Employment Growth Stalls in May (Again)

Key Takeaways

The U.S. employment recovery ground to a standstill in May, with elevated pay and income losses, high unemployment and low labor force participation all signaling that the road to recovery will be bumpier than many imagined.

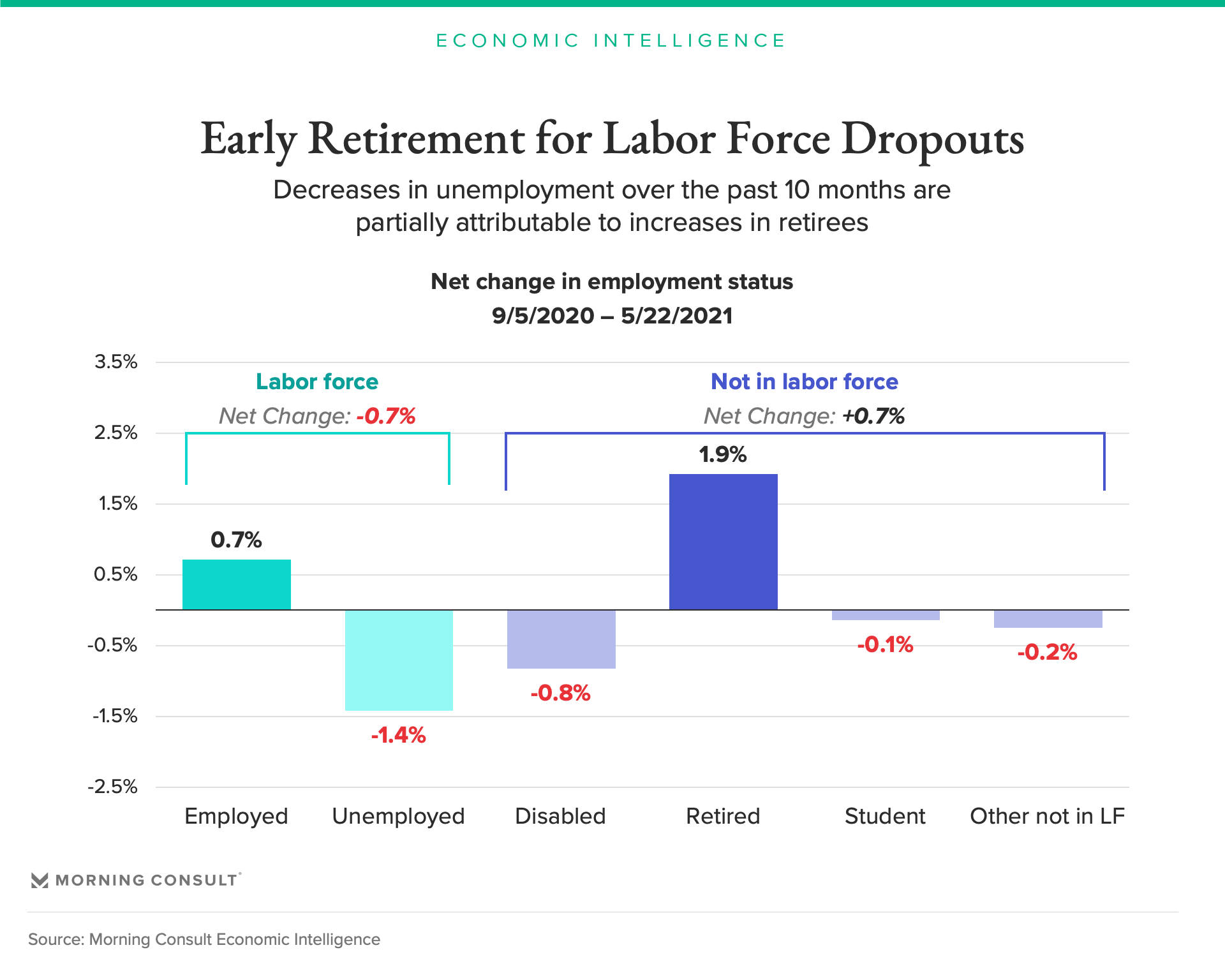

Over the past 10 months, most workers who dropped out of the labor force indicated that they had retired, suggesting that recent decreases in labor force participation are likely to persist even after the economy fully reopens.

Faster job growth is necessary over the summer to replace lost income from expiring federal unemployment benefits and to repay missed mortgage and rent payments.

The following analysis is based off of Morning Consult’s high frequency economic indicator data. Read more from our June 2021 U.S. Economic Outlook report.

The U.S. employment recovery ground to a standstill in May. Elevated pay and income losses, high unemployment and low labor force participation all signaled that the road to recovery will be bumpier than many imagined a few months ago. While the U.S. economy will likely add jobs in the coming months, the timing of the employment recovery matters. Additional delays in the timing of the employment recovery pose serious risks to the economic outlook over the next four months, particularly if households’ finances weaken before workers have additional wage income to pay their bills.

Fortunately, households’ finances remained strong enough through the end of April to withstand the slowdown in job creation, but the clock is ticking. Federal unemployment benefits are winding down, missed rent and mortgage payments are coming due, and prices of basic goods like gasoline and groceries are rising. Without additional income from jobs, millions of Americans will begin cutting back on spending and eating into their savings in June, leaving the consumer-driven economy more vulnerable in the months ahead.

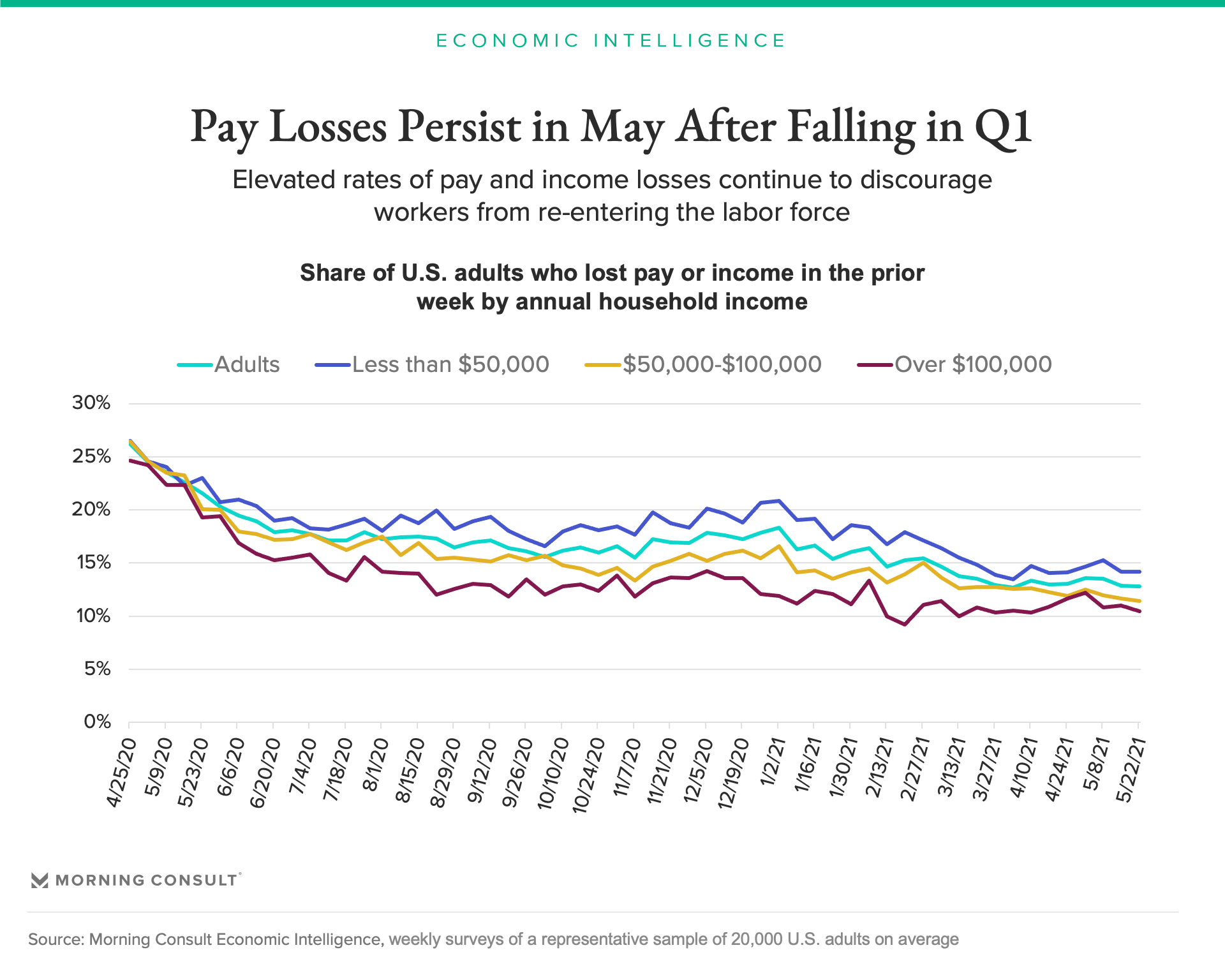

Pay losses

Pay and income losses remained elevated across the income spectrum at the end of May, indicating persistent weaknesses in the demand for labor. For the week ending May 22, 12.8 percent of the U.S. adult population experienced a loss of pay or income at some point during the prior week, essentially unchanged from the last full week of April.

The rate of pay and income losses has to fall further for workers who dropped out of the labor force to start looking for work. It is difficult for discouraged workers who stopped looking for work to justify spending the time to apply for jobs when they see their spouses, neighbors and friends continuing to lose pay or income.

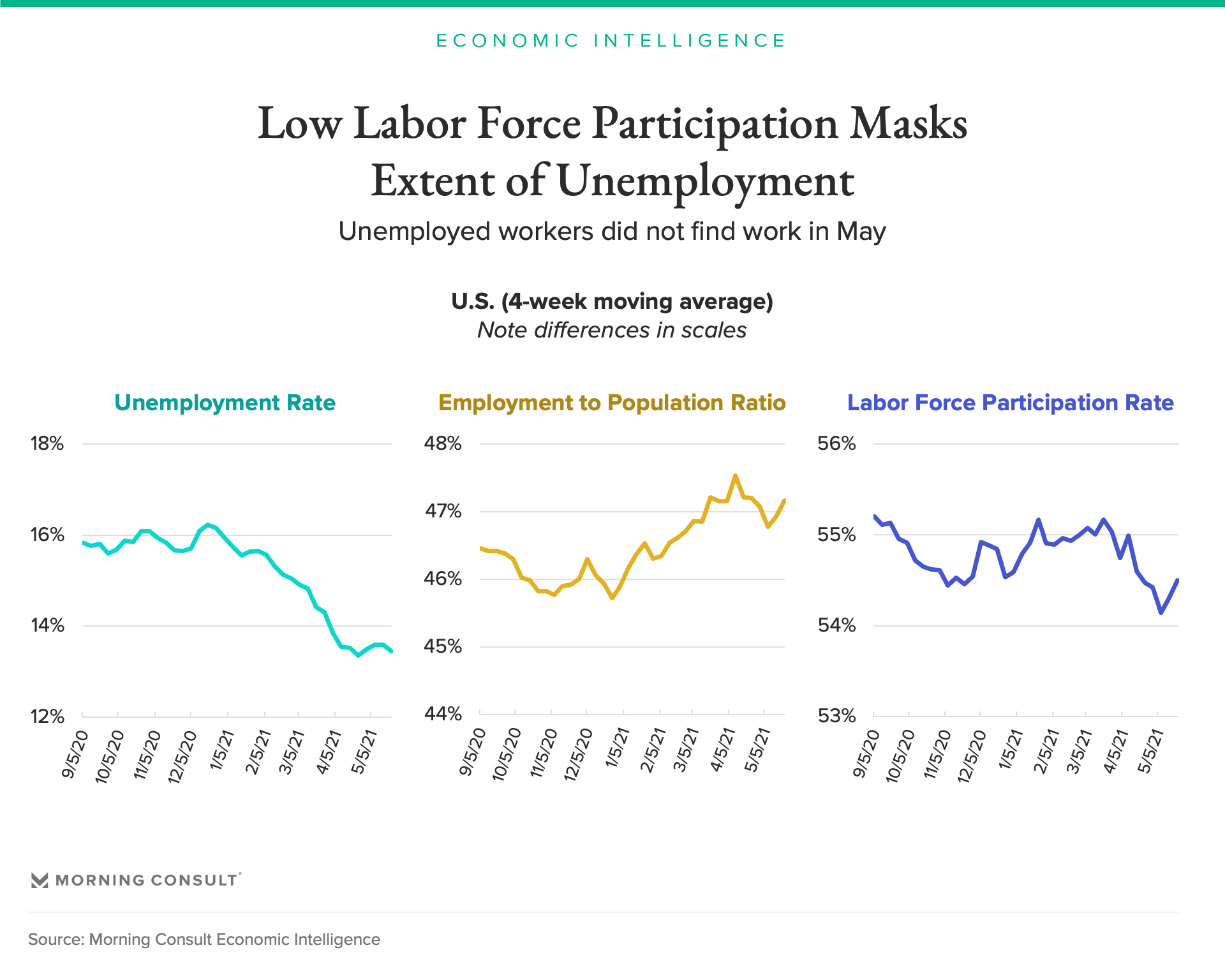

Unemployment and labor force participation

The unemployment rate in May remained essentially unchanged from April, stalling at 13.4 percent for the week ending May 22. However, low labor force participation rates in May mask additional weaknesses in the employment recovery not captured by the unemployment rate. At 54.5 percent, the labor force participation rate currently stands 0.7 percentage points below its value on Aug. 5, 2020. This decrease in labor force participation reclassifies previously unemployed adults as being out of the labor force, leading to a lower unemployment rate.

While many workers who drop out of the labor force are likely to re-enter once their prospects of finding a job improve, some of them will be permanently out of the labor force. From Aug. 5, 2020, to May 22, 2021, most workers who dropped out of the labor force indicated that they had retired. Growth in retirees suggests the recent fall in labor force participation will persist well after the economy reopens since retirees are less likely to return to the labor force than those that left for other temporary reasons such as school.

Looking ahead

The standstill in the employment recovery occurs against the backdrop of additional demands on workers’ wallets. Federal unemployment benefits are being phased out in some states as early as June 12, and the benefits expire across the country on Sept. 6. Homeowners and renters who have been in forbearance for the past 12 months are also on the hook to start repaying rent and mortgage payments they have not been making. Finally, rising gasoline prices are leaving households with less to spend on discretionary purchases.

Read more from our June report on the U.S. economic outlook.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]