enthusiasm for the product segment. This suggests that partisanship – whereby Democratic consumers' views of American-made goods are colored by their rebuke of the Trump administration – does not fully explain the trend. Economic dynamics are likely playing a role. Download the full report for an in-depth assessment of U.S. consumers’ attitudes toward the “Made in America” product segment.

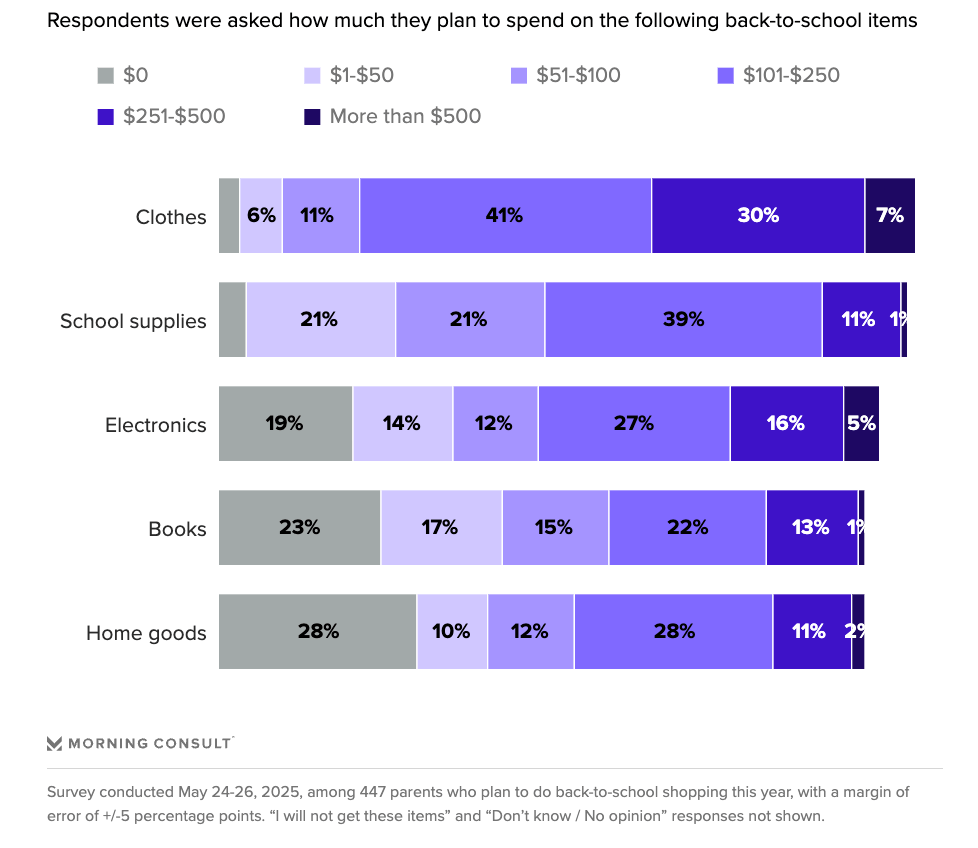

Parents allocate most of their back-to-school budgets to clothing

When asked how much they plan to spend on back-to-school overall, parents’ budgets are similar to 2024, with a plurality saying they anticipate spending between $251 and $500. That might mean buying fewer or lower cost items than what parents bought last year to compensate for higher costs. Clothing comprises the largest share of that budget, so tariffs’ impact on the apparel industry will be particularly painful for parents this season. Electronics and home goods — the latter a necessity for dorm-bound students — also require higher spending levels for parents outfitting their kids with those necessities (and nice to haves). Discover the categories causing the most sticker shock for back-to-school shoppers.

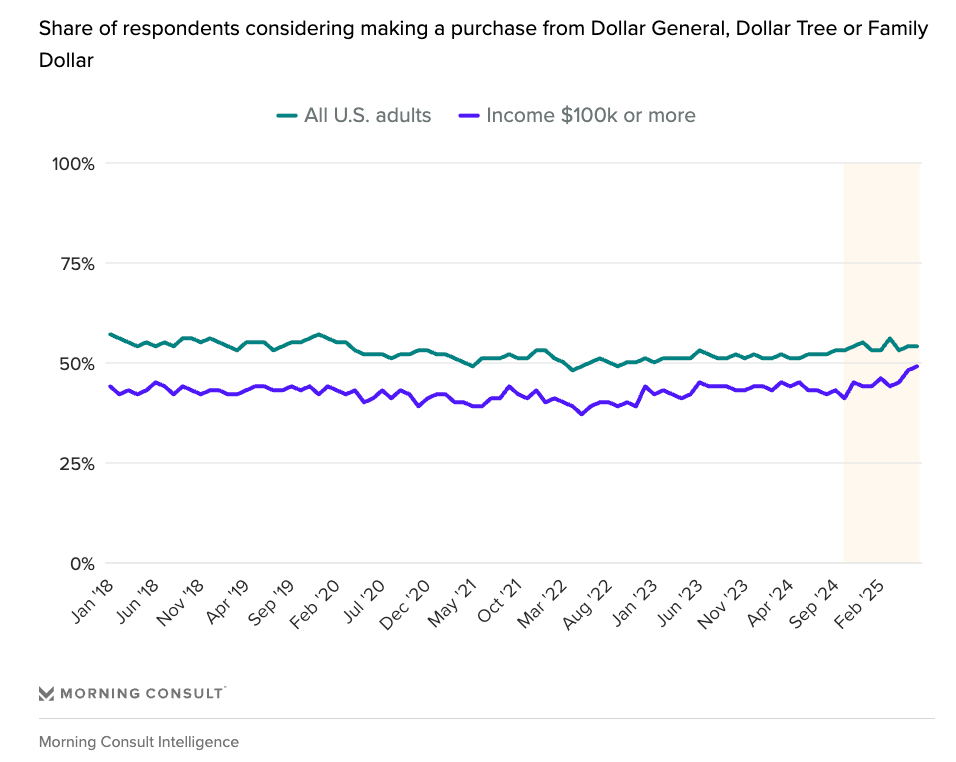

High-income shoppers are increasingly shopping at dollar stores

Per Morning Consult Intelligence, high-income shoppers have been increasingly including dollar stores in their consideration set since October 2024. We’ve seen an uptick in the share of those consumers who are “absolutely certain” or “very likely” to consider buying a product from Dollar General, Family Dollar or Dollar Tree, growing from 41% to 49%. Why the shift? This group’s consumer sentiment trended upward in the same time period, so they’re not doom spending. It’s more likely that they’re feeling the strain of price increases and trying to keep discretionary spending in check. This group is more likely to have kids at home than the overall population of six-figure households, and $100,000 just doesn’t go as far for larger households. See more shopping habits of high-income discount shoppers here.

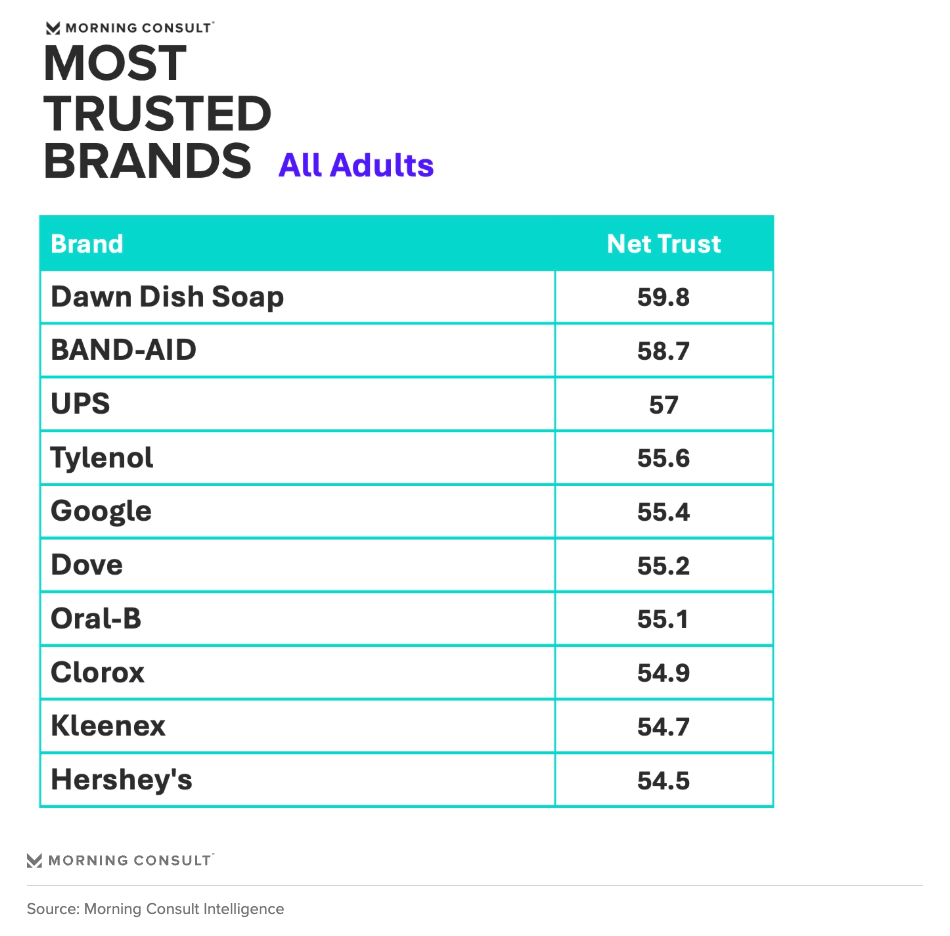

Everyday essentials top the 2025 Most Trusted Brands list

Brands like Dawn Dish Soap, BAND-AID, UPS, and Tylenol top the 2025 Most Trusted Brands list for all U.S. adults. These brands have become household staples, trusted for their reliability and consistent quality. In times of uncertainty, consumers gravitate toward brands that deliver on basic needs—echoing findings from Harvard Business Review that trust is often built on “competence and dependability.” Download the full report for more rankings among key consumer groups, including Gen Z.

Want more insights? Dive into additional analysis from our team of experts below.

- How Brands Should Respond to a Crisis, According to Consumers: Post on social. Our recent survey reveals that social media is U.S. adults’ preferred channel for hearing from brands by a wide margin, during a crisis or otherwise.

- Consumer Perceptions of Sustainability by Industry: Green energy, farming, and food & beverage industries are viewed as most environmentally sustainable by consumers.

- Social Media Shopping Activity Is Becoming Common Across Generations: Social media shopping isn’t just a young person’s game. The behavior is common for all consumers, including 34% of baby boomers.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].