Fading Uncertainty Drives October Job Growth

Key Takeaways

Employment indicators bounced back from delta-induced setbacks with relative speed in October, easing workers’ uncertainty regarding job stability.

Companies and industries that can demonstrate resilience to the pandemic have a natural advantage when it comes to attracting workers who are coming off the sidelines.

Pandemic-affected industries that increased salaries to compensate workers for the uncertainties they face have succeeded in preventing employees from applying for new positions, providing a blueprint for other businesses facing retention challenges.

The following analysis is based on Morning Consult’s high-frequency economic indicator data. Read more from our November 2021 U.S. Economic Outlook Report.

Getting more adults back to work is a crucial factor in bolstering future economic activity, and Morning Consult’s most recent employment data provides another encouraging signal: Pay and income losses fell considerably throughout this past month, unemployment decreased and more workers are actively applying for jobs.

These recent improvements not only reflect strengthening economic fundamentals, but also help reduce the uncertainty facing out-of-work adults who need to determine whether they should re-enter the labor force. Businesses refrain from making investments in the face of uncertainty. Why should workers be different? As it becomes increasingly clear which jobs are poised to withstand future COVID-19 outbreaks, employment uncertainty will fade away, making it even easier for more people to return to work.

Employment Uncertainty Faded in October

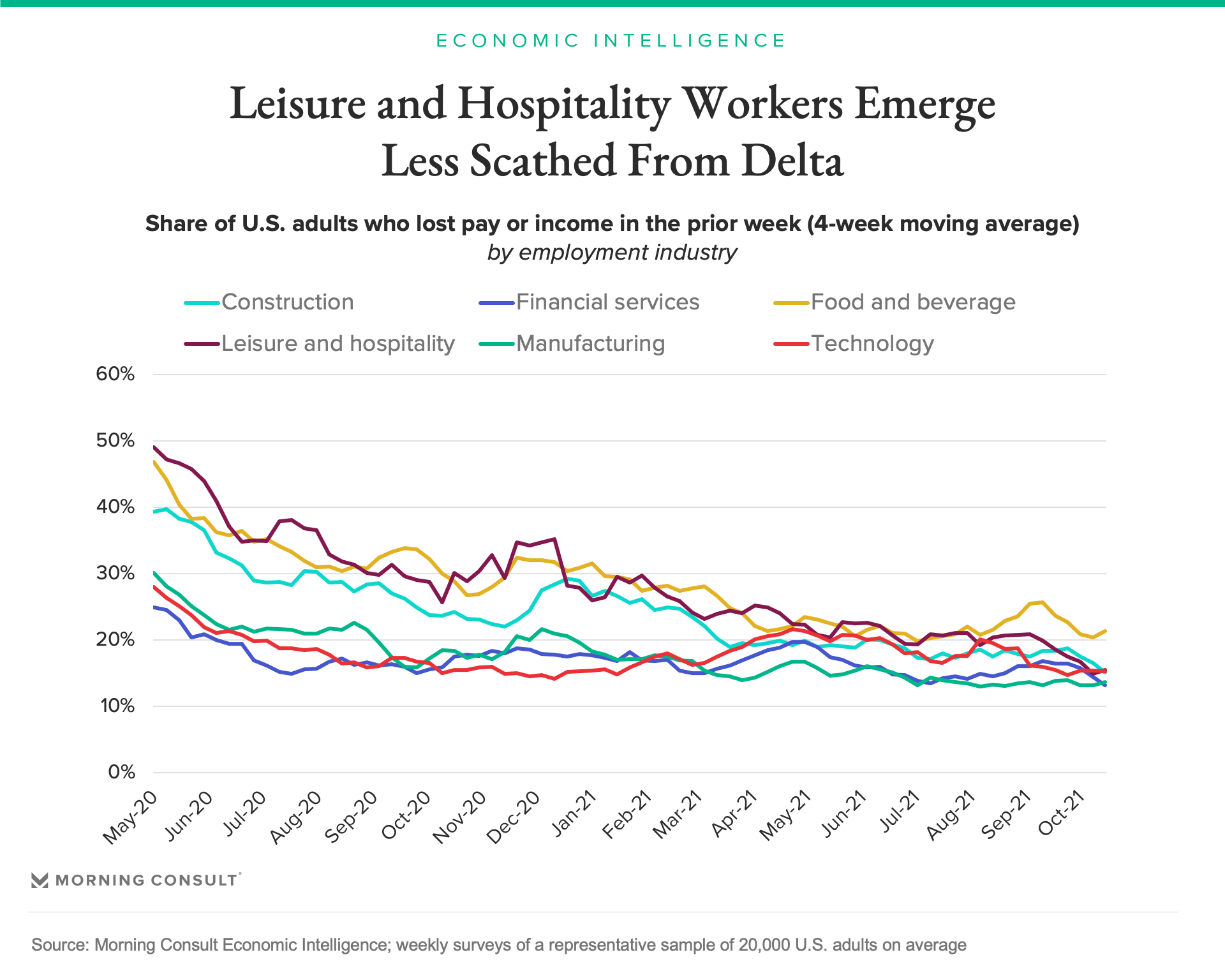

Pay and income losses among workers in pandemic-affected industries such as leisure and hospitality and food and beverage consistently fell throughout October, though they increased slightly at the end of the month.

Workers in both industries emerged from the delta-driven economic slowdown in better shape than they were coming out of the past two case surges. Ahead of Friday’s jobs report, this data provides a strong signal that job growth in the leisure and hospitality industry will yet again drive strong total job growth, as was the case before delta variant concerns curtailed economic growth in August and September.

From a longer-term perspective, the recent divergence in food and beverage and leisure and hospitality industries highlights the ongoing uncertainty faced by adults judging when and where they should return to looking for work. Should restaurant workers try to transfer into the leisure and hospitality industry? Or should they try to make the leap into other industries, such as manufacturing, that are less vulnerable to the pandemic but likely require different skill sets? Changes in Americans’ spending patterns and their comfort with engaging in basic social activities make it even more difficult for workers to know what they should do in order to build a career that can withstand the pandemic.

Attracting Workers Should Become Easier

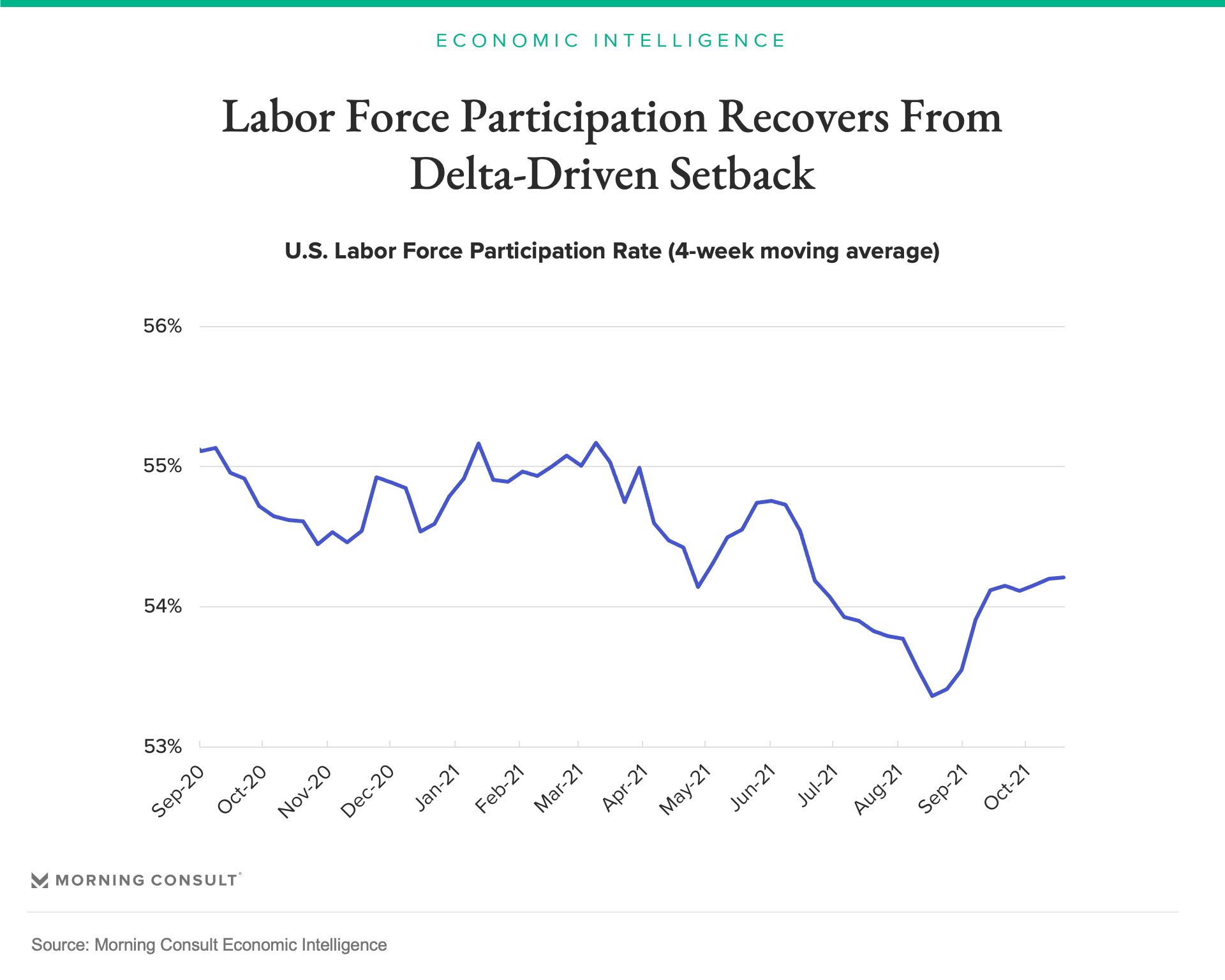

The recent widespread decreases in pay and income losses also provided valuable information to workers who remained outside the labor force and were considering applying for jobs. Morning Consult’s weekly labor force participation rate continued to improve throughout October, with the share of adults either working or actively looking for work making up all of the ground that it lost during the delta-driven surge in cases.

This increase in labor force participation indicates that the narrative of the Great Resignation mischaracterizes short-term cyclical movements as longer-term structural changes. While a growing share of employed adults stopped working or even looking for work in the third quarter, the change was not permanent: As uncertainty surrounding the future of work faded in September and October, a growing share of adults responded by looking for work.

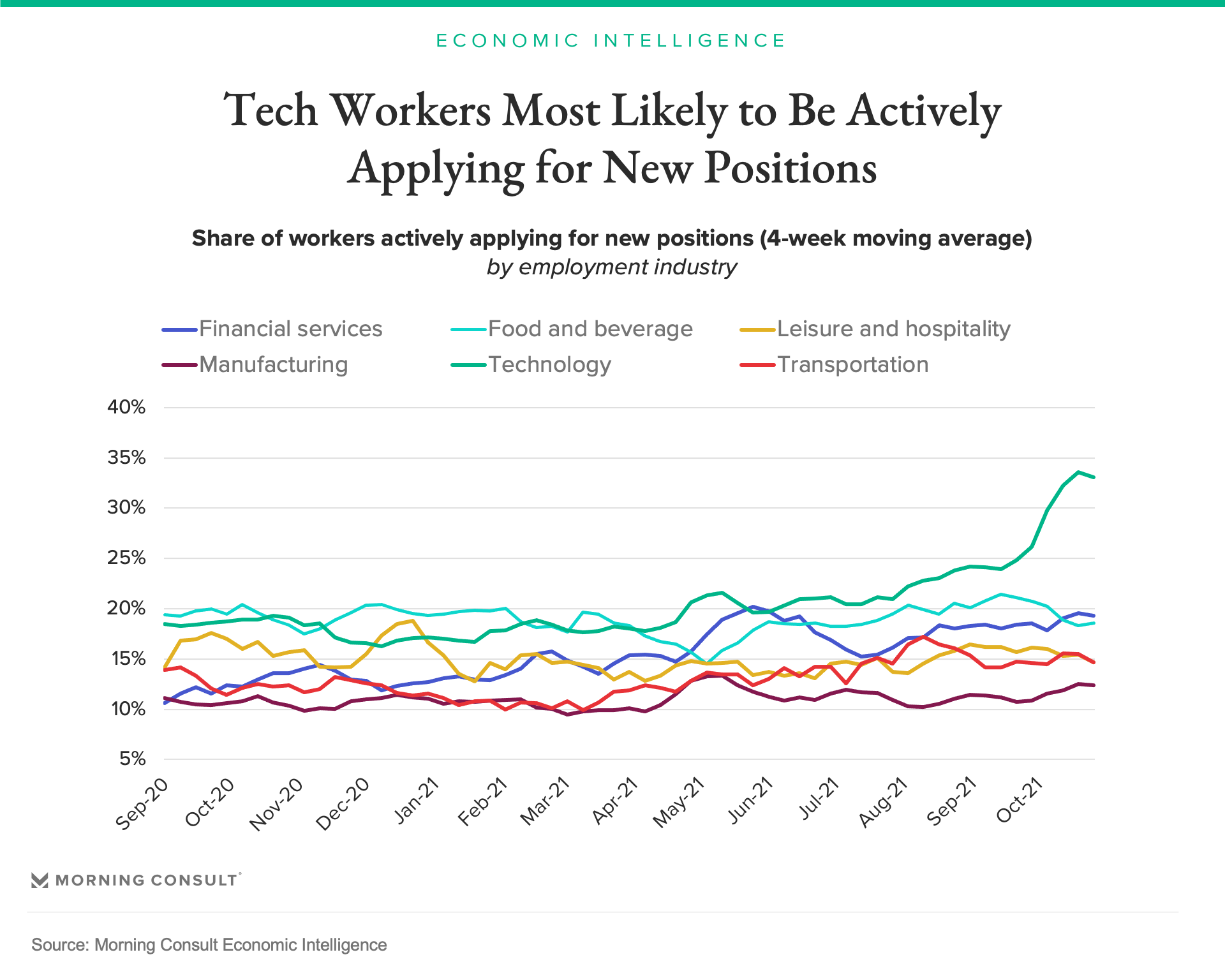

Worker Retention Grows More Challenging

The share of employed workers actively applying to new positions soared to a series high in October before settling at 18.7 percent for the week ending Oct. 30. The 1.2 percentage-point increase from the end of September to October implies that an additional 1.8 million employed workers actively applied for new positions during the month.The share of active applicants employed in the technology industry rose 8 points from September to October, significantly higher than any other industry.

Slower pay growth in the information sector may be driving some technology workers to look for new roles. As of September 2021, average wages had grown just 0.8 percent year on year within the information sector, according to the Bureau of Labor Statistics, compared with 4.6 percent wage growth for all industries. On the other hand, wages in the leisure and hospitality industry are up 10.8 percent since September 2020, potentially leading to higher job satisfaction and fewer active applicants currently working in that sector.

Lessons for employers

For employers, this data provides two key takeaways. First, workers continue to experience elevated uncertainty about the future of work and their optimal career paths in light of that uncertainty. Workers take jobs with the goal of optimizing their future earnings, and elevated uncertainty driven by the pandemic acts as a headwind to job creation. Companies and industries that can demonstrate resilience to the pandemic have a natural advantage in attracting workers who are coming off the sidelines.

Second, retaining higher-skilled workers is likely to become more difficult through the end of the year as an increase in active applications translates into more job switching. Pandemic-affected businesses that increased salaries in order to compensate workers for the uncertainties they face have succeeded in preventing their employees from applying for new positions, providing a blueprint for other companies facing retention challenges.

Read more from our November report on the U.S. economic outlook.

This calculation assumes the employed adult population remained constant at 151,955,000 from September to October. Morning Consult’s data indicates that a growing share of adults were employed in October, making this estimate a lower bound.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Jesse Wheeler previously worked at Morning Consult as a senior economist.