Workers May Be Unsure About Business Travel, but Leaders Aren’t

Key Takeaways

28% of business travel decision-makers and 32% of those in charge of company travel budgets said their workplace will increase business travel in the coming year, compared with 15% of all employed adults.

Business travel decision-makers are optimistic about growth in a number of areas, but allowance for food, beverage and entertainment is where they predict the strongest positive movement.

Travel brands can drive revenue by engaging the growing number of business travelers with premium offerings that may have been untenable as recently as last year.

For a daily briefing on the most important data, charts and insights from Morning Consult, sign up for Our Best Intel.

The importance of business travelers to the travel industry as a whole is well established. Following the near-complete shutdown of travel due to COVID-19, much was written (by this analyst included) about when, where and how business travel would return to normal. While it’s true that business travel will never look quite like it did before the pandemic, a recent Morning Consult survey suggests a more promising picture: While workers as a whole are still uncertain about business travel’s future, the leaders who are actually shaping travel policies at their organizations are much more optimistic.

Decision-makers are more bullish than the average worker on the future of business travel

If there’s one thing that is true of business travel since 2020, it’s that it has been inconsistent. Initial hopes that the sector would roar back as workers returned to the office fizzled when workers didn’t, in fact, return to the office (at least not at pre-pandemic levels). And a lack of clarity about the future of remote versus in-person versus hybrid work, coupled with macroeconomic volatility, is resulting in uncertainty among workers about the future of business trips. Around 3 in 10 employed U.S. adults said they’re uncertain about how work travel will evolve at their company in both the next year and the next five years.

There is another group of people, though, with more clarity on the future of business travel, because they’re the ones establishing policies and making decisions about it. Among business travel decision-makers — those who “sometimes” or “often” make decisions about where, when and how their direct reports, colleagues or companies as a whole travel for work — only 10% said they’re unsure about what will happen in the future. And, encouragingly, this group is far more likely than employed adults in general to say that business travel will increase at their company, both in the next year and the next five years.

Those in Charge of Business Travel Are More Optimistic About Its Recovery

Among those decision-makers, there is an even more influential subset: those who are specifically responsible for setting organizational business travel budgets. This group is more likely than other leaders to have a bullish outlook on work trips over the next few years, with nearly 1 in 3 saying business travel will increase in the next year and 2 in 5 predicting a rise in the next five years.

All of this is great news for the travel industry. Business travelers tend to outspend leisure travelers by a wide margin and represent outsized revenue for the sector, so their slow return, combined with the dampened outlook among business travelers themselves, is concerning. The comparative optimism among those making the decisions on policies and budgets offers an alternative narrative that is likely to be more realistic, given the knowledge these individuals have and their ability to influence behavior going forward.

More business travel and higher per-trip spending is likely, according to decision-makers

Business travel policies are intricate and varied between companies. For example, organizations have differing guidelines on which employees are allowed to travel, how frequently they can do so and how much they can spend. Generally, decision-makers are more optimistic than employed adults overall when it comes to all activities, but confidence varies by policy area.

Decision-makers showed the highest level of optimism for likely increases in the overall number of business trips employees are taking and the amount they can spend on expenses while on the road: The share who said both of these changes are “likely” is 18 percentage points higher than the share who said they are “unlikely.” For both of these activities, employees in general were much less optimistic — in fact, higher shares said both activities are unlikely to increase this year.

Decision-Makers Predict an Increase in Business Travel

When it comes to predicted negative changes — reductions in travel and spending — decision-makers also netted higher levels of confidence that changes were likely to happen, probably because they are more often privy to impending adjustments than the average employee. But the lower net shares for actions such as reducing business trips and restricting spending on the road, especially compared with the net shares saying these elements would see positive movement, suggest that this group is more optimistic than pessimistic.

One area where the negatives outweigh the positives for both groups is strictness about what types of expenses are covered — both decision-makers and employees alike predict some belt-tightening from their companies in this area in the coming year. Among decision-makers, the share that said this is likely to happen is 21 points higher than the share that said it’s unlikely. This may not mean that employees spend less, per se, but that companies may be more judicious about what is covered under their expense policies — in other words, tighter reporting and scrutiny.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

But overall, the prognosis is good. Companies across the travel industry can capitalize on this growth, whether it’s airlines that market premium seats to those who are now able to trade up or hotels that double down on room service, a typically pricey option that may be back on the table for travelers with extra allowances.

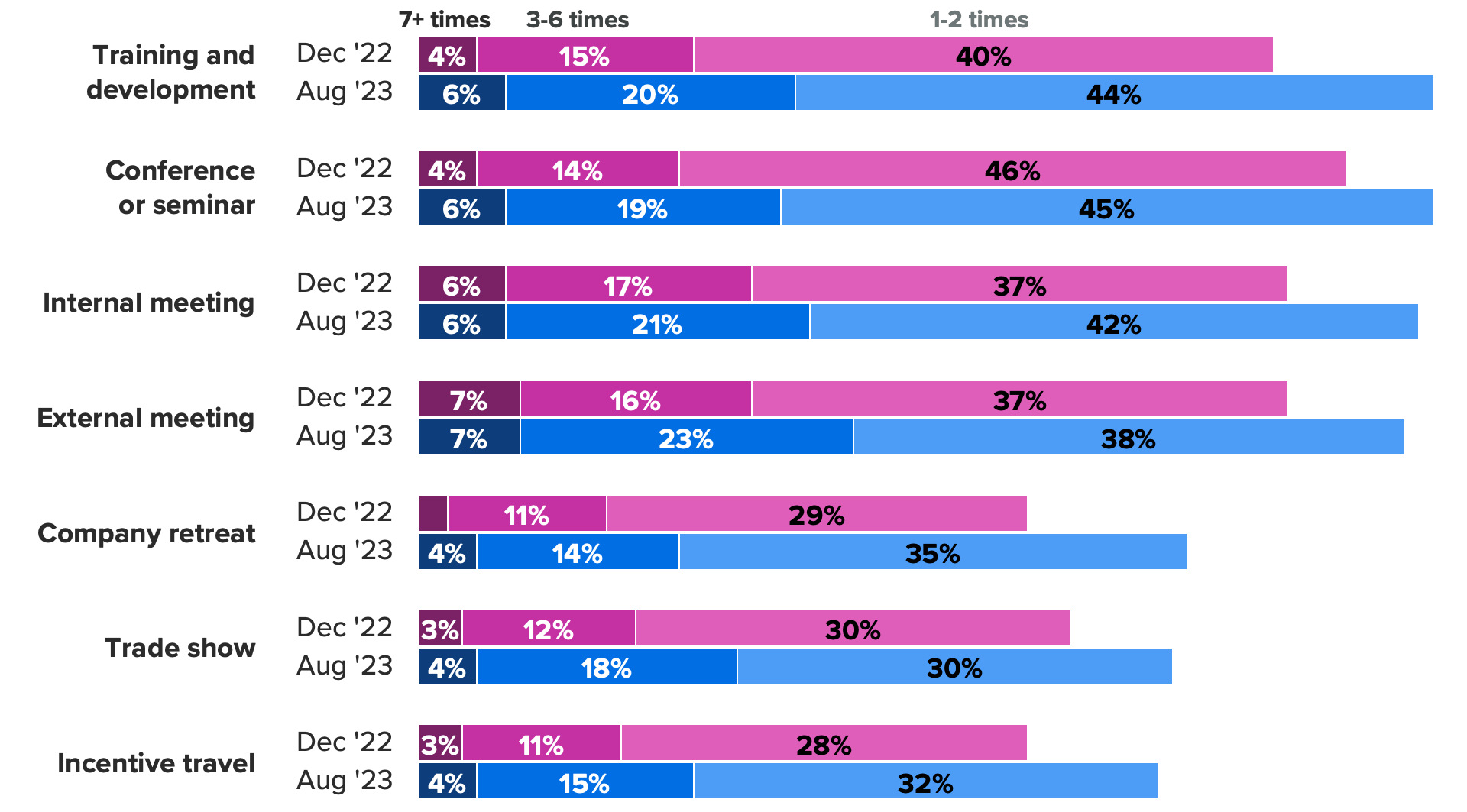

Internal occasions will drive business travel growth in the next year

Based on business travelers’ predictions, there will likely be an uptick in all types of business trips in the coming year, but growth will be driven in different ways, depending on the travel occasion. For example, conferences and training are the two most common types of business trips — 7 in 10 travelers said they will take a trip for each of these purposes in the next year. However, the growth in training and development trips will be spurred by the overall volume of business travelers who travel for this purpose: The share who said they plan to do so in the coming year is 11 points higher than it was at the end of 2022. The uptick in conference travel, on the other hand, will be driven by increased frequency. The share who said they will take at least one trip to a conference is up 7 points since December, but the share who said they’ll take three or more trips of this type is up 8 points.

More Workers Plan to Travel for All Business Occasions in the Coming Year

Overall, the categories showing the most growth are not client-centric: Training, company retreats and incentive travel have each made gains of at least 10 points. The expansion in these areas suggests that businesses are becoming more comfortable sending their employees on trips that may have been considered nonessential in 2021 and 2022.

One caution for companies, though — not all workers are keen on the growth of business travel. While a majority (88%) of employed adults said they’re either happy with how much they’re traveling for business or want to do so more, the share of workers who said they’re traveling too much has increased from 7% to 12% since December 2022. The growth is particularly notable among millennials, 16% of whom said they would like to travel less (compared with 8% in 2022), likely driven by caregiving responsibilities that often tie members of this generation closer to home.

Lindsey Roeschke is an analyst whose work focuses on behavior and expectations of consumers in the travel & hospitality and food & beverage categories, particularly through a generational and cultural lens. Prior to joining Morning Consult, she served as a director of consumer and culture analysis at Gartner. In addition to her research and advisory background, Lindsey has more than a decade of experience in the advertising world. She has lived and worked in seven cities across four continents.