As Republicans Stoke Fear About Increased IRS Enforcement, Most Voters Aren't Concerned

Senate Democrats’ recently passed Inflation Reduction Act of 2022 includes an $80 billion increase in funding for the Internal Revenue Service, a portion of which is specifically geared toward upping enforcement and collections actions. Despite a drumbeat of Republican messaging to the contrary, a new Morning Consult/Politico survey found that most voters aren’t worried about being audited due to the potential boost in enforcement, and a plurality believes high-income Americans will be the most likely subject of any increase in audits.

Most Voters Aren’t Concerned About Being Audited Amid Proposed $80 Billion Funding Infusion to the IRS

Despite GOP efforts to portray increased IRS funding as the beginning of an audit spree, most voters are not concerned

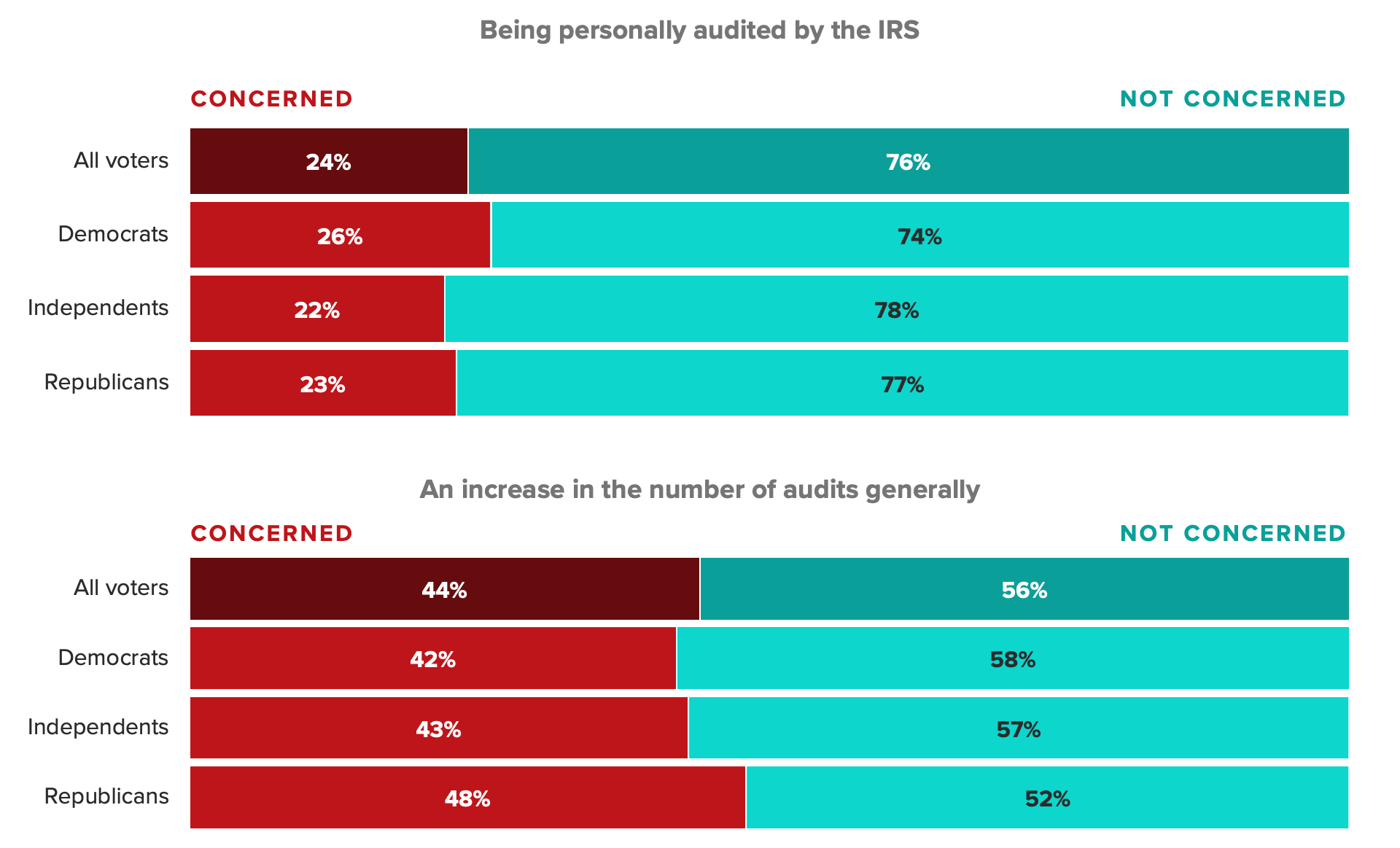

- Conservative media has echoed GOP lawmakers’ efforts to portray an increase in IRS funding as a potential auditing-free-for-all manned by 87,000 new IRS agents, but the majority of voters said they were not concerned about the prospect of being personally audited by the IRS, a view that was consistent among Democrats (74%), independents (78%) and Republicans (77%).

- More specifically, when it comes to possibly being personally audited, 44% of voters said they were “not at all concerned,” including 47% of Republicans and 41% of Democrats.

- Regardless of party affiliation, the share of voters who said they were “very” or “somewhat” concerned about being audited personally was about 1 in 4.

Nearly Half of Voters Believe Increased IRS Audits Will Be Directed at the Wealthy

Voters most likely to think high-income earners will bear brunt of increased audits, though middle class not far behind

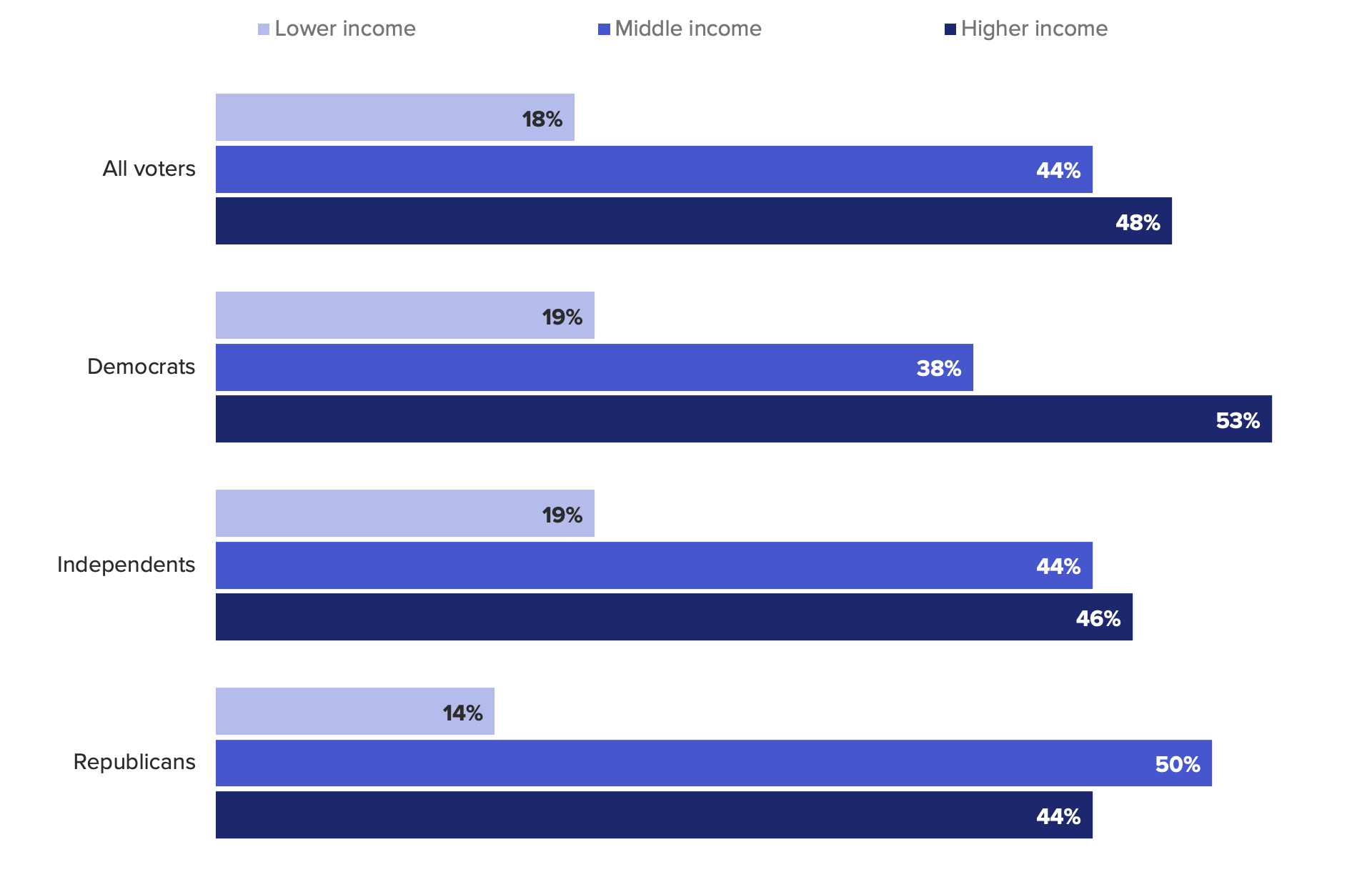

- Amid efforts by Republicans, media commentators and The Wall Street Journal editorial board to paint the spending package as fuel for the IRS to go “beast mode” on middle-class families, IRS Commissioner Chuck Rettig penned a letter to the Senate underscoring that the agency did not plan to utilize increased funds to go after middle-income taxpayers. The Biden administration’s version of the message may be getting through: 48% of voters said they believe the IRS will use funds to increase enforcement on wealthy taxpayers.

- Voters did see potential for middle-income earners to be subjected to increased audits, including 38% of Democrats, 44% of independents and 50% of Republicans who said that group of taxpayers may be the most likely target of ramped-up enforcement.

- Reports that Republican lawmakers were concerned about increased audits on lower-income families in part stemmed from a study that found households earning $25,000 or less were more likely to be audited. However, only 18% of voters said they believe that the IRS would use its new enforcement funds to go after low-income earners, including just 14% of Republicans.

The Aug. 5-7, 2022, survey was conducted among a representative sample of 2,005 registered voters, with an unweighted margin of error of plus or minus 2 percentage points.

Amanda Jacobson Snyder previously worked at Morning Consult as a data reporter covering finance.