The Economy Is Thriving, So Why Are Consumers Unhappy?

Data Downloads

With robust sample sizes, Morning Consult’s public opinion data can be analyzed by specific demographics, such as gender, generation, political party, income, race and more. Please contact [email protected] to purchase this data.

Prices are a top concern for consumers

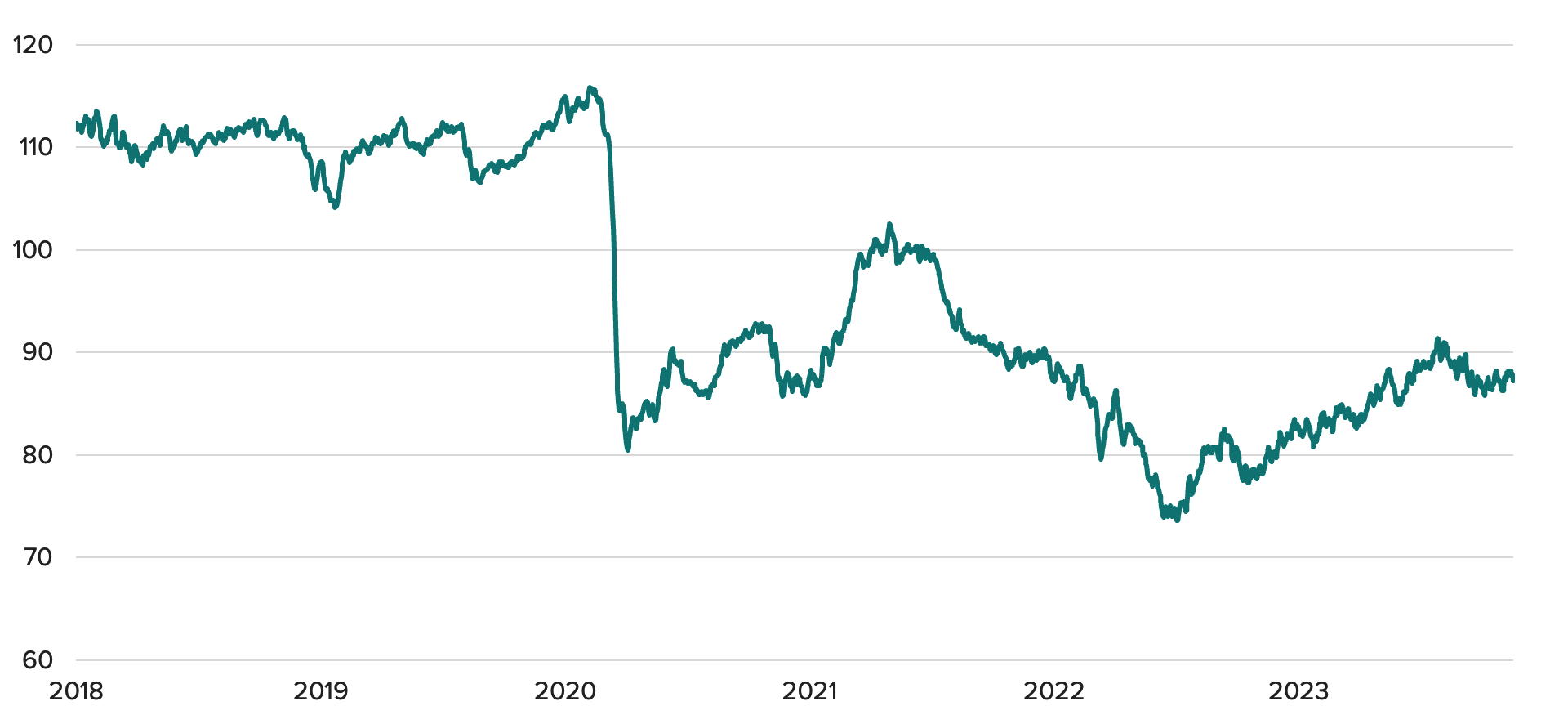

Although the unemployment rate is near historic lows, price growth has come down from its highs last summer and gross domestic product continues to grow robustly, consumers’ moods are dour: 80% of respondents in a recent Morning Consult survey gave the economy a C rating or below. In addition, consumer sentiment indexes, including Morning Consult’s daily Index of Consumer Sentiment, have not recovered to their pre-pandemic levels, even though many economic indicators show conditions better than or close to pre-pandemic levels.

Consumer Sentiment Has Not Bounced Back From the Pandemic

5-day moving average

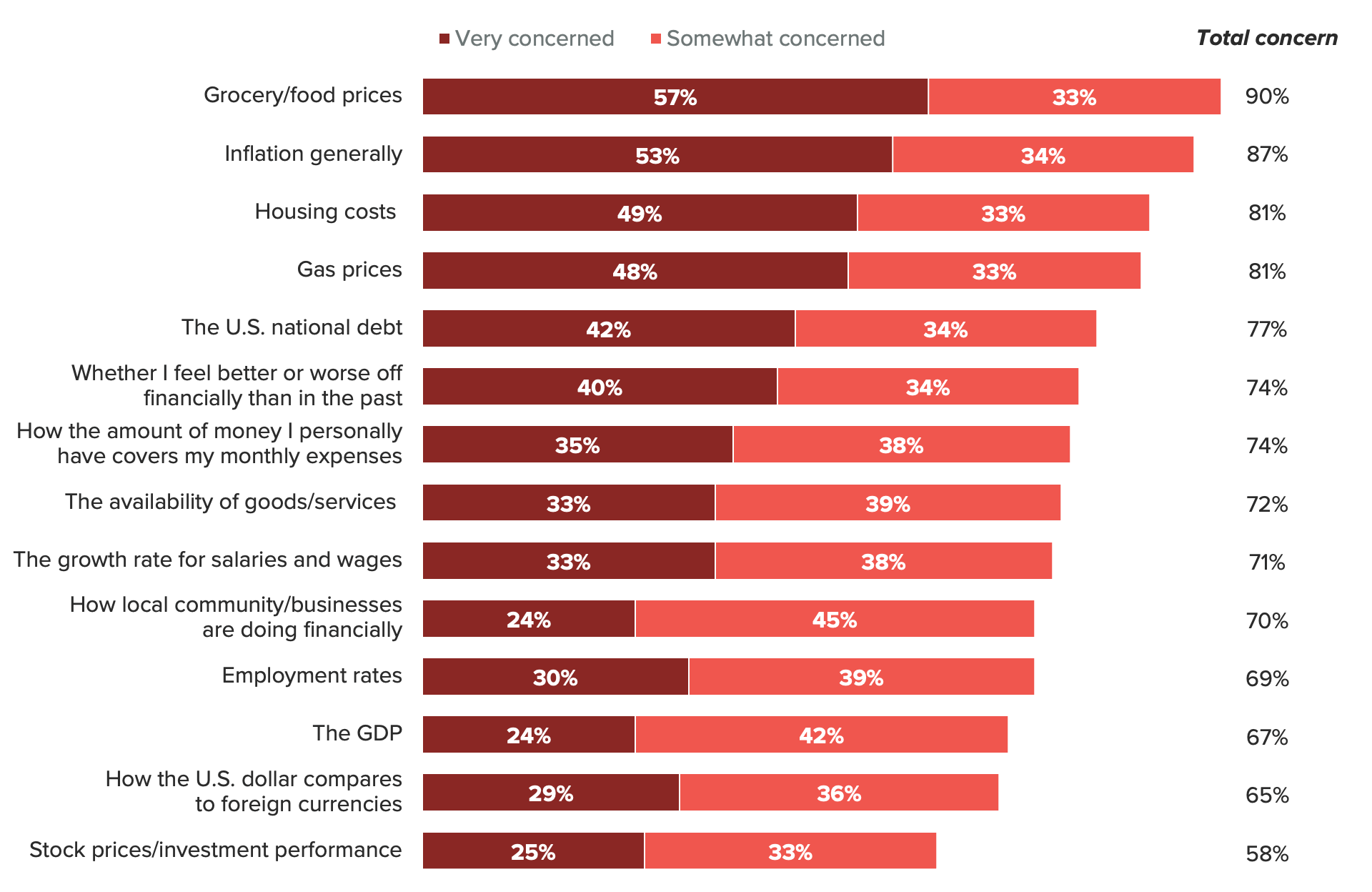

When asked about what concerns consumers have about the economy, prices and inflation are at the top of the list: 90% of consumers are “somewhat” or “very” concerned about grocery and food prices, followed closely by inflation in general. Housing costs and gas prices are also major worries for consumers, with more than 4 in 5 respondents expressing concern. In addition, consumers are more likely to be very concerned about inflation or prices than somewhat concerned, highlighting the particular worry they have regarding high prices. While a majority of adults are also concerned about employment rates and wage growth, respondents were more likely to be somewhat concerned about them rather than very concerned.

When Asked About the Economy, Consumers Are Most Concerned About Inflation and Prices

Concerns about prices remaining above their pre-pandemic levels are roughly as high as concerns about price growth

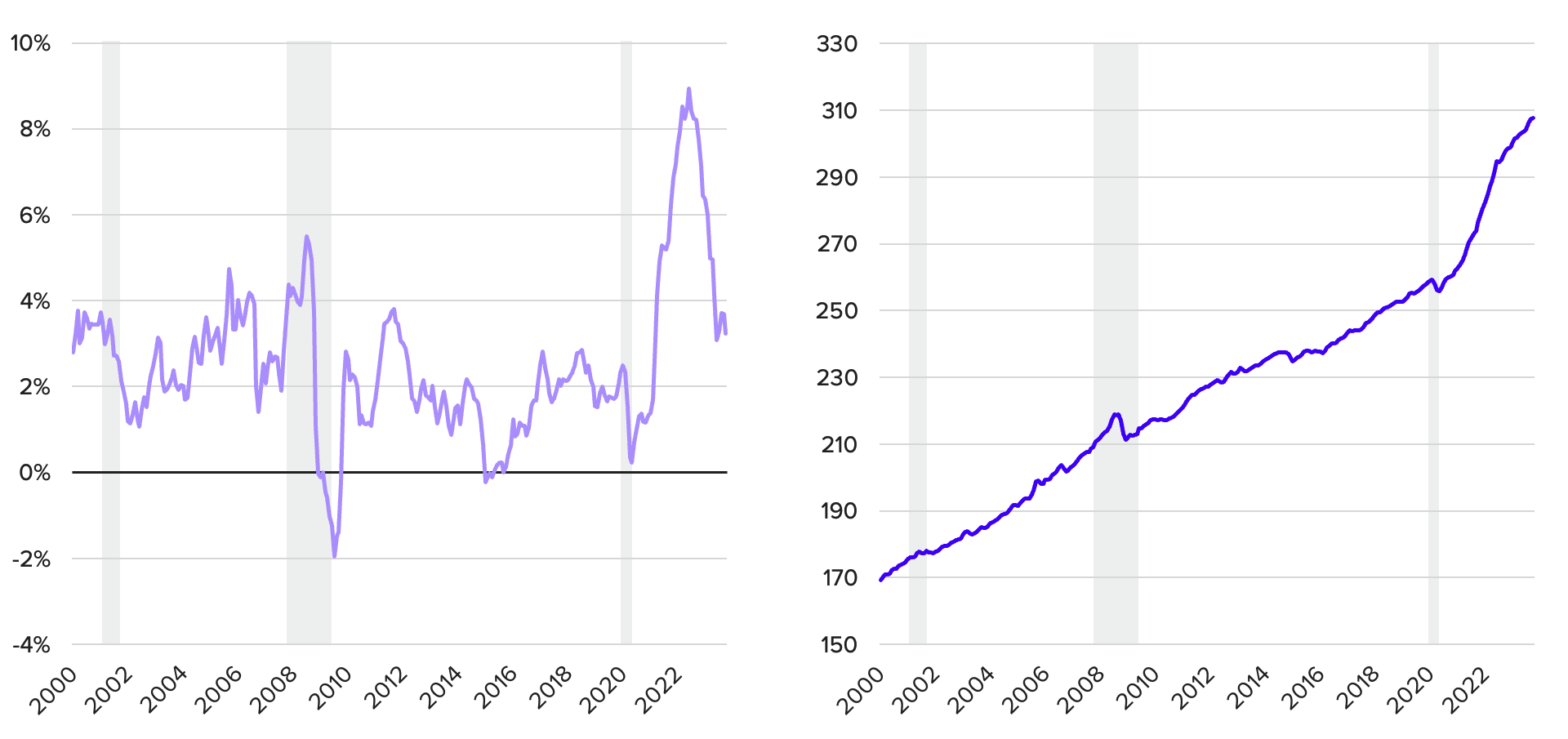

Inflation Is Down but the Price Levels Are Higher Than Ever

Year-over-year change in inflation (left) and price level index 1982-1984=100 (right)

Inflation, or the increase in prices, slowed to 3.2% in October, down from a high of nearly 9% in mid-2022. However, a decrease in inflation, or disinflation, is not the same thing as deflation, a reduction in the level of prices. Price levels overall generally go up over time, and they remain elevated relative to the pre-inflationary period.

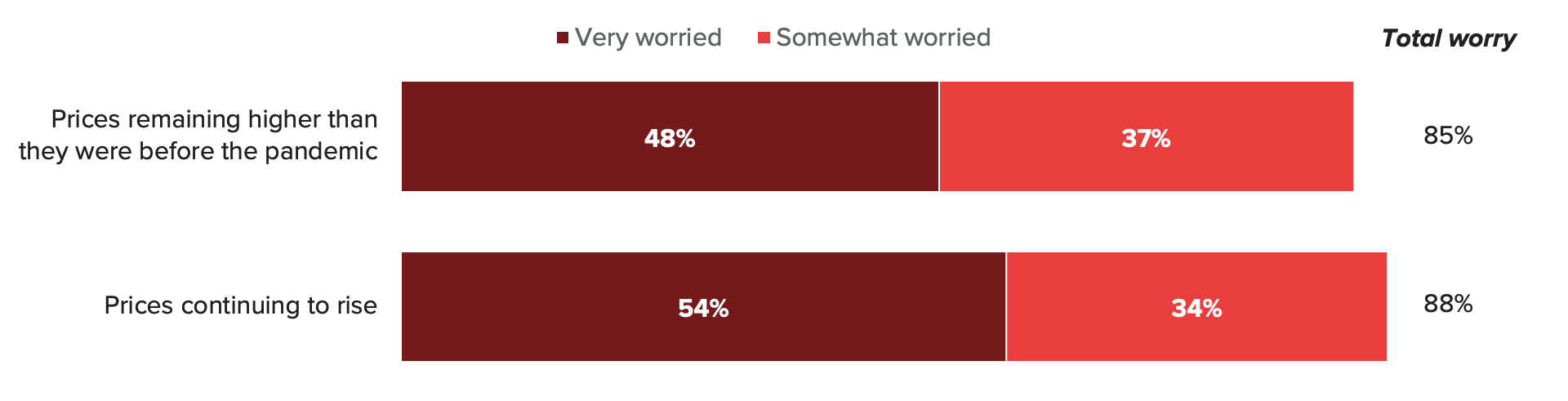

Consumers Are Almost Equally Worried About Price Growth and Price Levels

However, consumers are roughly as concerned about price levels as they are about price growth. When asked about their concern for each, consumers were slightly more likely to be worried about prices growing (88%) than they were to worry about the prices remaining above where they were in 2019 (85%).

Consumers really do dislike high prices: They would rather prices go down than their wages go up

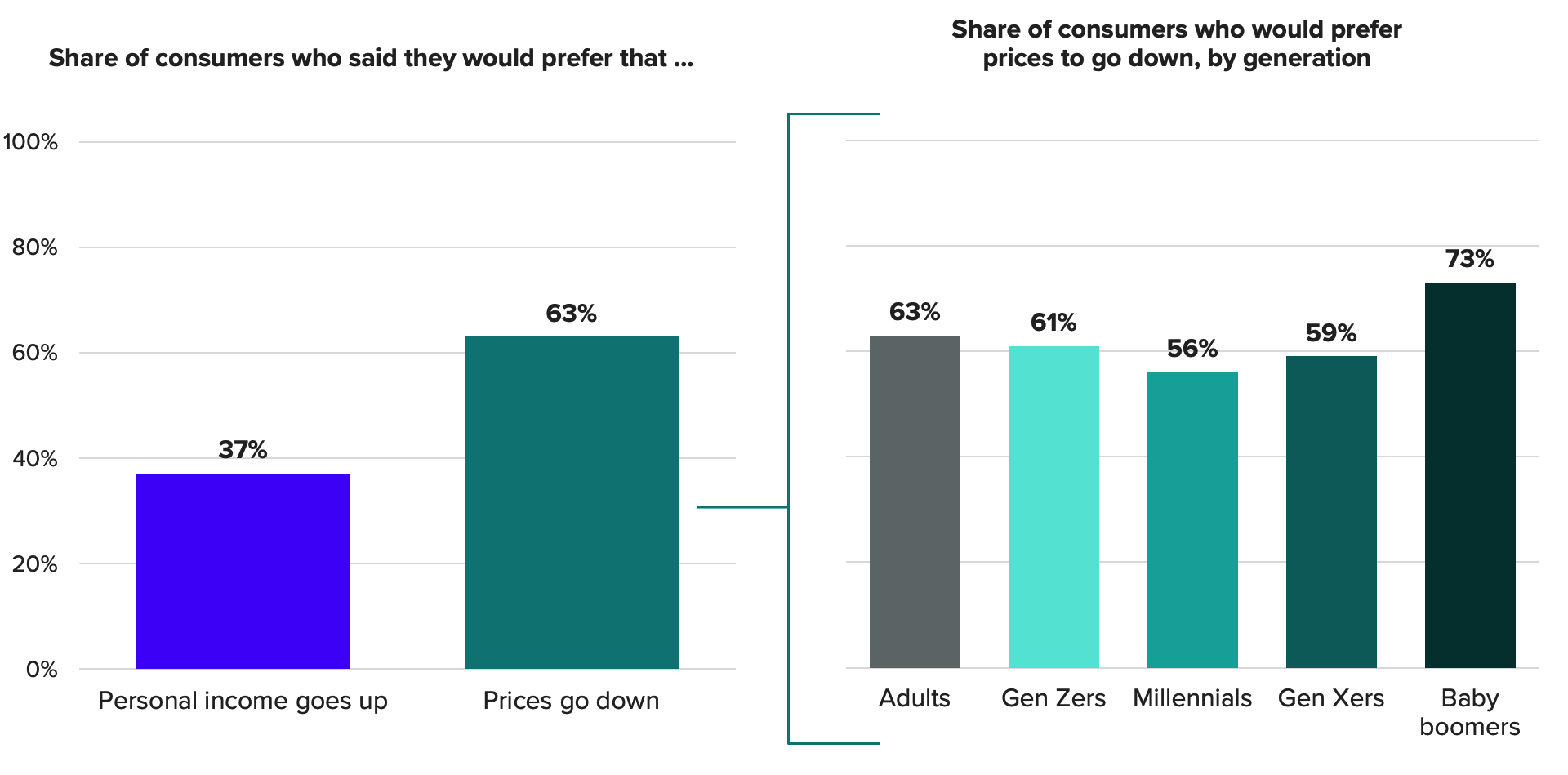

So what would make consumers less unhappy with high prices? High inflation reduces purchasing power, making consumers’ money go less far. Purchasing power can be boosted through increasing wages or declining prices. When asked if they would rather prices go down or their income to go up, consumers were more likely to say they would prefer prices to go down (63%) — in other words, consumers want deflation.

3 in 5 Consumers Would Prefer That Prices Go Down

Some of this could be explained by labor dynamics: Gen Zers (61%) and baby boomers (73%) are more likely than other generations to want prices to go down. The youngest and oldest generations are more likely to be out of the labor force, which would make them more sensitive to higher prices and less likely to be working for wages. However, even a slight majority of millennials and Gen Xers, who make up the majority of the workforce, would prefer prices to go down rather than their incomes to go up.

Perhaps a preference for deflation over higher income is due to loss aversion, or the phenomenon where losses are psychologically more severe than an equivalent win— i.e., people would rather recoup their “losses” from dealing with higher prices than have an equivalent gain through their income. Wages have grown faster than inflation in the past six months; however, respondents may not be feeling the benefits from recent wage gains as much as they felt the loss in purchasing power in the past inflationary cycle.

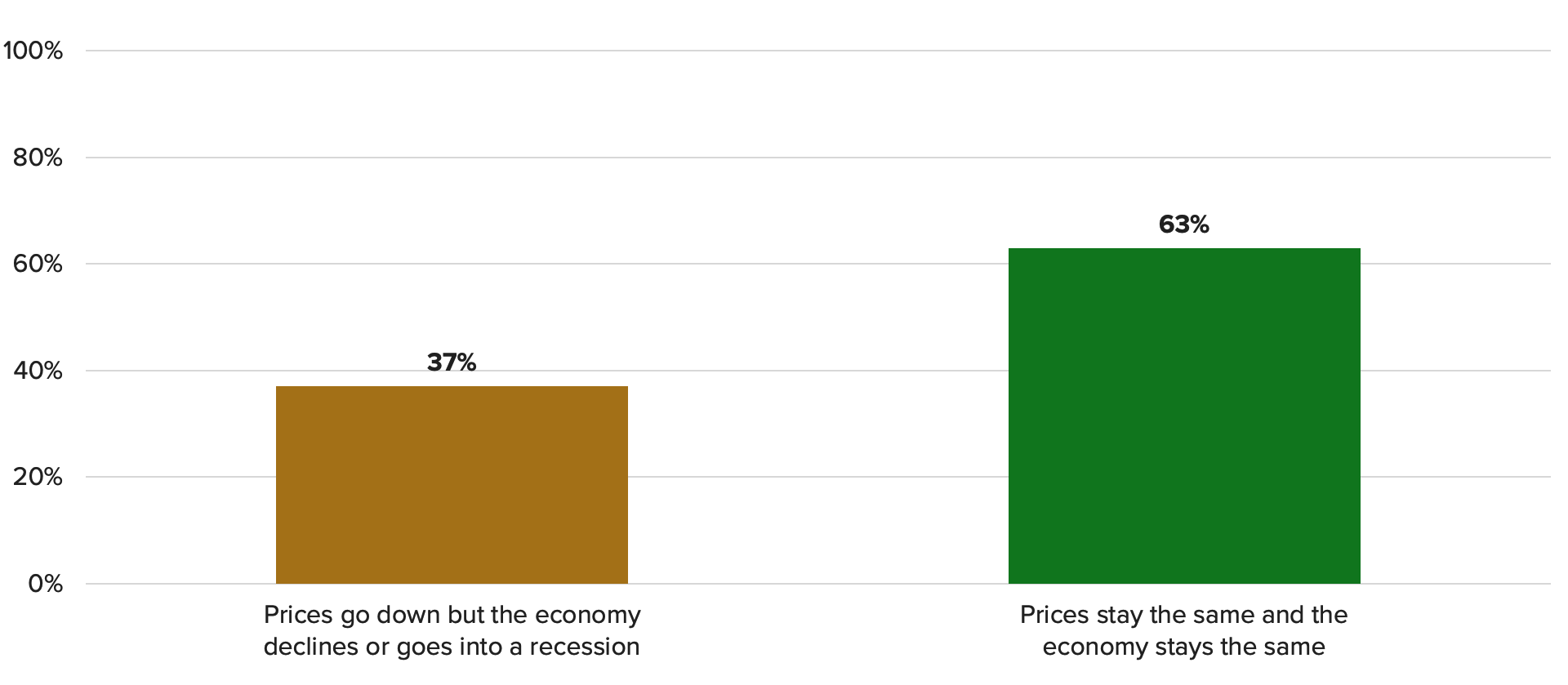

Most Consumers Don’t Want Deflation if It Comes With a Recession

When reframing the question to remind respondents that a reduction in the overall price level could lead to higher unemployment or a recession, the shares flip: More consumers would prefer that prices not go down, suggesting that although it may be most consumers’ first instinct to wish for lower prices, some change their original response when economic implications are pointed out. Baby boomers, who were most likely to want prices to go down before the recession language was included, had the most drastic reduction in the share wanting prices to decline, from 73% to 31%. Baby boomers have lived through the most recessions, so they could be more worried about the implications of an economic downturn.

At the same time, 37% of respondents still would prefer prices to go down even if it resulted in a recession, implying that a good share of consumers want prices to deflate no matter the economic consequences — or perhaps they think that they would be less personally affected. Another explanation could be that consumers are expecting a recession anyway: A potential recession has been at the forefront of economic news in recent years, especially with many economists predicting one since the Federal Reserve began its aggressive rate increases.

What we do that’s different: Morning Consult’s Consumer Confidence Survey is an exclusive high-frequency indicator of consumers’ economic and financial outlooks – the only daily measure of consumer confidence in more than 40 countries available today.

Why it matters: Our Index of Consumer Sentiment can be used to track and predict the University of Michigan sentiment index, derived from its Surveys of Consumers, in real time. The Federal Open Market Committee and the Board of Governors cited Morning Consult’s Index of Consumer Sentiment in its March 2020 emergency meeting to sound the alarm on the future of consumer spending amid the spread of COVID-19. It took the more traditional measurements at least two more weeks to reflect our daily measure.

Although inflation has come down substantially, higher price levels are a large concern for most consumers. While it is possible that some prices (such as gasoline) could go down without a recession, it is unlikely that the overall price level would decrease to pre-pandemic levels without an economic downturn.

When the economy began to reopen, many adults may have been expecting the world to be as it was before the pandemic, but many of the changes are here to stay. Prices were materially lower before the pandemic for many goods and services, and this appears to be jarring to a large share of consumers, especially for essentials like groceries. Perhaps consumers need to continue to see increases in their purchasing power via wage growth, as well as more time to adjust to the “new normal” of higher prices, before we see any material improvement in sentiment.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]