How the 'Less Is More' Mindset Could Hurt Perceived Value of Major Video Streamers

Key Takeaways

Video streamers’ content cost-cutting efforts can’t come at the expense of taking risks on expanding original franchises and licensing hits that originated on linear TV.

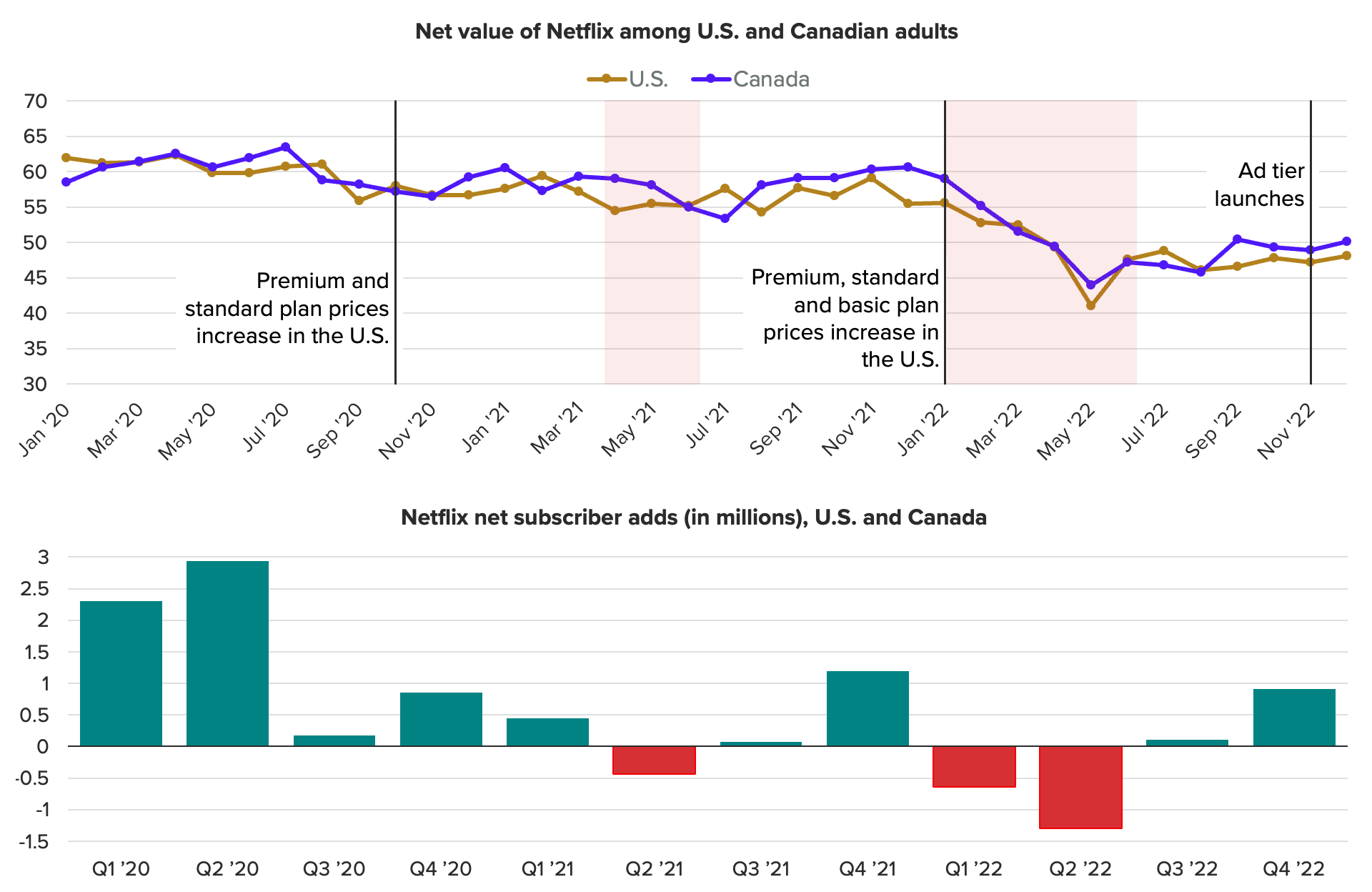

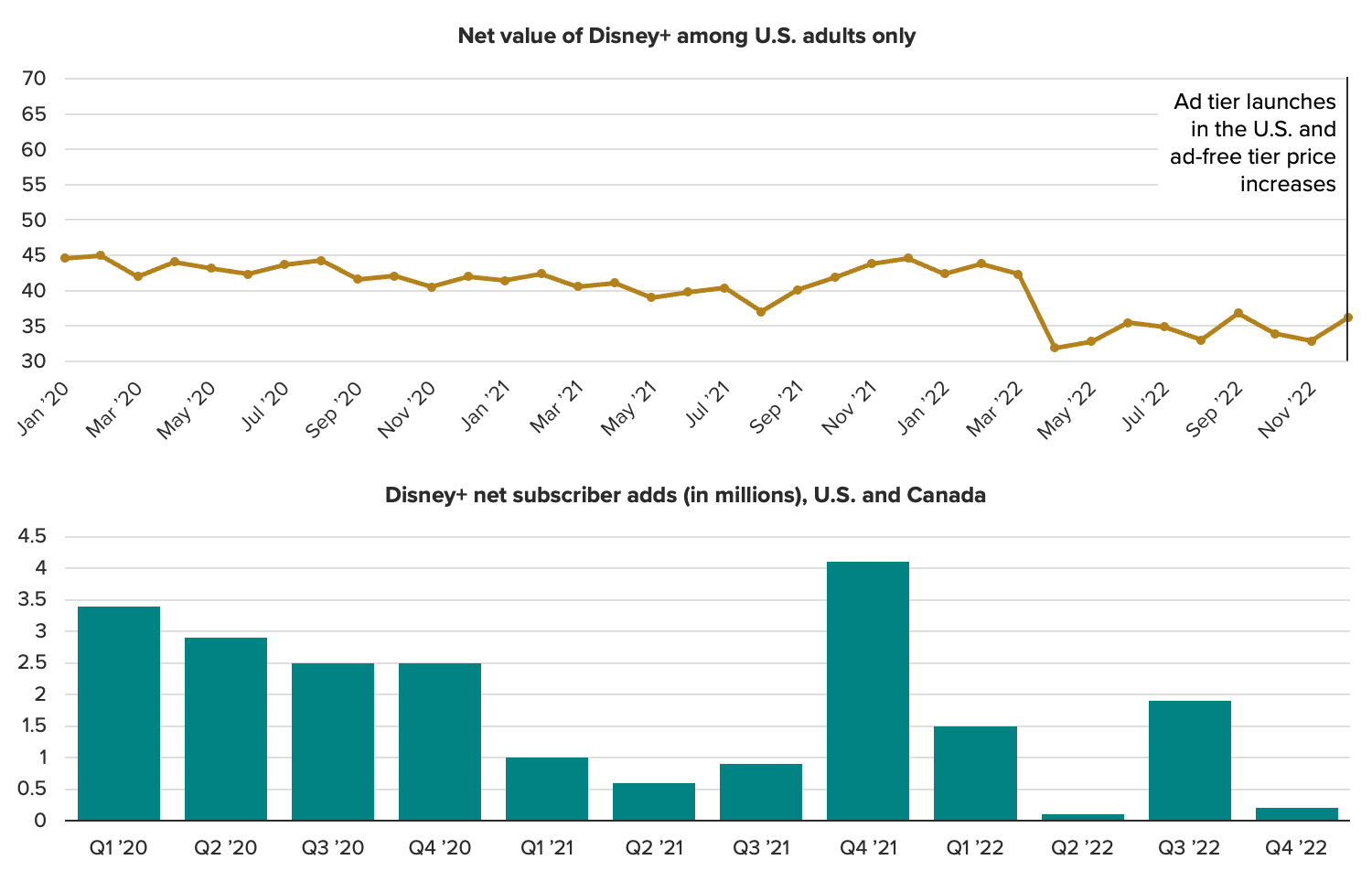

Netflix and Disney+ need to be especially mindful of this: Morning Consult Brand Intelligence data shows the net value of each dipped by around 10 points between January 2020 and December 2022.

Our net value scores, which help depict the health of a subscription-based business, show why it’s paramount for major video streamers to prove their worth to consumers in 2023.

Sign up for our daily entertainment news brief to get the latest entertainment industry news and analysis delivered to your inbox every morning.

Netflix’s 2022 subscriber losses spooked the entertainment industry into collectively agreeing that there’s another, more profitability-minded, way to grow. The once unthinkable acts of offloading titles and supplying rivals with content now seem like the cost of admission to the streaming wars. For example, in the past two months alone, Netflix has surrendered TV series and completed movies, while Disney has reportedly considered shifting its strategy to allow for more licensing of content to rivals.

But better-than-expected fourth-quarter subscriber results from Netflix and Disney+ show that, as streamers prioritize profits, things aren’t as dire as we once feared they could be.

While licensing content and eliminating low-performing titles can be a boon for the bottom line, things shouldn’t otherwise be business as usual for these two streamers: Data from Morning Consult Brand Intelligence, which tracks various brand health metrics for thousands of brands, shows that net value has dipped notably since 2020 for both Netflix and Disney+. We measure net value as the share of consumers who said a service provides good value minus the share that said it provides bad value. This metric can help streaming executives understand how subscriber growth on major platforms will fare in the coming months.

Steadily building out original franchises and licensing hit shows are critical to improving net value scores. Nearly all streamers’ libraries are big enough that making these types of additions periodically, rather than consistently adding batches of lower-profile titles, is likely appreciated most by consumers.

Why declining net value is bad for leading video streamers

Of the major U.S. subscription-based video streamers measured by Morning Consult Brand Intelligence, Netflix and Disney+ saw the largest drops in net value between January 2020 and December 2022.

Because MCBI net value scores are based on consumer surveys, rather than credit card spending data, they’re not interchangeable with churn rates. But net value is nonetheless useful for streaming strategy professionals — while consumer spending data can reveal how many consumers got to the point of canceling a service, trended consumer research helps confirm why they got to that point in the first place.

For example, the second quarter of 2022 ended up being better than expected for Netflix, but its first-half loss of nearly 2 million subscribers in the United States and Canada still felt surprisingly steep once it was officially reported in July. However, in the months prior, MCBI data had been showing that domestic consumers were becoming significantly less satisfied with the content the service was offering in relation to its price.

Between January and May 2022, the net value of Netflix dipped by about 15 points among respondents in both the United States and Canada. This drop in Netflix’s net value score was steeper than that of any comparable period since January 2020, and also coincided with two consecutive quarters of UCAN sub losses.

Third-party datasets would have shown elevated churn levels for Netflix in early 2022, but MCBI’s net value metric helps confirm that churn changes are also tied to longer-term value perceptions of the service, since churn is more capable of demonstrating single-title reactions than net value. While a consumer could cancel a service due to something like “Cuties,” they might still deem it as having good value despite offering one title they find objectionable.

While net value captures general intent from all consumers, rather than just a service’s subscribers, it behooves companies to know general value perceptions and whether the public thinks a streamer’s monthly fee is justified. After all, gaining new customers, rather than just retaining existing ones, is of paramount importance in the saturated domestic streaming market.

How Morning Consult Brand Intelligence’s net value metric can inform content strategy

Aside from Netflix, MCBI data can also shed light on how Disney+ has managed its late entry into the streaming market over the past few years. Disney+ has not been as publicly vocal about password-sharing concerns as Netflix, but it still needs to more compellingly convince consumers that its monthly fee is justified. The U.S. net value score of Disney+ between the beginning of 2020 and end of 2022 dipped by nearly 10 points. (Morning Consult does not currently measure the net value of Disney+ in Canada, but it’s likely the majority of the streamer’s UCAN subs still come from the United States.)

Moreover, the average U.S. net value of Disney+ in 2022 (36) was lower than it was in the two years prior (43 in 2020 and 41 in 2021). This low net value coincided with the addition of fewer UCAN subscribers to Disney+ in calendar 2022 than in 2021 and 2020.

The trend in the U.S. net value scores of Netflix and Disney+ suggests that they must be especially deliberate in their decisions to license out or offload shows, even though content quantity isn’t everything.

Being more deliberate in licensing decisions could take the form of licensing out more titles on a nonexclusive basis, as well as placing more of an emphasis on securing the rights to classics with hundreds of hours of runtime like “Friends” or “Grey’s Anatomy.” Franchises of that caliber aren’t frequently up for grabs, but they’re particularly important for streamers to lock down, as they can easily drive up viewership hours (something of high value to advertisers) and help attract older audiences (which are less saturated with video streaming subscriptions than younger ones).

The deals surrounding many of streaming’s biggest licensed shows vary, but many prominent deals reportedly are on half-decade terms: Five-year deals for “Friends” and “The Big Bang Theory” began on HBO Max in 2020, while deals of that length began for “The Office” and “Seinfeld” on Peacock and Netflix, respectively, in 2021. So the talks to lock down these prized TV assets won’t heat up for a couple of years.

Lessons learned from newer streamers for 2023 and beyond

For an example of how library titles can boost a streamer’s fortunes, look at NBCUniversal’s Peacock, which hit a record high U.S. net value of 36 in December 2022. The service had been largely ruled out as a streaming-wars also-ran until recently.

One reason for this success was Peacock’s housing of the first four seasons of “Yellowstone,” one of the biggest shows of 2022, which helped the streamer break into Nielsen’s top 10 series ranking for the first time ever. It has also been the exclusive U.S. streaming home of “Parks and Recreation” and “The Office” for years — still big selling points for many consumers.

But what will be critical for Peacock (and other major streamers) to solidify a new period of meaningful growth is a reliable output of blockbuster original series. Peacock still lacks a successful original on the scale of “Stranger Things” or “House of the Dragon.” The blend of pricey exclusive content and classic hits undoubtedly contributed to HBO Max’s 14-point rise in net value from its launch month to December 2022.

The need for both licensed TV hits and big-budget originals in the streaming wars seems antithetical to the current media climate, which prioritizes profits as much as subscriber count. But the message isn’t to revert to the “growth at all costs” stage; rather, it’s that streamers can’t focus so much on cost-cutting that they overlook opportunities to expand original franchises or to lock down the rights to classic TV shows that would help position them well for long-term growth.

Kevin Tran previously worked at Morning Consult as the senior media & entertainment analyst.