The Latest Retail Investing Trends: Fintech Brands Take a Hit; Inflation and Potential Recession Reverse Investor Diversity

The pandemic brought a burst of retail investing and usage of fintech investment apps especially, which will dampen if inflation gives way to a full-blown recession. For many consumers, that means their investing progress, already hard-fought, may get harder, and fintech investing brands will have to find new strategies to attract consumers.

For more on the current state of consumer banking and investments, read our report here.

The silver-lining pandemic conditions that led to a rise in increased retail investing in 2020 — broad stimulus payments, booming tech stocks and lots of time spent indoors — are now giving way to today’s global macroeconomic environment, and the makeup of retail investors and their investing habits will undoubtedly change.

Consumers are already showing softened demand for the fintech brokerages and robo-advisers they avidly adopted over the last two years, and coveted target audiences are no longer investing, meaning that now is the time for these brands to reassess acquisition and retention strategies.

Growth of fintech brokerages and robo-advisers has softened, reversed

Since the end of 2021, when usage was at its peak for fintechs Robinhood, Wealthfront and Acorns, each has shown statistically significant drops in the share of U.S. adults who report using the platforms, and their stocks have taken a hit and valuations have missed expectations.

Unfortunately for these brands, this is likely to continue. First, the end of stimulus payments, followed by high inflation, means less discretionary income and ever-dwindling financial cushions for consumers, resulting in less “play money” for those who used personally managed brokerage accounts or robo-advisers to dip their toes into the investing world.

Second, many of these fintech apps were intentionally designed to have low barriers to entry, and these entirely digital, mostly human-free ecosystems may mean that consumers perceive them as easiest to cut when things get difficult. Of course, while closing these accounts or cashing out is harder than signing up (and will involve fees and taxes), consumers who are cash-poor will likely close their robo-adviser or personal brokerage app accounts first.

Long-term, employer-sponsored funds are picking up

There’s a high likelihood that the reason why consumers are dropping their fintech investments is because record-high employment and a tight labor market mean that they can now access employer-sponsored investment accounts with increasingly attractive matching plans as employers compete for talent.

Morning Consult’s monthly tracking of consumers’ investment products already shows an uptick in this category specifically. The share of U.S. adults who have an employer-sponsored retirement account has grown from 27% to 31% between July 2021 and April 2022, while robo-adviser accounts are down from 8% to 5% over the same period. Behind employer-sponsored accounts, IRAs are the second most commonly cited investment account and have also shown an increase in the share of U.S. adults who use them, from 24% in January 2022 to 27% in April.

While the changes in the shares of U.S. adults who invest in each product have not been huge and have fluctuated across the last 10 months, the relatively smooth surface belies a changing investor makeup, which could result in meaningful changes in investment product holdings in the next few months. If the labor market remains tight and more consumers have access to investment-related products from their employers, the shifts we’re already starting to see will gain even more speed.

There are early signs of changing investor demographics

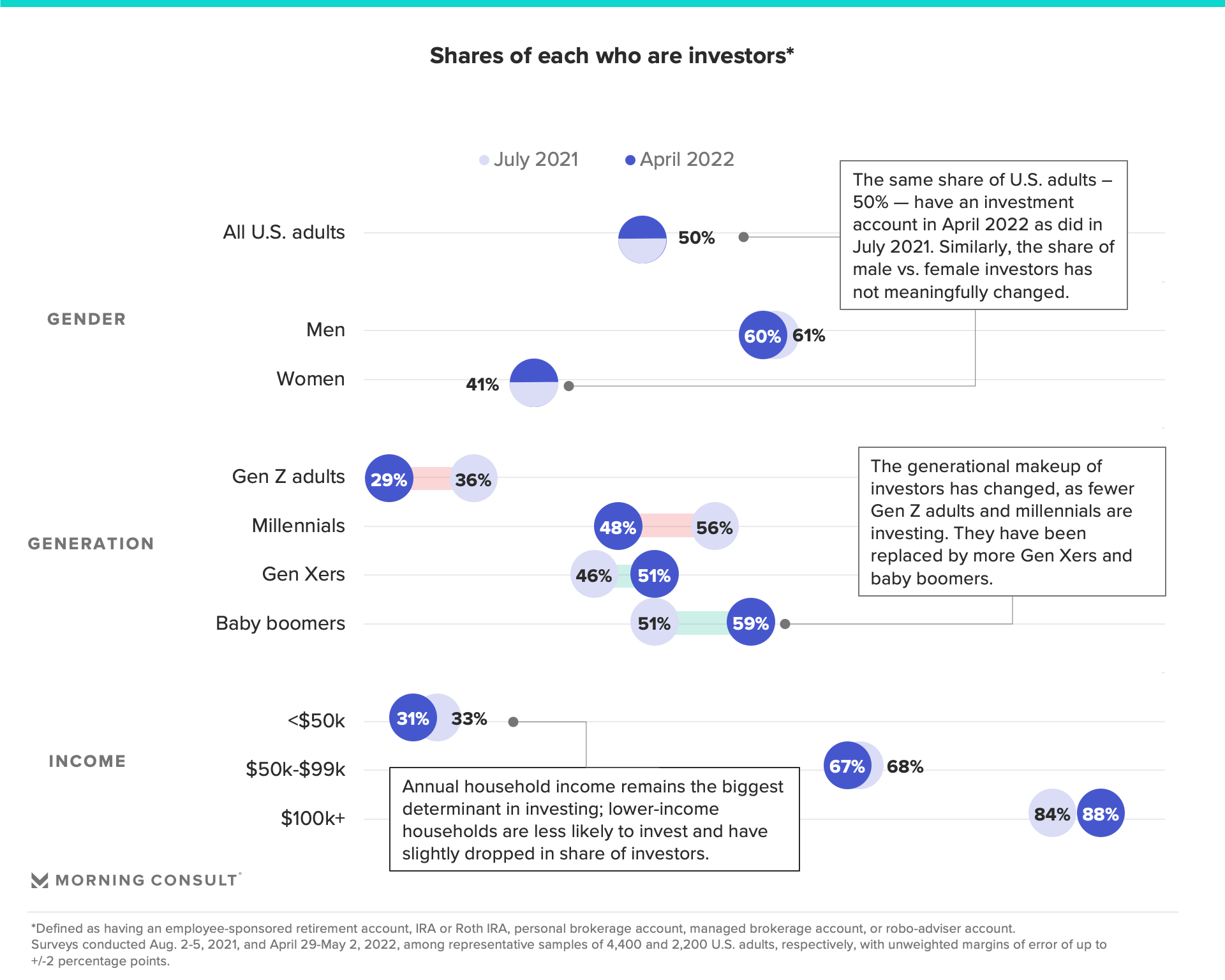

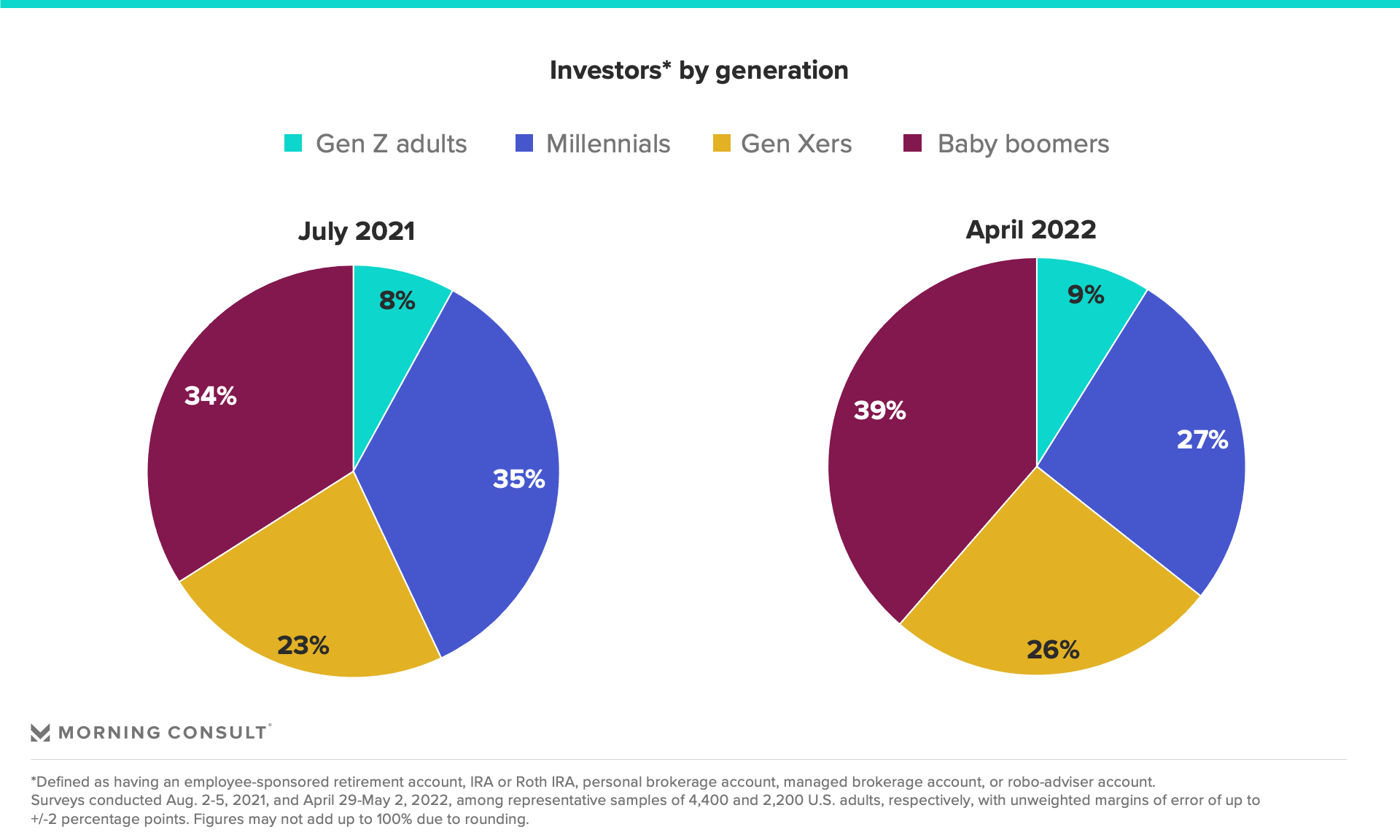

Half of U.S. adults are investors, which we define as those with one of the above five investment accounts. That figure has remained steady since July 2021 and likely will stay that way for at least the next few months. But there has been a shift in the demographic makeup of the group: The share of older investors is increasing. There are now lower shares of Gen Z adults and millennials who report having any kind of investment account, while the opposite is true of Gen Xers and baby boomers.

More than half of millennials (56%) were investors in July 2021, compared with slightly less than half (48%) in April 2022, and Gen Z adults experienced a similar drop during the same time period, from 36% to 29%.

Millennials are dropping investments almost across the board: robo-advisers, personal brokerage accounts, IRA and Roth IRAs, and managed accounts, with only rates of employee-sponsored accounts staying relatively steady.

Meanwhile, Gen Xers and baby boomers are more likely to invest; 59% of baby boomers are investors as of April 2022, compared with 51% in July 2021.

That means that among the entire pool of investors, Gen Xers now make up 26% and baby boomers 39%, up from 23% and 34% in July 2021, while millennials now make up only 27% of investors, down from 35% in July 2021.

The exodus of millennial investors is symptomatic of their financial well-being staying stubbornly low, which also afflicts lower-income adults. There are early signs that adults in lower-income households are also getting rid of investment products, although they are still within the margin of error.

This is bad news for fintechs that focused their strategy on attracting younger first-time investors and that have had trouble recruiting older investors, who are loyal to traditional institutions.

Adults aren’t investing at the rate they were, but that doesn’t mean they don’t want to be

Financial services providers would be wise to remember that a majority of the population has the goal of investing, despite progress being increasingly elusive to many. While only half of U.S. adults have an investment product, as defined above, 73% of adults report that they have a goal of investing. Unfortunately, fewer than half of these adults reported progress toward their investing goals in April 2022.

In general, progress toward long-term financial goals has stalled or reversed for most consumers since last year and will not improve if fewer consumers are investing. Traditionally underserved populations such as women, lower-income households and minorities are especially likely to report not making progress toward investing goals as of April 2022.

While this means there are still untapped investors that fintechs can serve, they may be even harder to recruit in an environment where most people have less discretionary income and less of a financial safety net — two factors that keep people from investing. If fintechs aren’t successful at bringing these groups into the retail investing world, then the discrepancies in investing progress between demographics will likely get worse.

What’s next for both consumers and brands?

If inflation does not soften meaningfully and if a full-blown recession takes hold, it’s likely that more adults, especially lower-income and younger adults, will be forced out of retail investing at least temporarily, and the investor pool will become increasingly homogenous: older and higher-income.

For fintechs, what worked to attract and retain consumers during the height of the pandemic won’t work during a bear market — the first that many upstart investing brands have had to contend with. These brands will need to focus more on retention and growing existing relationships while lowering their expectations for new customers. Usage will continue to fall among their target segments, and they will not be replaced by older or higher-income adults, who will stay with their more established providers.

To grow existing relationships, many are expanding their offering of crypto products (either wallets or exposure to bitcoin ETFs, for example), which — despite their volatility — consumers are still reporting purchasing and expecting to purchase. Beyond that, brands should focus on educating new investors, especially those experiencing their first downturn, and help investors align their allocations with their short- and long-term financial goals.

No doubt, in an environment where fewer investors are coming in, brands will also look for ways to make it harder to leave. Besides creating “stickiness” in relationships through multiple products, there’s also the possibility that additional companies will make it more expensive to move funds out of their apps. Regardless of the strategies fintech brands employ to weather the next period of uncertainty, the time to implement them is now.

Charlotte Principato previously worked at Morning Consult as a lead financial services analyst covering trends in the industry.