Voters Approve of U.S.-E.U. Trade and Tech Council’s Efforts to Strengthen Export Controls

Key Takeaways

U.S. voters broadly support export controls and investment screening for critical technologies on national security grounds, but they have little appetite for total bans.

On both the investment and export fronts, Americans are worried mostly about threats from China, while Europeans are focused on Russia in light of its invasion of Ukraine.

The announcement of greater U.S.-E.U. cooperation on export controls at this week’s Trade and Technology Council meeting means U.S. exporters can expect further restrictions on their goods to Russia and Belarus, and should watch closely for updates.

For now, European coordination on export controls and investment screening vis-a-vis China appears to be on the back burner. But U.S. voters’ support for these measures means companies should still be prepared for the Biden administration to make unilateral moves.

Export controls were among the hot topics up for U.S.-E.U. coordination at the Trade and Technology Council (TTC) meetings this week, and by all accounts they were an area of progress. The working group on export controls was initially formed to focus on limiting China’s access to dual-use technologies (commercial tech with military applications), but it has pivoted to Russia in light of the war in Ukraine and European disagreement on limiting exports to China, a far larger market. Investment screening cooperation, meanwhile, has made less progress and was absent from the White House’s fact sheet on deliverables from the ministerial meeting.

Export controls and investment screening

U.S. voters aren’t particularly supportive of a total ban on foreign companies purchasing American companies involved in producing critical technology, or of prohibiting all exports of critical technologies. But they strongly support partial bans in cases where the foreign companies are known or suspected to pose a national security risk.

U.S. Voters Strongly Support Partial Restrictions on Critical Technology Export and Investment

You say Russia, I say China

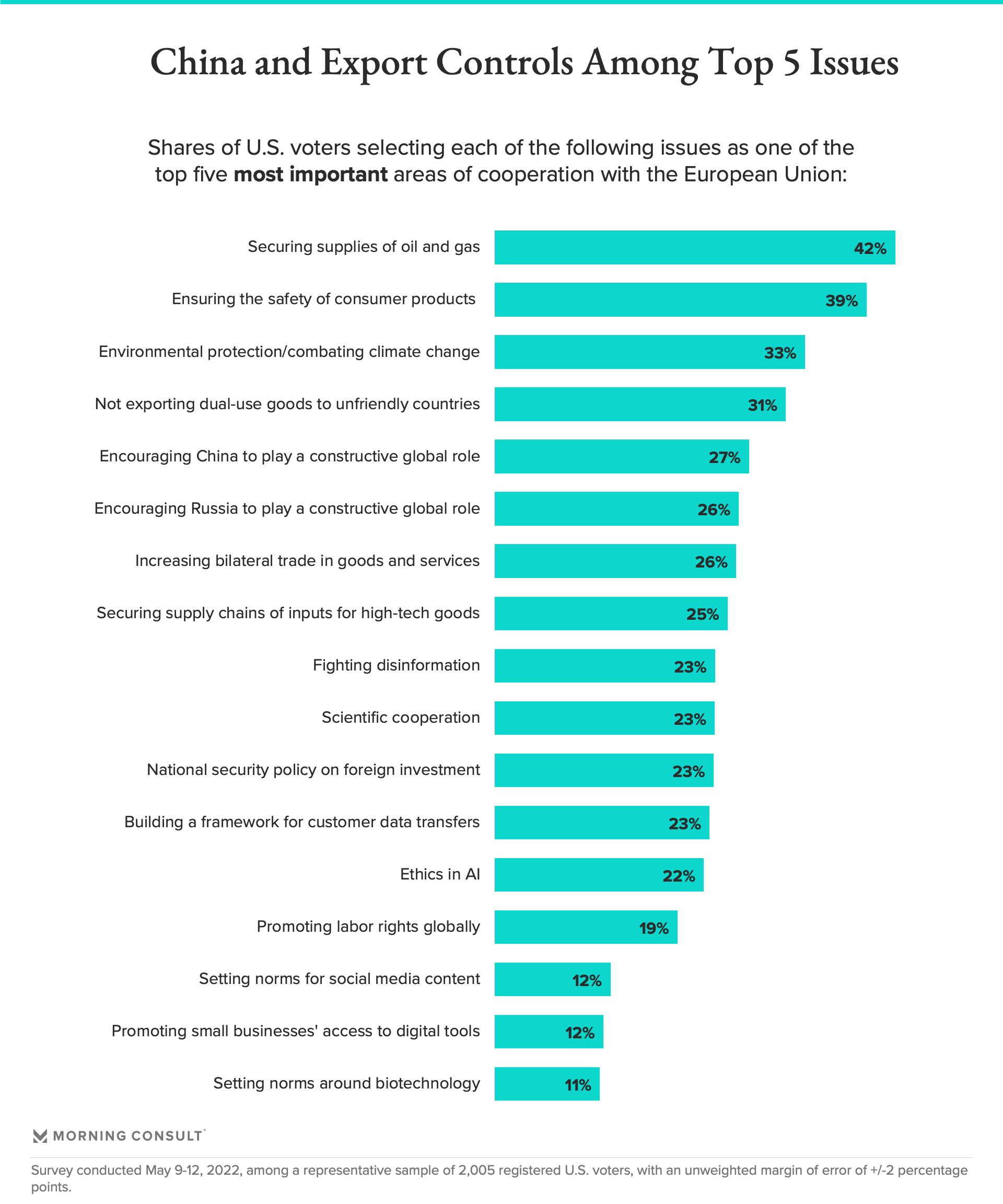

For now, U.S. voters are slightly more focused on China than Russia. “Encouraging China to play a constructive global role” and “Not exporting dual-use goods to unfriendly countries” both rank among the top five issues voters say the Biden administration should be cooperating on with the European Union, while “Encouraging Russia to play a constructive global role” falls just below. E.U. negotiators, on the other hand, have signaled a clear desire to focus on Russia over China.

In the Short Term, Expect Joint Progress on Russia and Unilateral Progress on China

Outcomes from the May 16 ministerial meeting show that the United States is amenable to matching the European Union’s focus on Russia in the short term, and U.S. companies producing goods on the Commerce Control List should expect additional restrictions on their ability to export to Russia and Belarus.

Ahead of the U.S. midterm elections in November and the TTC’s next meeting in December, deep cooperation with the European Union on export controls and investment screening issues vis-a-vis China is less likely, but the United States could move unilaterally on those issues in the meantime given the strong U.S. voter support for doing so. Companies’ government affairs and public policy teams should plan accordingly.

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].