Consumer Trust in Banks Remains High Despite Recent Bank Collapses

This story is part of a series tracking consumer sentiment and actions in banking following the collapse of Silicon Valley Bank and other regional banks in the United States.

Read more of our coverage: Consumer Actions After Bank Failures | Do Americans Support the Biden Administration’s SVB Rescue?

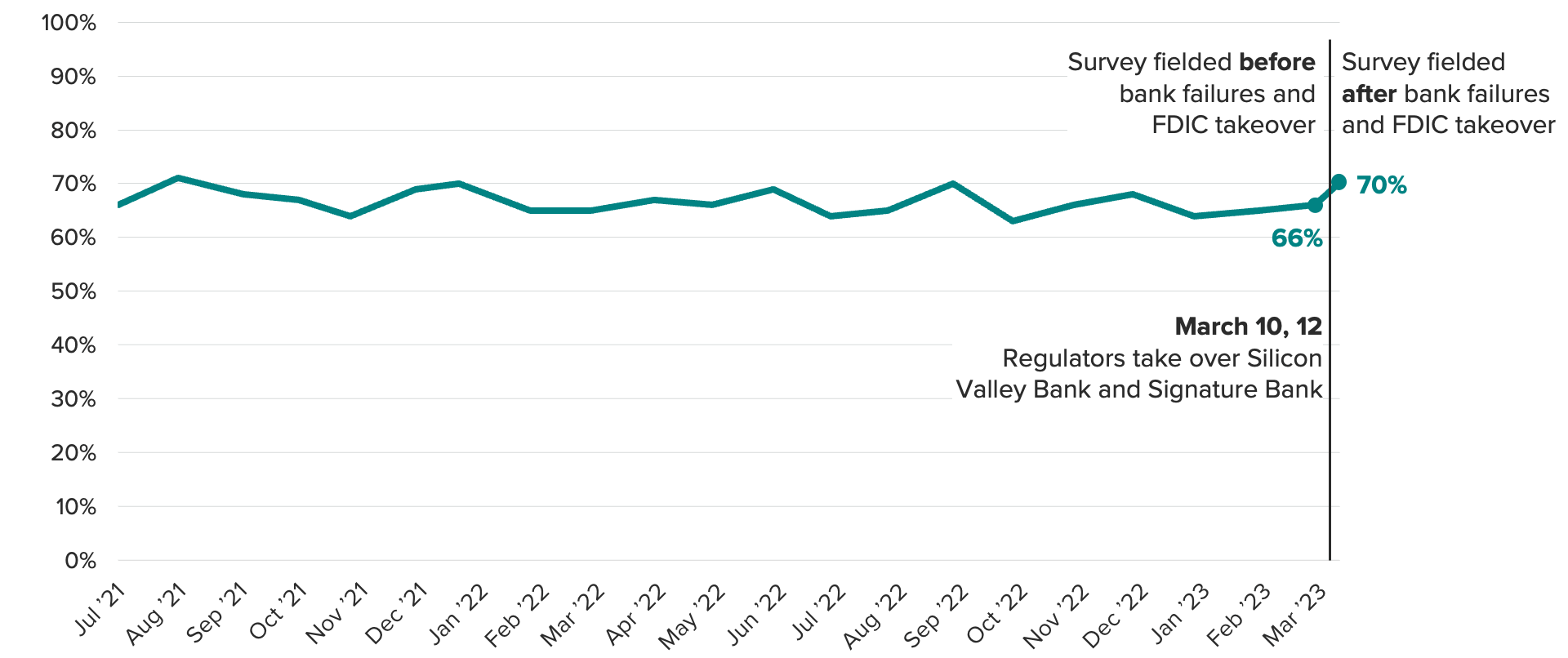

As news spread of the collapse of Silicon Valley Bank, Signature Bank and Silvergate Capital Corp., a new Morning Consult survey finds that Americans’ trust in banks has remained steady, with 7 in 10 saying they trust banks, with most bank customers saying they’re at least somewhat confident their deposits are safe in their account.

7 in 10 Adults Trust Banks

Bank trust relatively steady since last month

- Americans’ level of trust in banks has held steady as news of the collapse of three regional banks flooded the airwaves: 70% of Americans said they trust U.S. banks to do what is right in the latest survey, compared with 66% of adults who said the same in February.

- Digital bank customers were less likely to trust banks to do what is right, with 57% saying they trust them and 36% saying they don’t.

- When asked about their level of trust for other types of financial institutions, respondents’ trust in credit unions was not far behind their trust in banks, with 69% of all adults saying they trusted those institutions. Digital banks saw much lower levels of trust, however, with 44% of Americans saying they trust them.

- News of Silicon Valley Bank’s collapse reached most Americans: 59% said they had heard at least something about the failure of SVB, though fewer had heard about the collapse of Signature Bank (48%) and Silvergate Capital (34%).

Most Americans at Least Somewhat Confident Their Money Is Secure

Morning Consult analyst: Banking customer churn on par with normal activity, but cash withdrawals ‘surprising’

- Despite the recent bank collapses, most bank customers said they’re at least somewhat confident that their money is secure. About 1 in 3 bank customers said they’re “very confident” in their banks’ ability to provide them with all of the money in their accounts if they requested it, compared with just 5% who said they’re “not confident at all.”

- The survey found 1 in 5 adults with primary bank accounts has moved either some or all of their money from their account to somewhere else, such as their home or a safe, in response to the collapse of Silicon Valley Bank, Signature Bank and Silvergate Capital, while 15% have moved all or some of their money to a new bank account or credit union.

- Morning Consult Financial Services Analyst Charlotte Principato noted that a consistent undercurrent of consumers switching banks is normal, and Morning Consult Research Intelligence shows that around 8-10% of consumers are opening and closing bank accounts every month.

- “The share of consumers moving specifically because of SVB’s collapse is not alarming, but the share of adults withdrawing their money from banks is certainly surprising,” Principato said, observing that owners of cryptocurrency were the principal drivers of that latter trend.

Wealthier Adults More Likely to Express Confidence in Government Backstop for Their Bank

High-income households more likely to trust the government to step in to aid foundering banks

- Americans were more likely than not to say they trusted the government to step in and support their bank if it failed, but confidence was lowest among customers of digital banks.

- Adults with annual household incomes over $100,000 (29%) and Democrats (26%) were more likely to say they’re “very confident” that the government would support their bank. Digital bank customers were among the least optimistic, with just 15% being very confident.

- When asked about the three recent bank collapses, only 28% of the general population said they expected the events to have any impact on them personally in the coming weeks, but 73% expected them to have at least some impact on the U.S. economy.

- Most adults don’t think the problems with the banking industry will be limited to SVB, Silvergate and Signature: 65% said they believed more banks would be put into receivership by the Federal Deposit Insurance Corp.

While U.S. bank customers overall don’t seem to be worried by the recent bank turmoil, big banks are seeing an influx of new customers, even speeding up the onboarding process for those new accounts, according to the Financial Times. Bank of America Corp. reportedly gathered up more than $15 billion in new deposits as customers fled to the perceived safety of big-name banks.

The March 13-15, 2023, survey was conducted among a representative sample of 2,190 U.S. adults, with an unweighted margin of error of plus or minus 2 percentage points.

The story has been updated with a chart showing the trend in trust in banks.

Amanda Jacobson Snyder previously worked at Morning Consult as a data reporter covering finance.