More Money From “Side Hustles” Provides Spending Tailwind

Key Takeaways

U.S. adults are reporting rising income from business profits.

While self-employed adults rely most heavily on this income, the fastest income growth from business profits is among adults employed by the public or the private sectors, suggesting that a growing portion of these earnings are being derived from “side hustles.”

Many of the same groups earning more income from business profits, including Millennials, middle- to high-income adults and those living in urban areas, have also been driving spending growth.

Entrepreneurship picked up after the pandemic, and the economic benefits of being a business owner are being more widely shared. Morning Consult’s data suggests that, in addition to the resilient labor market, rising income from business profits has become another tailwind helping to support consumer spending.

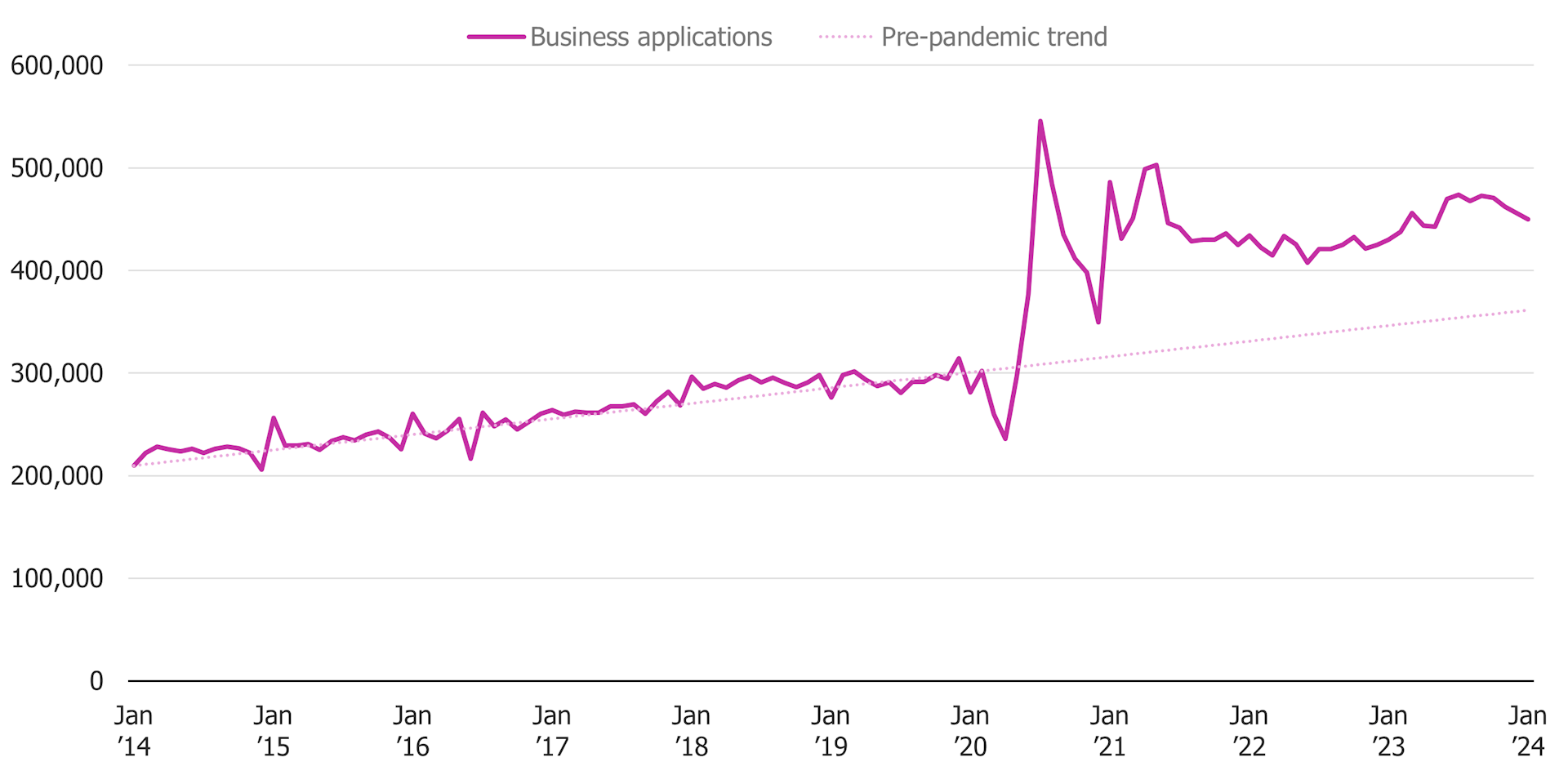

For several years now, Census Bureau data has shown an increase in consumers converting to entrepreneurs: Business formations picked up dramatically in the wake of the pandemic and have remained elevated through January 2024. Many of these fledgling businesses are consumer-facing: 35% of applications in January were for sectors such as retail, food services, entertainment, health and education. Over the course of the past year, cooling inflation and a resilient labor market have helped support consumer spending, boosting profits for businesses large and small. Morning Consult’s own Small-and-medium-sized business report revealed growing optimism among small business owners in recent months, and the Conference Board data showed CEO confidence steadily improved through early 2024.

More Americans Are Starting Businesses

Morning Consult’s data details monthly business earnings from a consumer perspective

What’s been less clear is the direct links between business ownership and consumer finances and, in turn, spending. Morning Consult’s monthly tracking of income sources can help illuminate these connections. Each month, Morning Consult Economic Intelligence asks how much money survey takers have earned from various sources, including “profits from a business.”* Over the past year, business profits have accounted for a small but fast-growing portion of monthly income. On average, U.S. adults reported earning $51 from business profits in February 2024, a 140% increase from the $21 reported for the same month a year ago. Additionally, despite making up only about 1% of total monthly income–with wages dwarfing all other sources–the increase in consumers’ reported earnings from business profits accounted for 9% of total income growth over the past year.

U.S. Consumers Earning More Income From Business Profits

Notably, the increase in income from business profits is not limited to self-employed workers. In fact, employees in both private and public sector jobs reported the largest increases in business profits over the past year. This trend suggests more U.S. adults may be supplementing regular wages and salaries from their primary employer with “side hustles”. Self-employed adults remained the most likely to say they earned income from business profits in February (36.5%), however this share was actually 0.3% below its year-ago level. Meanwhile, the shares of private and public sector workers reporting this type of income jumped 3.7 and 3.5 percentage points, respectively, over the past year. In other words, full-time owner-operators of independent bakeries or free-lance graphic designers may be earning quite a bit more than they did a year ago. However, even more growth in business profit income is occurring among those for whom it constitutes a side job on top of their regular employment, like a school teacher who sells jewelry at weekend craft fairs.

Employed Workers May Be Earning More Income From “Side Hustles”

Many of the same groups reporting the strongest income growth from business profits have also been driving spending growth. Millennials, middle- and- high income earners, and those living in urban areas all reported the strongest annual spending growth over the past three months among their peers groups. These same cohorts have reported the largest monthly amounts and the fastest annual growth in business profit income.

Groups Earning More From Business Profits Are Also Driving Spending Growth

Continued proliferation of consumer-entrepreneurs could amplify positive (or negative) spending shocks

Health of the labor market remains the most important determinant for consumer spending growth this year. Shifting patterns in income sources should not be overlooked, however, as they could exacerbate swings in consumer purchasing behavior.

As more everyday consumers rely on business profits to supplement income, the mechanism by which consumer spending influences household earnings becomes more direct. As profits rise and fall, so too do business-owner earnings, in contrast to employed workers whose wages and salaries are typically more stable and take longer to adapt in response to business conditions.

With a majority of the new business formations in recent years tied to retail establishments, consumer spending patterns are likely paramount to the success of these ventures. The growing reliance on business profits among U.S. adults indicated by Morning Consult’s data so far looks to have benefited economic growth by perpetuating a virtuous cycle: More income begets more spending, in turn boosting income and so on at the consumer level.

However, the directness of the link between spending and income facilitated by more consumer-entrepreneurs could prove to be a double-edged sword. A pullback in spending appetite could just as quickly transform this cycle to a vicious one as profits become losses, further dragging on outlays instead of supporting them.

* Note: The “profits from a business” income source does not include income from “dividends, interest payments or other proceeds from invested assets”, which are counted as a separate category in the survey.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]