Chinese Consumer Confidence Stabilizes in January, Despite Real Estate Concerns

Key Takeaways

January’s stabilization follows a sharp decline in consumer confidence in December, driven by a rise in COVID-19 outbreaks and unease about the real estate market.

Real estate concerns appear to have increased further in December, which could undermine households’ perceptions of their financial stability.

Much will depend on how Beijing responds to threats posed by the omicron variant and real estate market jitters; economic disruptions in China could potentially spill over to present headwinds to the global economy.

Last month, Morning Consult highlighted mounting economic risks in China as consumer confidence took a tumble amid COVID-19 outbreaks and real estate market anxiety. While sentiment has largely stabilized this month, Chinese consumers’ expectations on housing prices have continued to fall.

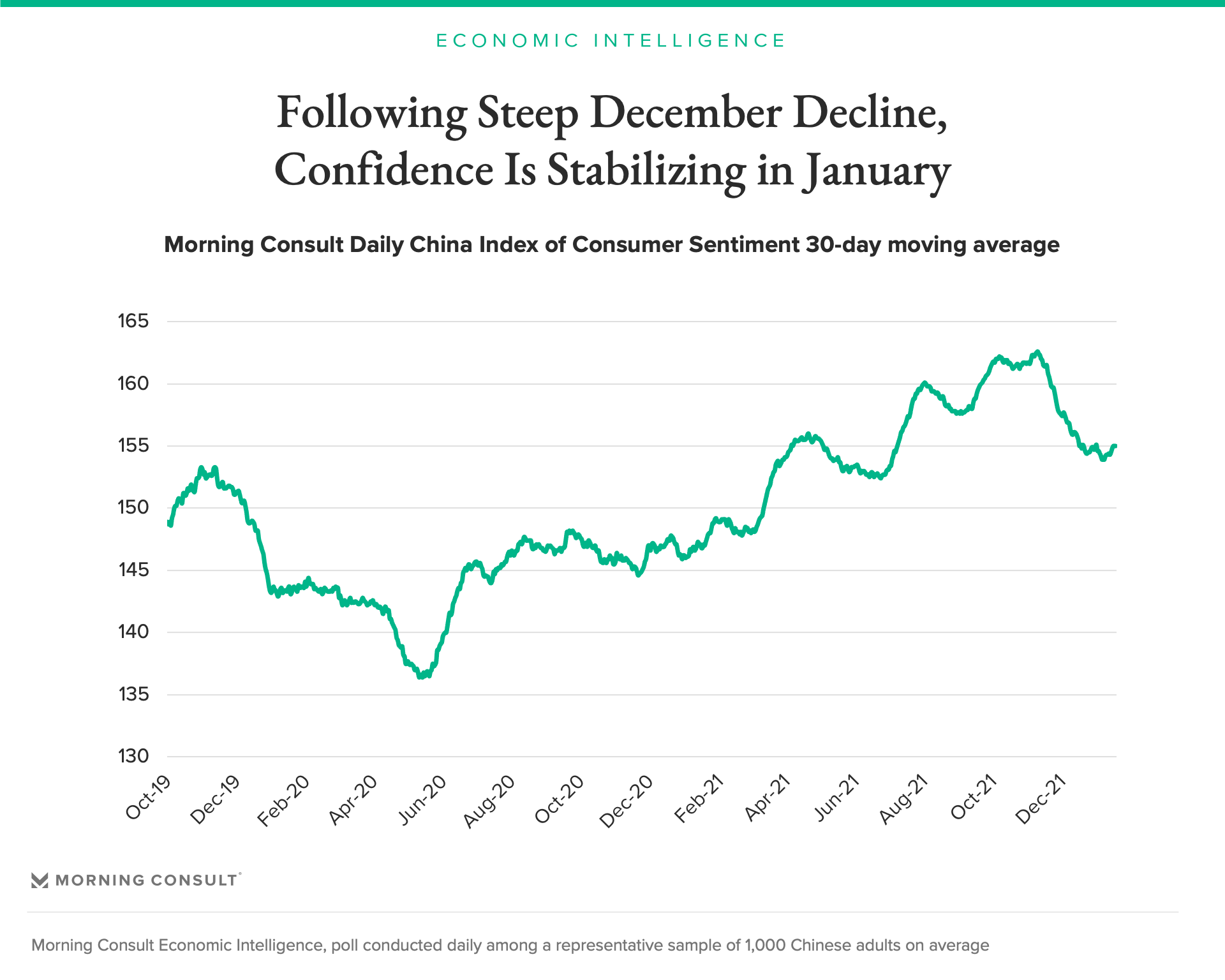

After significant declines in November and December, Morning Consult’s Index of Consumer Sentiment for China has largely moved sideways in the opening weeks of 2022. From Jan. 1 to Jan. 18, the 30-day moving average declined only 0.1 points, falling from 155.1 to 155.0. While the index appears to have stabilized, confidence has settled at a considerably lower level that is comparable to summer 2021.

While overall COVID-19 levels in China remain low compared to other countries, the December downturn in consumer confidence coincided with a significant increase in cases. (The 7-day moving average of new cases rose from 47 on Dec. 1 to a near-term peak of 227 on Jan 1. before falling to 165 as of Jan. 18.) Critically, these cases are spread over a wide geographic range, with clusters in multiple provinces, amplifying the negative impact on confidence and economic activity as the government continues to respond with lockdown measures as part of its zero-tolerance COVID-19 policy.

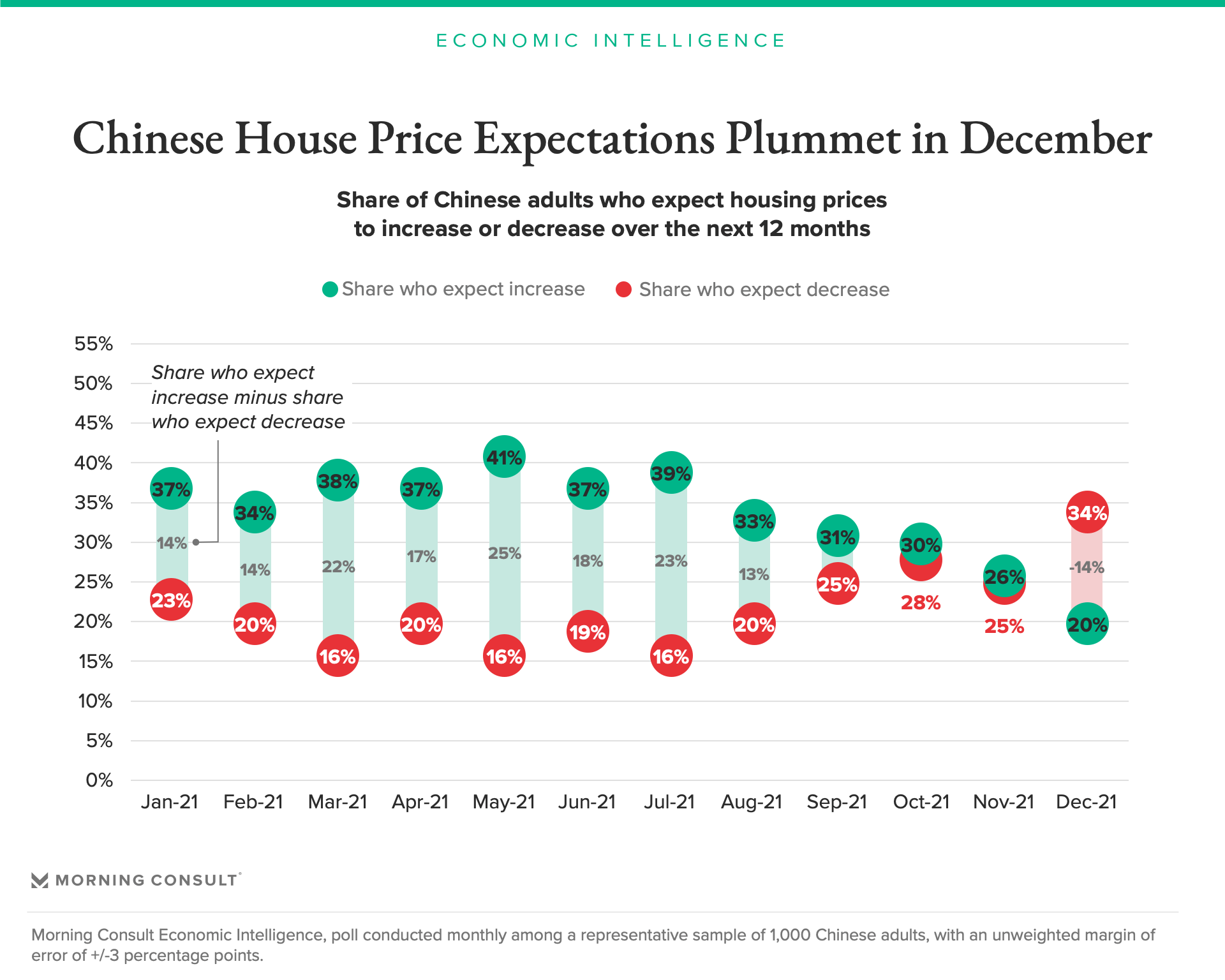

At the same time, views toward the country’s critical housing market appear to have soured further. Since Chinese property developer Evergrande’s financial troubles began to attract attention in July, expectations for housing prices have fallen considerably. And in December, they plunged into the red, with 34.1 percent of Chinese adults expecting the price of a house or apartment to decrease in the next 12 months, compared to 19.9 percent who expect prices to increase.

With much of China’s domestic savings wrapped up in real estate, a decline in prices has the potential to undermine household finances and spending. In a survey conducted by Morning Consult in October, 32 percent of Chinese adults said that selling their home for less than they paid for it would have a major impact on their financial security. Since July, there has been a broad pullback in spending across the 10 categories tracked by Morning Consult. From July to December, the share of Chinese adults who said they purchased electronics, furniture and home appliances fell by 12.9, 11.7 and 10.8 percentage points, respectively.

Overall, the economic risks emanating from China will continue to mount as Beijing gauges how to manage long-term macroprudential goals with near-term headwinds. For now, the government appears committed to its zero-tolerance policy on COVID-19, responding to each case cluster with firm restrictions and lockdowns. On the other hand, policies aimed at reining in speculative investment may be loosened or reconsidered, at least in the near term (as seen recently with the lowering of interest rates and easing of mortgage and bank reserve restrictions). With omicron looming, China’s ability to stick a soft landing in its property market and keep global supply chains flowing will likely be critical to maintaining the momentum of the global economic recovery in 2022.

Jesse Wheeler previously worked at Morning Consult as a senior economist.