The COVID-19 pandemic caused many countries to shut down large segments of their economies. While such efforts save lives, they devastate the economy by forcing businesses to close and workers to stay home. The economic impact has been so devastating that many countries are considering accepting some of the health risks associated with lifting bans on certain types of economic activity.

This research note argues that depressed levels of consumer confidence will continue to weigh on consumer spending across advanced economies as long as the number of cumulative COVID-19 cases continues to rise. Thus, reopening the economy without materially decreasing the cumulative number of coronavirus cases is unlikely to stimulate consumer spending or reignite the economy.

Data, Methodology and Findings

To better understand the trade-offs between economic growth and public health, we tested how highly correlated the number of COVID-19 cases is with consumer confidence.

The relationship between the number of COVID-19 cases and consumer confidence provides insight into the optimal prioritization of these two competing aims. A strong negative correlation indicates that reopening the economy before the number of cases falls is less likely to reignite economic activity. On the other hand, a weak negative correlation indicates that consumer confidence and consumer spending could return even without curbing the number of COVID-19 cases.

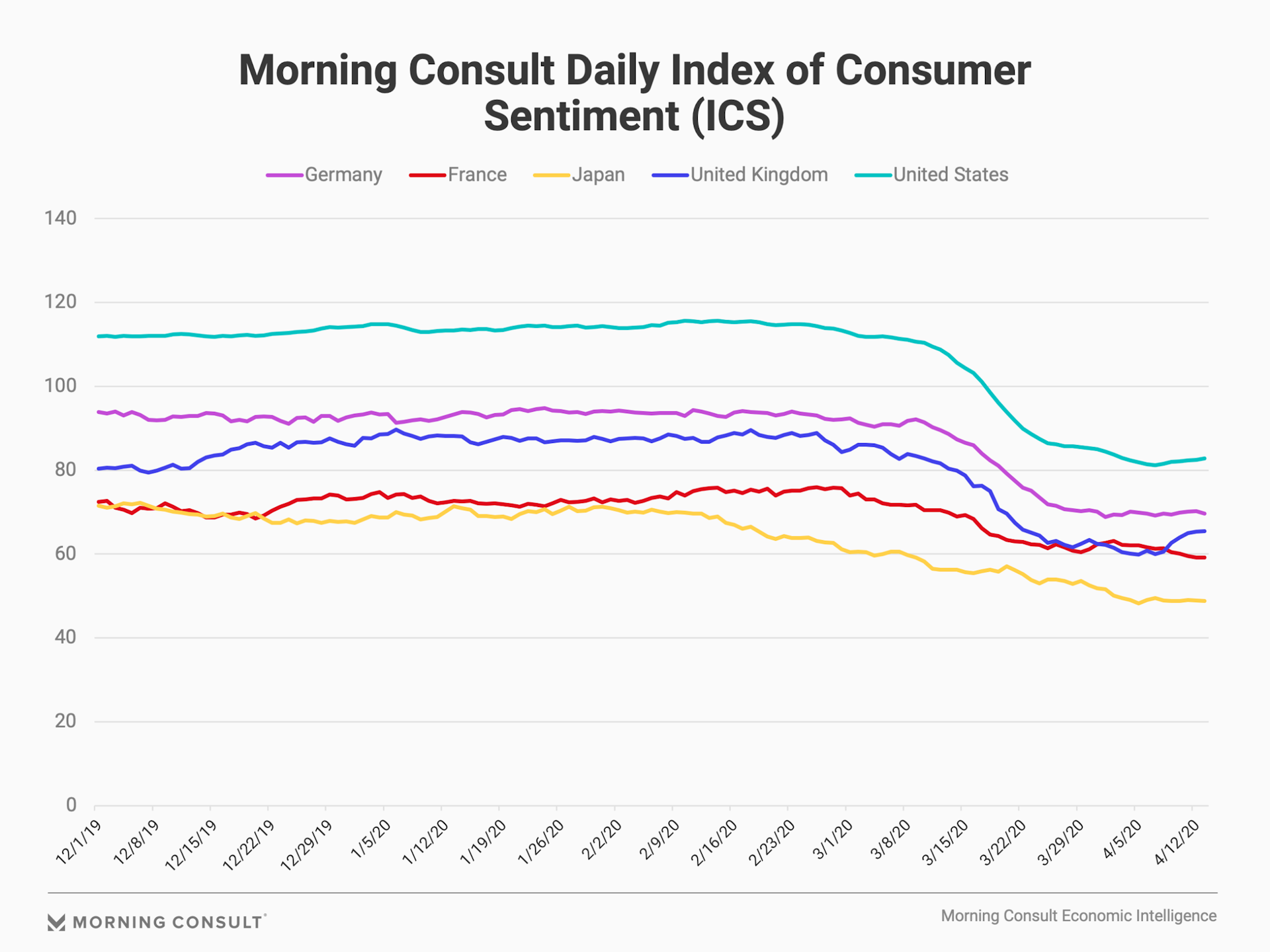

We analyzed the relationship between consumers’ economic outlook and the number of COVID-19 cases across five countries (the United States, the United Kingdom, Germany, France and Japan) using Morning Consult’s proprietary daily consumer confidence data.

We found that consumers’ views of the economy and their own personal financial conditions are highly negatively correlated with the number of COVID-19 cases in each of these countries. As the number of cases increases, consumer confidence falls.

This finding suggests that stopping the spread of the virus is a necessary condition for a rebound in global consumer confidence and global consumer spending.

COVID-19 exerted downward pressure on consumer confidence, but that does not mean that containing or eradicating the virus will in and of itself allay all of consumers’ concerns. The virus and economic shutdown have already caused widespread layoffs and economic harm that cannot be immediately reversed simply by stopping the spread of the virus. Policies to remedy these economic hardships will play an important role as well in boosting consumer confidence.

The Correlation Between Consumer Confidence and the Number of COVID-19 Cases

Since Feb. 1, 2020, consumer confidence has fallen most sharply in Japan and the least dramatically in France. The percentage decreases across the United States, United Kingdom and Germany are all similar.

While consumer confidence significantly deteriorated in February and March, the graph above shows that the rate of decrease has slowed across four of these countries. In the United States, United Kingdom, Germany and France, the largest single-day decline occurred between March 17, 2020 and March 19, 2020. Consumer confidence in the United Kingdom has actually increased since April 5, 2020.

The recent shallowing of the fall in consumer confidence raises the question: Can confidence rebound to pre-COVID-19 levels without a dramatic improvement in health outcomes? If it can, then the economy – and consumer spending, in particular – may be able to rebound following the easing of restrictions and limitations even without an improvement in health outcomes.

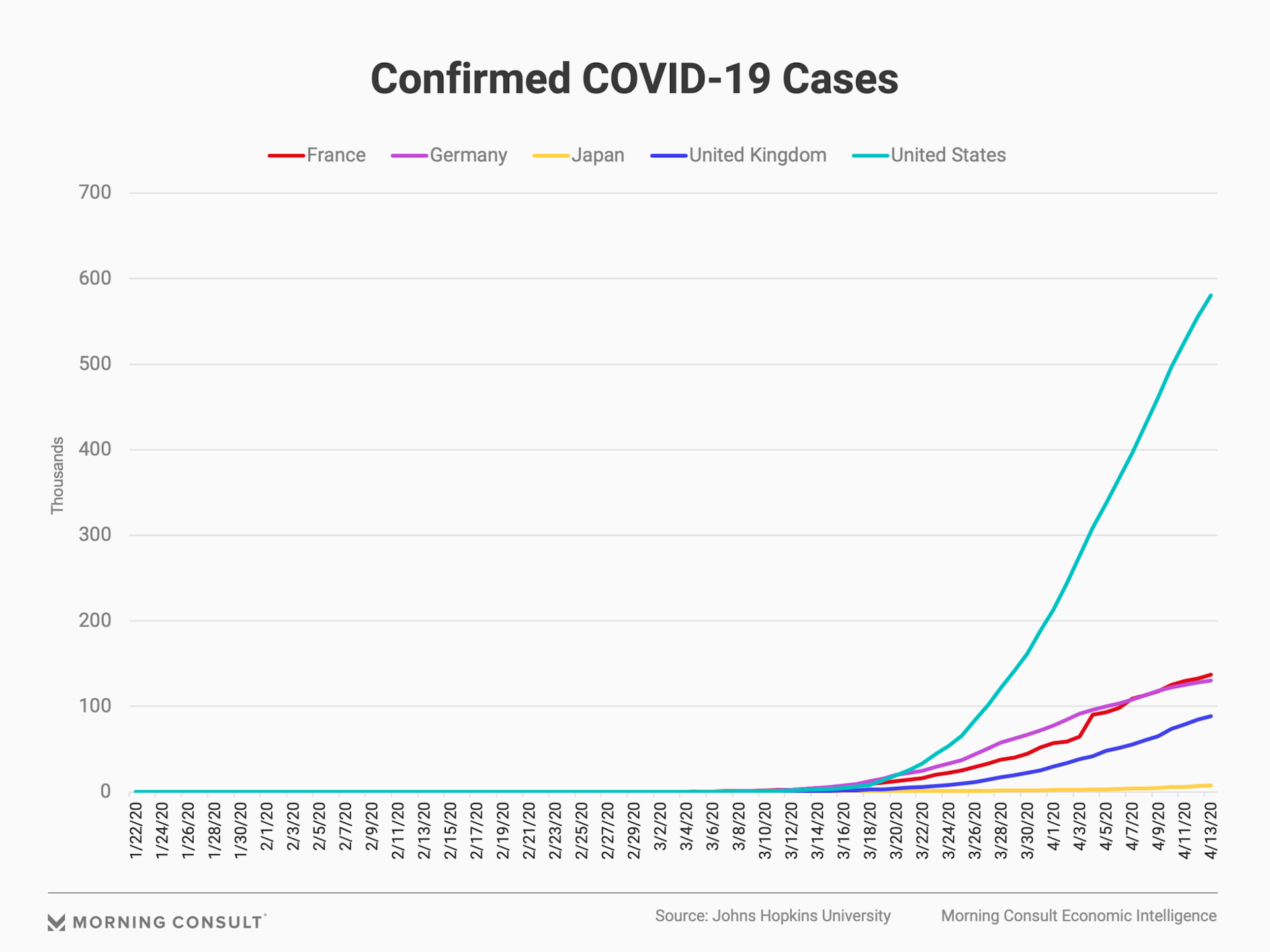

The cumulative number of confirmed COVID-19 cases in a given country is one of the most widely cited statistics summarizing the state of the outbreak in that country. The graph below charts this statistic for the five countries from Jan. 22, 2020, through April 13, 2020.

As is the case with the consumer confidence data, Japan is a strong outlier in terms of the number of confirmed COVID-19 cases. It has yet to experience the sort of exponential growth in the number of new cases that has occurred in the other four countries despite the fact that all five countries began March in a similar position. With the exception of Japan, the number of confirmed cases dramatically increased beginning in mid-March. The fact that Japan is an outlier in both cases suggests that there is likely a strong relationship between consumer confidence and the cumulative number of confirmed cases.

The table below presents the correlation between daily consumer confidence and the number of confirmed COVID-19 cases for France, Germany, Japan, the United Kingdom and the United States across three time lags. Testing different time lags provides insight into the possibility that it takes one or two days for consumers to process the updated number of confirmed COVID-19 cases and incorporate it into their economic outlook.

A time lag of zero days reflects correlations between consumer confidence and the number of confirmed COVID-19 cases on the same day. This column relies on data from Jan. 22 to April 13, 2020. A time lag of 1 day reflects correlations between the number of confirmed COVID-19 cases from Jan. 22 to April 12 and consumer confidence from Jan. 23 to April 13, 2020. Finally, a time lag of 2 days reflects correlations between the number of confirmed COVID-19 cases from Jan. 22 to April 11 and consumer confidence from Jan. 24 to April 13, 2020. As the lag increases, the number of days used to calculate the correlations decreases. Thus, the number of observations is 83 for zero lags, 82 for one lag, and 81 for two lags.

Table 1

There is a strong negative correlation in all five countries between the daily number of confirmed COVID-19 cases and daily consumer confidence: Consumers grow less optimistic about the economy as the number of confirmed cases increases.

This relationship is strongest in Germany and weakest in the United Kingdom. The relatively weak negative correlation in the United Kingdom is a function of the increase in confidence over the past five days, which directly corresponds to the announcement that U.K. Prime Minister Boris Johnson, who had tested positive for the coronavirus, was released from the intensive care unit after his health improved. Thus, the recent surge in U.K. consumer confidence reflects the outsized role that Johnson’s own personal health played in the media and the minds of the public. As focus in the country returns to the health of the general population, British consumers are likely to grow less confident.

The difference between Germany and France is surprising given the similarity of these countries in terms of geography, currency and number of confirmed COVID-19 cases. The total number of confirmed cases is similar across both countries (136,779 in France and 130,072 in Germany as of April 13, 2020). However, French consumers have not grown as pessimistic as their German neighbors.

Structural differences between the German and French economies explain some of this difference. Notably, manufacturing accounts for a larger portion of Germany’s economy, and Germany exports more of its total output than France. Taken together, these differences expose Germany to slowing global growth to a greater degree than France.

Table 1 also provides insight into consumers’ news consumption habits. With the exception of Japan, the cumulative number of cases on a given day is more highly negatively correlated with confidence on that same day compared to the following two days. One may have expected the number of cumulative cases today to be more highly correlated with consumer confidence tomorrow or the following day as consumers digest the news. This result indicates that consumers are highly aware of daily COVID-19 developments in their respective countries, essentially in real time.

In Japan, increasing the time lag between the announcement of confirmed cases and the date of the survey strengthens the correlation, which is consistent with the fact that the number of new cases in Japan has been relatively stable compared to the other four countries. Thus, consumers in Japan have less of a need to update their economic outlook based on the most recent update to the number of confirmed cases.

Comparing Table 1 and Table 2 confirms that consumers in the United States, United Kingdom, France and Germany care more about the cumulative number of cases than they do about the total number of COVID-19-induced deaths. Many studies have shown that the number of deaths lags the total number of cases, and consumers have wisely chosen the more forward-looking data point to inform their economic outlook.

Japan is the one exception. Japanese consumers rely more heavily on the number of confirmed COVID-19-induced deaths to inform their economic outlook than on the number of cumulative cases. One possible explanation for this difference is that testing in Japan has lagged that of other countries such that the number of confirmed cases more severely underreports the severity of the pandemic in Japan than in other countries. Although the number of confirmed deaths lags the number of confirmed cases, the Japanese appear to view it as a more reliable indicator of the state of the pandemic in Japan.

Table 2

Conclusion

Consumers across the world are closely following the coronavirus outbreak, and their assessment of their respective economies evolves in line with the cumulative number of COVID-19 cases in their respective countries. In Japan, consumers more closely follow the number of COVID-19-induced deaths, which is likely a function of skepticism regarding testing in Japan. This finding suggests that policymakers have to slow the number of confirmed cases and COVID-19-induced deaths before consumer confidence and consumer spending can improve. Reopening the economy in an environment of depressed consumer confidence is unlikely to generate adequate economic activity to justify the health risks.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]