Understanding Consumers’ Response to Rising Prices with Morning Consult’s New Framework for Supply Chains and Inflation

Key Takeaways

Supply chain disruptions continue to plague the price and availability of goods and services for U.S. consumers.

While purchases of staples like groceries and gas are bearing most of the weight from rising prices, purchases of discretionary goods and services have also begun to adjust to higher prices.

Disrupted supply chains and inflation are affecting the purchasing behavior of lower-income adults more so than their higher-earning peers: Adults from lower-earning households are more likely to report higher price sensitivity and a greater willingness to substitute with lower-priced alternatives.

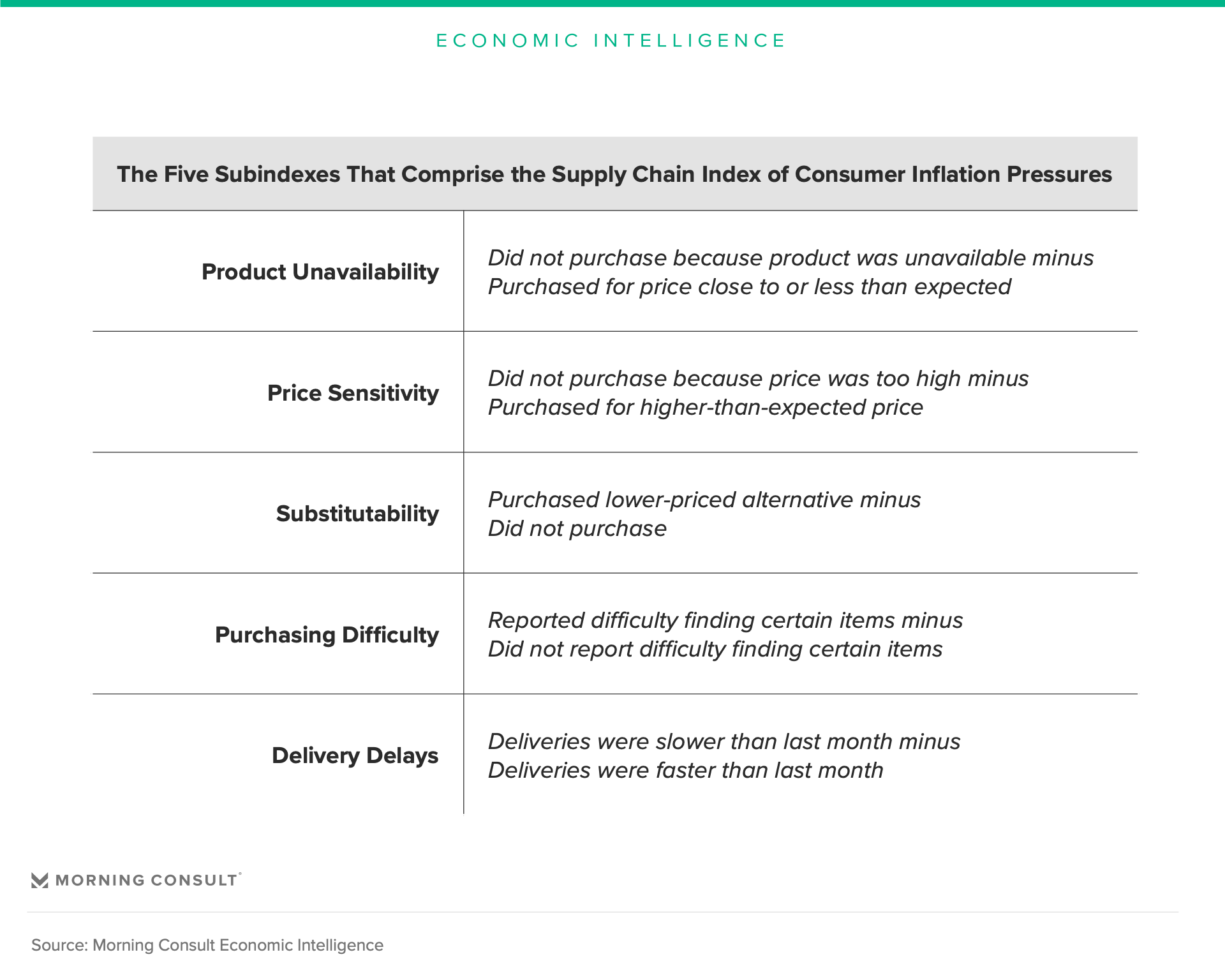

Morning Consult’s new subindexes track supply chain disruptions and inflationary pressures from the consumer perspective, providing insight into how U.S. adults are responding to rising prices and shortages across different types of goods and services. The table below describes the five subindexes:

The subindexes can be grouped by demographic, enabling evaluation of how various characteristics — such as income — might influence consumer purchasing behavior. The following analysis compares index scores from March 2022 by product and service groups and by income, offering a first look at the real-world insights that can be gleaned from these new subindexes.

More information on the Supply Chain Index of Consumer Inflation Pressures framework and methodology can be found in the full report.

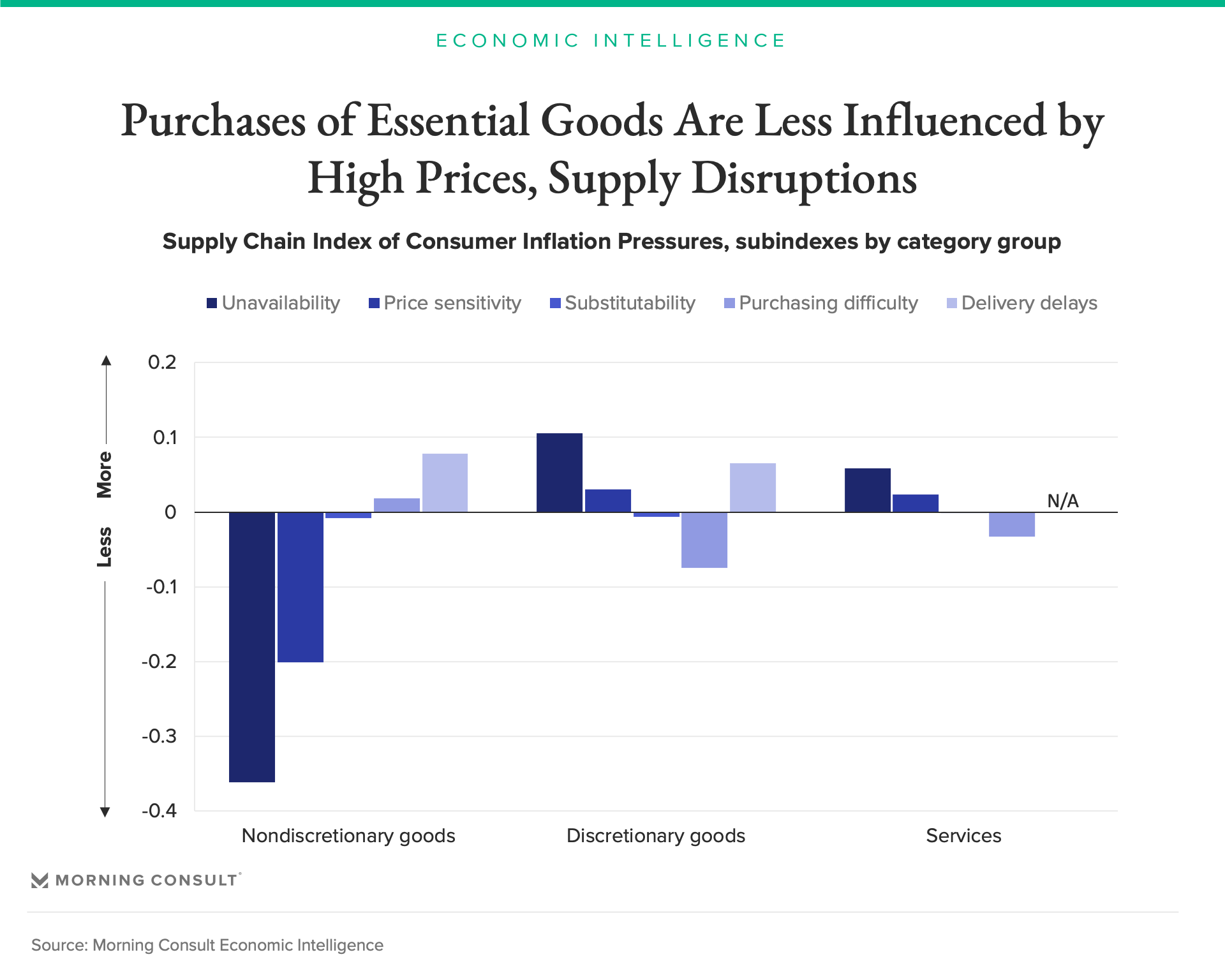

Demand for nondiscretionary goods is relatively inelastic

For the purpose of this analysis, essential goods include groceries, gasoline, paper goods and personal care products. When facing high prices or product unavailability in March, U.S. consumers were less willing to abandon purchases of household essentials than they were purchases of services or discretionary goods. Nondiscretionary goods were the only category with negative scores for price sensitivity in the new framework, meaning consumers opted to purchase these goods even in the face of elevated prices. Goods like groceries and gas fulfill vital needs, so consumers must purchase these items regardless of price.

The grocery category — which accounts for a relatively large share of nondiscretionary goods spending — continues to see supply chain disruptions, but most consumers eventually track down the elusive items. This finding is supported by two seemingly contradictory pieces of evidence: In March, nondiscretionary goods registered the highest purchasing difficulty score, which tracks how hard it is to find various products. But they also had the lowest score for unavailability, meaning relatively few adults chose not to purchase these goods because they were unavailable. When necessities like groceries are out of stock — as was often the case in March, according to the Purchasing Difficulty subindex — consumers expend additional effort to track them down, resulting in relatively few lost purchases of nondiscretionary goods due to unavailability.

In contrast, discretionary goods scored highest for unavailability and price sensitivity. This group contains items like furniture and electronics that typically aren’t oriented toward meeting critical, time-sensitive needs, so consumers facing frictions like higher-than-expected prices or unstocked shelves are more inclined to abandon these purchases. Discretionary goods also had lower purchasing difficulty and delivery delays than non-discretionary goods, suggesting nonessential products may be facing slightly less supply chain tension than staple goods.

Services are often treated like discretionary goods

Consumers’ purchasing behavior for the services tracked in Morning Consult’s Supply Chains and Inflation Survey — which includes both discretionary and nondiscretionary services — resembled their buying patterns for discretionary goods. Although services like shelter and health care are critical to overall well-being and might be expected to more closely mimic essential goods in their index scores, often these purchases can also be delayed for a time. For instance, there is usually a more flexible time horizon for procuring homes or appointments than for buying gas and groceries. The relatively low cost of deferring services — even essential ones — results in purchasing behavior that is more in line with discretionary goods.

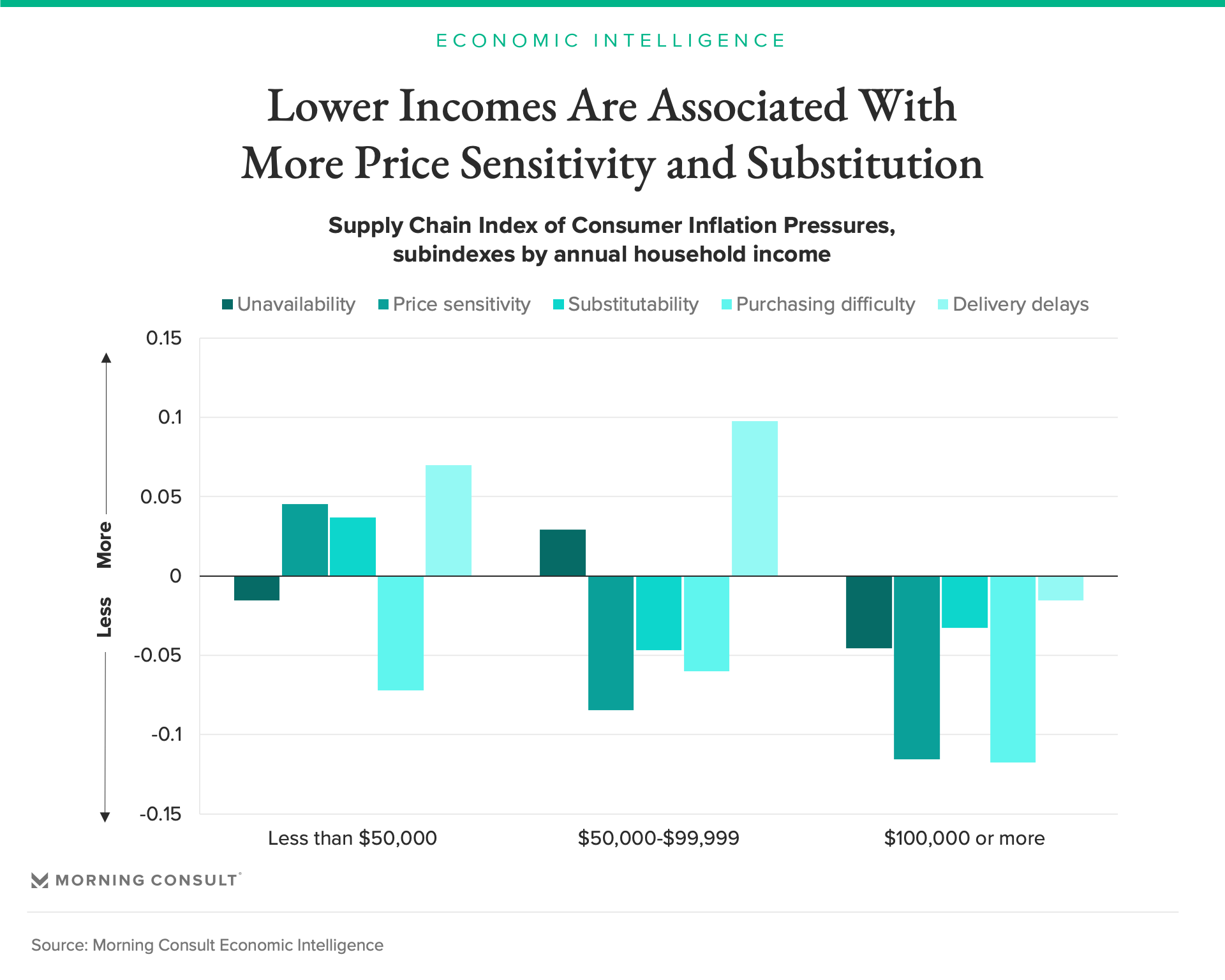

Higher-income adults’ purchasing behavior appears less affected by supply disruptions and inflation

In addition to grouping the subindexes by product or service category, they can also be sliced by demographic groups, such as annual household income. As might be expected, income levels appear to have a strong influence on consumer responses to rising prices and shortages. Supply chain disruptions and inflationary pressures were negatively correlated with income in March: The lowest income group had three of five subindex values above zero, the middle income group had two, and the highest earners had all negative values.

Adults with household incomes of less than $50,000 per year expressed greater price sensitivity than their higher-earning counterparts and were also more inclined to seek out lower-priced alternatives when faced with higher prices due to supply chain disruptions. Adults in the middle income group, with household incomes between $50,000 and $99,999 per year, were the most likely to report product unavailability or delivery delays.

Meanwhile, higher-earning households appeared to be the least price sensitive, the least likely to face purchasing difficulty or unavailable products, and the least likely to experience delivery delays. Higher incomes typically equate to more spending capacity, which enables access to a wider range of potential purchases since price is less of a limiting factor. Having more options increases the likelihood that a given item is available and affordable.

Coming soon: time series

Analyzing subindex scores for a single point in time provides useful insight into consumer purchasing behavior. Understanding consumer responses to inflation for essential versus nonessential goods or services is useful for businesses seeking to understand how the market will react to various pricing or supply chain developments. Similarly, demographic breakouts help isolate the nuances of purchasing behavior for specific customer groups. In the future, these subindexes offer the potential to unlock even greater value with the added dimension of time series data, which will be collected in the coming months.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Scott Brave previously worked at Morning Consult in economic analysis.