The Saudi Leisure Market Is Crowded, but Not Saturated

Key Takeaways

The Saudi public has welcomed new foreign offerings in the entertainment sector and plans to keep taking advantage of them amid Crown Prince Mohammed bin Salman’s top-down liberalization drive.

The domestic population — which kept the leisure sector afloat during the COVID-19 pandemic — will continue to be a bellwether for foreign investors entering the market.

While Saudi citizens have realized many of their leisure aspirations, the large and affluent expatriate community has greater unfulfilled demand, as well as different desires for leisure activities and types of experiences.

Foreign investors who are attentive to these dynamics and seasonal variability in demand stand to profit.

To the kingdom’s benefit, citizens and expats alike are highly enthusiastic about the Neom megaproject and believe it will enhance Saudi Arabia’s international image.

Sign up for a daily briefing on the most important data, charts and insights from Morning Consult.

Saudi Arabia brings to mind oil, striking desert landscapes and perhaps devout pilgrims circumambulating the Kaaba in Mecca. As part of its Vision 2030 initiative, the government would also like you to think of fun.

The main goal is economic: The Saudi government aims to leverage investment in the tourism and entertainment sectors to help diversify the national economy away from oil and position the city of Riyadh as a competitor to other regional hubs like Dubai and Doha. One line of effort has been attracting international brands and talent. But in a country where live music and cinemas had been banned for decades, these economic goals nevertheless signaled the crown’s intention to permit controlled social change in these areas.

As a high-income country, Saudi Arabia is an attractive market for potential investors. Our data suggests Saudi residents will continue to provide an important source of baseline income for realized investments — including ones with foreign participation — in the country’s entertainment sector.

Saudi adults welcome foreign investment in the leisure industry

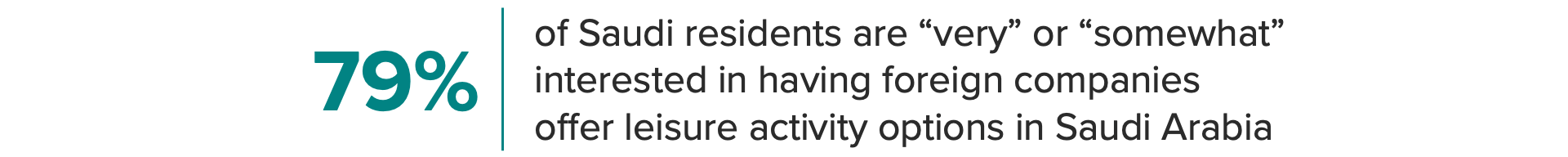

While the liberalization of the entertainment industry and the easing of related social restrictions were top-down initiatives, surveys conducted in December 2022 and February 2023 show that Saudi residents are keen to take advantage of new entertainment and leisure opportunities. They also favor foreign participation in the market.

During the early phases of the COVID-19 pandemic, many investments made with foreign tourists in mind pivoted to cater to domestic ones, including both Saudi citizens and the country’s large expatriate community.

Fortunately, Saudi residents are open to foreign investments in the sector: A large majority said they are “very” (41%) or “somewhat” (38%) interested in foreign participation. But Saudi citizens and expatriates have different ideas about what constitutes fun.

Expats just wanna have fun

Saudi citizens reported participating in leisure activities at a higher rate than expats and have fewer unfulfilled aspirations when it comes to those activities. For two-thirds of the leisure activities asked about in our survey, Saudi citizens were about as likely to say they had done the activity in the previous year as they were to say they wanted to do it in the coming year, indicating their leisure demands are mostly being satisfied. A few less common activities like rock climbing, horseback riding and skiing had much lower participation rates than other activities, but showed relatively high growth potential for the coming year.

Conversely, expatriates reported taking part in leisure activities less often on average, with larger gaps between the share who participated in a given activity and the share who said they wanted to participate in it in the following year. Investors in the sector should take note: Expatriates are a source of untapped demand in the Saudi recreation industry.

Expats in Saudi Arabia Have More Untapped Demand for Leisure Activities

Expats in Saudi wield income on par with adults in other high-income countries

As of 2021, Saudi Arabia’s population included roughly 22 million Saudis and 13.5 million expatriate workers. While the Saudi citizens in our sample reported higher income than expats — partially explaining why efforts to break into the Saudi leisure market have catered to the former — surveyed expatriates’ median household income fell in the range of $28,800 to $38,400 a year, placing them on par with median earners in the United States. For foreign investors, this finding reinforces our outlook that there are benefits to giving expats’ leisure interests a closer look.

Expats Report Lower Income Than Saudis, but High Income by Global Standards

Saudis want luxury, while expats want relaxation

Expats and their Saudi hosts are looking for different recreational experiences. For one, expatriates were more likely to say it was very important to be able to take part in activities with their spouses and children, contravening the common perception of expats as young and single. They also want their leisure time to be meaningful, entertaining and relaxing, but they care less about luxury than Saudi citizens. The latter are more likely to want customized, luxurious and thought-provoking experiences.

Saudis and Expats Want Different Things From Their Leisure Time

Neom unites expats and Saudis

Public perceptions of the proposed Neom megaproject — which includes a 105-mile-long city spanning the width of the Arabian Peninsula — is one area where expatriates and Saudis are aligned. The shares interested in visiting Neom are equal among both groups (89%), and the overwhelming majority of all Saudi residents (85%) agree it will enhance the kingdom’s international image. Most also describe it as luxurious, exciting and unique.

Saudi Residents Are Overwhelmingly Enthusiastic About Neom

Foreign investors should take note of seasonal variability in demand

Large majorities of Saudi residents agree there are enough activities in and between each of the country’s main “seasons,” which are akin to festivals, with specific cities offering a range of activities over a set time period. The two most important are the Riyadh season (from October through January) and the Jeddah season (May and June). The field is especially crowded during the cooler Riyadh season, with a majority of the Saudi public (52%) saying there are enough activities to enjoy.

Saudi Residents Have a Wealth of Options, Especially During the Cooler Months

Spoiled for choice, but spoiling for more

Despite a wealth of options, Saudi residents remain receptive to foreign investment in the leisure space and will be important trendsetters for new projects. Expatriates exhibit relatively strong untapped demand for additional leisure activities regardless of the time of year. This, along with their relatively high incomes and unique preferences for the kind of experiences they wish to have in their free time, makes them a market segment that industry players should examine more closely as they plan for and ramp up local investments.

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].

Aleezah Qasim is a senior manager of client services at Morning Consult.