The Stimulus-Fueled Economic Boom Is Upon Us, Strengthening U.S. Consumers' Finances

Key Takeaways

U.S. consumers are in a strong financial position, with financial vulnerabilities and job insecurities reaching 12-month lows and excess savings increasing among middle-income Americans.

Consumer delinquencies and defaults should remain at historic lows through the end of the summer when homeowners and renters are required to begin repaying missed mortgage and rent payments.

The savings accumulating among middle-income Americans represents the largest opportunity for consumer-facing firms.

U.S. consumer confidence significantly increased during the immediate aftermath of the American Rescue Plan being signed into law, as hundreds of millions of Americans received a third round of stimulus checks. The increase in consumer confidence provided the first indicator that U.S. consumers are ready to spend, but this analysis highlights the other key indicators necessary to understanding the U.S. economic recovery.

Over the past two weeks, additional data has confirmed the strength of U.S. consumers, highlighting which market segments are best-positioned to increase spending in the coming months.

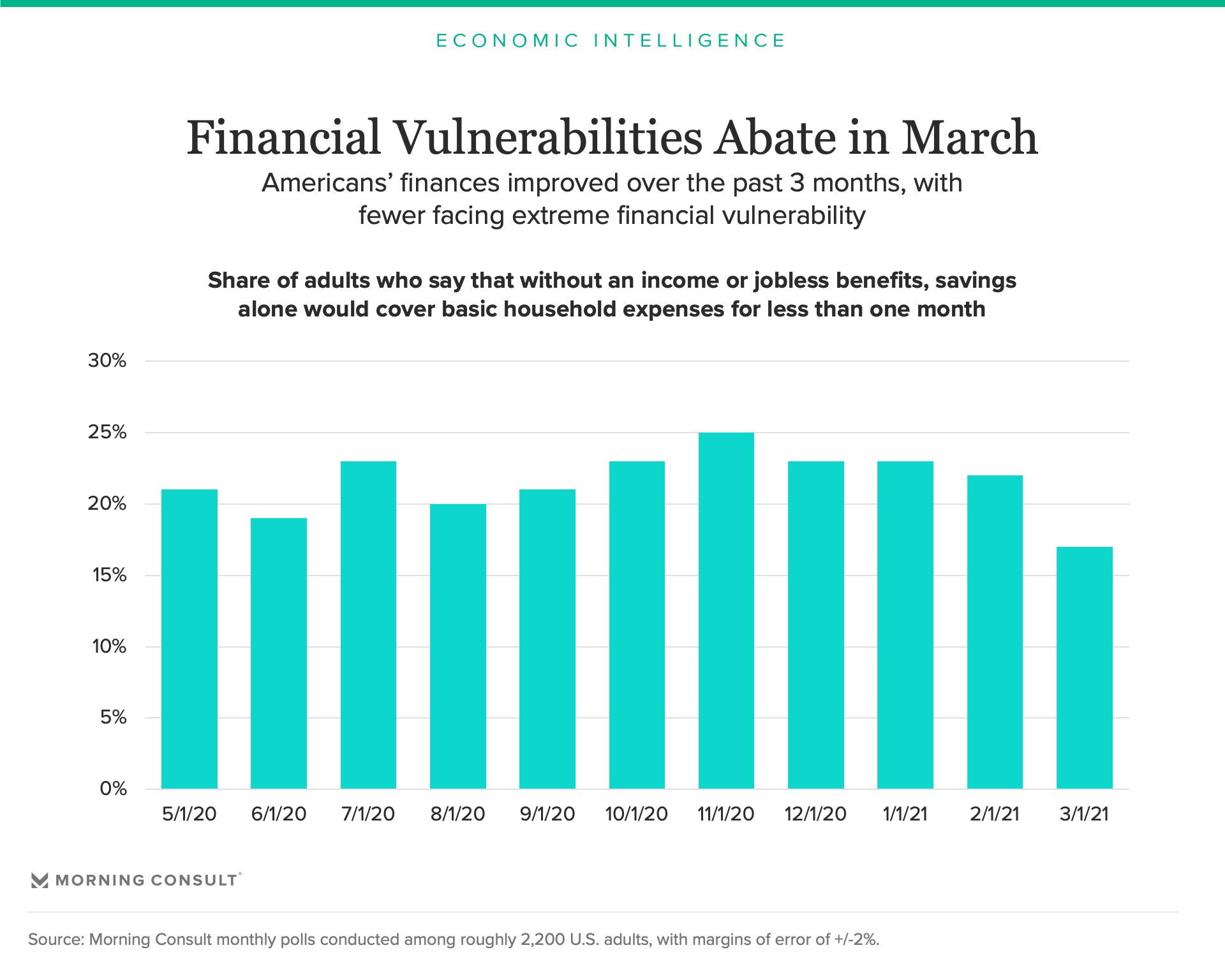

Fewer adults on the brink of financial ruin

Stimulus checks combined with enhanced federal unemployment benefits provided many Americans with a much-needed boost to their savings. In March, 17 percent of adults lacked adequate savings to pay their basic expenses for a full month, down from 22 percent in February and 25 percent in November. The March value is the lowest reading since Morning Consult began tracking this metric May 2020.

By quantifying the adequacy of savings relative to households’ basic expenses, this indicator tracks the share of financially vulnerable Americans. If these Americans were to lose their incomes from their jobs or unemployment benefits, they would not be able to pay their bills for a full month using just their savings. They would either have to rely on debt or default on their financial obligations.

Unlike measures of aggregate savings, this measure of households’ financial strength is not distorted by an increase in savings accruing to a relatively small share of the population. While aggregate personal savings have remained elevated following the passage of the CARES Act in March 2020, the share of financially vulnerable Americans consistently increased from August through November. The most recent reading indicates that stimulus checks from the American Rescue Plan provided financial assistance for those who needed it the most.

Due to these changes, consumer delinquencies and defaults are likely to remain at historically low levels for at least the next six months. By the end of the summer, many consumers will begin repaying mortgage and rent payments that are currently in forbearance. In the immediate future, these deferred liabilities will not harm consumer credit conditions.

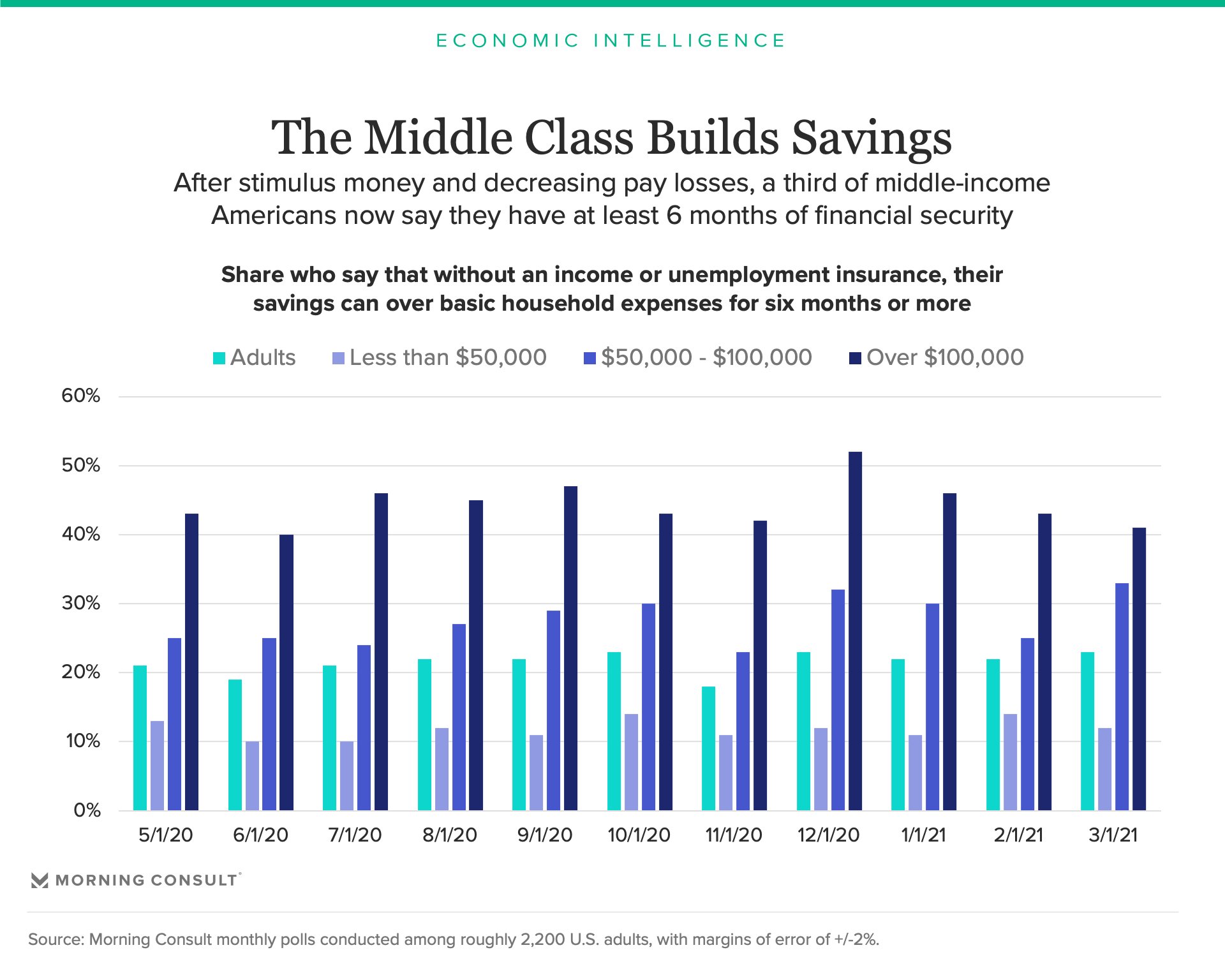

Middle-market opportunities

The share of middle-income consumers (i.e., incomes between $50,000-$100,000) with savings capable of paying basic expenses for six months or more increased in March to 33 percent, the highest value recorded since Morning Consult began tracking this indicator in May 2020. Additionally, the gap between high-income (i.e., incomes above $100,000) and middle-income adults with at least six months’ of savings narrowed to its lowest level over the past 11 months.

The increase in savings among middle-income adults reflects their eligibility for the third round of stimulus checks combined with decreases in pay and income losses among this group of consumers. In other words, not only are middle-income adults more likely to have received a third stimulus check than high-income adults, they also are able to put more of their checks into savings since they can use income to pay their expenses.

These recent developments indicate that there is greater purchasing power among middle-income households than there has been since May 2020. This middle-income market segment is likely to account for a larger share of total consumer spending over the next three to six months than it did during the recovery last May and June.

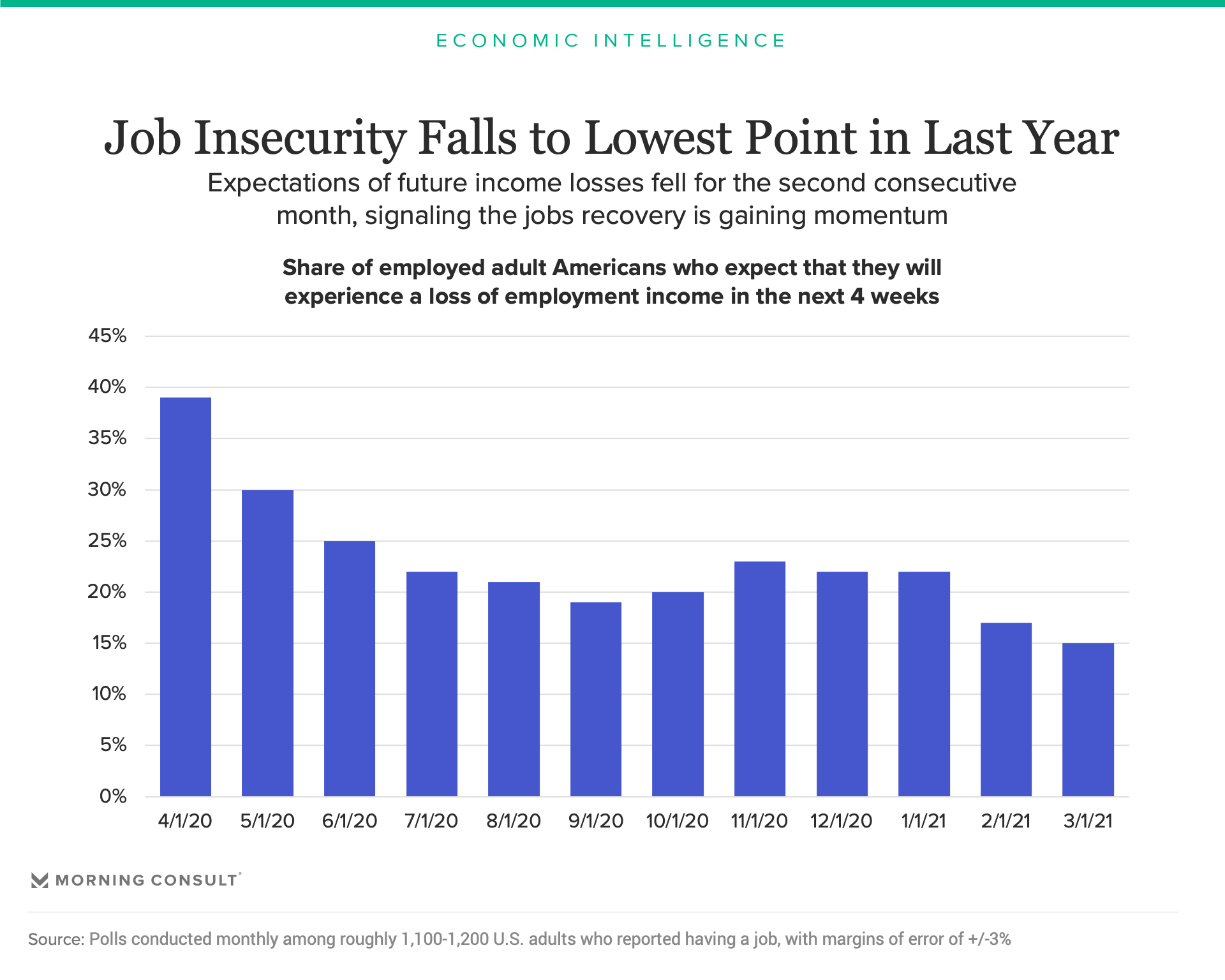

Employment expectations

The impact of the American Rescue Plan on Americans’ savings will last longer than the impact from the CARES Act since labor market conditions are stronger now than they were in April and May of last year.

Job insecurity among employed workers decreased for the second consecutive month in March. Among workers who had a job in March, 15 percent expect to experience a loss of pay or income over the next four weeks, down from 17 percent in February and 22 percent in January.

The dramatic improvement in workers’ optimism over the past three months provides the strongest indication that a robust employment recovery is gaining momentum. Workers live and breathe the day-to-day business conditions on the ground, and they sense that their employers are faring better than they did in January. That increase in demand for businesses’ products and services translates into a greater demand for labor, which is reflected in workers’ growing job security.

Taking a longer-term perspective, workers are significantly more confident now than they were a year ago. In April 2020, 39 percent of employed workers expected to experience a loss of pay or income over the next four weeks. That number gradually fell until October, when the benefits of fiscal stimulus expired and the United States experienced a dramatic increase in the number of new COVID-19 cases.

Low and falling levels of job insecurity not only bode well for the jobs recovery, they also speak to the issue of savings being converted into consumption. As long as workers retain their existing sources of income from employers, they will not need to hold onto as much of their savings, allowing them to increase consumption.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]