Confidence Continues to Fall in November

Key Takeaways

Following a brief spike earlier this month, U.S. consumer confidence resumed its decline in mid-November, with Morning Consult’s Index of Consumer Sentiment falling 1.3 points from Nov. 8 to Nov. 15.

The political divide that saw Republicans largely drive the decline in consumer sentiment in October has largely dissipated, with public health risks once again drawing the focus of consumers.

Rising prices will continue to be a major concern as the disparate impact of inflation on various demographic groups — including rural and older Americans — leads to gaps in consumer confidence and spending.

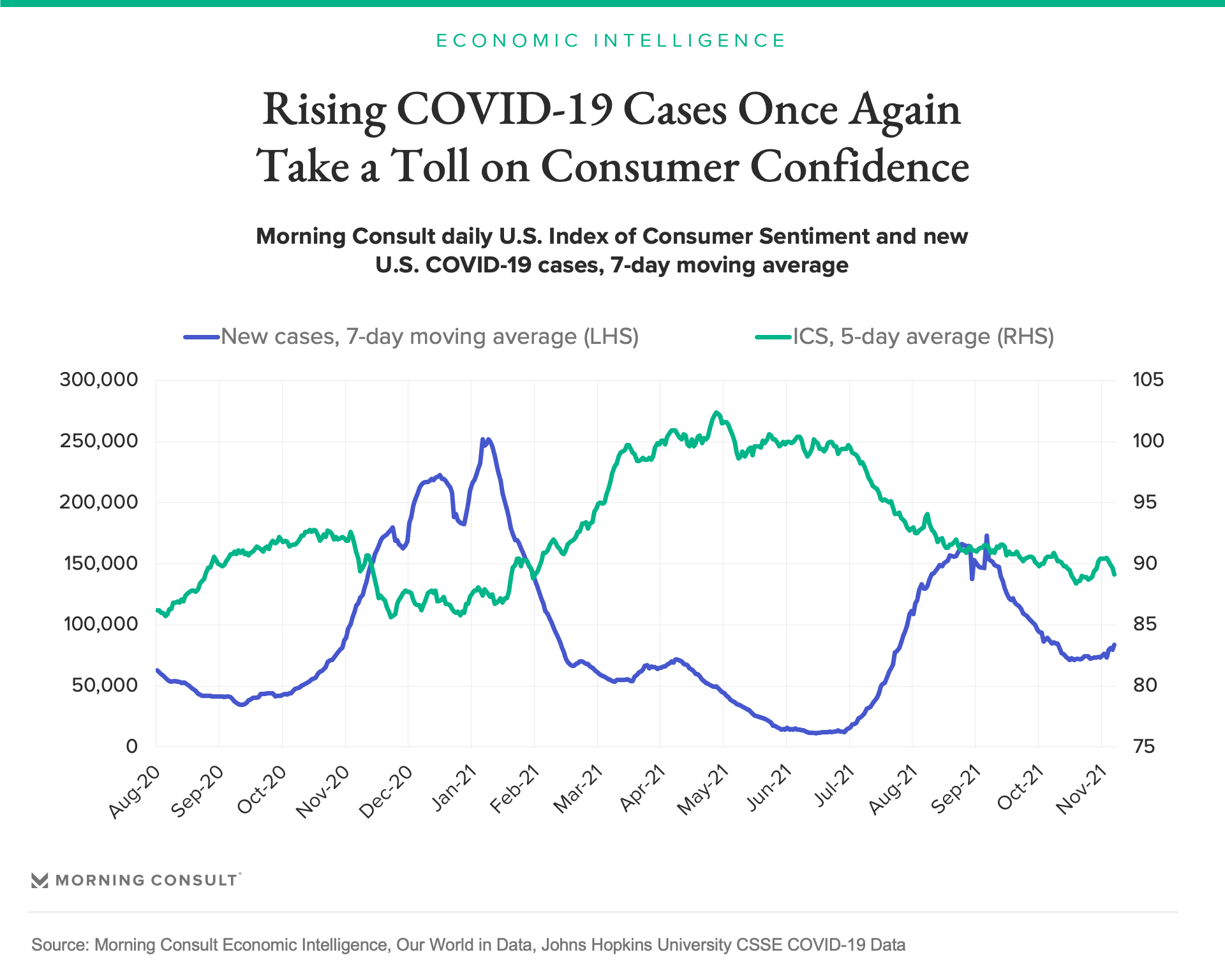

Consumer confidence in the United States has tumbled once again following a brief respite at the beginning of November. In the past week, Morning Consult’s Index of Consumer Sentiment fell 1.3 points, from 90.4 on Nov. 8 to 89.1 on Nov. 15. This most recent decline looks to be driven by rising COVID-19 cases — the 7-day average of new COVID cases in the United States rose from 73,400 to 83,500 during the same period — re-establishing the inverse relation between COVID cases and consumer confidence that had temporarily dissolved.

With public health concerns again taking the spotlight for consumers, the primary driver of the most recent decline in the ICS differs from the dip in October: Last month, consumer confidence fell, despite improvements in combating COVID, as consumers increasingly turned their attention to supply chain disruptions and rising prices. The lens through which they viewed both the risk of inflation and who or what policies might be to blame heavily impacted the overall reading of consumer confidence.

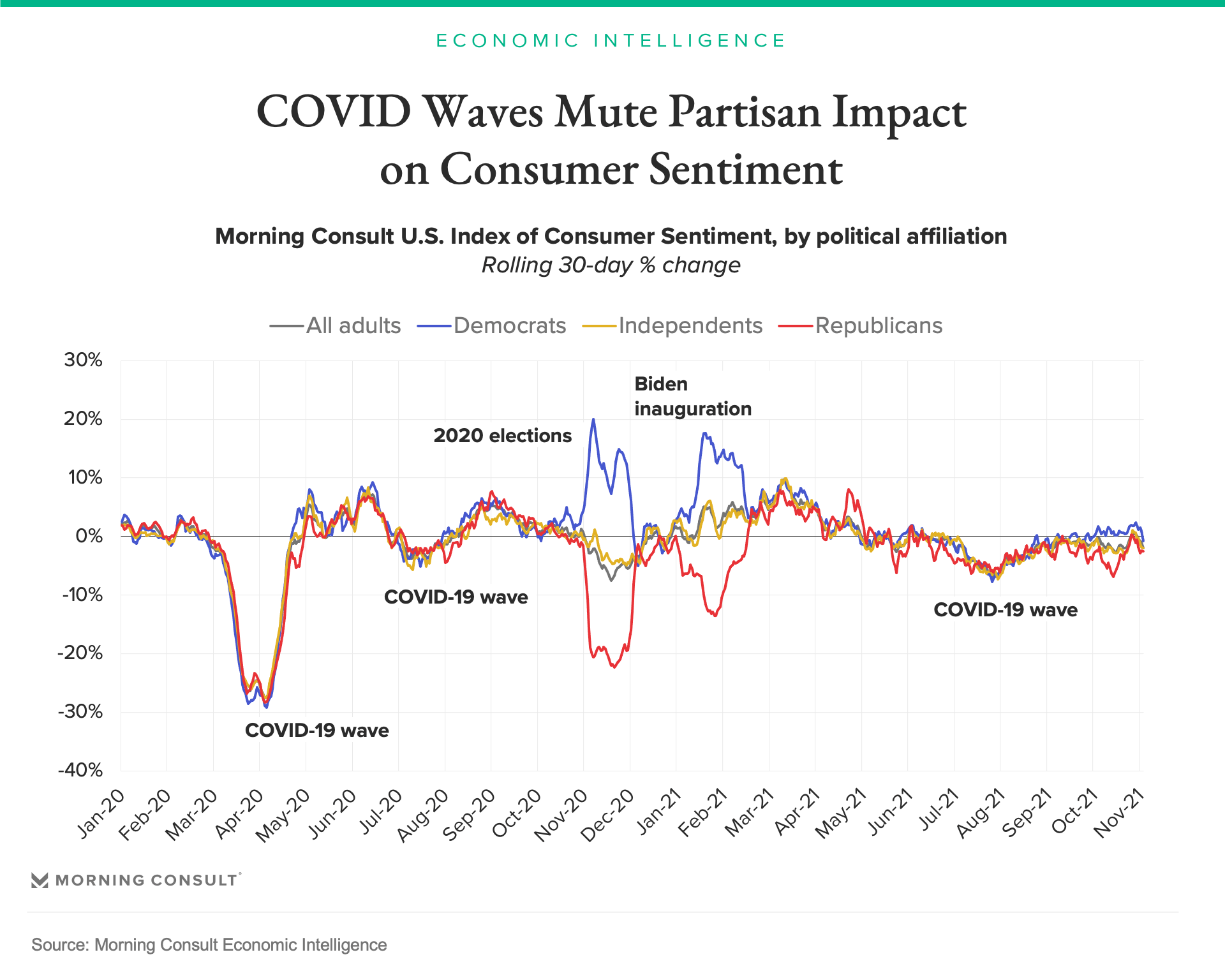

On Oct. 27, the lowest point for the ICS that month, the index had fallen by 2.6 percentage points from 30 days prior. This was largely driven by consumers that identify as Republicans, whose confidence had fallen by 6.3 points, compared to a decline of 2.8 points among independents and a rise of 0.2 points among Democrats.

While politics played a pivotal role in the October decline in sentiment, broader issues helped drive gaps in consumer confidence among other demographic groups, similar to and often overlapping with the Republican-Democratic divide noted in the chart above.

Broadly speaking, conservative voters are more likely to fear inflation, and therefore more likely to have their broader views of the economy and their own financial well-being impacted by price increases. Additionally, Republicans are more likely to come from groups disproportionately impacted by rising prices. They tend to be older, which would increase the impact of inflation, as retirees and pensioners would see their fixed incomes’ purchasing power erode. They also are more likely to be rural residents, who are feeling a bigger impact from rising prices on vehicles and gasoline than their urban counterparts.

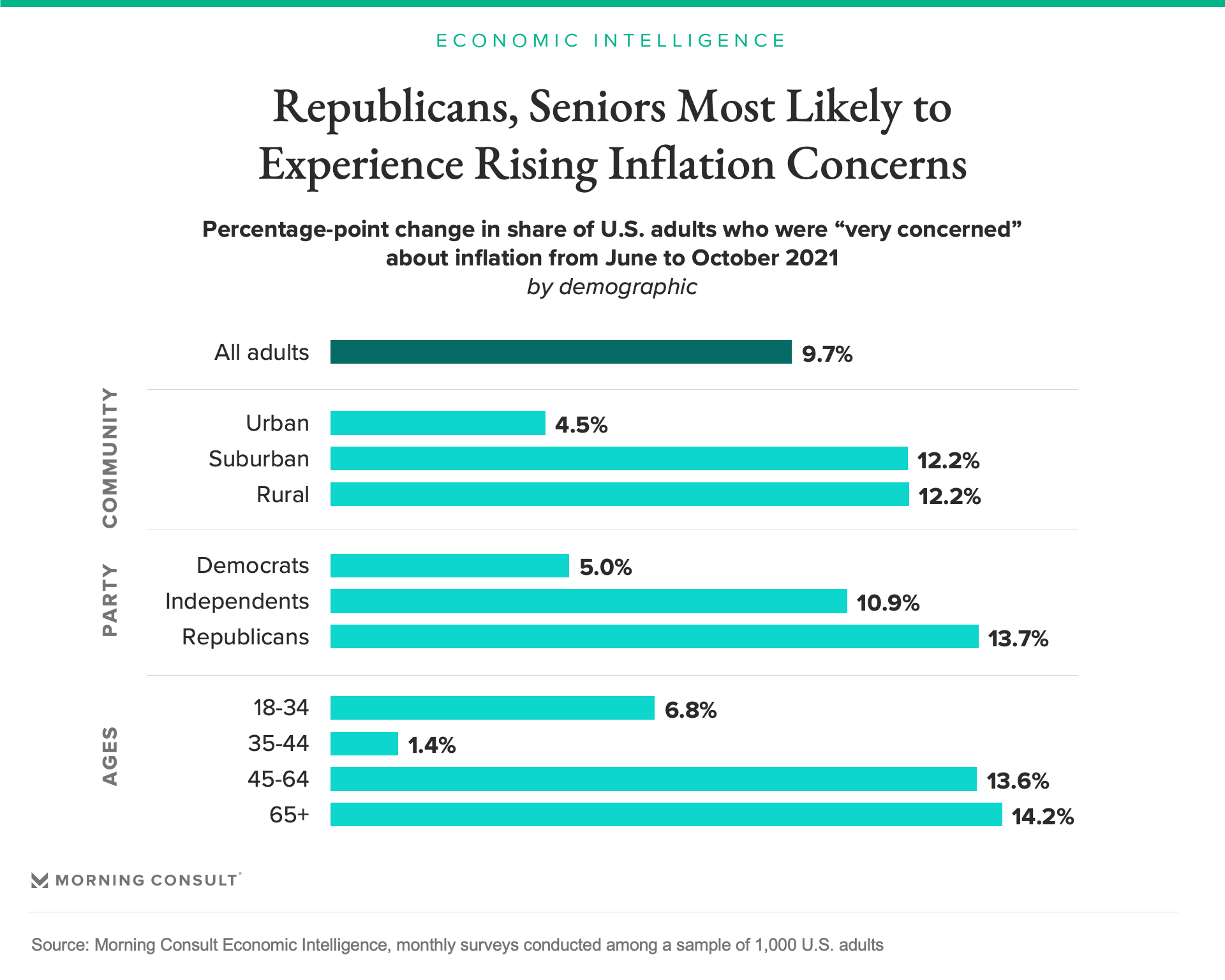

As such, we can see that it was more than just politics that drove the wedge in October. Since June, the share of U.S. adults who say they are “very concerned” about inflation has risen by 9.7 points, with large dispersions among age, community and political identification. Over that time period, the share of rural adults who said they are “very concerned” has risen 12.2 points, compared to 4.5 for urban adults, while the share of adults ages 65 and older who said they were very concerned rose 14.2 points.

Should cases rise further, consumer confidence is likely to continue its decline in the near term, with the deteriorating public health situation expected to overshadow any partisanship or inflation concerns as the key driver of shifts in consumer confidence.

Over the longer term, however, rising prices and other supply chain issues will continue to be a major concern. And while partisanship will maintain its role in the state of consumer sentiment, the disproportionate impact of rising prices will result in disparate outcomes in confidence and retail spending across different communities and consumer groups.

Jesse Wheeler previously worked at Morning Consult as a senior economist.