Wage Pressures Likely to Retreat as Labor Market Normalizes

Key Takeaways

Wage pressures that have accompanied an increasingly chaotic labor market are likely to subside in the coming quarters as labor force participation picks up and reopening-related labor shortages and disruptions begin to clear.

Job seekers and re-entrants into the workforce come with limited expectations for wage increases, with those expecting higher wages concentrated in sectors with face-to-face, less flexible work environments.

Pockets of labor market tightness will likely persist in industries offering less flexibility like retail, manufacturing, and leisure/hospitality as the labor market adjusts to the new normal.

This analyst note is part of a series that provides direct insight into the trajectory of jobs growth, wage growth and the broader economic recovery over the coming months. Sign up here to get the latest economic analysis.

U.S. job openings surged to 9.21 million in June, marking a record high. As employers attempt to rapidly grow their respective workforces, many are experimenting with different approaches to attracting and retaining talent, including raising wages, adding work hour flexibility and expanding other benefits.

In order to understand near-term wage dynamics, this analyst note measures workers' wage expectations relative to prior to the pandemic across different sectors and education levels. The results are based on a Morning Consult survey of a representative sample of 5,000 U.S. adults conducted June 22 - 25, 2021.

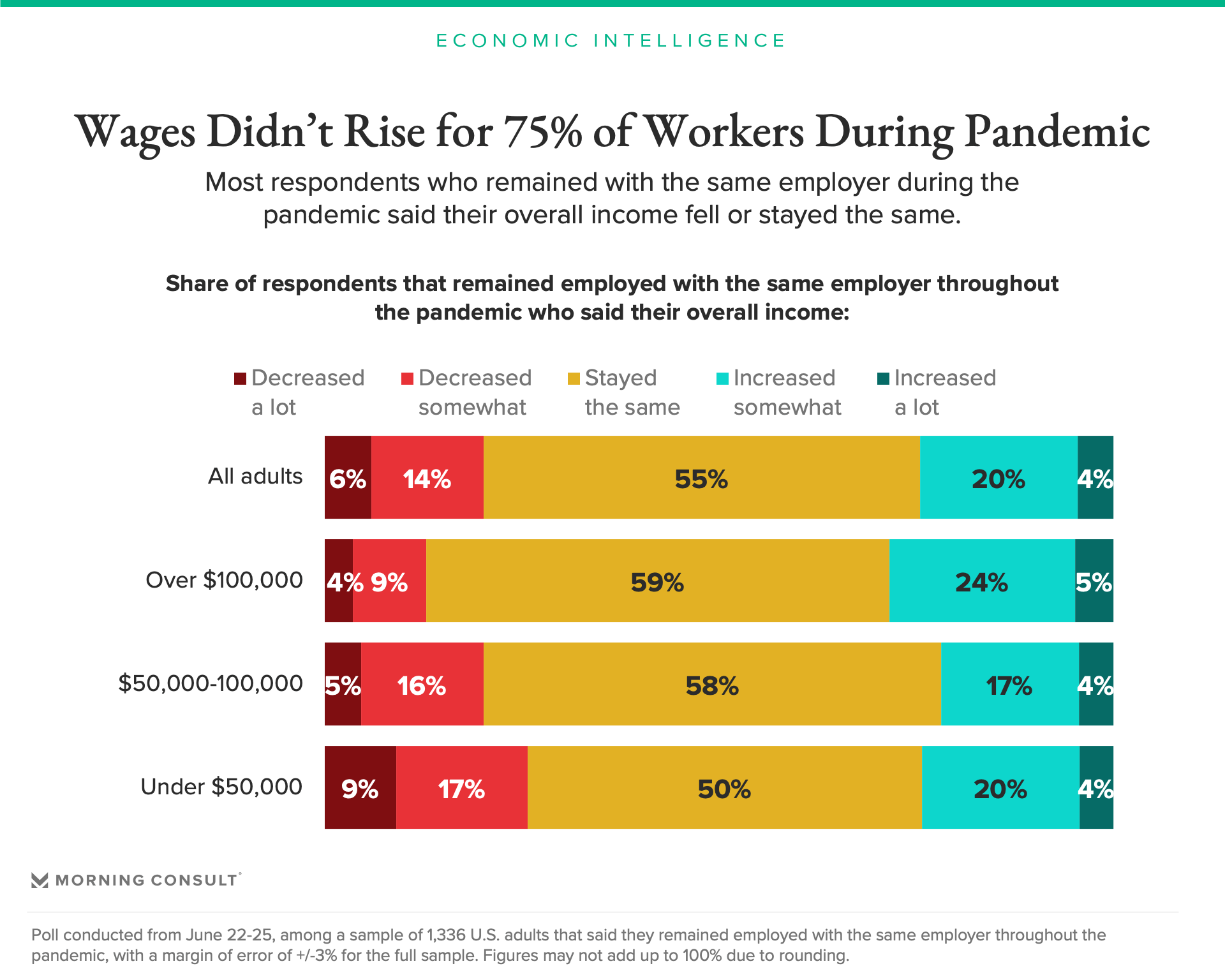

Income Growth Stalled For Most Workers During Pandemic

Despite recent reports of pay increases - especially for certain sectors like leisure and hospitality - and unusual incentive offerings, wage growth during the pandemic has been tepid. Only 24% of workers who remained employed during the pandemic said their overall incomes increased, compared to 55% that said it stayed the same and 20% who said it decreased, with employed lower income workers more likely to experience a loss of pay. This data is broadly consistent with the Atlanta Fed’s Wage Growth Tracker, which reported only 3.2% median hourly wage growth from April-June 2021 and 3.1% over the course of the pandemic.

Average Hourly Wage Pressures Will Likely Ease in the Coming Months

Looking ahead, Morning Consult data suggests that broad wage price pressures will likely begin to abate as early as September. In the coming months, 1.8 million unemployment benefits recipients will likely become employed and over 2 million homemakers, disabled persons, and early retirees are set to re-enter the labor force, which will add to workforce supply and help ease shortages.

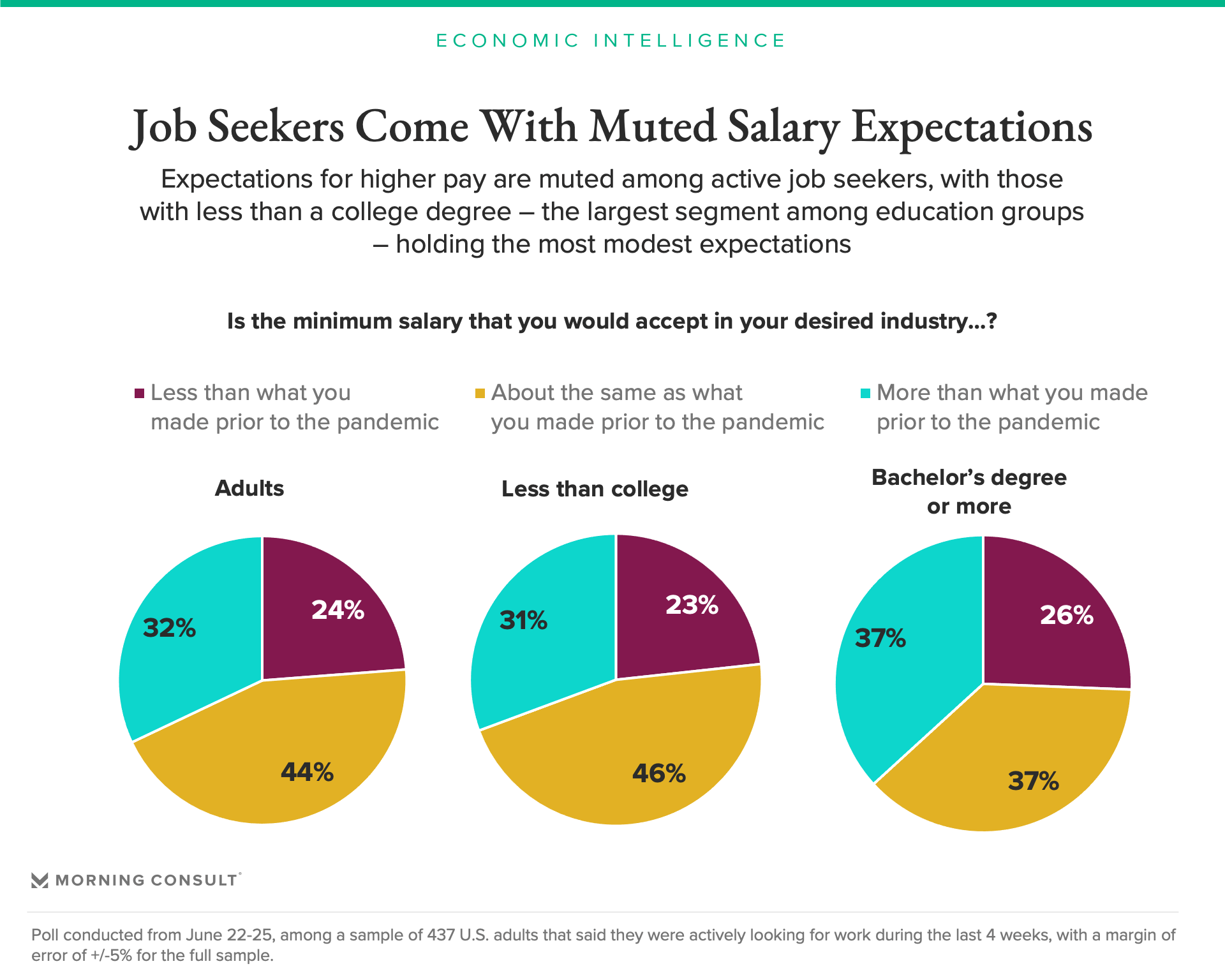

Furthermore, job seekers are coming to the job market with limited expectations for wage increases. Compared to pre-pandemic levels, expectations for higher wages remain fairly flat. 68% of job seekers in June indicated they were willing to accept the same or less than they earned prior to the pandemic. Expectations for higher pay are also lower among lower-skilled workers, with 31% of those with less than a college degree - the largest subgroup - expecting to earn more than they did prior to the pandemic, compared to 37% for those with a bachelor’s degree or more.

Decreased Desirability of Working in Stores, Factories Will Drive Wage Pressures in Certain Industries

While the tightness in the labor market should subside, some industries will continue experiencing elevated wage pressures, with higher wage expectations concentrated in more inflexible work locations. Among those actively seeking employment, 44% of those that previously worked in a factory and 42% of those that worked in a store expected higher wages relative to prior to the pandemic, compared to 32% for all adults. This suggests that employers that require face-to-face interaction and inflexible schedules will likely require relatively higher compensation to attract employees.

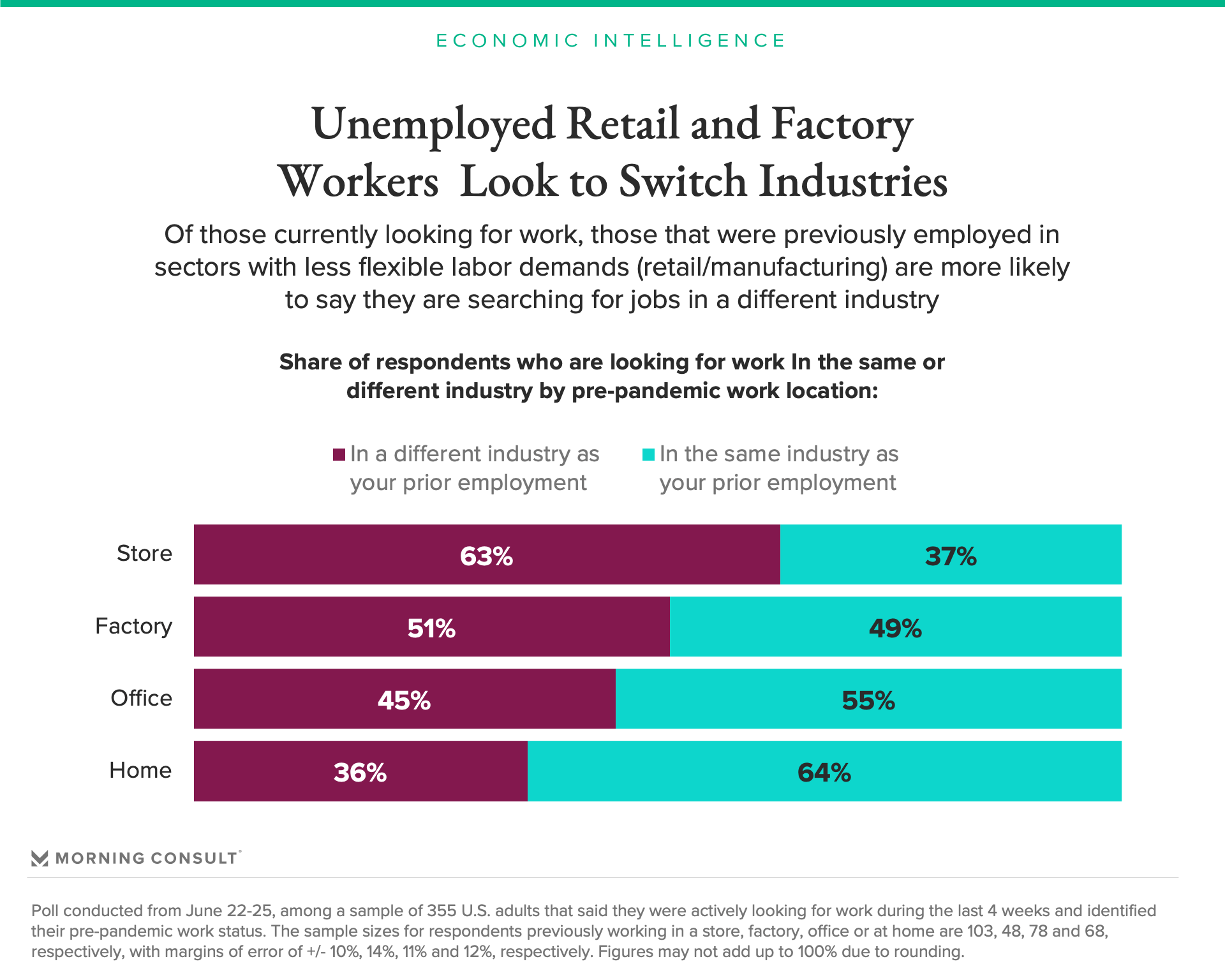

Additionally, among active job seekers in June, 63% of respondents who previously worked in a store and 51% of respondents who previously worked in a factory were looking for work in a different industry. This compares to 45% for office workers and only 36% for those that worked at home. As unemployed workers seek to change work environments away from stores and factories, businesses that employ a high share of store and retail workers are likely to continue facing elevated wage pressures.

Job Seekers Looking For Greater Flexibility, Not Just Higher Wages

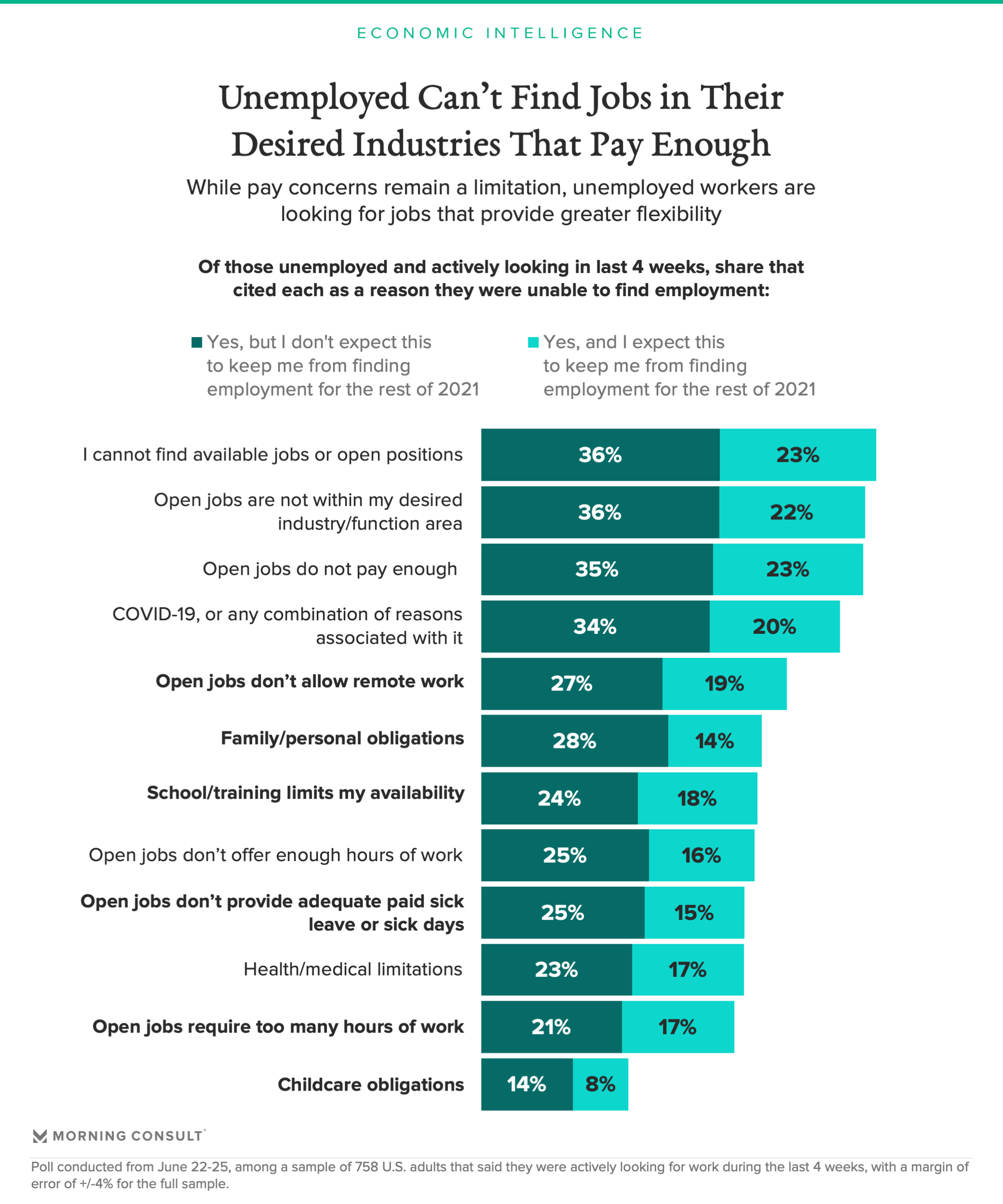

In addition to more money, active job seekers also cited issues surrounding job flexibility as a central reason for their inability to find work. Among active job seekers, 46% said a lack of availability of remote work prevented them from finding work; 42% cited family and school obligations; and 40% referenced inadequate paid leave or sick days. With such a high number of active job seekers looking for flexibility and more leniency on personal obligations, companies that are able to offer additional work flexibility have an upper hand in attracting workers as they reenter the labor force.

Post-Pandemic Economy Likely to Bring Modest and Uneven Wage Growth

While pockets of labor tightness will persist as the economy adjusts to the new normal, Morning Consult data suggests that much of the recent wage pressures will likely fade as workers return to the labor market en masse and bring with them limited expectations of wage increases. Most employers will see their hiring problems fade; however, those requiring face-to-face, non-flexible work environments (retail, leisure and hospitality, manufacturing, etc.) will likely need to adjust their hiring practices to the new realities of the post-pandemic economy.

Jesse Wheeler previously worked at Morning Consult as a senior economist.