The Public’s Use of Health Apps and Wearables Has Increased in Recent Years. But Digital Health Still Has Room to Grow

Key Takeaways

The use of health apps has grown by 6 percentage points since December 2018, while wearables usage has grown by 8 points, per Morning Consult data.

Respondents said exercise or heart rate monitoring was the primary reason for using a health app.

Adults who don’t use wearables said cost was the primary reason.

The digital takeover of the health care industry has put health management literally into the palms of people’s hands. Whether with smartphone health applications or wearable devices, people are tracking their health in ways they never have before.

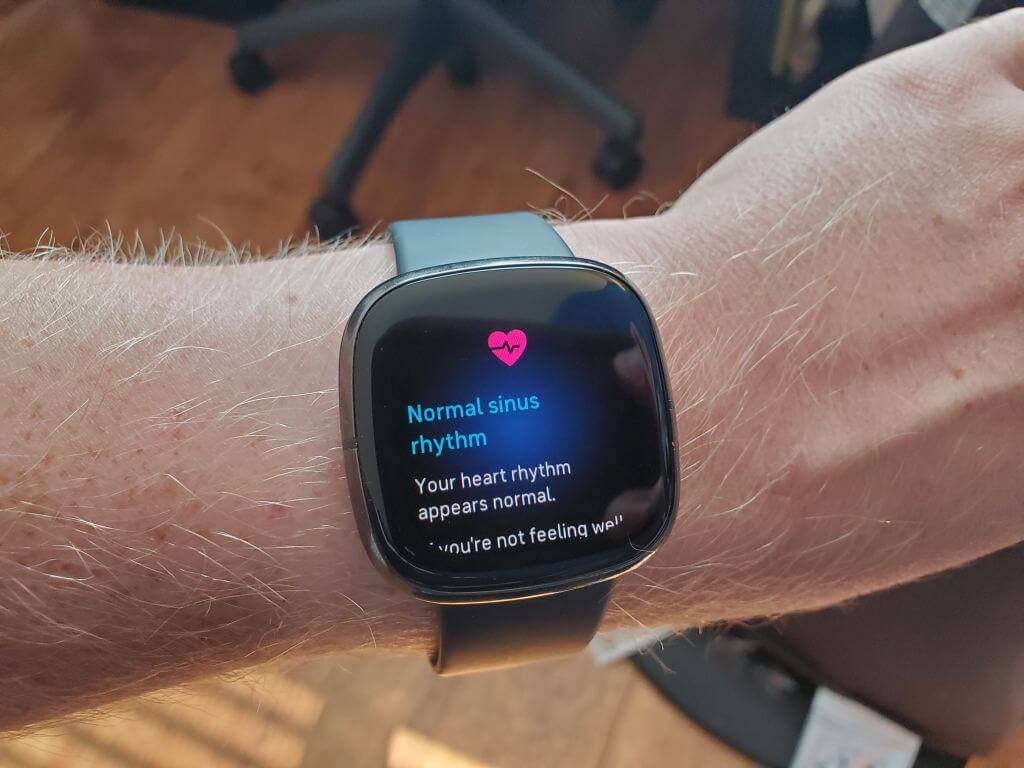

Digital health has developed from a step-counting tool to technology that can help manage chronic diseases and warn people of irregular heartbeats. What may have once been seen as a fad or an attempt by tech giants like Alphabet Inc.’s Google and Apple Inc. to gain influence in a lucrative industry has become a larger piece of patients’ and providers’ approach to treatment — and it’s an approach that the public appears increasingly comfortable with, Morning Consult data indicates.

Two in 5 U.S. adults now use health apps, an increase of 6 percentage points since late 2018, and the share of Americans who said they use wearables is up to 35%, an 8-point jump over the same period, according to a new Morning Consult survey.

“The last five years have been very exciting. I think the next five years is going to be potentially even more exciting and transformative as innovation continues to evolve in almost every area of health care,” Scott Whitaker, chief executive of the medical device industry group AdvaMed, said of wearables and data collected by trackers. The combination of consumers’ fascination with the technology and users’ recognition of the added value is “driving up the usage tremendously,” he added.

While usage of apps and wearables has climbed over the past four years, there is still room to grow, as the majority of adults said they do not use the technologies. However, the new survey reflects Whitaker’s sentiment on consumer fascination: Among users of health apps and wearables, at least half said they use the technologies at least once a day.

At Least Half of U.S. Adults With Health Apps or Wearables Use Them Daily

Despite increased usage, health apps and wearables did not see the same pandemic boost as virtual care

The pandemic forced providers to dramatically — and almost instantly — alter how they deliver care as facilities limited or shut down services to help prevent COVID-19 outbreaks.

Health agencies and private insurers opened up policies to cover virtual care services that were being utilized in what was supposed to be a temporary environment. Nearly three years later, Congress extended pandemic-era policies for telehealth and virtual care services through 2024.

While the pandemic put telehealth usage trends on fast forward, Adriana Krasniansky, a researcher with Rock Health, said wearables and apps were not changed as dramatically. Krasniansky explained that there are more factors at play than just the pandemic for wearables and apps, whereas telehealth was the only way for some patients to get care.

Among users of health apps, 45% said they used the technology about the same amount as they did before the pandemic, compared with 32% who said they’ve used it “much” or “somewhat” more. Among users of wearables, 44% said they used the devices about the same amount and 37% said they’ve used them more.

Ismene Grohmann, head of product for Abbott Laboratories’ new bio-wearables line Lingo, said people may be more interested in using wearables or tracking their health coming out of the pandemic, when they may have developed unhealthy tendencies or not been as focused on their overall health.

There is a “heightened interest” in “wellness or personal health that's driving the market,” Grohmann said. In talking to consumers in different countries, Abbott has found that “people are really, really interested in not only the classic weight loss, but also, ‘Why do I want to lose weight?’”

As the types of apps and wearables grow, the motivations for using them vary, but one stood out. Among U.S. adults who use health apps, 3 in 4 said exercise or heart rate monitoring was the primary reason, followed by tracking their sleep, weight and diet.

Health App Users Most Likely to Track Exercise and Heart Rate

The digital health industry is facing challenges despite its growth. Funding for U.S. digital health startups dropped to $15.3 billion last year after peaking at nearly twice that amount in 2021, according to a Rock Health report. Companies with digital health capabilities, some defined more as telehealth providers, are also dealing with the economic downturn and increased scrutiny regarding business practices and privacy.

Still, traditional medical device companies like Abbott and Medtronic PLC are embracing a more consumer-focused approach to digital health and wearables, and even non-traditional health care companies like Albertsons Cos. Inc. have recently announced digital health initiatives.

“There's definitely an expectation for this to become a significant contributor to Abbott's top line,” Grohmann said of the company’s wearables products.

And AdvaMed’s Whitaker said that along with patients, providers are now embracing a more tech-based approach to their treatments and health management plans.

Wearables proponents aim for greater adoption of products, regulatory assist

Amid the growth of digital health, wearables usage is trailing apps. Nearly 1 in 4 nonusers said that the cost of devices was their primary reason for not using or buying one.

Among respondents who do use wearables to track their health, 86% said the technology is either “very” or “somewhat” effective at helping them reach their goals.

Fitness Goals, Tracking Health Data Are Top Reasons People Buy and Use Wearables

Grohmann said further adoption of wearables is likely to come from people who already use a device like a smartwatch or a tracker. However, Abbott is working to make its sensor-based bio-wearables more accessible to a broader audience.

One crucial challenge will be not just getting people to use the technology, but changing people’s behaviors when they do.

“There's an opportunity here to create engagement that happens essentially every day, and that's necessary to create behavior change,” Grohmann said, pointing to how the technology captures and presents the “very unique profiles of our metabolic health.” She added that Lingo, which will offer bio-wearables to track glucose, ketones and lactate, will launch in mid-2023.

One way to help increase adoption is for public and private payers to open up coverage for devices that can cost hundreds, if not thousands, of dollars. Another factor for device coverage is paying for data processing systems and artificial intelligence services that some products use, in addition to paying for the device itself.

Whitaker said that while Medicare payment policies have opened up a bit over the past several years to cover more apps and wearables, Medicare is still “stuck in the ‘60s” as a primarily fee-for-service program.

“I'm not sure that as a payer, Medicare fully understands the value of wearables and other forms of technology to lower cost and improve health care outcomes for those in the Medicare program,” Whitaker said. The Food and Drug Administration has historically been much quicker “to recognize the technologies and help move those through their process to get to market.”

Ricky Zipp previously worked at Morning Consult as a health care analyst on the Industry Intelligence team.